UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

December 2, 2021

|

|

|

|

|

BHP GROUP LIMITED

(ABN 49 004 028 077)

(Exact name of Registrant as specified in its charter)

VICTORIA, AUSTRALIA

(Jurisdiction of incorporation or organisation)

171 COLLINS STREET, MELBOURNE,

VICTORIA 3000 AUSTRALIA

(Address of principal executive offices)

|

|

BHP GROUP PLC

(REG. NO. 3196209)

(Exact

name of Registrant as specified in its charter)

ENGLAND AND WALES

(Jurisdiction of incorporation or organisation)

NOVA SOUTH, 160 VICTORIA STREET

LONDON, SW1E 5LB

UNITED

KINGDOM

(Address of principal executive offices)

|

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F: ☒ Form 20-F ☐ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in

paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934: ☐ Yes ☒ No

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b): n/a

NEWS RELEASE

|

|

|

|

|

Release Time

|

|

IMMEDIATE

|

|

|

|

|

Date

|

|

2 December 2021

|

|

|

|

|

Release Number

|

|

32/21

|

Unification of BHP’s Dual Listed Company (DLC) structure

A video presentation by BHP CEO, Mike Henry, on the rationale and benefits of unification is available on BHP’s website at:

https://www.bhp.com/investors/presentations-events/presentations-and-briefings

A copy of the presentation is attached.

Further information on BHP can be found at: bhp.com

Authorised for lodgement by:

Stefanie Wilkinson

Group Company Secretary

|

|

|

|

|

Media Relations

|

|

Investor Relations

|

|

|

|

|

Email: media.relations@bhp.com

|

|

Email: investor.relations@bhp.com

|

|

|

|

|

Australia and Asia

|

|

Australia and Asia

|

|

|

|

|

Gabrielle Notley

|

|

Dinesh Bishop

|

|

Tel: +61 3 9609 3830 Mobile: +61 411 071 715

|

|

Mobile: + 61 407 033 909

|

|

|

|

|

Europe, Middle East and Africa

|

|

Europe, Middle East and Africa

|

|

|

|

|

Neil Burrows

|

|

James Bell

|

|

Tel: +44 20 7802 7484 Mobile: +44 7786 661 683

|

|

Tel: +44 20 7802 7144 Mobile: +44 7961 636 432

|

|

|

|

|

Americas

|

|

Americas

|

|

|

|

|

Judy Dane

|

|

Brian Massey

|

|

Tel: +1 713 961 8283 Mobile: +1 713 299 5342

|

|

Tel: +1 713 296 7919 Mobile: +1 832 870 7677

|

|

|

|

|

BHP Group Limited ABN 49 004 028 077

|

|

BHP Group plc Registration number 3196209

|

|

LEI WZE1WSENV6JSZFK0JC28

|

|

LEI 549300C116EOWV835768

|

|

Registered in Australia

|

|

Registered in England and Wales

|

|

Registered Office: Level 18, 171 Collins Street

|

|

Registered Office: Nova South, 160 Victoria Street

|

|

Melbourne Victoria 3000 Australia

|

|

London SW1E 5LB United Kingdom

|

|

Tel +61 1300 55 4757 Fax +61 3 9609 3015

|

|

Tel +44 20 7802 4000 Fax +44 20 7802 4111

|

Members of the BHP Group which is

headquartered in Australia

Follow us on social media

Unification of BHP’s DLC structure December 2021

Disclaimer The information in this presentation is current as at 2 December 2021. It is in summary form

and is not necessarily complete. Further information regarding unification (including a detailed timetable and more information on the advantages, disadvantages and risks associated with unification) will be provided to BHP shareholders in a

Shareholder Circular and UK Prospectus. Forward-looking statements This presentation contains forward-looking statements, including statements regarding: plans, strategies and objectives of management; approval of certain projects and consummation

of certain transactions; unification, including but not limited to, the perceived benefits of unification and expectations around the financial impact of unification on the BHP Group; future performance and future opportunities; provisions and

contingent liabilities; and tax and regulatory developments or approvals. Forward-looking statements may be identified by the use of terminology, including, but not limited to, ‘intend’, ‘aim’, ‘project’,

