Carlisle Companies Incorporated (NYSE:CSL) reported income from

continuing operations of $33.7 million, or $0.54 per diluted share,

for the quarter ended March 31, 2007 as compared with $39.7

million, or $0.64 per diluted share, for the first quarter 2006.

Net sales of $631.9 million in the first quarter 2007 were slightly

above net sales of $620.5 million in the first quarter of 2006.

Organic sales growth accounted for all of the increase in net sales

with growth in all segments except for Construction Materials which

experienced a 1% decline in net sales. Richmond McKinnish, Carlisle

President and CEO commented, �Operating results for the first

quarter were negatively impacted by competitive pricing and weather

related challenges in our Construction Materials business. While we

are disappointed with the first quarter results, we remain

optimistic about the non-residential construction market in 2007

and are confident that Carlisle�s long-term strategy of investment

in niche markets for its core businesses will continue to provide

strong returns for our investors. We have revised our full year

2007 guidance for income from continuing operations to reflect the

March 2007 stock-split, the projected accretion from the recently

announced Insulfoam acquisition and the first quarter results. Our

full year guidance is in the range of $3.15 to $3.25 per diluted

share, an increase of 10% to 13% above full year 2006 income from

continuing operations of $2.87 per diluted share.� Effective

January 2007, Carlisle changed its method of accounting for all

inventories to the first-in, first-out method (�FIFO�). If the

Company had determined the cost of its inventories by the last-in,

first-out method (�LIFO�) at March 31, 2007, income from continuing

operations would have been higher by $1.2 million, or $0.02 per

diluted share. In 2006, approximately 56% of the cost of

inventories was determined by the LIFO method. The consolidated

statement of earnings for the quarter ended March 31, 2006 and the

December 31, 2006 balance sheet have been revised to reflect this

change resulting in an increase of first quarter 2006 income from

continuing operations of $0.4 million, or $0.01 per diluted share,

an increase in 2006 inventories of $40.2 million and an increase in

2006 shareholders� equity of $25.1 million. The restatement of

inventory cost from LIFO to FIFO increased full year 2006 diluted

earnings per share from continuing operations from $2.85 to $2.87.

Carlisle�s effective tax rate of 31.5% for continuing operations

for the first quarter 2007 compares with an effective rate of 33.1%

for the first quarter 2006. The reduction in the effective rate is

due primarily to the increase of the Made in America tax deduction

from 3% of qualified production activity income to 6% beginning

January 1, 2007. Construction Materials: Net sales of $226.2

million in the first quarter 2007 were down slightly compared with

$228.0 million for the first quarter 2006. Growth in TPO

(thermoplastic polyolefin) roofing systems and insulation was

insufficient to offset declines in EPDM (synthetic rubber) roofing

systems. Extreme winter weather conditions, not experienced since

2004, persisted throughout the quarter hampering sales in the

Northeast and Midwest, both of which are strong EPDM markets. First

quarter 2007 earnings before interest and income taxes (�EBIT�) of

$20.9 million were 40% below first quarter 2006 EBIT of $35.0

million. The decline in EBIT was largely attributable to

competitive pricing pressure in insulation, decreased higher margin

EPDM sales and higher expenses associated with new plants and

marketing programs. First quarter 2007 and 2006 EBIT included $3.3

million and $4.7 million, respectively, in pre-tax gains for

proceeds received from the settlement of certain legal actions

initiated by Carlisle. Segment EBIT also reflects a pre-tax loss

for the first quarter 2007 and first quarter 2006 related to the

Company�s equity share of losses at its European roofing joint

venture, Icopal, of $2.3 million and $2.9 million, respectively.

