Carlisle Companies Incorporated (NYSE:CSL) reported net sales of

$675.5 million for the quarter ended December 31, 2007, an 11%

improvement over net sales of $608.7 million in the fourth quarter

of 2006. Organic sales growth of 4% was due primarily to increased

sales volumes for Construction Materials. The acquisition of

Insulfoam, in April 2007, accounted for $39.4 million, or 6%, of

sales growth in the fourth quarter. The impact of foreign currency

exchange rates on net sales growth was approximately 1% in the

fourth quarter. For the full year ended December 31, 2007, net

sales were $2.88 billion, a 12% increase over net sales of $2.56

billion in 2006. Organic growth of 7% was driven by increased sales

volumes across all reporting segments. The acquisition of Insulfoam

contributed $125.4 million, or 5%, to sales growth as compared to

last year. Net income from continuing operations was $40.9 million,

or $0.66 per diluted share, in the fourth quarter of 2007, an 8%

increase as compared with $38.0 million, or $0.61 per diluted

share, in the fourth quarter of 2006. Income from continuing

operations for the year ended December 31, 2007 was $213.0 million,

or $3.40 per diluted share, as compared to $178.8 million, or $2.87

per diluted share, reported in 2006. Income from continuing

operations for the full year of 2007 included an after-tax gain of

$29.9 million, or $0.48 per diluted share, on the sale of the

Company�s interest in the European roofing company, Icopal, on July

31, 2007. David A. Roberts, Chairman, President and Chief Executive

Officer, commented, �2007 was another successful year for Carlisle

with fourth quarter and full year sales growth in all of our

segments. Income from continuing operations of $2.92 per diluted

share, excluding the gain from the sale of Icopal of $0.48 per

diluted share, exceeded our guidance range of $2.80 to $2.85 per

diluted share. Our attention is now turned to the opportunities

ahead. We have established a five year average sales growth target

of 10% and have�set our sights on achieving a 15% operating income

margin by 2012. We plan to reach these goals through a combination

of operating excellence and strategic growth.� Roberts also

commented that �While it is early in the year, we expect organic

sales growth to be at least equal to 2007, and operating margin to

improve over the prior year.� �To help reach our goals, we are

announcing key management changes that will be critical in

achieving our long-term objectives,� continued Roberts. �Carlisle

will be leveraging some of its existing management team in new

responsibilities while adding to its management bench strength.

First, Kevin Forster, formerly President, Carlisle Asia Pacific,

will assume responsibilities as Group President for the Specialty

Products Group which now includes the Company�s braking businesses,

power transmission belt business and refrigerated truck body

business. Mike Popielec will serve as Group President of the

Applied Technologies Group which includes Carlisle�s foodservice

and wire and cable businesses, key growth platforms for the

Company. Mike�s focus will be on growth opportunities for these

businesses as well as the integration of the recent acquisition of

Dinex that is now part of the foodservice business. John Altmeyer

will continue as Group President for the Construction Materials

Group.� �I am pleased to announce that Fred Sutter has joined

Carlisle as Group President of the Transportation Products Group

managing the tire and wheel business and the specialty trailer

business,� stated Roberts. Sutter joins Carlisle from Graco Inc.

where he most recently served as Vice President and General Manager

of the Applied Fluid Technologies Division. During his tenure at

Graco, Sutter also served as Vice President of the Industrial and

Automotive Equipment Divisions and as Vice President, Asia Pacific

and Latin America. Sutter joined Graco from the Emerson Process

Group, a division of Emerson Electric. Sutter holds a B.S. in

Electrical Engineering from the University of Minnesota.� Roberts

also noted, �Carlisle is also very fortunate to have Chris Koch

join the Company as President, Carlisle Asia Pacific. Koch most

recently served as Vice President and General Manager, Asia Pacific

for Graco Inc. While at Graco, he held various positions including

Vice President, Lubrication Equipment Division. Prior to joining

Graco, Koch served as President of TEC, Inc., a subsidiary of H.B.

Fuller. He holds a B.A. in Economics from Macalester College and a

M.B.A. from the University of Minnesota.� �Both Fred and Chris are

excellent additions to the Carlisle management team,� said Roberts.

