ANALYST PRESENTATION February 7, 2017 Paul

B. Murphy, Jr. Chairman and CEO Investor Presentation June 2019 Filed pursuant to Rule 433 Registration File No. 333-225075 Supplementing the Preliminary Prospectus Supplement dated June 20, 2019 (To Prospectus dated May 21, 2018)

Disclaimers This communication contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, future events and our results of operations,

financial condition and financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,”

“believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,”

“projection,” “would” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based

on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution

you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking

statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Such factors include, without limitation, the “Risk Factors”

referenced in our Registration Statement on Form S-3 filed with the Securities and Exchange Commission (the “SEC”) on May 21, 2018, and our Registration Statement on Form S-4 filed with the SEC on July 20, 2018, other risks and

uncertainties listed from time to time in our reports and documents filed with the SEC, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and the following factors: business and economic conditions generally and in the

financial services industry, nationally and within our current and future geographic market areas; economic, market, operational, liquidity, credit and interest rate risks associated with our business; lack of seasoning in our loan portfolio;

deteriorating asset quality and higher loan charge-offs; the laws and regulations applicable to our business; our ability to achieve organic loan and deposit growth and the composition of such growth; increased competition in the financial services

industry, nationally, regionally or locally; our ability to maintain our historical earnings trends; our ability to raise additional capital to implement our business plan; material weaknesses in our internal control over financial reporting;

systems failures or interruptions involving our information technology and telecommunications systems or third-party servicers; the composition of our management team and our ability to attract and retain key personnel; the fiscal position of the

U.S. federal government and the soundness of other financial institutions; the composition of our loan portfolio, including the identity of our borrowers and the concentration of loans in energy-related industries and in our specialized industries;

the portion of our loan portfolio that is comprised of participations and shared national credits; the amount of nonperforming and classified assets we hold; the possibility that the anticipated benefits of the merger with State Bank are not

realized when expected or at all, including as a result of the impact of, or problems arising from, the integration of the two companies or as a result of the strength of the economy and competitive factors in the areas where Cadence does business.

Cadence can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the

date of this communication, and Cadence does not intend, and assumes no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of

unanticipated events or circumstances, except as required by applicable law. Certain of the financial measures and ratios we present, including “efficiency ratio,” “adjusted efficiency ratio,” “adjusted noninterest

expenses,” “adjusted operating revenue,” “tangible common equity ratio,” “tangible book value per share” and “return on average tangible common equity”, “adjusted return on average tangible

common equity”. “adjusted return on average assets”, “adjusted diluted earnings per share” and “pre-tax, pre-provision net earnings,” are supplemental measures that are not required by, or are not presented

in accordance with, U.S. generally accepted accounting principles (GAAP). We refer to these financial measures and ratios as “non-GAAP financial measures.” We consider the use of select non-GAAP financial measures and ratios to be useful

for financial and operational decision making and useful in evaluating period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance by excluding certain

expenditures or assets that we believe are not indicative of our primary business operating results or by presenting certain metrics on a fully taxable equivalent basis. We believe that management and investors benefit from referring to these

non-GAAP financial measures in assessing our performance and when planning, forecasting, analyzing and comparing past, present and future periods. These non-GAAP financial measures should not be considered a substitute for financial information

presented in accordance with GAAP and you should not rely on non-GAAP financial measures alone as measures of our performance. The non-GAAP financial measures we present may differ from non-GAAP financial measures used by our peers or other

companies. We compensate for these limitations by providing the equivalent GAAP measures whenever we present the non-GAAP financial measures and by including a reconciliation of the impact of the components adjusted for in the non-GAAP financial

measure so that both measures and the individual components may be considered when analyzing our performance. A reconciliation of non-GAAP financial measures to the comparable GAAP financial measures is included in the Appendix. Cadence

Bancorporation has filed a registration statement (including a prospectus and a preliminary prospectus supplement) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus and the

preliminary prospectus supplement in that registration statement and other documents Cadence Bancorporation has filed with the SEC for more complete information about Cadence Bancorporation and this offering. You may get these documents for free by

visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the proposed offering will arrange to send you copies of the prospectus and the preliminary prospectus supplement relating

to the proposed offering if you request it by calling Sandler O'Neill + Partners, L.P. toll-free at 866-805-4128 or U.S. Bancorp Investments, Inc. toll-free at 877-558-2607. Certain information contained in this presentation and statements made

orally during this presentation relates to or is based on publications and other data obtained from third party sources. While we believe these third party sources to be reliable as of the date of this presentation, we have not independently

verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from such third party sources.

