By Jared S. Hopkins

Bristol-Myers Squibb Co., fresh off completing one of the

largest drug-industry mergers ever, is counting on the acquisition

to pay off quickly with new products and ease Wall Street

concerns.

Bristol waited nearly 11 months for its controversial $74

billion deal for Celgene to close, in November. During that span,

U.S. regulators approved two cancer drugs from Celgene, and a

third, for treating multiple sclerosis, could get the go-ahead by

March and eventually provide what analysts see as $3 billion in

annual sales.

The product additions are timely for the combined company, which

is facing patent expirations on some of its big-selling

therapies.

"I feel better today than I felt even the day we closed,"

Bristol Chief Executive Giovanni Caforio said in an interview. "The

power of the innovation engine of the new company is becoming very

clear."

The merger aimed to create a cancer-drug powerhouse with eight

products on the market, each generating more than $1 billion in

annual sales. Yet investors had their doubts. Bristol shares fell

14% the day of the announcement, and an activist-investor campaign

led by hedge fund Starboard Value LP ensued to upend the deal. A

handful of other shareholders also expressed displeasure, including

the fifth-largest shareholder, Dodge & Cox, The Wall Street

Journal reported.

Among Wall Street's concerns: The two drugmakers'

biggest-selling products faced the prospect of falling sales.

Bristol's Opdivo cancer therapy was losing ground to Merck &

Co.'s Keytruda, while Celgene's Revlimid multiple-myeloma treatment

is expected to confront copies in 2022.

In addition, antitrust regulators required that Bristol slough

off Celgene's lucrative psoriasis therapy Otezla, which ultimately

went to Amgen Inc. for $13.4 billion.

Now, after initial skepticism, investors appear to be coming

around. Bristol shares rose more than 26% in the last three months

of 2019, compared with an 11% gain for the NYSE Arca Pharmaceutical

Index and an 8.5% uptick for the S&P 500.

"Every single decision, commercially and in the pipeline, looks

like it broke in Celgene's favor," said Ronny Gal, an analyst at

Sanford C. Bernstein & Co.

But analysts also warn that it isn't all clear sailing for the

expanded company. They cite weaker Opdivo sales, intense

competition in the cancer-drug market and the challenge to Bristol

management of digesting a company as large as Celgene while

shepherding drug candidates to approval.

There also are questions about growth several years out, said

Tim Anderson, an analyst at Wolfe Research.

"Where is that solution going to come from?" Dr. Anderson said.

"It has to be more than what we're seeing today in the phase-three

pipeline. Are there interesting assets on the earlier side of the

Celgene pipeline?"

Bristol plans to launch six new drugs over the next two years,

said Dr. Caforio, who became CEO in 2015.

He said the company is prepared for the decline in Revlimid

sales, which he described as "more of a slope than a cliff." He

also said Opdivo revenue should resume growth in 2021 if the drug

wins additional approvals.

In the near term, Dr. Caforio said, the New York-based company

will draw growth from legacy products. Those could include

Revlimid, which notched $8.1 billion in sales through the first

nine months last year, and the blood-thinner Eliquis, which

generated $5.9 billion during the same period.

Dr. Caforio said Bristol will look to do smaller acquisitions

but probably hold off on larger deals for a couple of years until

it has trimmed the $39 billion debt incurred in acquiring

Celgene.

Bristol pioneered the development of cancer agents known as

immunotherapies, which unleash the body's immune system on tumors.

It now sells two such drugs, Opdivo and Yervoy, which treat cancers

including skin and lung.

But the company lost its advantage in the lucrative lung-cancer

market to rival Merck, a setback that diminished sales prospects

and sent its shares falling.

Meantime, Celgene has transformed the treatment of multiple

myeloma starting with the repurposing of the Thalidomide sleeping

pill -- known for its history of causing birth defects -- into

Revlimid.

The recent pipeline progress is helping the combined company

move past its merger travails. An anemia drug from Celgene called

Reblozyl, which U.S. regulators approved last year, is projected by

JPMorgan Chase to exceed $1 billion in annual sales.

The Food and Drug Administration has said it would make a

decision by March on ozanimod, a multiple-sclerosis therapy that

analysts expect to be a multibillion-dollar seller. Bristol is also

testing the drug in patients with ulcerative colitis.

Also up for approval is a cellular therapy targeting leukemia

that analysts say could surpass $1 billion in yearly sales.

Approval of the so-called CAR-T drug, known as liso-cel, would help

Bristol remain a big player in the blood-cancer market after

Revlimid copies become available.

The company said last month that another CAR-T treatment, in

development with Bluebird Bio Inc., was shown to be effective and

safe in multiple myeloma patients. A regulatory approval filing is

expected this year, Bristol has said.

Write to Jared S. Hopkins at jared.hopkins@wsj.com

(END) Dow Jones Newswires

January 12, 2020 09:14 ET (14:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

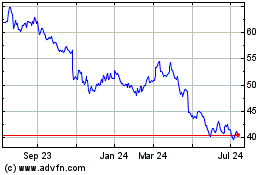

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

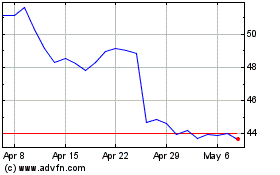

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024