Barrick Gold Corporation (NYSE:GOLD)(TSX:ABX) announced today that

it continues to make good progress on achieving its goals and

objectives set out at the start of the year.

Reflecting another solid operating performance

across its portfolio, Barrick announced preliminary second quarter

sales of 1.37 million ounces of gold and 96 million pounds of

copper, as well as preliminary second quarter production of 1.35

million ounces of gold and 97 million pounds of copper. The average

market price for gold in the second quarter was $1,309 per ounce,

while the average market price for copper in the second quarter was

$2.77 per pound.

Preliminary second quarter gold sales and

production are in line with the solid base set in the first quarter

and support annual production at the upper end of the 2019 group

guidance range, driven by strong performances from Loulo-Gounkoto

and Veladero offset by lower production at Barrick Nevada, as

guided, and production interruptions at Pueblo Viejo. This is

before including the impact of the Nevada Gold Mines joint venture

transaction that was successfully completed on July 1, 2019 and

which, as indicated, is expected to positively impact the

production outlook for the year. Second quarter gold costs per

ounce are expected to be marginally higher than Q1 2019.

Preliminary second quarter copper sales and

production were slightly lower than the first quarter of the year,

primarily as a result of lower production at Lumwana. Despite this,

the ongoing efficiency initiatives that have been implemented are

expected to result in a slight quarter-over-quarter decrease in our

copper costs per pound. The 2019 copper production and cost

guidance is unchanged.

Barrick will provide additional discussion and

analysis regarding its second quarter production and sales when the

Company reports its quarterly results before North American markets

open on August 12, 2019, followed by a live presentation by

President and CEO Mark Bristow at 11:00 am EDT at Barrick's

corporate office in Toronto. The presentation will be linked to a

webcast and conference call.

The following table includes preliminary gold

and copper production and sales results from our operations:

|

|

Three months ended June 30, 2019 |

|

|

Production |

Sales |

| Gold

(equity ounces (000s)) |

|

Cortez |

280 |

281 |

|

Goldstrike1 |

181 |

181 |

|

Turquoise Ridge (75%) |

65 |

85 |

| Barrick

Nevada |

526 |

547 |

|

Loulo-Gounkoto (80%) |

147 |

148 |

| Pueblo

Viejo (60%) |

124 |

132 |

| Kibali

(45%) |

95 |

95 |

| Acacia

(63.9%) |

101 |

92 |

| Veladero

(50%) |

75 |

74 |

| Porgera

(47.5%) |

61 |

63 |

| Tongon

(89.7%) |

61 |

59 |

|

Hemlo |

55 |

56 |

|

Kalgoorlie (50%) |

57 |

55 |

| Lagunas

Norte |

39 |

38 |

| Morila

(40%) |

6 |

7 |

| Golden

Sunlight |

6 |

6 |

|

Total Gold |

1,353 |

1,372 |

| Copper

(equity pounds (millions)) |

|

Lumwana |

49 |

48 |

| Zaldívar

(50%) |

32 |

31 |

|

Jabal Sayid (50%) |

16 |

17 |

|

Total Copper |

97 |

96 |

Enquiries:

|

Kathy du Plessis Investor & Media Relations +44 20 7557

7738 barrick@dpapr.com |

David Lee Director, Investor Relations +1 416 307 5164

davidlee@barrick.com |

Website: www.barrick.com

Technical Information

The scientific and technical information

contained in this news release has been reviewed and approved by:

Steven Yopps, MMSA, Barrick’s Director - Metallurgy, North America;

Chad Yuhasz, P.Geo, Barrick’s Mineral Resource Manager, Latin

America and Australia Pacific; and Simon Bottoms, CGeol, Barrick's

Mineral Resources Manager, Africa and Middle East – each a

“Qualified Person” as defined in National Instrument 43-101 –

Standards of Disclosure for Mineral Projects.

Second Quarter 2019 Results

Barrick will release its Second Quarter 2019

Results before market open on August 12, 2019, followed by a

live presentation by President and CEO Mark Bristow at 11:00 am EDT

at Barrick's corporate office in Toronto. The presentation

will be linked to a webcast and conference call.

US and Canada, 1-800-319-4610UK, 0808 101

2791International, +1 416 915-3239Webcast

If you wish to attend the presentation in

Toronto, please contact David Lee at investor@barrick.com. The Q2

2019 presentation materials will be available on Barrick’s website

at www.barrick.com.

The webcast will remain on the website for later

viewing, and the conference call will be available for replay by

telephone at 1-855-669-9658 (US and Canada) and +1 604 674-8052

(international), access code 3391.

Endnote 1

Includes our 60% equity share of South

Arturo.

Cautionary Statements Regarding

Preliminary Second Quarter Production and Sales for 2019, and

Forward-Looking Information

Barrick cautions that, whether or not expressly

stated, all second quarter figures contained in this press release

including, without limitation, production levels and sales are

preliminary, and reflect our expected second quarter results as of

the date of this press release. Actual reported second quarter

production levels and sales are subject to management’s final

review, as well as review by the Company’s independent accounting

firm, and may vary significantly from those expectations because of

a number of factors, including, without limitation, additional or

revised information, and changes in accounting standards or

policies, or in how those standards are applied. Barrick will

provide additional discussion and analysis and other important

information about its second quarter production levels and sales

and associated costs when it reports actual results on

August 12, 2019. For a complete picture of the Company’s

financial performance, it will be necessary to review all of the

information in the Company’s second quarter financial report and

related MD&A. Accordingly, readers are cautioned not to rely

solely on the information contained herein.

