Carpenter Technology Corporation (NYSE: CRS) (the “Company”) today

announced financial results for the fiscal fourth quarter and year

ended June 30, 2019. For the quarter, the Company reported net

income of $48.9 million, or $1.00 earnings per diluted share.

“The fourth quarter marked the end to a successful year as we

generated our strongest quarterly operating income performance

since fiscal year 2013,” said Tony Thene, Carpenter Technology’s

President and CEO. “Key highlights of the quarter include SAO

delivering 20.4% adjusted operating margin, positive total company

free cash flow of $115.8 million, and our 12th consecutive quarter

of year-over-year backlog growth. The fourth quarter’s operating

income results were driven by a continued strong product mix as we

generated double digit sequential and year-over-year revenue growth

in the Aerospace and Defense end-use market given our sub-market

diversity and broad platform exposure. Also, growth in the

Medical end-use market remained robust as we continued to benefit

from our direct customer relationships with leading OEMs and

increasing demand for our high-value titanium solutions.”

“Our fiscal year 2019 performance demonstrates the value of

strong execution of our commercial and manufacturing strategies

which drove consistent year-over-year revenue and earnings growth

in the Aerospace and Defense and Medical end-use markets. During

the year, we made significant progress on obtaining the necessary

Aerospace qualifications for our Athens facility. We also continued

to look to the future and took innovative steps to strengthen our

leadership position through targeted investments in key emerging

technologies. This past year we significantly advanced our additive

manufacturing platform by adding powder lifecycle management

solutions through the acquisition of LPW Technology Ltd. In

addition, the expansion of our soft magnetics capabilities remains

on track as we seek to capitalize on the disruptive impact of

electrification across multiple end-use markets.”

“Looking ahead, we are focused on advancing our solutions

approach, capturing additional productivity and capacity gains

through the Carpenter Operating Model, and investing in the future

of our industry and our end-use markets. We believe the further

execution of our strategy will enhance our long-term growth

potential and drive sustainable long-term value creation for our

customers and shareholders.”

Financial Highlights

| ($ in

millions) |

|

Q4 |

|

Q4 |

|

Q3 |

|

YTD |

|

YTD |

| |

|

FY2019 |

|

FY2018 |

|

FY2019 |

|

FY2019 |

|

FY2018 |

| Net Sales |

$ |

641.4 |

|

$ |

618.0 |

|

|

$ |

609.9 |

|

|

|

$ |

2,380.2 |

|

|

$ |

2,157.7 |

| Net Sales

Excluding Surcharge (a) |

$ |

533.3 |

|

$ |

494.5 |

|

|

$ |

503.0 |

|

|

|

$ |

1,942.1 |

|

|

$ |

1,792.3 |

| Operating

Income |

$ |

67.9 |

|

$ |

60.0 |

|

|

$ |

73.2 |

|

|

|

$ |

241.4 |

|

|

$ |

189.3 |

| Adjusted Operating

Income Excluding Special Items (a) |

$ |

67.9 |

|

$ |

60.0 |

|

|

$ |

73.2 |

|

|

|

$ |

242.6 |

|

|

$ |

189.3 |

| Net Income |

$ |

48.9 |

|

$ |

42.8 |

|

|

$ |

51.1 |

|

|

|

$ |

167.0 |

|

|

$ |

188.5 |

| Cash Provided from

Operating Activities |

$ |

175.1 |

|

$ |

118.5 |

|

|

$ |

10.0 |

|

|

|

$ |

232.4 |

|

|

$ |

209.2 |

| Free Cash Flow

(a) |

$ |

115.8 |

|

$ |

55.9 |

|

|

$ |

(37.0 |

) |

|

|

$ |

(53.7 |

) |

|

$ |

34.7 |

| |

|

|

|

|

|

|

|

|

|

|

| |

(a) non-GAAP

financial measures explained in the attached tables |

|

|

|

Net sales for the fourth quarter of fiscal year 2019 were $641.4

million compared with $618.0 million in the fourth quarter of

fiscal year 2018, an increase of $23.4 million (4 percent), on 4

percent lower volume. Net sales excluding surcharge were $533.3

million, an increase of $38.8 million (8 percent) from the same

period a year ago.

Operating income was $67.9 million compared to $60.0 million in

the prior year period. These results primarily reflect strong

commercial execution and improved market conditions in key end-use

markets compared to the prior year period.

