Barclays Activist Investor Edward Bramson Sells Entire Stake -- 2nd Update

May 07 2021 - 8:02AM

Dow Jones News

By Simon Clark

LONDON -- Edward Bramson's Sherborne Investors said it sold its

entire stake in Barclays PLC, giving up on a yearslong activist

campaign to restructure the bank the British bank with a major Wall

Street presence.

Sherborne, which seeks to influence the strategy of companies it

owns shares in, was one of the bank's biggest shareholders with a

6% stake, worth around $2.5 billion.

Mr. Bramson unsuccessfully attempted to join the board of

Barclays and petitioned its chief executive, American banker Jes

Staley, to scale back investment-banking operations in favor of

investing more in its U.K. retail bank.

Sherborne struggled to turn a profit on Barclays. Since it

disclosed its stake in March 2018, Barclays shares, including

dividends, returned a loss of around 8%, according to FactSet. The

S&P 500 over that time has given investors a total return of

more than 60%. Barclays shares rose 2% Friday.

"It is a pity that the opportunity did not arise to join the

board of Barclays to assist in a turnaround," Sherborne said in a

statement.

A Barclays spokesperson declined to comment.

Other investors have also found it difficult to capitalize on

the troubles of Europe's deeply discounted banks. New York-based

private-equity firm Cerberus Capital Management LP acquired large

stakes in Germany's Deutsche Bank AG and Commerzbank AG in recent

years and pushed for changes, while the share prices of both banks

have languished.

Mr. Bramson's retreat is a vindication for Mr. Staley, who

opposed Mr. Bramson's vision for a smaller, less risk-taking

Barclays that would focus more on its bread-and-butter U.K. lending

business. He kept a large investment-banking operation, which

proved to be a strong source of profits during the pandemic.

"The war is over," Investec Securities analyst Ian Gordon wrote

in a note. "Barclays' management had de facto already 'won the

argument' with Sherborne regarding the future business mix of the

group."

The conflict between Mr. Bramson and Mr. Staley was tense at

times. Early on, Mr. Staley told colleagues: "He wants us to

retreat into a foxhole? He should go back to Connecticut,"

referring to the state where Mr. Bramson had a home.

Mr. Bramson also criticized Mr. Staley for his professional

relationship with late financier and convicted sex offender Jeffrey

Epstein.

In March 2020, Sherborne called on Barclays to withdraw its

support for Mr. Staley and said it would vote against his

re-election at the bank's annual meeting. A month later, Sherborne

said that "with great reluctance" it would only withhold its vote

on Mr. Staley's re-election because of the challenges the bank

faced during the coronavirus pandemic.

"We continue to believe that Mr. Staley has not demonstrated the

level of judgment befitting a director or senior executive of the

company," Sherborne said in April 2020.

The U.K.'s Financial Conduct Authority and Prudential Regulation

Authority have been examining Mr. Staley's characterization to

Barclays of his relationship with Mr. Epstein and the bank's

subsequent description of the relationship to regulators.

Mr. Staley previously led JPMorgan Chase & Co.'s private

bank, where he met Mr. Epstein, who was a client. Last year, he

said he regretted having had any relationship with Mr. Epstein.

Sherborne struck a more conciliatory note as it sold its shares

in Barclays.

"Business is not a science and so people of goodwill may,

therefore, sometimes differ," Sherborne said Friday.

Sherborne said it had begun building a position in another

unidentified company.

"We think that the new investment will produce better returns

and has a clearer prospect of our becoming engaged in an operating

turnaround, which is the primary contributor to Sherborne

Investors' investment returns," the company said in a

statement.

Write to Simon Clark at simon.clark@wsj.com

(END) Dow Jones Newswires

May 07, 2021 07:47 ET (11:47 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

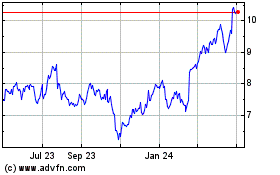

Barclays (NYSE:BCS)

Historical Stock Chart

From Mar 2024 to Apr 2024

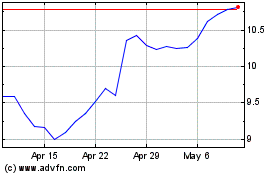

Barclays (NYSE:BCS)

Historical Stock Chart

From Apr 2023 to Apr 2024