Terms of Proposed Offering Issuer: Cadence

Bancorporation (NYSE: CADE) Security Type: Fixed-to-Floating Rate Subordinated Notes due June 2029 Ratings¹: BBB- by Kroll Bond Rating Agency, Inc.; A- by Egan-Jones Rating Company; [BB] by S&P Global Coupon: []% Term: 10 Years (Non-Call 5

Years) Redemption: At the Company’s option beginning in 2024 at 100% of par Use of Proceeds: To repay, together with cash on hand or other immediately available funds, the Company's 4.875% senior notes due June 28, 2019, or for general

corporate purposes Book-Running Managers: Sandler O’Neill + Partners, L.P. and US Bancorp Co-Manager: Raymond James Note: No representation or warranty is made regarding the adequacy or completeness of this summary information. Potential

investors should refer to the offering documentation for their decision-making purposes, including the Preliminary Prospectus Supplement and Prospectus available on the SEC Web site and the documents incorporated by reference therein. (1) A

securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time

Key Investment Highlights Well Positioned

in Attractive Markets in Texas and the Southeast 1 Proven Business Model Focused on Client Relationships, High Touch, and Personal Service 2 Middle Market C&I focus, Texas franchise and Specialized Industries Drive Growth 3 Mid-Sized Bank with

Large Bank Skill Set and Talent 4 Disciplined Underwriting and Well Established Risk Management Framework 5 Attractive Run-Rate Core Profitability and Return Profile 6 Respected Veteran Management Team and Board of Directors 7

Historical Financial Performance 44% 62%

74% 17% 26% 74% 80% 84% 20% 16% 92% 8% 96% 4% (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix Note: Historical balance sheet and income statement increase in 1Q19 due to the

State Bank acquisition closing 3.71% 3.52% 3.59% 3.64% 3.66% 3.58% 3.55% 4.21% Net Interest Margin (%)

Net Income ($mm) Key Profitability Metrics

Earnings Per Share Return on Tangible Equity Return on Assets (1) “Adjusted” figures are considered non-GAAP financial measures. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix GAAP Reporting Basis Adjusted

("Non-GAAP")(1)

First Quarter 2019 Highlights $ in

millions, except per share and unless otherwise indicated (1) Favorable (Unfavorable) comparison versus prior period. YoY represents 3/31/19 vs. 3/31/18. QoQ represents 3/31/19 vs. 12/31/18. (2) Considered a non-GAAP financial measure. See

“Non-GAAP Measures and Ratio Reconciliation” in the appendix (3) Annualized for the three month periods.

Executive Management Team – Proven

& Experienced Name Title Experience Paul B. Murphy, Jr. Chairman / CEO Co-Founder and former CEO of Amegy bank Grew Amegy Bank from 1 location / $50mm in assets in 1990 to 85 locations / $11bn in assets by 2010 Generated a 36x return and 16 year

IRR of 25%+ for initial investors when sold to Zions in 2005 Spent 9 years at Allied Bank of Texas/First Interstate Samuel M. Tortorici President CEO of Regions Bank C&I business Oversaw ~$40bn of loan commitments and deposits generating over

$1bn in revenue. Led 500 bankers across 16 states Over 12 years In the Atlanta market, integrated one whole bank acquisition and grew business services, wealth, retail and specialized industries Valerie C. Toalson EVP, Chief Financial Officer CFO of

BankAtlantic Bancorp (7 years) 13 years at Bank of Oklahoma in various senior roles including Controller, Credit Services and Chief Auditor Financial Services Audit Manager at Price Waterhouse Hank Holmes EVP, Business Services President of Cadence

Bank Former Director of Special Assets, Private Banking and Commercial Real Estate divisions at Amegy Bank of Texas Spent 18 years at Amegy; 10 years on Executive Management Team Randy Schultz EVP, Specialized Industries Founder and managing

director of Regions Bank’s Restaurant Banking Group (RRB) Managing Director of Bank of America’s Restaurant and Beverage Finance Group (RBFG) Grew portfolio from $300mm in assets to over $7bn David F. Black EVP, Chief Risk Officer Former

Chief Credit Officer and Executive Vice President of State Bank Former Director of Corporate Strategy at First Horizon National Corporation and held various leadership roles at Wachovia, Wells Fargo and SunTrust Sheila E. Ray EVP, Chief Talent