Cash provided from operating activities in the fourth quarter of

fiscal year 2019 was $175.1 million, compared to $118.5 million in

the same quarter last year. The increase in operating cash flow

primarily reflects a reduction in inventory coupled with higher

sales during the quarter. Free cash flow in the fourth quarter of

fiscal year 2019 was $115.8 million, compared to $55.9

million in the same quarter last year. The increase in free

cash flow was primarily due to higher cash from operating

activities in the quarter. Capital expenditures were $49.7 million

in the fourth quarter of fiscal year 2019 compared to $54.0 million

in the same quarter last year.

Total liquidity, including cash and available revolver balance,

was $401.3 million at the end of the fourth quarter of fiscal year

2019. This consisted of $27.0 million of cash and $374.3 million of

available borrowings under the Company’s credit facility.

Conference Call and Webcast Presentation

Carpenter Technology will host a conference call and webcast

presentation today, August 1st at 10:00 a.m. ET, to discuss the

financial results of operations for the fourth quarter and full

fiscal year 2019. Please dial +1 412-317-9259 for access to the

live conference call. Access to the live webcast will be available

at Carpenter Technology’s website

(http://www.carpentertechnology.com), and a replay will soon be

made available at http://www.carpentertechnology.com. Presentation

materials used during this conference call will be available for

viewing and download at http://www.carpentertechnology.com.

Non-GAAP Financial Measures

This press release includes discussions of financial measures

that have not been determined in accordance with U.S. Generally

Accepted Accounting Principles (GAAP). A reconciliation of the

non-GAAP financial measures to their most directly comparable

financial measures prepared in accordance with GAAP, accompanied by

reasons why the Company believes the non-GAAP measures are

important, are included in the attached schedules.

About Carpenter Technology

Carpenter Technology Corporation is a recognized leader in

high-performance specialty alloy-based materials and process

solutions for critical applications in the aerospace, defense,

transportation, energy, industrial, medical, and consumer

electronics markets. Founded in 1889, Carpenter

Technology has evolved to become a pioneer in premium

specialty alloys, including titanium, nickel, and cobalt, as well

as alloys specifically engineered for additive manufacturing (AM)

processes and soft magnetics applications. Carpenter

Technology has expanded its AM capabilities to provide a

complete end-to-end solution to accelerate materials innovation and

streamline parts production. More information about Carpenter

Technology can be found at www.carpentertechnology.com.

Forward-Looking Statements

This presentation contains forward-looking statements within the

meaning of the Private Securities Litigation Act of 1995. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ from those projected,

anticipated or implied. The most significant of these uncertainties

are described in Carpenter Technology’s filings with the Securities

and Exchange Commission, including its report on Form 10-K for the

year ended June 30, 2018, Form 10-Q for the quarters ended

September 30, 2018, December 31, 2018 and March 31, 2019 and the

exhibits attached to those filings. They include but are not

limited to: (1) the cyclical nature of the specialty materials

business and certain end-use markets, including aerospace, defense,

industrial, transportation, consumer, medical, and energy, or other

influences on Carpenter Technology’s business such as new

competitors, the consolidation of competitors, customers, and

suppliers or the transfer of manufacturing capacity from the United

States to foreign countries; (2) the ability of Carpenter

Technology to achieve cash generation, growth, earnings,

profitability, operating income, cost savings and reductions,

qualifications, productivity improvements or process changes; (3)

the ability to recoup increases in the cost of energy, raw

materials, freight or other factors; (4) domestic and foreign

excess manufacturing capacity for certain metals; (5) fluctuations

in currency exchange rates; (6) the effect of government trade

actions; (7) the valuation of the assets and liabilities in

Carpenter Technology’s pension trusts and the accounting for

pension plans; (8) possible labor disputes or work stoppages; (9)

the potential that our customers may substitute alternate materials

or adopt different manufacturing practices that replace or limit

the suitability of our products; (10) the ability to successfully

acquire and integrate acquisitions; (11) the availability of credit

facilities to Carpenter Technology, its customers or other members

of the supply chain; (12) the ability to obtain energy or raw

materials, especially from suppliers located in countries that may

be subject to unstable political or economic conditions; (13)

Carpenter Technology’s manufacturing processes are dependent upon

highly specialized equipment located primarily in facilities in

Reading and Latrobe, Pennsylvania and Athens, Alabama for which

there may be limited alternatives if there are significant

equipment failures or a catastrophic event; (14) the ability to

hire and retain key personnel, including members of the executive

management team, management, metallurgists and other skilled

personnel; and (15) fluctuations in oil and gas prices and

production. Any of these factors could have an adverse and/or

fluctuating effect on Carpenter Technology’s results of operations.