‘anticipate’, ‘estimate’, ‘plan’, ‘believe’, ‘expect’, ‘may’, ‘should’, ‘will’, ‘would’, ‘continue’, ‘annualised’ or similar words. These

statements discuss future expectations concerning the results of assets or financial conditions, or provide other forward-looking information. The forward-looking statements are based on the information available as at the date of this presentation

and/or the date of the Group’s planning processes or scenario analysis processes. There are inherent limitations with scenario analysis and it is difficult to predict which, if any, of the scenarios might eventuate. Scenarios do not constitute

definitive outcomes for us. Scenario analysis relies on assumptions that may or may not be, or prove to be, correct and may or may not eventuate, and scenarios may be impacted by additional factors to the assumptions disclosed. Additionally,

forward-looking statements in this release are not guarantees or predictions of future performance or outcomes, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual

results or outcomes to differ materially from those expressed in the statements contained in this release. BHP cautions against reliance on any forward-looking statements or guidance, particularly in light of the current economic climate and the

significant volatility, uncertainty and disruption arising in connection with COVID-19. Except as required by applicable regulations or by law, BHP does not undertake to publicly update or review any

forward-looking statements, whether as a result of new information or future events. Past performance cannot be relied on as a guide to future performance. For further information concerning risks associated with Unification, please refer to the

risk factors to be disclosed in the Shareholder Circular. Alternative performance measures We use various alternative performance measures to reflect our underlying performance. For further information please refer to alternative performance

measures set out on pages 62—77 of the BHP Results for the year ended 30 June 2021. No offer of securities Nothing in this presentation should be construed as either an offeror a solicitation of an offer to buy or sell any securities, or a

solicitation of any vote or approval, in any jurisdiction, or be treated or relied upon as a recommendation or advice by BHP. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as

amended, or pursuant to an exemption from, or in a transaction not subject to, such registration requirements. Reliance on third party information The views expressed in this presentation contain information that has been derived from publicly

available sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. This presentation should not be relied upon as a recommendation or forecast by

BHP. Notice to overseas shareholders The distribution of this presentation into a jurisdiction other than the United Kingdom or Australia may be restricted by law and therefore persons into whose possession this release comes should inform

themselves about and observe any such restrictions. Any failure to comply with any such restrictions may constitute a violation of the securities laws of any such jurisdiction. No action has been or will be taken by the BHP to distribute this

presentation in any jurisdiction where action for that purpose may be required or doing so is restricted by law. Accordingly, this presentation may not be distributed or published in any jurisdiction except under circumstances that will result in

compliance with any applicable laws and regulations. Notice to US investors The securities to be issued by Limited in connection with Unification have not been, and will not be, registered under the US Securities Act of 1933, as amended (the

“US Securities Act”), or the securities laws of any state or other jurisdiction of the United States. Any securities to be issued if Unification is completed are anticipated to be issued in reliance on the exemption from the registration

requirements of the US Securities Act provided by Section 3(a)(10) thereof on the basis of the approval of the High Court of Justice in England and Wales. Unification of BHP’s DLC structure December 2021 2

Unification is in best interests of BHP shareholders The Board unanimously recommends shareholders vote in

favour Unification of Dual Listed Company structureBHP Group structure immediately after Unification Plc shareholders entitled to receive one Limited share for each Plc share they ownUnified BHP shareholders Unification will be implemented by way of

a UK scheme of arrangementComprising pre-Unification whereby BHP Limited will acquire all shares in BHP PlcPlc shareholders and Limited shareholders1 Subject to shareholder approval, UK court sanction and

remaining regulatory approvals Limited Next steps ListingStandard listingSecondary listingNYSE listed Shareholder documentation, including an Independent Expert Report,on ASXon LSEon JSEADR program will be available via the BHP website on or around

8 December 2021 Plc and Limited shareholder Meetings expected to be held 20 January 2022BHP assets If all conditions to unification are satisfied, completion is expected on 31 January 2022 Unification of BHP’s DLC structure

December 20213

Setting up BHP for the future Unification will create a more simple, more agile BHP with greater strategic

flexibility SimplificationStrategic flexibility A natural extension of initiatives on our portfolio,Improves BHP’s flexibility to continue to reshape its makes BHP more efficientportfolio, such as the merger of BHP Petroleum with Woodside