Industrial Components: Net sales of $229.6 million for the three

months ended March 31, 2007 increased slightly over net sales of

$224.1 million for the same period in 2006. EBIT of $24.6 million

in the first quarter of 2007 increased 16% as compared with $21.2

million reported in the first quarter of 2006. Increased sales

volumes in the consumer lawn and garden market as well as higher

selling prices to offset raw material cost increases contributed to

the improved net sales and earnings. Specialty Products: The

Company�s braking business recorded net sales of $49.7 million for

the three months ended March 31, 2007 compared with $47.0 million

for the same period 2006. First quarter 2007 EBIT of $2.2 million

increased 47% over first quarter 2006 EBIT of $1.5 million. The

improvement in earnings is primarily due to improved operating

results for the Company�s on-highway brake business. Carlisle

recently hired Joseph La Varra, a thirty-year veteran of the brake

and friction industry, as president of the on-highway brake

business. Transportation Products: Increased sales in construction

and commercial trailers contributed to the 5% increase in net sales

for the Company�s specialty trailer business. First quarter 2007

net sales of $46.6 million compared favorably with net sales of

$44.3 million in 2006. First quarter 2007 EBIT of $6.8 million was

slightly lower than 2006 EBIT of $7.1 million on less favorable

product mix. General Industry: Net sales of $79.8 million in the

first quarter of 2007 compared favorably with net sales of $77.1

million in the first quarter of 2006. EBIT in the first quarter of

2007 of $7.1 million compared with EBIT of $8.0 million for the

same period of 2006. The wire and cable business experienced strong

sales and earnings growth primarily due to record aerospace sales.