Officer Former CFO, COO, Corporate Secretary and EVP at State Bank Former Chief Financial Officer of First Bank of Georgia,

Veteran Board of Directors – Active

& Engaged Name Title Experience Paul B. Murphy, Jr. Chairman / CEO CEO of Cadence Bancorporation Co-Founder and former CEO of Amegy bank William B. Harrison, Jr. Lead Outside Director Former Chairman/CEO J.P. Morgan Chase, Chase Manhattan,

Chemical Bank Member of the J.P. Morgan International Council, Advisory Board member of Aurora Capital Group, Advisory Board of Chilton Investment Company, and Advisory Board of Spencer Stuart Joseph W. Evans Vice Chairman Former Chairman and CEO of

State Bank Financial Corporation and its subsidiary Former Chairman, President and CEO of Flag Financial J. Richard Fredericks Director Founding Partner and Managing Director at Main Management Montgomery Securities (17x All-American analyst),

Shuman, Agnew & Company, Dean Witter Virginia A. Hepner Director Former director of State Bank Financial Corporation with 25 years of banking experience Former President and CEO of The Woodruff Arts Center Precious W. Owodunni Director President

of Mountaintop Consulting, LLC Former Vice President at Goldman, Sachs & Co., experienced in private equity investments and part of the Mergers & Strategic Advisory Group Marc J. Shapiro Director Former non-executive Chairman and former Vice

Chairman for Finance and Risk Management of J.P. Morgan Chase Former CEO Texas Commerce Bank Scott M. Stuart Director Co-founder and managing partner of Sageview Capital Former Partner and part of investment committee at KKR Kathy Waller Director

Former Chief Financial Officer and President, Enabling Services of The Coca-Cola Company, retiring after 32 years of leading the company’s global finance, technical and shared services. J. Thomas Wiley, Jr. Director Former CEO, Director and

President of State Bank Financial Corporation and its subsidiary Former Chairman, CEO and President of Coastal Bankshares, Inc. and its subsidiary bank

Cadence Bank History - A Franchise

Evolved March 2011 Cadence Bank, N.A. Starkville, MS-based $1.5bn in assets 38 branches 126-yr history July 2012 Encore Bank, N.A. Houston, TX-based $1.6bn in assets 12 branches Linscomb & Williams Encore Trust Town & Country Insurance April

2011 Superior Bank, N.A. Birmingham, AL-based $2.6bn in assets 73 branches 54-yr history FDIC Loss Share Agreement ($ in millions) 2013 2014 2015 2016 2017 2018 CAGR Assets $6,453 $7,945 $8,812 $9,531 $10,949 $12,730 14.6 % Loans $4,859 $6,193

$6,917 $7,433 $8,253 $10,054 15.7 % Acquired $1,466 $1,073 $730 $554 $458 $550 (17.8)% Originated $3,394 $5,120 $6,186 $6,879 $7,795 $9,504 22.9 % Deposits $5,347 $6,580 $6,987 $8,017 $9,011 $10,709 14.9 % Branches 99 81 66 66 65 66 (7.8)% FTEs

1,373 1,344 1,218 1,193 1,205 1,170 (3.1)% September 2011 Added a 16 person C&I team in Houston December 2011 Added a 6 person Specialized Industries lending team including Healthcare and Restaurant August 2012 Tampa Commercial Banking Business

Banking Treasury Management April 2017 $173mm Initial Public Offering Capital Raise M&A / Recruit Talent Growth & Operating Leverage FORMATION 2009 – Oct. 2010 Cadence Bancorp, LLC Board of Directors and management team formed

Buy/recap distressed banks in need of capital and mgt. $1bn committed capital raise RETURN OF CAPITAL - LLC Nov. 2017 – Sep. 2018 April 2017 IPO provided access to public markets Three marketed follow-on offerings totaling $1.1b Two block

trades totaling $688mm and final share distribution by LLC 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Cadence Branch (66) State Bank Branch (32) Cadence LPO / Trust Office January 2019 Announced acquisition Atlanta, GA-based $4.9bn in assets