The forward-looking statements in this document are intended to be

subject to the safe harbor protection provided by Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended.

Carpenter Technology undertakes no obligation to update or revise

any forward-looking statements.

PRELIMINARYCONSOLIDATED

STATEMENTS OF INCOME(in millions, except per share

data)(Unaudited)

| |

|

Three Months Ended |

|

Year Ended |

| |

|

June 30, |

|

June 30, |

| |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

|

| NET SALES |

|

$ |

641.4 |

|

|

$ |

618.0 |

|

|

$ |

2,380.2 |

|

|

$ |

2,157.7 |

|

| Cost of sales |

|

518.5 |

|

|

503.1 |

|

|

1,935.4 |

|

|

1,775.4 |

|

| Gross profit |

|

122.9 |

|

|

114.9 |

|

|

444.8 |

|

|

382.3 |

|

| |

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

55.0 |

|

|

54.9 |

|

|

203.4 |

|

|

193.0 |

|

| Operating income |

|

67.9 |

|

|

60.0 |

|

|

241.4 |

|

|

189.3 |

|

| |

|

|

|

|

|

|

|

|

| Interest expense |

|

(5.7 |

) |

|

(6.4 |

) |

|

(26.0 |

) |

|

(28.3 |

) |

| Other income (expense),

net |

|

0.4 |

|

|

(0.1 |

) |

|

0.6 |

|

|

(0.8 |

) |

| |

|

|

|

|

|

|

|

|

| Income before income

taxes |

|

62.6 |

|

|

53.5 |

|

|

216.0 |

|

|

160.2 |

|

| Income tax expense

(benefit) |

|

13.7 |

|

|

10.7 |

|

|

49.0 |

|

|

(28.3 |

) |

| |

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

48.9 |

|

|

$ |

42.8 |

|

|

$ |

167.0 |

|

|

$ |

188.5 |

|

| |

|

|

|

|

|

|

|

|

| EARNINGS PER COMMON

SHARE: |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.01 |

|

|

$ |

0.90 |

|

|

$ |

3.46 |

|

|

$ |

3.96 |

|

|

Diluted |

|

$ |

1.00 |

|

|

$ |

0.88 |

|

|

$ |

3.43 |

|

|

$ |

3.92 |

|

| |

|

|

|

|

|

|

|

|

| WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING: |

|

|

|

|

|

|

|

|

|

Basic |

|

47.7 |

|

|

47.4 |

|

|

47.7 |

|

|

47.2 |

|

|

Diluted |

|

48.1 |

|

|

48.0 |

|

|

48.1 |

|

|

47.6 |

|

| |

|

|

|

|

|

|

|

|

| Cash dividends per common

share |

|

$ |

0.20 |

|

|

$ |

0.18 |

|

|

$ |

0.80 |

|

|

$ |

0.72 |

|

PRELIMINARYCONSOLIDATED

STATEMENTS OF CASH FLOWS(in millions)(Unaudited)