Streamlined dividend arrangements$A single global share price Dividends will continue to be paid in shareholders’BHP shares traded on the ASX, LSE and JSE would be local currency2 but Limited will no longer have to makeinterchangeable without

the historical price differential dividend payments to Plcbetween Limited and Plc shares3. The ASX has historically traded on higher valuation multiples than the LSE Unification of BHP’s DLC structure December 20214

Shareholders can continue to invest on existing exchanges No change to dividend policy, dividend currency or

commitment to retail shareholder engagement Retail investors inPosition does not change LimitedBHP’s ability to fully frank dividends will remain unchanged Continue to be able to buy/sell BHP shares on the LSE4 and JSE Retail investors inUK and

South African shareholders can continue to receive their dividends in pounds or rand respectively Plc Continue to be able to vote on shareholder resolutions and participate in AGMs5 Retail investors that ownNo change to Limited ADS holders US

ADSsPlc ADS holders will receive new Limited ADSs on a 1-1 basis in the same way they hold their existing Plc ADSs Unification of BHP’s DLC structure December 20215

Right time to unify Payments from Limited to Plc to fund dividends have increased, consuming franking credits.

Unification costs have fallen. Reduction in Plc earnings contributionSubstantial growth in BHP Group dividendsSignificant reduction in Unification costs8 (%, Underlying EBIT)(US$ billion)(US$ billion) 50182.0 ~US$1.2 billion reduction 2591.0 US$350-450m 000.0 FY01 6FY217FY01FY21BeforeNow Unification of BHP’s DLC structure December 20216

BHP’sstrong fundamentals areunchanged Our investment proposition will continue to grow shareholder value

and sustainable returns Operational Disciplined excellence capital allocation Value and returns World classContinuousSuccessfulStrongEmbeddedPipeline ofSustainabilityIncreasingStrong assetsimprovementprojectbalanceCapitalorganicand socialexposure to

shareholder in culture anddeliverysheet Allocation opportunities value future facing returns capabilitiesFrameworkindustrycommodities leadership Unification of BHP’s DLC structure December 20217

Appendix

Footnotes 1. Slide 3: Includes pre-Unification holders of Plc ADSs and

Limited ADSs, representing shares of Plc and Limited respectively. 2. Slide 4: Shareholders will continue to have dividends paid in the currency they have elected prior to Unification. 3. Slide 4: There are not expected to be any material

differences in the respective share prices on each exchange when adjusted for currency differences. 4. Slide 5: UK shareholders who hold their shares as nominees or through investment funds should speak directly to their ISA manager or fund manager

respectively, to assess the implications 5. Slide 5: The manner in which, and extent to which, shareholders can attend and vote at the AGM will depend on the way in which they hold their Limited shares following unification. 6. Slide 6: FY01

represents Plc’s share of Profit from ordinary activities before income tax, sourced from the Proforma Consolidated Statement of Financial Performance for FY01. Excludes allocation of Proforma adjustments. 7. Slide 6: FY21 represents reported

Underlying EBIT contribution from assets held under BHP Group Plc, where these are individually reported in the asset tables, as a percentage of Underlying EBIT for the Group (excluding Underlying EBITDA from third party products, inter-company,

statutory adjustments or group and unallocated). 8. Slide 6: Reduction in transaction costs is predominantly due to the restructure of BHP Billiton Marketing Asia following settlement of the transfer pricing dispute with the ATO and the recently

updated assessment of the likelihood of recovering NSWEC associated tax losses. Unification of BHP’s DLC structure December 2021 9

Unification overview, timeline and approvals Prospectus and Shareholder Circular published in December ahead of

shareholder votes in January On or around 8 December 2021 (UK time)20 January 202231 January 2022 Indicative key datesPublication of the Shareholder Circular, Limited General Meeting Target completion date (including Independent Expert

Report and notice of meetings), Prospectus and JSE Plc General Meeting and Scheme Meeting Pre-Listing announcement, via BHP’s website Approval of Unification at both Plc and Limited shareholder meetings

Outstanding approvalsCourt sanction of the UK scheme of arrangement Approval of the National Treasury of South Africa and an outstanding competition regulatory clearance Unification will be implemented by way of a UK scheme of arrangement whereby