�I was fortunate to have worked with Fred and Chris at Graco. I

know firsthand the talent and experience they bring to their new

roles. I am confident that with the addition of Chris and Fred to

our already strong management team, we will drive the Company

towards achievement of our long-term goals.� Roberts concluded his

comments by noting �These organizational changes represent how we

will manage the Carlisle businesses going forward. Our current

financial reporting segments will be reviewed and future changes in

our segmentation may be necessary to reflect the Company�s

management structure.� Below is an overview of the new operations

management structure: Carlisle Construction Materials Group, John

Altmeyer, Group President � Carlisle Transportation Products Group,

Fred Sutter, Group President Carlisle Tire & Wheel Trail King �

Carlisle Applied Technologies Group, Mike Popielec, Group President

Carlisle FoodService Products Tensolite � Carlisle Specialty

Products Group, Kevin Forster, Group President Motion Control

Carlisle Industrial Brake & Friction Carlisle Power

Transmission Johnson Truck Bodies � Carlisle Asia Pacific, Chris

Koch, Regional President Construction Materials: Growth in

Insulation and TPO (thermoplastic polyolefin) roofing systems

volumes contributed to net sales of $339.0 million in the fourth

quarter 2007. The 22% increase over 2006 net sales of $278.6

million also included $39.4 million of net sales from the Insulfoam

acquisition. Net sales for the full year of 2007 were up 23% from

2006 on higher insulation and TPO sales. The acquisition of

Insulfoam contributed $125.4 million in the current year. Earnings

before interest and income taxes (�EBIT�) of $43.3 million in the

fourth quarter of 2007 were 15% higher than in the same period

2006. EBIT for the year ended 2007 was $240.6 million, compared to

$175.9 million in 2006, and included a $48.5 million gain on the

sale of Icopal. Earnings margins for the three and twelve months

ended December 31, 2007 were impacted by increased competition.

Industrial Components: Net sales of $167.7 million for the three

months ended December 31, 2007 increased 4% compared with net sales

of $161.6 million in 2006, primarily reflecting increased sales in

the commercial lawn and garden market, offsetting lower sales in

the high-speed trailer market. Sales for the year ended December

31, 2007 were $799.9 million, a 5% increase compared to the prior

year reflecting improvements in the consumer and commercial power

equipment and replacement markets, which more than offset lower

sales of power transmission belts, high-speed trailer tires and

styled wheels. EBIT of $8.7 million in the fourth quarter of 2007

was slightly below EBIT of $8.8 million for the same period of 2006

partially resulting from increased raw material costs. For the full

year of 2007, EBIT was $58.9 million as compared with $59.9 million

for 2006. The 2% decrease is due primarily to lower sales and

earnings for the power transmission belts business. Specialty

Products: The Company�s braking business recorded net sales of

$40.3 million in the fourth quarter of 2007 as compared to net

sales of $40.1 million for the same period in 2006. Net sales for

the year ended December 31, 2007 were $181.4 million, a 4% increase

over net sales of $174.5 million for the full year 2006. For 2007,

sales in the off-highway business improved 8% over the prior year

on increased demand in the mining and heavy construction markets.

On-highway brake sales were down year-over-year, impacted by the

2006 pre-buy of heavy-duty trucks associated with certain

regulatory emission changes. Fourth quarter 2007 EBIT of $0.6

million compared favorably with the loss of $0.8 million in the

fourth quarter 2006, reflecting improved performance in the

off-highway business. Full year 2007 EBIT of $5.1 million was lower

than EBIT of $9.7 million in 2006. Results for the year ended

December 31, 2007 reflected pre-tax charges of $4.6 million related

to asset impairment and restructuring costs, net of a $1.2 million

gain on the sale of a closed facility. Also included in the 2007

full year results was a $4.7 million charge related to the facility

and management transition of an acquired operation in Wales, U.K.