The Company�s foodservice business had modest year-over-year sales

growth in the first quarter 2007 while EBIT was slightly lower

compared with the prior year largely due to the timing of certain

marketing activities. The refrigerated truck body business

experienced unfavorable net sales and earnings comparisons to the

prior year on reduced fleet sales as some customers increased total

2006 capital spending in advance of certain regulatory emissions

changes that were effective January 1, 2007. Discontinued

Operations Income from discontinued operations for the first

quarter 2007 of $3.1 million, or $0.05 per diluted share, compared

with income for the first quarter 2006 of $1.9 million, or $0.03

per diluted share. The increase was primarily due to a purchase

price adjustment in favor of Carlisle associated with the sale of

Carlisle Process Systems. Net Income Net income for the first

quarter 2007 was $36.8 million, or $0.59 per diluted share,

compared to $41.6 million, or $0.67 per diluted share, for the

first quarter 2006. The decrease in net income was primarily due to

the decrease in earnings for the Construction Materials segment

which was negatively impacted by competitive pricing and severe

weather challenges. Cash Flow Cash flow provided by continuing

operations of $64.4 million for the three months ended March 31,

2007 compared with $1.1 million provided by continuing operations

for the same period in 2006. Operating cash flow for the first

quarter 2007 was positively impacted by a $70.0 million increase in

the utilization of the Company�s securitization program. Cash used

in investing activities was $39.8 million in 2007 compared to $24.0

million in 2006. Capital expenditures of $18.8 million in 2007

compared with $26.6 million in 2006 as the Company has completed

construction of the majority of its new production facilities for

the Construction Materials segment. Net cash used for investing

activities in 2007 included $22.7 million for acquisitions of

manufacturing operations in China for Carlisle�s specialty tire and

wheel business and wire and cable business. Net cash flow used in

financing activities of $142.0 million in 2007 included the

retirement of $150.0 million in senior notes. Conference Call and

Webcast The Company will discuss first quarter 2007 results on a

conference call for investors on Tuesday, April 24, 2007 at 11:00

a.m. Eastern. The call may be accessed live at

http://www.carlisle.com/investors/conference_call.html, or the

taped call may be listened to shortly following the live call at

the same website location until May 8, 2007. A PowerPoint

presentation will also be available for viewing and/or printing at

the same website location. Forward-Looking Statements This press

release contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. These

statements are based on management\'s current expectations and are

subject to uncertainty and changes in circumstances. Actual results

may differ materially from these expectations due to changes in

global economic, business, competitive, market and regulatory

factors. More detailed information about these factors is contained

in the Company's filings with the Securities and Exchange

Commission. The Company undertakes no duty to update

forward-looking statements. Carlisle is a diversified global

manufacturing company serving the construction materials,

commercial roofing, specialty tire and wheel, power transmission,

heavy-duty brake and friction, heavy-haul truck trailer,

refrigerated truck body, foodservice, and aerospace and test and

measurement industries. CARLISLE COMPANIES INCORPORATED Financial

Results For the periods ended March 31 (In millions, except per

share data) (Unaudited) � First Quarter 2007� 2006* % Change� Net

sales $ 631.9� $ 620.5� 2% � Income from continuing operations $

33.7� $ 39.7� -15% � Income from discontinued operations � 3.1� �

1.9� NM� Net income $ 36.8� $ 41.6� -11% � Basic earnings per share

Continuing operations $ 0.55� $ 0.65� -15% Discontinued operations

� 0.05� � 0.03� NM� Net income $ 0.60� $ 0.68� -12% � Diluted

earnings per share Continuing operations $ 0.54� $ 0.64� -16%

Discontinued operations � 0.05� � 0.03� NM� Net income $ 0.59� $

0.67� -12% � SEGMENT FINANCIAL DATA (Continuing Operations) (In

millions) � First Quarter 2007� � 2006* Sales EBIT % Sales Sales

EBIT % Sales Construction Materials $ 226.2� $ 20.9� 9.2% $ 228.0�

$ 35.0� 15.4% Industrial Components 229.6� 24.6� 10.7% 224.1� 21.2�

9.5% Specialty Products 49.7� 2.2� 4.4% 47.0� 1.5� 3.2%

Transportation Products 46.6� 6.8� 14.6% 44.3� 7.1� 16.0% General

Industry � 79.8� � 7.1� 8.9% � 77.1� � 8.0� 10.4% Subtotal 631.9�

61.6� 9.7% 620.5� 72.8� 11.7% Corporate � -� � (8.4) � -� � (9.2)

Total $ 631.9� $ 53.2� 8.4% $ 620.5� $ 63.6� 10.2% � * 2006 figures

have been revised to reflect the change in method of accounting for

inventory, discontinued operations, the stock split and to conform

with the 2007 segment presentation. NM = Not Meaningful CARLISLE

COMPANIES INCORPORATED Consolidated Statement of Earnings For the

periods ended March 31 (In thousands except per share data)