BHP Group Limited will acquire all shares in BHP Group Plc Plc shareholders will be entitled to receive one new Limited share in exchange for each Plc share they own1 ImplementationImplementation requires both Limited and Plc shareholder support

–special resolutions requiring approval by at least 75% of votes cast by Limited and Plc shareholders –Plc UK scheme of arrangement requires approval by both a simple majority by number of Plc shareholders voting and Plc shareholders

representing 75% of the votes cast OwnershipLimited and existing Plc shareholders would have equivalent economic and voting interests in BHP post unification as they do under the current DLC structure 1. The nature of the tradeable interest will

differ in each jurisdiction. Unification of BHP’s DLC structure December 202110

Unification impact on corporate structure Unification will be implemented by way of UK scheme of arrangement,

whereby BHP Group Limited will acquire BHP Group Plc Current StructureProposed Structure Ltd ShareholdersPlc ShareholdersLtd & Plc Shareholders ~58%~42% combined sharescombined shares BHP PlcBHP Ltd BHP LtdASX primary listing; DLC

SharingLSE primary listing; ASX primary listing;LSE standard listing; AgreementJSE secondary listing; NYSE Level II ADRJSE secondary listing; NYSE Level II ADRNYSE Level II ADR Ltd OperationsPlc OperationsLtd & Plc Operations

AssetsAssetsAssets WAIOSamarco Pampa NorteNSWEC2WAIOPampa Norte EscondidaPetroleum1 AntaminaCerrejon1EscondidaSamarco Olympic DamBMC1Olympic DamJansen BMAJansenBMANSWEC2 Antamina 1. BHP has signed agreements to divest its 33.3 per cent interest

in Cerrejón and 80% interest in BMC, and separate its Petroleum business. 2. The review process for NSWEC is progressing, in line with the two-year timeframe announced in August 2020. BHP remains open

to all options and continues consultation with relevant stakeholders. Unification of BHP’s DLC structure December 202111

Unification will eliminate DLC dividend arrangements Limited is currently funding the majority of Plc dividends

given recent portfolio changes and growth in dividends Under the DLC Structure, Limited and Plc are required to pay the same perPlc earnings contribution has fallen… share cash dividends to their shareholders(%, Underlying EBIT) Historically,

both Limited and Plc were able to fully fund dividends from their50 own earnings However, in recent years, with the reduction in Plc’s earnings and the growth25 in BHP’s dividends, significant dividend payments have been made from Limited

to Plc via the DLC Dividend Share (“DDS”) Existing DLC structure expected to require ongoing dividend payments from0 Limited to Plc resulting in increased consumption of franking creditsFY01 1FY21 2 –Any dividends paid from Limited to

Plc must be franked to the same extent as dividends on Limited shares, meaning that should the DLC…as BHP Group dividends have grown structure continue, Limited would be expected to continue to pay a(US$ billion) material quantum of fully

franked dividends to Plc 18 –Plc cannot use those franking credits, nor can it distribute them to its shareholders Unification will remove the DLC-related dividend arrangements and result in9 all BHP

dividends (and associated franking credits) being paid directly to all BHP shareholders 0 FY01FY21 1. FY01 represents Plc’s share of Profit from ordinary activities before income tax, sourced from the Proforma Consolidated Statement of

Financial Performance for FY01. Excludes allocation of Proforma adjustments. 2. FY21 represents reported Underlying EBIT contribution from assets held under BHP Group Plc, where these are individually reported in the asset tables, as a percentage of

Underlying EBIT for the Group (excluding Underlying EBITDA from third party products, inter-company, statutory adjustments or group and unallocated). Unification of BHP’s DLC structure December 202112

Unification will not change ability to fully frank dividends Unification eliminates DLC Dividend arrangements,

enables all dividends and franking credits to be paid directly to shareholders Franking credit (FC) balance and significant generation of creditsUnification prior to BHP Petroleum merger with Woodside allows more from strong operations will sustain

franked returnsfranking credits to be directly distributed to Limited shareholders (US$ billion, franking credit balance1)(US$ billion, franking credit movement from Woodside merger2) 368 FY16-20 FY21 184 00