32 branches Merger History Recruit Teams / Organic Growth

$17.5 billion of Assets $13 billion of

Loans ~$15 billion of Deposits $250+ million legal lending limit Enhancing A Compelling Growth Story Source: S&P Global Market Intelligence and Company reports. Unaudited financial highlights are historical and do not include any pro forma

acquisition accounting adjustments. Ranking based on FDIC deposit data as of June 30, 2018. (1) Based on non-CCAR Banks. 98 branch locations over six states Over 175,000 individual business and consumer clients Creates leading regional banking

franchise – scale, growth, asset sensitive profile Enhances growth-centric profile with a strong footprint throughout Atlanta, middle, and coastal Georgia markets Export Cadence and State Bank’s core competencies across the combined

local and national businesses Expands middle market C&I lending franchise and new wealth & trust capabilities to customers throughout Atlanta and other Georgia markets 4th largest bank in Georgia1 6th largest bank in Atlanta1 6th largest BHC

w/ HQ in Texas 75th largest bank in U.S.

Commentary $ in billions Markets with

large, growing populations Texas is the 2nd largest economy among U.S. states and 10th largest global economy Texas has an attractive infrastructure supported by job growth, active business climate, strong trade and foreign investment State Bank

enhances growth-centric profile with key metro-market additions in Atlanta, Augusta, and Greater Savannah Georgia has 1,000+ companies in the $50 to $500 million revenue Middle Market space Birmingham, Tampa and Huntsville are established and stable

Southeast markets Southeast markets provide steady growth and high quality funding to complement our Texas franchise Source: U.S. Census data from Nielsen, Bureau of Labor Statistics and S&P Global Market Intelligence; Deposit market share data

as of June 30, 2018. Attractive Markets – Diverse and Complementary Review of Largest MSAs

Proven Business Model & Long-Term

Client Relationships Banking Financial Services (1) Reflects combined Cadence Bancorporation information as of March 31, 2019. Financial Services revenue includes Cadence Capital Inc., formerly Cadence Insurance. Excludes corporate expenses. (2)

Added or enhanced through State Bank acquisition as of January 1, 2019 Segment Revenue Contribution(1) Banking Business Line Revenue Contribution(1) Product Offering Commercial Banking Corporate and middle market commercial and industrial

Specialized industries (restaurant, healthcare, technology) Energy Community and small business banking Commercial real estate Asset-based & correspondent lending(2) Retail Banking Business banking (serves 45,000 businesses)(2) Mortgage and

other consumer (serves 225,000 consumer)(2) Private Banking SBA Lending(2) Investment Management Focus on the affluent and high net worth segments Linscomb & Williams – 45 year history Trust Services Personal and institutional trust

services Specialty in court-created trusts Portfolio managers average 25 years of experience Treasury/Cash Management Commercial services for deposit management Altera Payroll Services(2) Focused on delivering high-touch, personalized service across

our franchise; Over 190 relationship managers with an average of 22 years of experience(1) 1Q19 Banking Segment Revenue : $ 187.4mm 1Q19 Total Revenue1 : $ 204.1mm

Highlights Disciplined Loan Growth $ in

millions, unless otherwise indicated Broad-Based Loan Generation Loans increased $3.6 billion or 36% to $13.6 billion QoQ with the closing of State Bank on 1/1/19. Excluding the merger impact, loans increased $248 million or 2.4% reflecting

continued organic demand. Cadence continues to be commercial-focused, reflecting 75% of total loans. C&I and CRE production and pipelines remain attractive with healthy commercial customer activity in our markets. (1) Period End Financials. (2)

Figures do not equal 100% due to rounding. (3) Favorable (Unfavorable) comparison versus prior period. YoY represents 3/31/19 vs. 3/31/18. QoQ represents 3/31/19 vs. 12/31/18. 1Q19 Loan Breakdown and Historical Comparison

Steady Credit Quality $ in millions,

unless otherwise indicated Nonperforming Assets(1) Highlights Net Charge Offs (1) NPA% represents total nonperforming assets (NPAs) to total loans and OREO and other NPAs Net-charge offs of $0.6 million in 1Q19 or 2 bps of average loans (annualized)

with the largest charge off of $0.5 million related to a Technology loan that was sold at a discount during March. NPA%(1) declined to 0.6% compared to 0.8% in both 1Q18 and 4Q18. Total nonperforming assets increased $14 million from the prior year

and increased $4 million from 4Q18 to $86 million. Originated portfolio delinquency (30+ days past due) of 23 bps compared to 14 bps in 4Q18, increase primarily due to one C&I credit that had an administrative issue that has since been resolved.