| |

|

Year Ended |

| |

|

June 30, |

| |

|

2019 |

|

2018 |

| OPERATING ACTIVITIES: |

|

|

|

|

|

Net income |

|

$ |

167.0 |

|

|

$ |

188.5 |

|

| Adjustments to reconcile net

income to net cash provided from operating activities: |

|

|

|

|

|

Depreciation and amortization |

|

121.5 |

|

|

116.6 |

|

|

Deferred income taxes |

|

16.5 |

|

|

(61.1 |

) |

|

Net pension expense |

|

11.6 |

|

|

14.2 |

|

|

Share-based compensation expense |

|

17.6 |

|

|

17.6 |

|

|

Net loss on disposals of property, plant and equipment and assets

held for sale |

|

1.2 |

|

|

2.5 |

|

|

Gain on insurance recovery |

|

(11.4 |

) |

|

— |

|

| Changes in working capital and

other: |

|

|

|

|

|

Accounts receivable |

|

(5.3 |

) |

|

(86.8 |

) |

|

Inventories |

|

(94.0 |

) |

|

0.4 |

|

|

Other current assets |

|

6.8 |

|

|

(9.6 |

) |

|

Accounts payable |

|

20.1 |

|

|

10.7 |

|

|

Accrued liabilities |

|

(4.9 |

) |

|

28.7 |

|

|

Pension plan contributions |

|

(5.5 |

) |

|

(6.7 |

) |

|

Other postretirement plan contributions |

|

(3.1 |

) |

|

(3.4 |

) |

|

Other, net |

|

(5.7 |

) |

|

(2.4 |

) |

|

Net cash provided from operating activities |

|

232.4 |

|

|

209.2 |

|

| |

|

|

|

|

| INVESTING ACTIVITIES: |

|

|

|

|

| Purchases of property, plant,

equipment and software |

|

(180.3 |

) |

|

(135.0 |

) |

| Acquisition of businesses, net

of cash acquired |

|

(79.0 |

) |

|

(13.3 |

) |

| Proceeds from disposals of

property, plant and equipment and assets held for sale |

|

0.4 |

|

|

1.9 |

|

| Proceeds from insurance

recovery |

|

11.4 |

|

|

— |

|

| Proceeds from note receivable

from sale of equity method investment |

|

— |

|

|

6.3 |

|

| Proceeds from sales and

maturities of marketable securities |

|

2.9 |

|

|

0.7 |

|

|

Net cash used for investing activities |

|

(244.6 |

) |

|

(139.4 |

) |

| |

|

|

|

|

| FINANCING ACTIVITIES: |

|

|

|

|

| Credit agreement

borrowings |

|

163.9 |

|

|

— |

|

| Credit agreement

repayments |

|

(163.9 |

) |

|

— |

|

| Net change in short-term

credit agreement borrowings |

|

19.7 |

|

|

— |

|

| Dividends paid |

|

(38.6 |

) |

|

(34.4 |

) |

| Payments on long-term

debt |

|

— |

|

|

(55.0 |

) |

| Proceeds from stock options

exercised |

|

3.9 |

|

|

12.9 |

|

| Withholding tax payments on

share-based compensation awards |

|

(4.4 |

) |

|

(2.4 |

) |

|

Net cash used for financing activities |

|

(19.4 |

) |

|

(78.9 |

) |

| |

|

|

|

|

| Effect of exchange rate

changes on cash and cash equivalents |

|

2.4 |

|

|

(1.0 |

) |

| |

|

|

|

|

| DECREASE IN CASH AND CASH

EQUIVALENTS |

|

(29.2 |

) |

|

(10.1 |

) |

| Cash and cash equivalents at

beginning of period |

|

56.2 |

|

|

66.3 |

|

| |

|

|

|

|

| Cash and cash equivalents at

end of period |

|

$ |

27.0 |

|

|

$ |

56.2 |

|

PRELIMINARYCONSOLIDATED

BALANCE SHEETS(in millions)(Unaudited)

| |

|

June 30, |

| |

|

2019 |

|

2018 |

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

27.0 |

|

|

$ |

56.2 |

|

|

Accounts receivable, net |

|

384.1 |

|

|

378.5 |

|

|

Inventories |

|

787.7 |

|

|

689.2 |

|

|

Other current assets |

|

37.4 |

|

|

54.9 |

|

|

Total current assets |

|

1,236.2 |

|

|

1,178.8 |

|

| Property, plant and equipment,

net |

|

1,366.2 |

|

|

1,313.4 |

|

| Goodwill |

|

326.4 |

|

|

268.7 |

|

| Other intangibles, net |

|

67.2 |

|

|

63.3 |

|

| Deferred income taxes |

|

4.2 |

|

|

4.3 |

|

| Other assets |

|

187.6 |

|

|

178.5 |

|

|

Total assets |

|

$ |

3,187.8 |

|

|

$ |

3,007.0 |

|

| |

|

|

|

|

| LIABILITIES |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Short-term credit agreement borrowings |