Finally, Barrick cautions that this press

release contains forward-looking statements with respect to: (i)

Barrick’s production; and (ii) costs per ounce for gold and per

pound for copper.

Forward-looking statements are necessarily based

upon a number of estimates and assumptions including material

estimates and assumptions related to the factors set forth below

that, while considered reasonable by the Company as at the date of

this press release in light of management’s experience and

perception of current conditions and expected developments, are

inherently subject to significant business, economic, and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements, and undue reliance

should not be placed on such statements and information. Such

factors include, but are not limited to: fluctuations in the spot

and forward price of gold, copper, or certain other commodities

(such as silver, diesel fuel, natural gas, and electricity); the

speculative nature of mineral exploration and development; changes

in mineral production performance, exploitation, and exploration

successes; risks associated with projects in the early stages of

evaluation, and for which additional engineering and other analysis

is required; the duration of the Tanzanian ban on mineral

concentrate exports; the ultimate terms of any definitive agreement

between Acacia and the Government of Tanzania to resolve a dispute

relating to the imposition of the concentrate export ban and

allegations by the Government of Tanzania that Acacia

under-declared the metal content of concentrate exports from

Tanzania and related matters; whether Acacia will approve the terms

of any final agreement reached between Barrick and the Government

of Tanzania with respect to the dispute between Acacia and the

Government of Tanzania; disruption of supply routes which may cause

delays in construction and mining activities at Barrick’s more

remote properties; whether benefits expected from recent

transactions are realized; diminishing quantities or grades of

reserves; increased costs, delays, suspensions and technical

challenges associated with the construction of capital projects;

operating or technical difficulties in connection with mining or

development activities, including geotechnical challenges and

disruptions in the maintenance or provision of required

infrastructure and information technology systems; failure to

comply with environmental and health and safety laws and

regulations; timing of receipt of, or failure to comply with,

necessary permits and approvals; uncertainty whether some or all of

targeted investments and projects will meet the Company’s capital

allocation objectives and internal hurdle rate; the impact of

global liquidity and credit availability on the timing of cash

flows and the values of assets and liabilities based on projected

future cash flows; the impact of inflation; fluctuations in the

currency markets; changes in national and local government

legislation, taxation, controls or regulations and/ or changes in

the administration of laws, policies and practices, expropriation

or nationalization of property and political or economic

developments in Canada, the United States, and other jurisdictions

in which the Company or its affiliates do or may carry on business

in the future; lack of certainty with respect to foreign legal

systems, corruption and other factors that are inconsistent with

the rule of law; damage to the Company’s reputation due to the

actual or perceived occurrence of any number of events, including

negative publicity with respect to the Company’s handling of

environmental matters or dealings with community groups, whether

true or not; the possibility that future exploration results will

not be consistent with the Company’s expectations; risks that

exploration data may be incomplete and considerable additional work

may be required to complete further evaluation, including but not

limited to drilling, engineering and socioeconomic studies and

investment; risk of loss due to acts of war, terrorism, sabotage

and civil disturbances; litigation and legal and administrative

proceedings; contests over title to properties, particularly title

to undeveloped properties, or over access to water, power and other

required infrastructure; business opportunities that may be

presented to, or pursued by, the Company; our ability to

successfully integrate acquisitions or complete divestitures; risks

associated with working with partners in jointly controlled assets;

employee relations including loss of key employees; increased costs

and physical risks, including extreme weather events and resource

shortages, related to climate change; and availability and

increased costs associated with mining inputs and labor. In

addition, there are risks and hazards associated with the business

of mineral exploration, development and mining, including

environmental hazards, industrial accidents, unusual or unexpected

formations, pressures, cave-ins, flooding and gold bullion, copper

cathode or gold or copper concentrate losses (and the risk of

inadequate insurance, or inability to obtain insurance, to cover

these risks).

Many of these uncertainties and contingencies

can affect our actual results and could cause actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, us. Readers

are cautioned that forward-looking statements are not guarantees of

future performance. All of the forward-looking statements made in

this press release are qualified by these cautionary statements.

Specific reference is made to the most recent Form 40-F/Annual

Information Form on file with the SEC and Canadian provincial

securities regulatory authorities for a more detailed discussion of

some of the factors underlying forward-looking statements and the

risks that may affect Barrick’s ability to achieve the expectations

set forth in the forward-looking statements contained in this press

release.

Barrick disclaims any intention or obligation to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise, except as required

by applicable law.

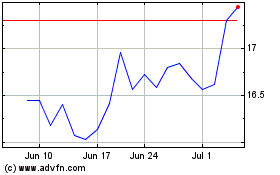

Barrick Gold (NYSE:GOLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

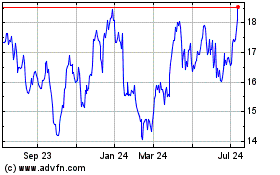

Barrick Gold (NYSE:GOLD)

Historical Stock Chart

From Apr 2023 to Apr 2024