Statement of Changes in Beneficial Ownership (4)

December 20 2019 - 3:01PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Conaway Gregory F |

2. Issuer Name and Ticker or Trading Symbol

Callon Petroleum Co

[

CPE

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Vice President & CAO |

|

(Last)

(First)

(Middle)

2000 W. SAM HOUSTON PKWY. S., SUITE 2000 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/20/2019 |

|

(Street)

HOUSTON, TX 77042

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 12/20/2019 | | A | | 51716 (1) | A | (2) | 51716 | D | |

| Common Stock | 12/20/2019 | | A | | 61460 (3) | A | (4) | 113176 | D | |

| Common Stock | 12/20/2019 | | A | | 9545 (5)(6) | A | (7) | 122721 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Stock Appreciation Rights | $15.59 | 12/20/2019 | | A | | 19961 | | 12/20/2019 | 3/17/2021 | Common Stock | 19961.0 | (8) | 19961 | D | |

| Stock Appreciation Rights | $15.39 | 12/20/2019 | | A | | 20051 | | 12/20/2019 | 3/23/2022 | Common Stock | 20051.0 | (9) | 40012 | D | |

| Stock Appreciation Rights | $8.38 | 12/20/2019 | | A | | 31442 | | 12/20/2019 | 3/17/2025 | Common Stock | 31442.0 | (10) | 71454 | D | |

| Stock Appreciation Rights | $6.27 | 12/20/2019 | | A | | 42588 | | 12/20/2019 | 3/17/2026 | Common Stock | 42588.0 | (11) | 114042 | D | |

| Explanation of Responses: |

| (1) | On December 20, 2019, Callon Petroleum Company ("Callon") and Carrizo Oil & Gas, Inc. ("Carrizo") completed the transactions contemplated by that certain Agreement and Plan of Merger, dated as of July 14, 2019, as amended on August 19, 2019 and further amended on November 13, 2019 (the "Merger Agreement"), by and between Callon and Carrizo, pursuant to which Carrizo merged with and into Callon, with Callon as the surviving corporation (the "Merger"). Pursuant to the Merger Agreement, at the Effective Time (as defined therein), each share of common stock, par value $0.01 per share, of Carrizo ("Carrizo common stock") beneficially owned by the Reporting Person at the effective time of the Merger, was cancelled and exchanged for 1.75 shares of common stock, par value $0.01 per share, of Callon ("Callon common stock"). |

| (2) | Received in exchange for 29,552 shares of Carrizo common stock in connection with the Merger. On the effective date of the Merger, the closing price of Callon common stock was $4.72 per share and the closing price of Carrizo common stock was $8.25 per share. |

| (3) | Pursuant to the Merger Agreement, at the Effective Time, the Carrizo restricted stock units of the Reporting Person immediately vested and were converted into the right to receive a number of shares of Callon common stock that is equal to the product of (a) the number of shares of Carrizo common stock subject to such Carrizo restricted stock unit as of immediately prior to the Effective Time, multiplied by (b) 1.75, rounded up to the nearest whole share, subject to any applicable withholding taxes. The above number represents an estimate of the number shares of Callon common stock to be received by the Reporting Person pursuant to the Merger Agreement in exchange for their Carrizo restricted stock units. To be updated by amendment, if necessary. |

| (4) | Received in exchange for 55,746 Carrizo restricted stock units in connection with the Merger. On the effective date of the Merger, the closing price of Callon common stock was $4.72 per share and the closing price of Carrizo common stock was $8.25 per share. |

| (5) | Pursuant to the Merger Agreement, at the Effective Time, the Carrizo performance shares of the Reporting Person immediately vested and were converted into the right receive a number of shares of Callon common stock that is equal to the product of (a) the greater of (1)the target number of shares of Carrizo common stock subject to such Carrizo performance share award as of immediately prior to the effective time and (2)the number of shares of Carrizo common stock to be earned based on actual achievement of the performance criteria set forth in the applicable award agreement, measured based on a shortened performance period that ends as of the close of the business day prior to the effective time (if such performance is determinable, and as determined by the Carrizo board of directors immediately prior to the effective time), multiplied by (b)1.75, rounded up to the nearest whole share, subject to any applicable withholding taxes. |

| (6) | The above number represents an estimate of the number shares of Callon common stock to be received by the Reporting Person pursuant to the Merger Agreement in exchange for their Carrizo restricted stock units. To be updated by amendment, if necessary. |

| (7) | Received in exchange for 8,657 Carrizo performance shares in connection with the Merger. On the effective date of the Merger, the closing price of Callon common stock was $4.72 per share and the closing price of Carrizo common stock was $8.25 per share. |

| (8) | Received in connection with the Merger in exchange for 11,406 Carrizo stock appreciation rights with an exercise price of $27.295. |

| (9) | Received in connection with the Merger in exchange for 11,458 Carrizo stock appreciation rights with an exercise price of $26.94. |

| (10) | Received in connection with the Merger in exchange for 17,967 Carrizo stock appreciation rights with an exercise price of $14.67. |

| (11) | Received in connection with the Merger in exchange for 24,336 Carrizo stock appreciation rights with an exercise price of $10.98. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Conaway Gregory F

2000 W. SAM HOUSTON PKWY. S.

SUITE 2000

HOUSTON, TX 77042 |

|

| Vice President & CAO |

|

Signatures

|

| /s/ Gregory F. Conaway, by Stacy E. Skelton, Attorney-in-Fact | | 12/20/2019 |

| **Signature of Reporting Person | Date |

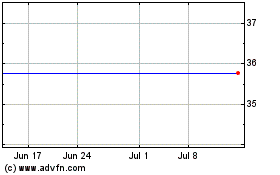

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Mar 2024 to Apr 2024

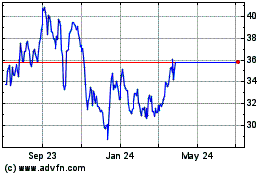

Callon Petroleum (NYSE:CPE)

Historical Stock Chart

From Apr 2023 to Apr 2024