Provision in 1Q19 of $11.2 million was driven by robust loan growth, increases in certain specifically reviewed credits in general C&I and restaurants, and some credit migration within pass rated credits as the portfolio continues to season. The

allowance for credit losses was $105.0 million or 0.8% of total loans at 1Q19. The 1Q19 allowance ratio was impacted by the addition of State Bank loans that were marked due to purchase accounting and accordingly do not have a related allowance.

Highlights Targeted Core Deposit(2)

Growth $ in millions, unless otherwise indicated Deposit Growth 1Q19 Deposit Breakdown and Comparison Core Deposits(2) increased $3.7 billion or 38% from prior quarter with the closing of State Bank. Organic core deposits (excluding impact of

merger) declined a net ($113) million(4) or 1.2% in 1Q19 due to seasonal deposit volatility. Noninterest bearing deposits increased $756 million or 31% since 4Q18 and now make up 23% of total deposits. (1) Favorable (Unfavorable) comparison versus

prior period. YoY represents 3/31/19 vs. 3/31/18. QoQ represents 3/31/19 vs. 12/31/18. (2) Core deposits are defined as total deposits excluding brokered deposits (3) Figures may not total due to rounding (4) Excludes the merged deposits from State

Bank as well as $311 million of State Bank funds on deposit at Cadence as of 12/31/2018 reclassified to cash at merger. Core Deposit Geography (3/31/19)

Net Interest Margin $ in millions,

unless otherwise indicated Highlights (1) Cycle-to-date reflects changes since 4Q15 and incorporates the nine (9) increases in the Fed Funds rate and one-month Libor since December 16, 2015 NIM, Yields & Costs Cumulative Betas (Cycle-to-date)

Net interest margin (tax equivalent) was 4.21% vs. 3.55% for 4Q18, reflecting the impact of the State Bank merger, combined with originated earning asset yields increasing meaningfully more than organic deposit costs. Originated loan yields,

excluding ACI and ANCI loans, was 5.46% in 1Q19, increasing +26bp QoQ and +67bp YoY, reflecting selective pricing and the December rate increase. ~69% of the total loan portfolio is floating at 1Q19. Total cost of deposits was 1.30% for 1Q19 vs.

1.34% for 4Q18. The merger impact reduced costs by 16 bp, partially offset by first quarter increases in deposit costs of 12 bp. Total earning asset yields increased 57 bp to 5.52% from 4.95% in 4Q18 as the total cost of funds for 1Q19 decreased 9

bp to 1.42% compared to 1.51% for 4Q18. The originated loan beta (excluding acquired loans) was 85% cycle-to-date(1) demonstrating the interest-sensitivity of the loan portfolio. The cycle-to-date(1) total deposit beta was 41%, and was positively

impacted in 1Q19 with the closing of the merger with State Bank and continued deposit pricing discipline.

Proactive Measures to De-Risk Net

Interest Income Entered a $4 billion notional collar on 2/28/19 to protect against lower interest rates, while maintaining asset sensitivity Summary: Assuming no change in fair value from Day 1, the Time Value contra-interest of $17 million would be

the only P&L impact over the 5-year term. Any fair value changes impact earnings: declines in LIBOR from Day 1 = more interest income (i.e., rate protection); increases in LIBOR from Day 1 = contra-interest income (less interest income,

offsetting inherent asset sensitivity). Structured with 5-year term; Bought Floor at 3% and Cap at 4.7%, and Sold Cap at 3.5% and Floor at 0% $128 million option price consists of Intrinsic Value of $111 million and Time Value of $17 million The

$128 million is booked as an asset, which will be reduced (increased) over time by Option Receipts (Payments) Changes in fair value are recorded to the asset, with the offset in Other Comprehensive Income (“OCI”) Option Receipts

(Payments) are based on the floor/cap terms reset to LIBOR monthly, and are recorded into interest income The Intrinsic Value is recorded as contra-interest income over the life of the contract(1), offset in OCI The Time Value is recorded as

contra-interest income over the life of the contract(2), offset in OCI No Collar With Collar Net Interest Income $(46) mm $44 mm $(6) mm $24 mm % ∆ Net Interest Income for +/- 100bps Rate Shock Peer Avg NII Sensitivity 6.9% + 100 bp (7.2)% -