Transportation Products: Fourth quarter 2007 net sales of $48.4

million increased 7% over net sales of $45.4 million in the same

period of 2006. Net sales for the full year ended December 31, 2007

were $189.8 million, a 4% increase as compared to $183.0 million

for 2006. Fourth quarter 2007 EBIT of $7.2 million increased 8% as

compared with 2006 EBIT of $6.7 million. For the full year, EBIT

was $28.3 million in 2007, down 8% from 2006. Increased labor and

overhead costs associated with recent capacity expansion at the

Company�s new Fargo, North Dakota and expanded Brookville,

Pennsylvania facilities and increased raw material costs

contributed to the earnings decline. General Industry: Net sales of

$80.1 million in the fourth quarter of 2007 declined 3% from 2006

fourth quarter net sales of $83.0 million as increased sales in the

foodservice and high-performance wire and cable businesses were

more than offset by lower sales in the refrigerated truck bodies

business. EBIT in the fourth quarter of 2007 of $9.0 million

increased 7% over $8.4 million for the same period of 2006. The

Company successfully managed the negative impact on earnings of the

refrigerated truck bodies sales decline through cost containment.

For the year ended December 31, 2007, net sales were $339.9

million, a 4% increase over net sales of $326.2 million in 2006. A

20% net sales improvement in the wire and cable business,

reflecting increased demand in the aerospace market, and a 6%

increase in the foodservice business more than offset the

previously mentioned decline in the refrigerated truck bodies

business. The strong sales performance for the wire and cable and

foodservice businesses contributed to EBIT of $38.2 million for the

year ended 2007, a 27% improvement over the prior year. Results for

2006 included a $2.5 million charge related to an arbitration

proceeding concerning the termination of a supply agreement in the

wire and cable business. Corporate Corporate pre-tax expense of

$41.7 million for the year ended December 31, 2007 compared to

pre-tax expense of $28.5 million for the same period in 2006. The

increase in expense included $6.6 million of costs associated with

the change in executive management in the second quarter 2007,

charges of $3.1 million associated with the sale of Icopal, and

$1.1 million in expenses related to a terminated acquisition

initiative. Pre-tax expense in 2006 was reduced by $2.0 million as

a result of the favorable resolution of certain legal matters.

Discontinued Operations Income from discontinued operations for the

three and twelve months ended December 31, 2006 included an

after-tax gain of $34.6 million on the sale of the Carlisle Systems

& Equipment businesses, which included Carlisle Process Systems

and the Walker Group. Net Income Net income for the fourth quarter

2007 was $42.9 million, or $0.69 per diluted share, compared to

$78.1 million, or $1.25 per diluted share, for the fourth quarter

2006. Net income for the year ended December 31, 2007 was $215.6

million, or $3.44 per diluted share, which compared to $217.1

million, or $3.49 per diluted share, for the year ended December

31, 2006. Included in the full year 2007 results was an after-tax

gain of $29.9 million, or $0.48 per diluted share, on the sale of

Icopal. The gain on the sale of Icopal was partially offset by

after-tax charges of $4.5 million associated with the change in

management, $3.2 million for plant closure and asset impairment

charges for the on-highway brake business, and $4.7 million for

facility and management transition for the off-highway brake

business. Results for the three and twelve months ended December

31, 2006 included an after-tax gain of $34.6 million, or $0.56 per

diluted share, on the sale of the Carlisle Systems & Equipment

businesses. Cash Flow Cash flow provided by operations of $259.3

million for the year ended December 31, 2007 compared favorably

with cash provided by operations of $19.9 million for the year

ended December 31, 2006. Cash used from working capital was $1.9

million in 2007, which compared to $87.8 million in 2006. Operating

cash flow for 2006 reflected a decrease of $137.9 million in the

utilization of the Company�s securitization program. In the third

quarter of 2007, the Company effectively terminated its existing

accounts receivable securitization facility and subsequently

executed a new agreement whereby the receivables and related debt

are included on the balance sheet. Cash flows related to the

securitization facility have been reported as a financing activity

in 2007. Cash used in investing activities was $134.1 million in

2007 compared to cash provided from investing activities of $11.1

million in 2006. Cash used for acquisitions of $189.7 million in

2007 included the purchase of Insulfoam and the acquisitions of

manufacturing operations in China for the tire and wheel and

high-performance wire and cable businesses. Cash from the sale of

investments, property and equipment included $114.8 million from

the sale of Icopal and $15.7 million received for notes and accrued

interest owed to the Company by Icopal. Proceeds from the sale of

investments, property and equipment in 2006 include $99.5 million

from the sale of the Carlisle Systems & Equipment businesses.

