Bristol Myers to Buy Turning Point Therapeutics for $4.1 Billion

June 03 2022 - 7:43AM

Dow Jones News

By Colin Kellaher

Bristol Myers Squibb Co. on Friday said it agreed to buy

clinical-stage precision-oncology company Turning Point

Therapeutics Inc. for $4.1 billion, or $76 a share, in cash.

The purchase price is more than double Thursday's closing price

of $34.16 for San Diego-based Turning Point.

New York biopharmaceutical company Bristol Myers said the deal

bolsters its oncology pipeline with the addition of Turning Point's

lead asset, repotrectinib, a next-generation, potential

best-in-class tyrosine kinase inhibitor targeting the ROS1 and NTRK

oncogenic drivers of non-small cell lung cancer and other advanced

solid tumors.

Bristol Myers said it expects repotrectinib to win U.S. Food and

Drug Administration approval in the second half of 2023 and to

become a new standard of care for patients with ROS1-positive

non-small cell lung cancer in the first-line setting.

Bristol Myers said it will use cash on hand fund the

acquisition, which it expects to complete in the third quarter.

Turning Point shares more than doubled in premarket trading to

$73.57.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

June 03, 2022 07:28 ET (11:28 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

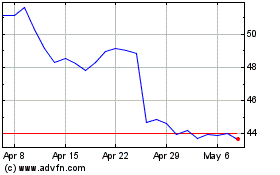

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

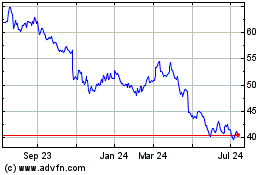

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024