Report of Foreign Issuer (6-k)

February 07 2019 - 5:23PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For the month of February, 2019

Commission File Number 1-11414

BANCO

LATINOAMERICANO DE COMERCIO EXTERIOR, S.A.

(Exact name of Registrant as specified in

its Charter)

FOREIGN

TRADE BANK OF LATIN AMERICA, INC.

(Translation of Registrant’s name

into English)

Business Park Torre V, Ave. La Rotonda,

Costa del Este

P.O. Box 0819-08730

Panama City, Republic of Panama

(Address of Registrant’s Principal

Executive Offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes

¨

No

x

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes

¨

No

x

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

Date: February 7, 2019

|

|

|

|

|

|

|

FOREIGN TRADE BANK OF LATIN AMERICA, INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Ana Graciela de Méndez

|

|

|

|

|

Name: Ana Graciela de Méndez

|

|

|

|

Title: CFO

|

Bladex

acts as Joint Lead Arranger of a US$131.5 million senior, secured

acquisition finance bridge facility for Corporación Favorita

Panama City,

Republic of Panama, February 7, 2019 –

Banco Latinoamericano de Comercio Exterior, S.A. (“

Bladex

”

or the “

Bank

”) today announced the successful closing of a US$131.5 million senior Acquisition Finance bridge

facility (the “Facility” or the “Loan”) for Corporación Favorita C.A. (“Corp. Favorita”

or the “Borrower”). The Facility was secured by liquid deposits of the Borrower in Ecuadorian banks.

Corp. Favorita

is a leading Ecuadorian Company, with over US$1.9 billion in sales and US$1.6 billion in total assets. The Borrower is primarily

engaged in the sale of mass consumer products through its network of more than 150 supermarkets (Supermaxi, Megamaxi, Aki, Gran

Aki, Super Aki, Jugueton, Supersaldos and Titán) located throughout the country's provinces.

The Loan was structured

as a club deal between Bladex, Banco General and Grupo Promerica, acting together as Joint Lead Arrangers. Bladex is also the Administrative

Agent under the Facility.

Proceeds of the

Facility were used to support Corp. Favorita’s cross border acquisition for a majority interest in Rey Holdings Corp., a

holding company owner of supermarket chains (Rey, Romero and Mr. Precio), convenience stores (ZAZ), and pharmacies (Metro Plus)

in Panama, generating over US$700 million in sales.

Bladex, a multinational bank originally

established by the central banks of Latin-American and Caribbean countries, began operations in 1979 to promote foreign trade and

economic integration in the Region. The Bank, headquartered in Panama, also has offices in Argentina, Brazil, Colombia, Mexico,

Peru, and the United States of America, supporting the regional expansion and servicing its customer base, which includes financial

institutions and corporations.

Bladex is listed on the NYSE in the United

States of America (NYSE: BLX), since 1992, and its shareholders include: central banks and state-owned banks and entities representing

23 Latin American countries; commercial banks and financial institutions; and institutional and retail investors through its public

listing.

For further information on Bladex, please access its website

at

www.bladex.com

or contact:

Mónica Cosulich – VP, Finance and Investor Relations

E-mail address: ir@bladex.com Tel.: (+507) 210-8563

Head Office Address: Torre V, Business Park, Avenida La Rotonda,

Urb. Costa del Este,

Panama, Republic of Panama

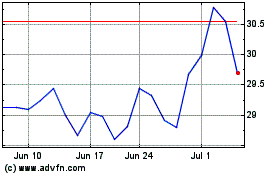

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

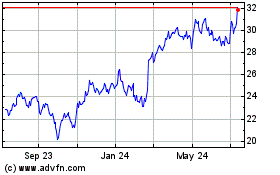

Banco Latinoamericano de... (NYSE:BLX)

Historical Stock Chart

From Apr 2023 to Apr 2024