Capital expenditures of $82.5 million in 2007 compared with $95.5

million in 2006. Net cash flow used in financing activities of

$182.4 million in 2007 included the retirement of $150.0 million in

senior notes and the repurchase of 1.5 million shares of the

Company�s stock for $60.0 million. Cash provided by financing

activities of $74.5 million in 2006 included proceeds from the

issuance of $150.0 million in senior notes. Conference Call and

Webcast The Company will discuss fourth quarter 2007 results on a

conference call for investors on Monday, February 11, 2008 at 9:00

a.m. Eastern. The call may be accessed live at

http://www.carlisle.com/investors/conference_call.html, or the

taped call may be listened to shortly following the live call at

the same website location until February 25, 2008. Forward-Looking

Statements This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. These statements are based on management's current

expectations and are subject to uncertainty and changes in

circumstances. Actual results may differ materially from these

expectations due to changes in global economic, business,

competitive, market and regulatory factors. More detailed

information about these factors is contained in the Company's

filings with the Securities and Exchange Commission. The Company

undertakes no duty to update forward-looking statements. Carlisle

is a diversified global manufacturing company serving the

construction materials, commercial roofing, specialty tire and

wheel, power transmission, heavy-duty brake and friction,

heavy-haul truck trailer, refrigerated truck body, foodservice, and

aerospace and test and measurement industries. CARLISLE COMPANIES

INCORPORATED Financial Results For the periods ended December 31

(In millions, except per share data) (Unaudited) � � � � � � Fourth

Quarter Twelve Months � 2007 � 2006* � % Change � � 2007 � 2006* �

% Change � Net sales $ 675.5 $ 608.7 11 % $ 2,876.4 $ 2,559.4 12 %

� Income from continuing operations $ 40.9 $ 38.0 8 % $ 213.0 $

178.8 19 % � Income from discontinued operations � 2.0 � � 40.1 �

NM � 2.6 � � 38.3 � NM Net income $ 42.9 � $ 78.1 � -45 % $ 215.6 �

$ 217.1 � -1 % � Basic earnings per share Continuing operations $

0.67 $ 0.62 8 % $ 3.46 $ 2.92 18 % Discontinued operations � 0.03 �

� 0.65 � NM � 0.04 � � 0.62 � NM Net income $ 0.70 � $ 1.27 � -45 %

$ 3.50 � $ 3.54 � -1 % � Diluted earnings per share Continuing

operations $ 0.66 $ 0.61 8 % $ 3.40 $ 2.87 19 % Discontinued

operations � 0.03 � � 0.64 � NM � 0.04 � � 0.62 � NM Net income $

0.69 � $ 1.25 � -45 % $ 3.44 � $ 3.49 � -1 % � SEGMENT FINANCIAL

DATA (Continuing Operations) (In millions) � Fourth Quarter 2007 �

2006* Sales � EBIT � % Sales Sales � EBIT � % Sales Construction

Materials $ 339.0 $ 43.3 12.8 % $ 278.6 $ 37.6 13.5 % Industrial

Components 167.7 8.7 5.2 % 161.6 8.8 5.4 % Specialty Products 40.3

0.6 1.5 % 40.1 (0.8 ) -2.0 % Transportation Products 48.4 7.2 14.9

% 45.4 6.7 14.8 % General Industry � 80.1 � � 9.0 � 11.2 % � 83.0 �

� 8.4 � 10.1 % Subtotal 675.5 68.8 10.2 % 608.7 60.7 10.0 %

Corporate � - � � (9.1 ) � - � � (4.8 ) Total $ 675.5 $ 59.7 � 8.8

% $ 608.7 $ 55.9 � 9.2 % � Twelve Months 2007 � 2006* Sales � EBIT

