Leveraged Buyouts Come Roaring Back After Coronavirus-Related Lull

October 21 2020 - 5:59AM

Dow Jones News

By Miriam Gottfried

The market for leveraged buyouts has sprung back to life after

private-equity firms finished triaging their coronavirus-stricken

portfolio companies and shifted attention back to their mounting

cash piles.

Buyout firms spent the bulk of the second quarter battened down

as they assessed the economic damage of the shutdown on the

companies they own, particularly those in hard-hit sectors such as

live entertainment, travel, retail and energy. Those in need

conserved cash, drew down revolving-credit facilities or sought

rescue financing.

That trend reversed itself in the three months ended Sept. 30 as

firms struck $146 billion of new deals globally, up from a feeble

$53.3 billion in the second quarter and $103.8 billion in the third

quarter of 2019, according to Dealogic. In the opening weeks of the

fourth quarter, $17.4 billion of buyouts have already been

announced.

Some of those were new deals, and another chunk represented the

resumption of sale processes that were put on hold when the virus

struck, according to bankers and buyout executives. Facilitating

the comeback was the return of the market for leveraged loans, the

below-investment-grade loans used to fund many buyouts, which

retreated significantly when most of the world went into

lockdown.

In August, Blackstone Group Inc. announced a deal to buy

genealogy-research company Ancestry for $4.7 billion, including

debt, from a group led by Silver Lake. Later that month

private-equity firm Clayton Dubilier & Rice LLC said it would

buy Epicor Software Corp. from KKR & Co., also for $4.7

billion, including debt.

KKR struck a deal the following month to buy 1-800 Contacts from

AEA Investors for more than $3 billion. All three of these deals

involved private-equity firms buying companies from each other, a

trend that has become increasingly common in recent years.

"There's been a definite push in sectors that were recovering

and where it felt like there was economic stability," said John

Cokinos, co-head of leveraged finance at RBC Capital Markets.

RBC co-led a financing for CD&R's $4 billion deal to buy the

construction and industrial business of HD Supply Holdings Inc.,

known as White Cap. The process had been tabled a week before the

virus hit New York City, but it was revived over the summer, Mr.

Cokinos said.

September marked the first month since February that the volume

of leveraged loans marketed to investors in the U.S. and Europe

accounted for more than half of global loan volume, Dealogic data

show. Such loans have steadily become less costly for borrowers

since the virus hit, thanks in part to a pickup in the formation of

new collateralized loan obligations -- the primary buyer for

leveraged loans.

Despite the rebound, the first nine months of 2020 have had the

lowest buyout volume since 2016, when $227.1 billion of

transactions were announced during the first nine months of the

year. And there is still plenty of uncertainty around the outcome

of the U.S. presidential election and the pace of the economic

recovery.

Firms are sitting on $2.65 trillion of cash waiting to be

invested in private markets, with nearly two-thirds of that set

aside for private-equity deals, according to data provider

Preqin.

Before the pandemic, high asset prices caused many firms to be

judicious with their deal making in hopes that a downturn would

soon offer more-favorable investment opportunities. The coronavirus

seemed as though it might offer that.

But the window of opportunity to take advantage of turmoil in

the market proved brief, thanks in large part to the Federal

Reserve. It implemented a corporate-bond-buying program that

included the debt of investment-grade companies as well as those

that had investment-grade credit ratings before March 22. That

flooded the market with liquidity, and stocks have largely

continued to charge higher ever since.

There were some firms able to seize the moment, including Silver

Lake and Apollo Global Management Inc., which put billions of

dollars to work by providing rescue financing to companies

including Airbnb Inc. and Expedia Group Inc. Others, such as

Blackstone, have preferred to mostly lie in wait with the idea that

economic recovery will prove slower than the stock market's recent

performance suggests.

For private-equity firms, which must also sell off their

investments profitably, the buoyant stock market hasn't been all

bad. Firms exited $131 billion of deals in the third quarter,

compared with $19.6 billion in the second quarter and $95.9 billion

a year earlier, according to Dealogic.

Among the biggest was Thoma Bravo LP's $11 billion deal to sell

mortgage-software company Ellie Mae Inc. to New York Stock Exchange

owner Intercontinental Exchange Inc., announced in August.

Write to Miriam Gottfried at Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

October 21, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

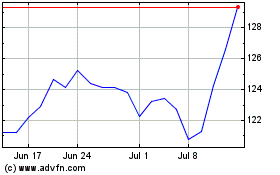

Blackstone (NYSE:BX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackstone (NYSE:BX)

Historical Stock Chart

From Apr 2023 to Apr 2024