|

$ |

19.7 |

|

|

$ |

— |

|

|

Accounts payable |

|

238.7 |

|

|

214.7 |

|

|

Accrued liabilities |

|

157.6 |

|

|

148.6 |

|

|

Total current liabilities |

|

416.0 |

|

|

363.3 |

|

| |

|

|

|

|

| Long-term debt |

|

550.6 |

|

|

545.7 |

|

| Accrued pension liabilities |

|

371.2 |

|

|

288.8 |

|

| Accrued postretirement

benefits |

|

122.1 |

|

|

108.2 |

|

| Deferred income taxes |

|

142.7 |

|

|

161.6 |

|

| Other liabilities |

|

65.1 |

|

|

53.5 |

|

|

Total liabilities |

|

1,667.7 |

|

|

1,521.1 |

|

| |

|

|

|

|

| STOCKHOLDERS' EQUITY |

|

|

|

|

| Common stock |

|

279.0 |

|

|

278.6 |

|

| Capital in excess of par

value |

|

320.4 |

|

|

310.0 |

|

| Reinvested earnings |

|

1,605.3 |

|

|

1,475.9 |

|

| Common stock in treasury, at

cost |

|

(332.8 |

) |

|

(338.8 |

) |

| Accumulated other

comprehensive loss |

|

(351.8 |

) |

|

(239.8 |

) |

|

Total stockholders' equity |

|

1,520.1 |

|

|

1,485.9 |

|

|

Total liabilities and stockholders' equity |

|

$ |

3,187.8 |

|

|

$ |

3,007.0 |

|

PRELIMINARYSEGMENT

FINANCIAL DATA(in millions, except pounds

sold)(Unaudited)

| |

Three Months Ended |

|

Year Ended |

| |

June 30, |

|

June 30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| Pounds sold (000): |