� % Sales Sales � EBIT � % Sales Construction Materials $ 1,365.4 $

240.6 17.6 % $ 1,111.2 $ 175.9 15.8 % Industrial Components 799.9

58.9 7.4 % 764.5 59.9 7.8 % Specialty Products 181.4 5.1 2.8 %

174.5 9.7 5.6 % Transportation Products 189.8 28.3 14.9 % 183.0

30.9 16.9 % General Industry � 339.9 � � 38.2 � 11.2 % � 326.2 � �

30.1 � 9.2 % Subtotal 2,876.4 371.1 12.9 % 2,559.4 306.5 12.0 %

Corporate � - � � (41.7 ) � - � � (28.5 ) Total $ 2,876.4 � $ 329.4

� 11.5 % $ 2,559.4 � $ 278.0 � 10.9 % � * 2006 figures have been

revised to reflect the change in method of accounting for

inventory, discontinued operations and the stock split. � NM = Not

Meaningful CARLISLE COMPANIES INCORPORATED Consolidated Statement

of Earnings For the periods ended December 31 (In thousands except

per share data) (Unaudited) � � Fourth Quarter � Twelve Months �

2007 � � 2006* � % Change � � 2007 � � 2006* � % Change � Net sales

$ 675,534 � � $ 608,701 � � 11.0 % $ 2,876,383 � � $ 2,559,410 � �

12.4 % Cost and expenses: � � � � Cost of goods sold 542,786

492,286 10.3 % 2,293,130 2,035,269 12.7 % Selling and

administrative expenses 69,381 61,679 12.5 % 286,056 241,640 18.4 %

Research and development expenses 4,272 3,769 13.3 % 17,392 15,087

15.3 % Other income, net � (615 ) � � (4,926 ) � NM � � (49,581 ) �

� (10,634 ) � NM � � Earnings before interest & income taxes

59,710 55,893 6.8 % 329,386 278,048 18.5 % � Interest expense, net

� 1,334 � � � 5,386 � � -75.2 % � 10,044 � � � 20,313 � � -50.6 % �

Earnings before income taxes 58,376 50,507 15.6 % 319,342 257,735

23.9 % � Income taxes � 17,427 � � � 12,482 � � 39.6 % � 106,321 �

� � 78,942 � � 34.7 % 29.9 % 24.7 % 33.3 % 30.6 % Income from

continuing operations � 40,949 � � � 38,025 � � 7.7 % � 213,021 � �

� 178,793 � � 19.1 % Percent of net sales 6.1 % 6.2 % 7.4 % 7.0 % �

Income from discontinued operations � 1,993 � � � 40,108 � � NM � �

2,616 � � � 38,282 � � NM � � Net income $ 42,942 � � $ 78,133 � �

-45.0 % $ 215,637 � � $ 217,075 � � -0.7 % � Basic earnings per

share Continuing operations $ 0.67 $ 0.62 8.1 % $ 3.46 $ 2.92 18.5

% Discontinued operations � 0.03 � � � 0.65 � � NM � � 0.04 � � �

0.62 � � NM � Basic earnings per share $ 0.70 � � $ 1.27 � � -44.9

% $ 3.50 � � $ 3.54 � � -1.1 % � Diluted earnings per share

Continuing operations $ 0.66 $ 0.61 8.2 % $ 3.40 $ 2.87 18.5 %

Discontinued operations � 0.03 � � � 0.64 � � NM � � 0.04 � � �

0.62 � � NM � Diluted earnings per share $ 0.69 � � $ 1.25 � �

-44.8 % $ 3.44 � � $ 3.49 � � -1.4 % � Average shares outstanding

(000's) - basic � 61,319 � � � 61,429 � � 61,692 � � � 61,240 �

Average shares outstanding (000's) - diluted � 62,041 � � � 62,258

� � 62,630 � � � 62,236 � � Dividends $ 8,934 � � $ 8,330 � � � $

34,743 � � $ 32,010 � � � Dividends per share $ 0.145 � � $ 0.135 �

� 7.4 % $ 0.560 � � $ 0.520 � � 7.7 % � * 2006 figures have been

revised to reflect the change in method of accounting for

inventory, discontinued operations, and the stock split. � NM = Not

Meaningful CARLISLE COMPANIES INCORPORATED Comparative Condensed

Consolidated Balance Sheet (In thousands) (Unaudited) � � December

31, � December 31, � 2007 2006* Assets � � Current Assets Cash and