100 bp Down 100bp shock impact improved by $40mm; from (7.2)% to (1.0)%, well above peers at (6)% Up 100bp shock impact lowered by $20mm; from 6.9% to 4.0%, inline with peers Source: Peer Sensitivity from June 2018 public filings (1) Intrinsic Value

amortizes as follows: 2019 $17.1mm; 2020 $22.1mm; 2021 $25.3mm; 2022 $23.8mm; 2023 $19.7mm; 2024 $2.8mm (2) Time Value amortizes as follows: 2019 $46k; 2020 $1.9mm; 2021 $3.2mm; 2022 $4.5mm; 2023 $6.2mm; 2024 $1.1mm

Highlights Attractive Noninterest

Income Platform Total Noninterest Income Composition(1) Total Noninterest Income Growth(3) $ in millions, unless otherwise indicated 1Q19 Total Noninterest Income: $ 31mm Total noninterest income of $30.7 million, +$9.7 million or 46.0% from 4Q18.

Addition of State Bank customers have increased banking fees along with new revenue sources (payroll processing and insurance of $1.9 million and SBA income of $1.4 million) during first quarter 2019. The broad diversification in noninterest income

is highlighted by 18% investment advisory fees, 17% service fees, 16% credit fees and 14% trust services. Assets Under Management(2) (1) Figures may not total due to rounding (2) Total Assets Under Management adjusted to exclude Escrow, Safekeeping

& QSF (3) Cadence Insurance was sold to Baldwin Krystyn Sherman Partners in June 2018 Total Noninterest Income / Total Revenue 21.5 % 20.6 % 19.6 % 16.9 % 15.3 %

Expense Management & Operating

Leverage Noninterest Expense ($mm) Highlights 1Q19 adjusted net income(1) of $75.0 million was up $33.5 million or 81% from 4Q18, representing the merger with State Bank and strong core growth. The adjusted efficiency ratio(1) for 1Q19 of 45.7%,

improved from 49.0% in 4Q18 and 50.2% in 1Q18, reflecting operating leverage and strong growth in revenue. The combination with State Bank brings additional capacity to the organization and further opportunity to consolidate operating costs and

leverage balance sheet growth. Efficiency Ratio(1) (1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix GAAP Reporting Basis Adjusted ("Non-GAAP")(1) Net Income ($mm)

CBRG Portfolio Overview1 Specialized

Industries: Restaurant Banking $ in millions, unless otherwise indicated Total Restaurant Industry Loans1 Approximately $1.1 billion of CBRG loans with an average loan size of ~$14 million as of 3/31/19 As of 3/31/19, approximately 70% franchisee

clients and ~30% franchisors-operating companies Solid credit results and active portfolio management: Since inception, only ~$400k charge-offs (strategic exit) 75% limited service and 25% full service restaurants Diversified exposure across 42

concepts and multiple geographies (1) Total Restaurant Industry Loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes and include certain loans originated outside of the Cadence Bank

Restaurant Group (CBRG). Other figures are for CBRG only. CBRG Sector Concentration CBRG Concept Exposure Mix

CBHBG Portfolio Overview1 Specialized

Industries: Healthcare Banking $ in millions, unless otherwise indicated Total Healthcare Industry Loans1 Approximately $644 million in Healthcare Banking Group (CBHBG) funded loans, $832 million in total committed balances, and 49 clients as of

3/31/19 Granular portfolio with average funded loans of approximately $13 million by client Approximately 85% of clients are based in or have significant operations in Texas and the Southeastern United States Highly selective client acquisition

strategy focused on: Strong and experienced management teams Appropriate healthcare sector selection Client partners (management and private equity) looking to use moderate leverage Significant equity and junior capital in client capital stack

(Typical capital structure has equity as a minimum of 40-50% of total capital). Well-diversified by sector: The REIT sector includes clients with portfolio diversification at the client level Additional diversification within the sectors. For

example, Post-acute includes Home Health, Hospice and Nursing. (1) Total Healthcare Industry Loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes, excluding non-owner occupied CRE, and

include certain loans originated outside of the Cadence Bank Healthcare Group (CBHBG). Other figures are for CBHBG only, which include certain healthcare related loans categorized as non-owner occupied CRE in our financial statements, and are

therefore not included in the above Healthcare Industry NAICS figures. CBHBG Sector Concentration1

CBTBG Portfolio Overview Specialized

Industries: Technology Banking $ in millions, unless otherwise indicated CBTBG Total Loans Approx. $1 billion in commitments since inception in Technology Banking Group (CBTBG). Provide Debt Financing to technology companies (EBITDA typically >

