Current Report Filing (8-k)

June 27 2022 - 4:55PM

Edgar (US Regulatory)

false000092762800009276282022-06-272022-06-270000927628us-gaap:CommonStockMember2022-06-272022-06-270000927628cof:SeriesIPreferredStockMember2022-06-272022-06-270000927628cof:SeriesJPreferredStockMember2022-06-272022-06-270000927628cof:SeriesKPreferredStockMemberMember2022-06-272022-06-270000927628cof:SeriesLPreferredStockMemberMember2022-06-272022-06-270000927628cof:SeriesNPreferredStockMember2022-06-272022-06-270000927628cof:SeniorNotesDue2024Member2022-06-272022-06-270000927628cof:SeniorNotesDue2029Member2022-06-272022-06-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 8-K

____________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

June 27, 2022

Date of Report (Date of earliest event reported)

____________________________________

CAPITAL ONE FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________

| | | | | | | | | | | |

| Delaware | 001-13300 | 54-1719854 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| 1680 Capital One Drive, | | |

| McLean, | Virginia | | 22102 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (703) 720-1000

(Not applicable)

(Former name or former address, if changed since last report)

____________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

| Common Stock (par value $.01 per share) | COF | New York Stock Exchange |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series I | COF PRI | New York Stock Exchange |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series J | COF PRJ | New York Stock Exchange |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series K | COF PRK | New York Stock Exchange |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series L | COF PRL | New York Stock Exchange |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series N | COF PRN | New York Stock Exchange |

| 0.800% Senior Notes Due 2024 | COF24 | New York Stock Exchange |

| 1.650% Senior Notes Due 2029 | COF29 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On June 27, 2022, Capital One Financial Corporation (the “Company”) issued a press release announcing the Company’s Stress Capital Buffer Requirement (“SCB”), as calculated by the Board of Governors of the Federal Reserve System 2022 Comprehensive Capital Analysis and Review (“CCAR”) process, is 3.1 percent, effective October 1, 2022. The Company's previously disclosed SCB of 2.5 percent, as calculated by the Board of Governors of the Federal Reserve System 2021 CCAR process, will remain in effect until September 30, 2022.

The Company also posted a summary of the Company’s stress test results on its website (http://www.capitalone.com). This summary shows the results of the Company’s modeling of the Federal Reserve's severely adverse scenario. From the home page, select “About” choose “Investors” to access the Investor Center, select “Financials”, and then choose “Capital One Stress Test Results” to view the current summary.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL |

Cautionary Statements Regarding Forward-Looking Statements.

The attached press release and information provided pursuant to Items 8.01 and 9.01 contain forward-looking statements, which involve a number of risks and uncertainties. The Company cautions readers that any forward-looking information is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking information due to a number of factors, including those listed from time to time in reports that the Company files with the Securities and Exchange Commission, including, but not limited to, the Annual Report on Form 10-K for the year ended December 31, 2021.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| CAPITAL ONE FINANCIAL CORPORATION |

| |

| Date: June 27, 2022 | By: | /s/ Matthew W. Cooper |

| | Matthew W. Cooper |

| | General Counsel and Corporate Secretary |

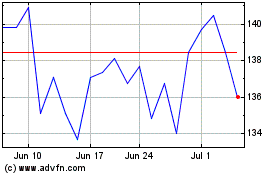

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Mar 2024 to Apr 2024

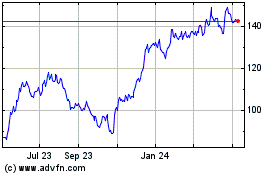

Capital One Financial (NYSE:COF)

Historical Stock Chart

From Apr 2023 to Apr 2024