cash equivalents $ 88,435 $ 144,029 Receivables 367,810 353,108

Inventories 492,274 450,004 Prepaid expenses and other 71,442

54,892 Current assets held for sale � 3,231 � 5,477 Total current

assets � 1,023,192 � 1,007,510 Property, plant and equipment, net

537,637 458,480 Other assets 425,465 436,869 Non-current assets

held for sale � 2,500 � 4,227 Total Assets $ 1,988,794 $ 1,907,086

� Liabilities and Shareholders' Equity Current Liabilities

Short-term debt, including current maturities $ 58,571 $ 151,676

Accounts payable 142,896 142,405 Accrued expenses 186,392 175,849

Current liabilities associated with assets held for sale � 328 �

912 Total current liabilities � 388,187 � 470,842 Long-term debt

262,809 274,658 Other liabilities 218,903 194,264 Shareholders'

equity � 1,118,895 � 967,322 Total Liabilities and Shareholders'

Equity $ 1,988,794 $ 1,907,086 � * 2006 figures have been revised

to reflect the change in accounting for inventory, retained

earnings adjustments from the adoption of FIN 48 and discontinued

operations. CARLISLE COMPANIES INCORPORATED Comparative Condensed

Consolidated Statement of Cash Flows For the Twelve Months Ended

December 31 (In thousands) (Unaudited) � � � 2007 � � 2006*

Operating activities Net income $ 215,637 $ 217,075 Reconciliation

of net earnings to cash flows: Depreciation and amortization 65,874

59,836 Non-cash compensation 13,603 6,844 Excess tax benefits from

share based compensation (5,420 ) (3,710 ) Earnings from equity

investments (2,474 ) (6,022 ) Loss on writedown of assets 7,831

5,610 Foreign exchange (gain) loss (122 ) 362 Deferred taxes 18,796

5,083 Gain on investments, property and equipment, net (52,209 )

(37,302 ) Receivables under securitization program - (137,900 )

Working capital (1,922 ) (87,789 ) Other � (292 ) � (2,209 ) Net

cash provided by operating activities � 259,302 � � 19,878 �

Investing activities Capital expenditures (82,510 ) (95,479 )

Acquisitions, net of cash (189,686 ) (1,875 ) Proceeds from

investments, property and equipment, net 138,019 108,906 Other �

113 � � (433 ) Net cash (used in) provided by investing activities

� (134,064 ) � 11,119 � Financing activities Net change in

short-term debt and revolving credit lines (120,636 ) (55,762 )

Proceeds from receivables securitization facility 15,000 - Proceeds

from long-term debt - 148,875 Reductions of long-term debt (11 )

(6,889 ) Dividends (34,743 ) (32,010 ) Proceeds from hedging

activities - 5,643 Excess tax benefits from share based

compensation 5,420 3,710 Treasury shares and stock options, net

12,507 12,098 Treasury share repurchases (59,957 ) - Other � 24 � �

(1,215 ) Net cash (used in) provided by financing activities �

(182,396 ) � 74,450 � Effect of exchange rate changes on cash �

1,564 � � (163 ) Change in cash and cash equivalents (55,594 )

105,284 Cash and cash equivalents Beginning of period � 144,029 � �

38,745 � End of period $ 88,435 � $ 144,029 � � � * 2006 figures

have been revised to reflect the change in method of accounting for

inventory.

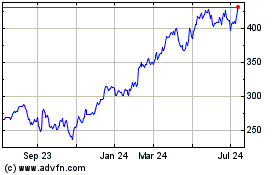

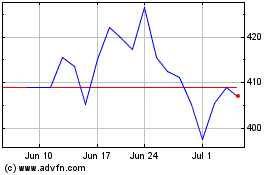

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Sep 2023 to Sep 2024