$10 million) whose products are: Already adopted by the markets – No venture/start-up Defensible and sustainable Scalable for revenue growth Well-diversified sector investment in 21 sub-verticals (1) Data reflects Cadence Bank Technology

Banking Group (CBTBG) information only. Technology industry loans for Cadence Bancorporation, as reported in our publicly filed financial statements, are based on NAICS codes and include certain loans originated outside of CBTBG. CBTBG Sector

Concentration CBTBG Vertical Concentration

Portfolio Overview Energy Portfolio $

in millions, unless otherwise indicated Total Energy Industry Loans Our team of relationship managers with between 15 to 30+ years of experience, have significant industry and customer expertise Conservative sector level (Midstream, E&P,

Services) underwriting guidelines, active portfolio monitoring, and ongoing stress testing Stable credit portfolio due to active resolutions and improvement in overall energy sector environment 60% of energy loans consist of Midstream, with zero net

charge-offs since inception as of March 31, 2019 Portfolio Mix (3/31/19) Portfolio Trends (Last 5 years) Energy Loans / Total Loans 17.5 % 15.4 % 12.6 % 11.3 % 12.8 % Energy NPLs / Energy Loans 0.6 % 4.5 % 12.1 % 4.6 % 1.6 %

Energy Loans Detail $ in millions Note:

Figures may not total due to rounding.

Pro Forma Capital Ratios (1)

Outstanding Senior Note of $145 million is net $10 million of which the Company (Cadence Bancorporation) currently holds on balance sheet at the holding company Source: S&P Global Market Intelligence [$85] million offering Assumes use of

proceeds to repay, together with cash on hand or other immediately available funds, the Company's 4.875% senior notes due June 28, 2019, or for general corporate purposes¹ Key Offering Assumptions Bank Level as of March 31, 2019 Company Level

as of March 31, 2019

Pro Forma Double Leverage and Interest

Coverage 27 (1) Assumes approximately $145 million Senior Note with a 4.875% coupon; Outstanding Senior Note of $145 million is net $10 million of which the Company (Cadence Bancorporation) currently holds on balance sheet at the holding company

Source: S&P Global Market Intelligence

Holding Company Liquidity Source:

S&P Global Market Intelligence To meet short-term liquidity needs, CADE maintains a targeted cash position and has borrowing capacity through many wholesale sources including the FHLB, correspondent banks and the Federal Reserve Bank As of March

31, 2019, the FHLB issued irrevocable letters of credit totaling $445 million As of March 31, 2019, the Company had $95.9 million in cash at the parent only level The Company has a revolving line of credit of $100.0mm

Appendix

Non-GAAP Measures and Ratio

Reconciliation $ in millions (1) Other non-routine expenses for 2Q18 were $1.1 million and included expenses related to the sale of the assets of our insurance company. This compares to $2.3 million for 1Q18, representing legal costs associated with

litigation related to a pre-acquisition matter of a legacy acquired bank that has been resolved. Note: Figures may not total due to rounding.

Non-GAAP Measures and Ratio

Reconciliation, continued Note: Figures may not total due to rounding. (1) Annualized for the three month periods. $ in millions, unless otherwise indicated

Non-GAAP Measures and Ratio

Reconciliation, continued $ in millions, unless otherwise indicated (1) Annualized for the three month periods. (2) Other non-routine expenses for 2Q18 were $1.1 million and included expenses related to the sale of the assets of our insurance

company. This compares to $2.3 million for 1Q18, representing legal costs associated with litigation related to a pre-acquisition matter of a legacy acquired bank that has been resolved. Note: Figures may not total due to rounding.

Summary Balance Sheet – Period

End $ in millions Note: Figures may not total due to rounding.

Summary Income Statement $ in millions

(1) Considered a non-GAAP financial measure. See “Non-GAAP Measures and Ratio Reconciliation” in the appendix Note: Figures may not total due to rounding.

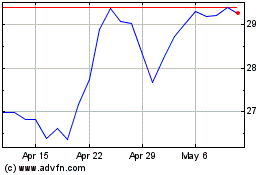

Cadence Bank (NYSE:CADE)

Historical Stock Chart

From Mar 2024 to Apr 2024

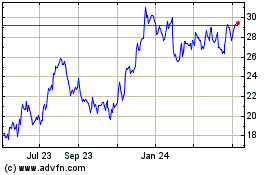

Cadence Bank (NYSE:CADE)

Historical Stock Chart

From Apr 2023 to Apr 2024