FY16 openingFC generationFC distributedFC consumedFC distributedFY21 closingPre unificationPost unification FC balancefrom operationsthroughfunding PlcthroughFC balance dividendsdividendsbuy-backsFCs distributed directly to Limited shareholders

through merger FCs consumed through merger (DDS payment to replenish Plc retained earnings) FY16 – FY21FCs consumed through merger (In-specie distribution to Ltd shareholders) 1. All balances have been

translated using an exchange rate of AUD/USD 0.75. 2. Based on Woodside share price as at 26 November 2021. Unification of BHP’s DLC structure December 202113

A single global share price The ASX has historically traded on higher valuation multiples than the LSE ASX P/E

multiples have consistently traded at a premium over the FTSE1,2Indexes have a similar composition S&P/ASX2002 Energy and materials 19.2 x 18.3 x 17.2 x17.4 xFinancials 16.2 x 15.2 x14.6 x14.6 x 14.2 x14.4 xConsumer Healthcare Real estate

FTSE1002Industrials Communications Technology BHP 10 year10 year average5 year average3 year average1 year averageUtilities average P/E Unclassified LimitedPlcS&P/ASX 200 FTSE 100 1. There are a number of potential explanations for the

differential, including market differences, differences in the profiles of index constituents and the fact that dividends on many Australian shares carry franking credits. 2. Source: Bloomberg as at 26 November 2021. Unification of BHP’s

DLC structure December 202114

Offsetting index flows Increased weighting on the ASX will likely create demand for Limited shares mitigating

the removal from other indices The expected increase in BHP’s S&P/ASX indices weighting andBHP shareholder composition (pre-Unification)1 removal from FTSE UK Index Series may result in increased

trading in BHP shares in the short termPlcLimited Unification is expected to result in index related buying and selling5% 16%15% that will offset to some extent20% – Currently ~15% of Plc’s share register and ~20% of Limited’s6% share

register are held by passive index funds33% 20% The number of Limited shares on the ASX will increase by ~72% as 2.1 billion of Plc shares are exchanged for Limited shares which25% will result in an increased weighting in the S&P/ASX 200

index35%8%17% Significant liquidity in BHP’s shares and the ASX will assist in the absorption of temporarily heightened flowsIndex fundsActive UK (Plc) Active South Africa (Plc)Active Australia (Ltd) Active (Rest of World)Retail Other 1.

Estimated based on BHP’s shareholder register as at 29 October 2021. Unification of BHP’s DLC structure December 202115

High standards of governance maintained BHP will remain committed to maintaining high standards of corporate

governance The BHP Board’s approach to corporate governance matters will be broadly consistent with the current approach Post-Unification, while BHP will no longer be required to comply or explain

non-compliance with the UK Corporate Governance Impact ofCode, BHP will remain subject to: Unification–the ASX Listing Rules, Corporate Governance Council Principles and Recommendations and the

Corporations Act –the UK Listing Regime for Standard Listings –the US Exchange Act, the US Sarbanes-Oxley Act and NYSE listing standards applicable to it as a foreign private issuer BHP shareholders will be afforded a number of protections

by law as noted above, including relating to (but not limited to): Restrictions on non-pro rata issues of new shares Takeovers Capital management – capital reductions and share buy-backs Significant changes in nature or scale of activities Best practice Directors remuneration Disclosure of substantial shareholdings protections Transactions involving directors and other related parties

Protection of minority shareholders BHP also intends to take further voluntary actions to maintain its high standards of corporate governance, such as committing to hold annual re-elections of all Non-Executive Directors Unification of BHP’s DLC structure December 202116

SIGNATURES

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BHP Group Limited and BHP Group Plc

|

|

|

|

|

|

|

Date: December 2, 2021

|

|

|

|

By:

|

|

/s/ Stefanie Wilkinson

|

|

|

|

|

|

Name:

|

|

Stefanie Wilkinson

|

|

|

|

|

|

Title:

|

|

Group Company Secretary

|

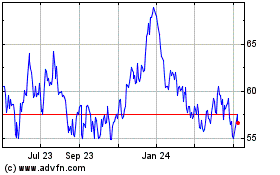

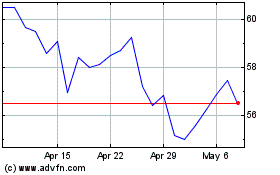

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024