(Unaudited) First Quarter � 2007� 2006* % Change� Net sales $

631,861� $ 620,489� 1.8% Cost and expenses: Cost of goods sold

507,373� 492,643� 3.0% Selling and administrative expenses 69,164�

60,829� 13.7% Research and development expenses 4,389� 3,884� 13.0%

Other income, net � (2,246) � (463) NM� � Earnings before interest

& income taxes 53,181� 63,596� -16.4% � Interest expense, net �

4,057� � 4,256� -4.7% � Earnings before income taxes 49,124�

59,340� -17.2% � Income taxes � 15,465� � 19,630� -21.2% 31.5%

33.1% Income from continuing operations � 33,659� � 39,710� -15.2%

Percent of net sales 5.3% 6.4% � Income from discontinued

operations � 3,174� � 1,887� NM� � Net income $ 36,833� $ 41,597�

-11.5% � Basic earnings per share Continuing operations $ 0.55� $

0.65� -15.4% Discontinued operations � 0.05� � 0.03� NM� Basic

earnings per share $ 0.60� $ 0.68� -11.8% � Diluted earnings per

share Continuing operations $ 0.54� $ 0.64� -15.6% Discontinued

operations � 0.05� � 0.03� NM� Diluted earnings per share $ 0.59� $

0.67� -11.9% � Average shares outstanding (000's) - basic � 61,655�

� 60,888� Average shares outstanding (000's) - diluted � 62,508� �

61,954� � Dividends $ 8,379� $ 7,657� � Dividends per share $ 0.14�

$ 0.13� 7.7% � * 2006 figures have been revised to reflect the

change in method of accounting for inventory, discontinued

operations, and the stock split. NM = Not Meaningful CARLISLE

COMPANIES INCORPORATED Comparative Condensed Consolidated Balance

Sheet (In thousands) (Unaudited) March 31, December 31, � 2007� �

2006* Assets Current Assets Cash and cash equivalents $ 26,848� $

144,029� Receivables 320,443� 355,409� Inventories 475,958�

452,136� Prepaid expenses and other 46,003� 55,040� Current assets

held for sale � 766� � � 896� Total current assets � 870,018� � �

1,007,510� Property, plant and equipment, net 486,390� 462,307�

Other assets 441,086� 436,869� Non-current assets held for sale �

400� � � 400� Total Assets $ 1,797,894� � $ 1,907,086� �

Liabilities and Shareholders' Equity Current Liabilities Short-term

debt, including current maturities $ 8,048� $ 151,676� Accounts

payable 150,811� 142,964� Accrued expenses 142,026� 176,060�

Current liabilities associated with assets held for sale � 32� � �

142� Total current liabilities � 300,917� � � 470,842� Long-term

debt 275,050� 274,658� Other liabilities 214,039� 194,264�

Shareholders' equity � 1,007,888� � � 967,322� Total Liabilities

and Shareholders' Equity $ 1,797,894� � $ 1,907,086� � * 2006

figures have been revised to reflect the change in accounting for

inventory and retained earnings adjustments from the adoption of

FIN 48. � CARLISLE COMPANIES INCORPORATED Comparative Condensed

Consolidated Statement of Cash Flows For the Three Months Ended

March 31 (In thousands) (Unaudited) � 2007� � 2006* Operating

activities Net income $ 36,833� $ 41,597� Reconciliation of net

earnings to cash flows: Depreciation and amortization 15,455�

14,163� Non-cash compensation 3,318� 2,448� Excess tax benefits

from share based compensation (2,983) (2,843) Loss on equity

investments 2,195� 2,954� Deferred taxes (3,473) 2,188� (Gain) loss

on investments, property and equipment, net (4,867) 103�

Receivables under securitization program 70,000� (4,900) Working

capital (51,565) (54,357) Other � (496) � � (276) Net cash provided

by operating activities � 64,417� � � 1,077� Investing activities

Capital expenditures (18,802) (26,571) Acquisitions, net of cash

(22,719) -� Proceeds from investments, property and equipment, net

1,404� 2,376� Other � 320� � � 223� Net cash used in investing

activities � (39,797) � � (23,972) Financing activities Net change

in short-term debt and revolving credit lines (143,687) 4,139�

Proceeds from long-term debt 365� -� Reductions of long-term debt

-� (38) Dividends (8,379) (7,657) Excess tax benefits from share

based compensation 2,983� 2,843� Treasury shares and stock options,

net � 6,698� � � 8,762� Net cash provided by (used in) financing

activities � (142,020) � � 8,049� Effect of exchange rate changes

on cash � 219� � � 69� Change in cash and cash equivalents

(117,181) (14,777) Cash and cash equivalents Beginning of period �

144,029� � � 38,745� End of period $ 26,848� � $ 23,968� � * 2006

figures have been revised to reflect the change in method of

accounting for inventory and to reflect discontinued operations.

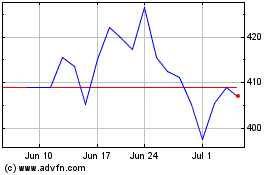

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Aug 2024 to Sep 2024

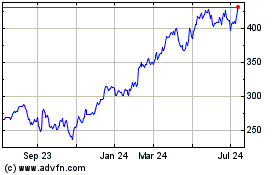

Carlisle Companies (NYSE:CSL)

Historical Stock Chart

From Sep 2023 to Sep 2024