By Cheryl Winokur Munk

As cyberattacks become more frequent, the demand for

cybersecurity-related services is naturally booming. And that may

be something investors can take advantage of.

One of the most direct options is to invest in an

exchange-traded fund that focuses on cybersecurity. Funds that

invest in providers of hardware, software, products and services in

cybersecurity have continued to crop up since the first came to

market in 2014.

"If you think cybersecurity is an interesting area for growth,

but you don't know which company is best positioned to take

advantage of this growth, an ETF could be a good bet," says Ben

Johnson, director of global exchange-traded fund research at

Morningstar.

There are caveats. Thematic funds tend to be riskier than broad

market plays, and so aren't suitable as a building block of a core

portfolio, Mr. Johnson says. In addition, he says, by the time

you're seeing headlines around a particular investing theme,

investor enthusiasm generally is already priced in.

Investors who own a cybersecurity ETF likely won't need more

than one, Mr. Johnson says. Roughly half of cybersecurity ETF

holdings overlap, on average, which means their performances can be

dramatically different. But, Mr. Johnson says, the leading stocks

typically are also found in tech and growth funds, which can lead a

portfolio to overconcentrate in cybersecurity.

Here is a look at a few of the cybersecurity ETFs available.

ETFMG Prime Cyber Security ETF (HACK) was the first ETF to

target the cybersecurity industry and tracks the Prime Cyber

Defense Index. The fund holds the shares of 59 companies and covers

such subcategories as systems software, communications equipment,

application software, research and consulting services.

Inception: Nov. 11, 2014

Expense ratio: 0.60%

Net assets as of June 5: $2.17 billion

One-year annualized market price return as of June 4: 32.04%

Three-year: 15.90%

Five-year: 19.20%

Top holdings as of June 5: Cisco Systems Inc., a developer and

manufacturer of networking, cloud and security products, BlackBerry

Ltd., a developer of security software and services, and Proofpoint

Inc., an enterprise security company.

First Trust Nasdaq Cybersecurity ETF (CIBR) seeks investment

results that correspond generally to the price and yield (before

fees and expenses) of its index, the Nasdaq CTA Cybersecurity

Index. To be included in this fund, which consists of 40 holdings,

a security must be listed on an index-eligible global stock

exchange and classified as a cybersecurity company as determined by

the Consumer Technology Association. For instance, each security

must have a world-wide market capitalization of at least $250

million and have a minimum three-month average daily trading volume

of $1 million.

Inception: July 6, 2015

Expense ratio: 0.60%

Net assets as of June 4: $3.66 billion

One-year annualized market price return as of June 4: 34.04%

Three-year: 17.90%

Five-year: 20.10%

Top holdings as of June 4: Cisco Systems, Accenture PLC, a

provider of management consulting and technology services, and

CrowdStrike Holdings Inc., a provider of cloud-based security

technology.

Global X Cybersecurity ETF (BUG), according to its fund summary,

focuses on companies that are mainly developing and managing

security protocols for computer systems, software and hardware and

devices. The fund, with 32 holdings, tracks the Indxx Cybersecurity

Index, whose companies generate at least 50% of their revenues from

cybersecurity activities.

Inception: Oct. 25, 2019

Expense ratio: 0.50%

Net assets as of June 3: $361.4 million

One-year annualized market price return as of June 4: 38.34%

Three-year: N/A

Five-year: N/A

Top holdings as of June 4: Zscaler Inc., a cloud-based

information-security platform, CrowdStrike Holdings and Fortinet

Inc., a developer and seller of cybersecurity solutions.

iShares Cybersecurity & Tech ETF (IHAK) seeks to track the

investment results of the NYSE FactSet Global Cyber Security Index,

composed of developed- and emerging-market companies involved in

cybersecurity and technology, including hardware, software,

products and services.

Inception: June 11, 2019

Expense ratio: 0.47%

Net assets as of June 4: $515.6 million

One-year annualized market price return as of June 4: 32.86%

Three-year: N/A

Five-year:N/A

Top holdings as of June 4: Fortinet, Proofpoint and

CrowdStrike.

WisdomTree Cybersecurity Fund (WCBR) consists of the shares of

25 high-growth companies expected to drive key cybersecurity

developments and innovations over the medium to long term. It seeks

to track the price and yield performance, before fees and expenses,

of the WisdomTree Team8 Cybersecurity Index, which focuses on seven

cybersecurity themes, including cloud security capabilities,

privacy and smart security solutions. Companies in the index must

have a minimum market capitalization of $300 million and a minimum

three-month average daily trading volume of $1 million, among other

qualifications.

Inception: Jan. 28, 2021

Expense ratio: 0.45%

Net assets as of June 4: $18.8 million

One-year annualized market price return as of June 4: N/A

Three-year: N/A

Five-year: N/A

Top holdings as of June 4: Cloudflare Inc., a web infrastructure

and website security company, Datadog Inc., a monitoring service

for cloud-scale applications, and Rapid7 Inc., a security analytics

and automation provider.

ProShares Ultra Nasdaq Cybersecurity (UCYB) seeks daily

investment results, before fees and expenses, that correspond to

two times the daily performance of its benchmark, the Nasdaq CTA

Cybersecurity Index.

Inception: Jan. 19, 2021

Expense ratio: 0.98%

Net assets as of March 31: $2.5 million

One-year annualized market price return as of June 4: N/A

Three-year: N/A

Five-year:N/A

Ms. Winokur Munk is a writer in West Orange, N.J. She can be

reached at reports@wsj.com.

(END) Dow Jones Newswires

June 07, 2021 10:18 ET (14:18 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

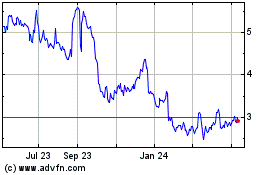

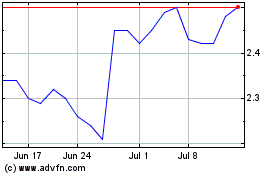

BlackBerry (NYSE:BB)

Historical Stock Chart

From Mar 2024 to Apr 2024

BlackBerry (NYSE:BB)

Historical Stock Chart

From Apr 2023 to Apr 2024