|

|

|

|

|

|

|

|

Specialty Alloys Operations |

66,682 |

|

|

70,190 |

|

|

256,360 |

|

|

258,326 |

|

|

Performance Engineered Products |

4,180 |

|

|

2,636 |

|

|

13,752 |

|

|

12,388 |

|

|

Intersegment |

(778 |

) |

|

288 |

|

|

(2,576 |

) |

|

(5,094 |

) |

|

Consolidated pounds sold |

70,084 |

|

|

73,114 |

|

|

267,536 |

|

|

265,620 |

|

| |

|

|

|

|

|

|

|

| Net sales: |

|

|

|

|

|

|

|

|

Specialty Alloys Operations |

|

|

|

|

|

|

|

|

Net sales excluding surcharge |

$ |

425.6 |

|

|

$ |

395.3 |

|

|

$ |

1,536.6 |

|

|

$ |

1,434.1 |

|

|

Surcharge |

106.4 |

|

|

123.0 |

|

|

430.7 |

|

|

369.7 |

|

|

Specialty Alloys Operations net sales |

532.0 |

|

|

518.3 |

|

|

1,967.3 |

|

|

1,803.8 |

|

| |

|

|

|

|

|

|

|

|

Performance Engineered Products |

|

|

|

|

|

|

|

|

Net sales excluding surcharge |

123.7 |

|

|

113.7 |

|

|

467.0 |

|

|

426.3 |

|

|

Surcharge |

2.7 |

|

|

2.6 |

|

|

12.8 |

|

|

3.4 |

|

|

Performance Engineered Products net sales |

126.4 |

|

|

116.3 |

|

|

479.8 |

|

|

429.7 |

|

| |

|

|

|

|

|

|

|

|

Intersegment |

|

|

|

|

|

|

|

|

Net sales excluding surcharge |

(16.0 |

) |

|

(14.5 |

) |

|

(61.5 |

) |

|

(68.1 |

) |

|

Surcharge |

(1.0 |

) |

|

(2.1 |

) |

|

(5.4 |

) |

|

(7.7 |

) |

|

Intersegment net sales |

(17.0 |

) |

|

(16.6 |

) |

|

(66.9 |

) |

|

(75.8 |

) |

| |

|

|

|

|

|

|

|

|

Consolidated net sales |

$ |

641.4 |

|

|

$ |

618.0 |

|

|

$ |

2,380.2 |

|

|

$ |

2,157.7 |

|

| |

|

|

|

|

|

|

|

| Operating income: |

|

|

|

|

|

|

|

|

Specialty Alloys Operations |

$ |

86.9 |

|

|

$ |

74.1 |

|

|

$ |

282.2 |

|

|

$ |

232.4 |

|

|

Performance Engineered Products |

1.7 |

|

|

7.9 |

|

|

30.0 |

|

|

26.1 |

|

|

Corporate costs |

(21.1 |

) |

|

(21.5 |

) |

|

(72.7 |

) |

|

(66.4 |

) |

|

Intersegment |

0.4 |

|

|

(0.5 |

) |

|

1.9 |

|

|

(2.8 |

) |

|

Consolidated operating income |

$ |

67.9 |

|

|

$ |

60.0 |

|

|

$ |

241.4 |

|

|

$ |

189.3 |

|

The Company has two reportable segments, Specialty Alloys

Operations (“SAO”) and Performance Engineered Products (“PEP”).

The SAO segment is comprised of Carpenter's major premium alloy

and stainless steel manufacturing operations. This includes

operations performed at mills primarily in Reading and Latrobe,

Pennsylvania and surrounding areas as well as South Carolina and

Alabama.

The PEP segment is comprised of the Company’s differentiated

operations. This segment includes the Dynamet titanium business,

the Carpenter Powder Products (CPP) business, the Amega West

business, the CalRAM business, the LPW Technology Ltd. (LPW)

business and the Latrobe and Mexico distribution businesses. The

businesses in the PEP segment are managed with an entrepreneurial

structure to promote flexibility and agility to quickly respond to

market dynamics. It is our belief this model will ultimately

drive overall revenue and profit growth. The pounds sold data

above for the PEP segment includes only the Dynamet, CPP and LPW

businesses.

Corporate costs are comprised of executive and director

compensation, and other corporate facilities and administrative

expenses not allocated to the segments. Also included are items

that management considers not representative of ongoing operations

and other specifically-identified income or expense items.

The service cost component of net pension expense, which

represents the estimated cost of future pension liabilities earned

associated with active employees, is included in the operating

results of the business segments. The residual net pension

expense is comprised of the expected return on plan assets,

interest costs on the projected benefit obligations of the plans,

and amortization of actuarial gains and losses and prior service

costs and is included in other income (expense), net.

PRELIMINARYNON-GAAP

FINANCIAL MEASURES(in millions, except per share

data)(Unaudited)

| ADJUSTED OPERATING MARGIN

EXCLUDING SURCHARGE AND SPECIAL ITEMS |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

June 30, |

|

June 30, |

| |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

641.4 |

|

|

$ |

618.0 |

|

|

$ |

2,380.2 |

|

|

$ |

2,157.7 |

|

| Less: surcharge revenue |

|

108.1 |

|

|

123.5 |

|

|

438.1 |

|

|

365.4 |

|

| Net sales excluding

surcharge |

|

$ |

533.3 |

|

|

$ |

494.5 |

|

|

$ |

1,942.1 |

|

|

$ |

1,792.3 |

|

| |

|

|

|

|

|

|

|

|

| Operating income |

|

$ |

67.9 |

|

|

$ |

60.0 |

|

|

$ |

241.4 |

|

|

$ |

189.3 |

|

| |

|

|

|

|

|

|

|

|

| Special items: |

|

|

|

|

|

|

|

|

|

Acquisition-related costs |

|

— |

|

|

— |

|

|

1.2 |

|

|

— |

|

| Operating income excluding

special items |

|

$ |

67.9 |

|

|

$ |

60.0 |

|

|

$ |

242.6 |

|

|

$ |

189.3 |

|

| |

|

|

|

|

|

|

|

|

| Operating margin |

|

10.6 |

% |

|

9.7 |

% |

|

10.1 |

% |

|

8.8 |

% |

| |

|

|

|

|

|

|

|

|

| Adjusted operating margin

excluding surcharge and special items |

|

12.7 |

% |

|

12.1 |

% |

|

12.5 |

% |

|

10.6 |

% |

Management believes that removing the impact of raw material

surcharge from operating margin provides a more consistent basis

for comparing results of operations from period to period, thereby

permitting management to evaluate performance and investors to make

decisions based on the ongoing operations of the Company. In

addition, management believes that excluding the impact of special

items is helpful in analyzing the operating performance of the

Company, as these items are not indicative of ongoing operating

performance. Management uses its results excluding these

amounts to evaluate its operating performance and to discuss its

business with investment institutions, the Company’s board of

directors and others.

