Bristol-Myers Squibb Reports Higher Profit, Revises Full-Year Outlook

July 25 2019 - 8:13AM

Dow Jones News

By Aisha Al-Muslim

Bristol-Myers Squibb Co. (BMY) said its profit and revenue rose

in the latest quarter on stronger demand for its key drugs, as the

global biopharmaceutical company looks ahead to closing its $74

billion acquisition of rival Celgene Corp. (CELG) later this

year.

The New York-based company reported a profit for the second

quarter of $1.43 billion, or 87 cents a share, up from $373

million, or 23 cents a share, a year earlier.

Excluding one-time items, earnings were $1.18 a share, above the

$1.06 a share analysts polled by FactSet were looking for.

Revenue rose 10% to $6.27 billion, above the consensus forecast

of $6.12 billion.

Revenue growth was helped by its two largest brands, Opdivo,

which is used to treat types of lung cancer, and blood-thinner

Eliquis. Revenue from Opdivo grew 12%, while Eliquis increased by

24%.

For 2019, Bristol-Myers Squibb lowered its per-share earnings

guidance range to $3.73 to $3.83, down from its previous outlook of

$3.84 to $3.94. The company increased its adjusted per-share

earnings range to $4.20 to $4.30, up from its prior forecast of

$4.10 to $4.20.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

July 25, 2019 07:58 ET (11:58 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

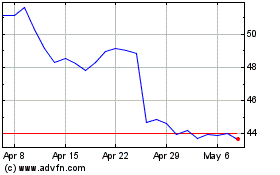

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

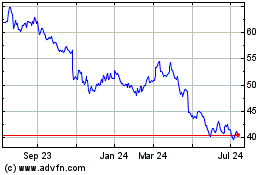

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024