Beazer Homes USA, Inc. (NYSE: BZH) (the “Company”) announced

today the early results of its previously announced cash tender

offer (the “Offer”) for any and all of its $500 million aggregate

principal amount of outstanding 8.75% Senior Notes due 2022 (the

“Notes”), and its concurrent consent solicitation (together with

the Offer, the “Offer and Consent Solicitation”) to amend the

indenture governing the Notes to eliminate substantially all of the

restrictive covenants and certain events of default and shorten the

minimum notice period required for optional redemptions by the

Company from 15 calendar days to two calendar days (the

“Amendments”), in each case, upon the terms and conditions included

in the Offer to Purchase and Consent Solicitation Statement, dated

September 10, 2019 (the “Offer to Purchase”).

As of the consent deadline, which was 5:00 p.m., New York City

time, on September 23, 2019 (the “Consent Deadline”), the aggregate

principal amount of the Notes and related consents that have been

validly tendered and delivered and not validly withdrawn or revoked

was $465,333,000, representing 93.07% of the $500,000,000 aggregate

outstanding principal amount of the Notes.

As a result of obtaining consents from more than 50% of the

outstanding Notes, the Company, the subsidiary guarantors and the

trustee are entering into a supplemental indenture (the

“Supplemental Indenture”) to the indenture governing the Notes

giving effect to the Amendments. The Supplemental Indenture will

become effective immediately upon acceptance for purchase by the

Company of the Notes validly tendered and not withdrawn prior to

the Consent Deadline, and will be binding on all holders of the

Notes, even those who did not deliver a consent at or prior to the

Consent Deadline.

The Offer and Consent Solicitation is subject to the

satisfaction or waiver of certain conditions as described in the

Offer to Purchase, including (i) the receipt of at least $500

million in gross proceeds from one or more offerings of senior

notes and borrowings under the Company’s new senior unsecured term

loan, in each case, on terms acceptable to the Company and (ii)

satisfaction of certain general conditions to the Offer and Consent

Solicitation, in each case as described in more detail in the Offer

to Purchase. If any of the conditions are not satisfied, the

Company may terminate the Offer and Consent Solicitation and return

tendered Notes, may waive unsatisfied conditions and accept for

payment and purchase all validly tendered Notes, may extend the

Offer and Consent Solicitation or may otherwise amend the Offer and

Consent Solicitation.

Subject to the terms and conditions of the Offer and Consent

Solicitation being satisfied or waived, holders who validly

tendered and did not withdraw Notes prior to the Consent Deadline

will, if their Notes are accepted for purchase, receive the “Total

Consideration” equal to $1,046.25 per $1,000 principal amount of

Notes. In addition to the Total Consideration, holders will receive

accrued and unpaid interest on the Notes from the most recent

payment of semi-annual interest preceding the Early Settlement Date

to, but not including, the Early Settlement Date. The Early

Settlement Date is expected to be September 24, 2019.

The Withdrawal Deadline has passed. Accordingly, any validly

tendered Notes and delivered consents may no longer be withdrawn or

revoked.

The Company currently intends to redeem, as soon as practical

after the Early Settlement Date, any Notes that remain outstanding

following the Offer and Consent Solicitation in accordance with the

terms of the indenture governing the Notes. However, there is no

requirement in the indenture or otherwise that the Company redeem

any Notes, and unless redeemed, such Notes will continue to remain

outstanding.

The complete terms and conditions of the Offer and Consent

Solicitation are set forth in the Offer to Purchase that has been

sent to holders of the Notes. Holders are urged to read the Offer

to Purchase carefully.

The Company has engaged Credit Suisse Securities (USA) LLC to

act as Dealer Manager and Solicitation Agent for the Offer and

Consent Solicitation. Persons with questions regarding the Offer

and Consent Solicitation should contact Credit Suisse Securities

(USA) LLC toll-free at (800) 820-1653 or collect at (212) 325-2476.

Requests for documents should be directed to D.F. King & Co.,

Inc., the Tender and Information Agent for the Offer and Consent

Solicitation, at (212) 269-5550 (for banks and brokers) or (800)

591-8263 (for noteholders), or via the following web address:

www.dfking.com/bzh.

This press release is for informational purposes only and is not

an offer to purchase or a solicitation of an offer to purchase with

respect to any of the Notes. The Offer and Consent Solicitation is

being made pursuant to the tender offer documents, including the

Offer to Purchase that the Company has distributed to holders of

the Notes. The Offer and Consent Solicitation is not being made to

holders of Notes in any jurisdiction in which the making or

acceptance thereof would not be in compliance with the securities

or other laws of such jurisdiction. None of the Company, the Dealer

Manager and Solicitation Agent, the Tender and Information Agent or

their respective affiliates is making any recommendation as to

whether or not holders should tender all or any portion of their

Notes in the Offer and Consent Solicitation.

Forward Looking Statements

Statements contained in this release that state the Company’s or

management’s intentions, expectations or predictions of the future

are forward-looking statements. Specifically, the Company cannot

assure you that the Offer and Consent Solicitation described above

will be consummated on the terms currently contemplated, if at all.

The forward-looking statements involve risks and uncertainties and

actual results may differ materially from those projected or

implied. The Company disclaims any intention or obligation to

revise any forward-looking statements whether as a result of new

information, future events or otherwise.

About Beazer Homes USA, Inc.

Headquartered in Atlanta, Beazer Homes (NYSE: BZH) is one of the

country’s largest homebuilders. Every Beazer home is designed and

built to provide Surprising Performance, giving you more quality

and more comfort from the moment you move in - saving you money

every month. With Beazer’s Choice Plans™, you can personalize your

primary living areas - giving you a choice of how you want to live

in the home, at no additional cost. And unlike most national

homebuilders, we empower our customers to shop and compare loan

options. Our Mortgage Choice program gives you the resources to

easily compare multiple loan offers and choose the best lender and

loan offer for you, saving you thousands over the life of your

loan. We build our homes in Arizona, California, Delaware, Florida,

Georgia, Indiana, Maryland, Nevada, North Carolina, South Carolina,

Tennessee, Texas, and Virginia. For more information, visit

beazer.com, or check out beazer.com on Facebook, Instagram and

Twitter.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190923005840/en/

Beazer Homes USA, Inc. David I. Goldberg Vice President of

Treasury and Investor Relations 770-829-3700

investor.relations@beazer.com

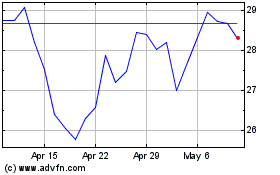

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Mar 2024 to Apr 2024

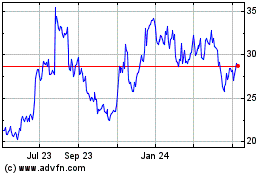

Beazer Homes USA (NYSE:BZH)

Historical Stock Chart

From Apr 2023 to Apr 2024