| ADJUSTED EARNINGS PER SHARE

EXCLUDING SPECIAL ITEMS |

|

Income Before Income Taxes |

|

Income Tax Expense |

|

Net Income |

|

Earnings Per Diluted Share* |

| |

|

|

|

|

|

|

|

|

|

Three months ended June 30, 2019, as reported |

|

$ |

62.6 |

|

|

$ |

(13.7 |

) |

|

$ |

48.9 |

|

|

$ |

1.00 |

|

| |

|

|

|

|

|

|

|

|

| Special items: |

|

|

|

|

|

|

|

|

|

None reported |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Three months ended June 30,

2019, as adjusted |

|

$ |

62.6 |

|

|

$ |

(13.7 |

) |

|

$ |

48.9 |

|

|

$ |

1.00 |

|

| |

|

|

|

|

|

|

|

|

| * Impact per

diluted share calculated using weighted average common shares

outstanding of 48.1 million for the three months ended June 30,

2019. |

| ADJUSTED EARNINGS PER SHARE

EXCLUDING SPECIAL ITEMS |

|

Income Before Income Taxes |

|

Income Tax Expense |

|

Net Income |

|

Earnings Per Diluted Share* |

| |

|

|

|

|

|

|

|

|

|

Three months ended June 30, 2018, as reported |

|

$ |

53.5 |

|

|

$ |

(10.7 |

) |

|

$ |

42.8 |

|

|

$ |

0.88 |

|

| |

|

|

|

|

|

|

|

|

| Special items: |

|

|

|

|

|

|

|

|

|

Impact of U.S. tax reform and other legislative changes |

|

— |

|

|

(0.7 |

) |

|

(0.7 |

) |

|

(0.01 |

) |

| |

|

|

|

|

|

|

|

|

| Three months ended June 30,

2018, as adjusted |

|

$ |

53.5 |

|

|

$ |

(11.4 |

) |

|

$ |

42.1 |

|

|

$ |

0.87 |

|

| |

|

|

|

|

|

|

|

|

| * Impact per

diluted share calculated using weighted average common shares

outstanding of 48.0 million for the three months ended June 30,

2018. |

| ADJUSTED EARNINGS PER SHARE

EXCLUDING SPECIAL ITEMS |

|

Income Before Income Taxes |

|

Income Tax Expense |

|

Net Income |

|

Earnings Per Diluted Share* |

| |

|

|

|

|

|

|

|

|

|

Year ended June 30, 2019, as reported |

|

$ |

216.0 |

|

|

$ |

(49.0 |

) |

|

$ |

167.0 |

|

|

$ |

3.43 |

|

| |

|

|

|

|

|

|

|

|

| Special items: |

|

|

|

|

|

|

|

|

| Acquisition-related costs |

|

1.2 |

|

|

— |

|

|

1.2 |

|

|

0.03 |

|

| |

|

|

|

|

|

|

|

|

| Year ended June 30, 2019, as

adjusted |

|

$ |

217.2 |

|

|

$ |

(49.0 |

) |

|

$ |

168.2 |

|

|

$ |

3.46 |

|

| |

|

|

|

|

|

|

|

|

| * Impact per

diluted share calculated using weighted average common shares

outstanding of 48.1 million for the year ended June 30, 2019. |

| ADJUSTED EARNINGS PER SHARE

EXCLUDING SPECIAL ITEMS |

|

Income Before Income Taxes |

|

Income Tax Benefit (Expense) |

|

Net Income |

|

Earnings Per Diluted Share* |

| |

|

|

|

|

|

|

|

|

|

Year ended June 30, 2018, as reported |

|

$ |

160.2 |

|

|

$ |

28.3 |

|

|

$ |

188.5 |

|

|

$ |

3.92 |

|

| |

|

|

|

|

|

|

|

|

| Special Items: |

|

|

|

|

|

|

|

|

|

Impact of U.S. tax reform and other legislative changes |

|

— |

|

|

(68.3 |

) |

|

(68.3 |

) |

|

(1.42 |

) |

| |

|

|

|

|

|

|

|

|

| Year ended June 30, 2018, as

adjusted |

|

$ |

160.2 |

|

|

$ |

(40.0 |

) |

|

$ |

120.2 |

|

|

$ |

2.50 |

|

| |

|

|

|

|

|

|

|

|

| * Impact per diluted

share calculated using weighted average common shares outstanding

of 47.6 million for the year ended June 30, 2018. |

Management believes that earnings per share adjusted to exclude

the impact of special items is helpful in analyzing the operating

performance of the Company, as these items are not indicative of

ongoing operating performance. Management uses its results

excluding these amounts to evaluate its operating performance and

to discuss its business with investment institutions, the Company's

board of directors and others.

| |

|

Three Months Ended |

|

Year Ended |

| |

|

June 30, |

|

June 30, |

| FREE CASH FLOW |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

|

|

Net cash provided from operating activities |

|

$ |

175.1 |

|

|

$ |

118.5 |

|

|

$ |

232.4 |

|

|

$ |

209.2 |

|

| Purchases of property, plant,

equipment and software |

|

(49.7 |

) |

|

(54.0 |

) |

|

(180.3 |

) |

|

(135.0 |

) |

| Acquisition of businesses, net

of cash acquired |

|

— |

|

|

— |

|

|

(79.0 |

) |

|

(13.3 |

) |

| Proceeds from disposals of

property, plant and equipment and assets held for sale |

|

0.1 |

|

|

— |

|

|

0.4 |

|

|

1.9 |

|

| Proceeds from note receivable

from sale of equity method investment |

|

— |

|

|

— |

|

|

— |

|

|

6.3 |

|

| Proceeds from insurance

recovery |

|

— |

|

|

— |

|

|

11.4 |

|

|

— |

|

| Dividends paid |

|

(9.7 |

) |

|

(8.6 |

) |

|

(38.6 |

) |

|

(34.4 |

) |

| |

|

|

|

|

|

|

|

|

| Free cash flow |

|

$ |

115.8 |

|

|

$ |

55.9 |

|

|

$ |

(53.7 |

) |

|

$ |

34.7 |

|

Management believes that the free cash flow measure provides

useful information to investors regarding our financial condition

because it is a measure of cash generated which management

evaluates for alternative uses.

PRELIMINARYSUPPLEMENTAL

SCHEDULES(in millions)(Unaudited)

| |

Three Months Ended |

|

Year Ended |

| |

June 30, |

|

June 30, |

| NET SALES BY END-USE

MARKET |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

|

|

|

|

|

|

|

| End-Use Market Excluding

Surcharge: |

|

|

|

|

|

|

|

|

Aerospace and Defense |

$ |

303.9 |

|

|

$ |

260.7 |

|

|

$ |

1,051.5 |

|

|

$ |

957.1 |

|

|

Medical |

51.2 |

|

|

41.1 |

|

|

176.3 |

|

|

149.3 |

|

|

Energy |

39.6 |

|

|

40.2 |

|

|

154.3 |

|

|

131.3 |

|

|

Transportation |

32.3 |

|

|

33.7 |

|

|

126.6 |

|

|

127.9 |

|

|

Industrial and Consumer |

74.5 |

|

|

81.9 |

|

|

298.5 |

|

|

295.9 |

|

|

Distribution |

31.8 |

|

|

36.9 |

|

|

134.9 |

|

|

130.8 |

|

| |

|

|

|

|

|

|

|

| Total net sales excluding

surcharge |

533.3 |

|

|

494.5 |

|

|

1,942.1 |

|

|

1,792.3 |

|

| |

|

|

|

|

|

|

|

| Surcharge revenue |

108.1 |

|

|

123.5 |

|

|

438.1 |

|

|

365.4 |

|

| |

|

|

|

|

|

|

|

| Total net sales |

$ |

641.4 |

|

|

$ |

618.0 |

|

|

$ |

2,380.2 |

|

|

$ |

2,157.7 |

|

| Media Inquiries: |

Investor Inquiries: |

| Heather Beardsley |

The Plunkett Group |

| +1 610-208-2278 |

Brad Edwards |

| hbeardsley@cartech.com |

+1 212-739-6740 |

| |

brad@theplunkettgroup.com |

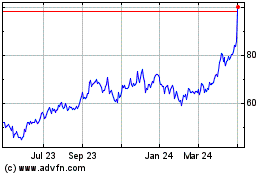

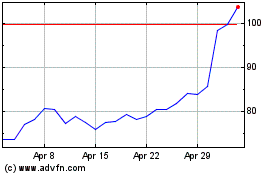

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Apr 2023 to Apr 2024