Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

June 23 2021 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of June, 2021

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

Material Fact

Banco Bradesco S.A. (Bradesco or Company) informs to its

shareholders and the market in general that the Board of Directors, at a meeting held today, have approved the Board of Directors’

proposal for payment of interim interest on shareholders’ equity relating to the first half of 2021, for the total value of R$5,000,000,000.00,

where R$0.490007301 concerns common share and R$0.539008031 concerns preferred share.

Those shareholders registered at the Company records on

July 2, 2021 shall be paid (date of declaration and base date of right), the stock being negotiated “ex right” at the interim

interest on shareholders´ equity as of July 5, 2021.

The payment:

|

|

a)

|

shall be made on July 12, 2021 for the net value

of R$0.416506206 per common share and R$0.458156826 per preferred share, after deducting the withholding income tax of 15

percent (15%), except for the legal entity shareholders who are exempt from such taxation, who will receive by the declared amount;

|

|

|

b)

|

shall be performed as follows:

|

-

to the shareholders whose shares are deposited at the Company and

who keep their register and banking data updated, by means of credit in the current accounts in a Financial Institution appointed by them;

and

-

to the shareholders whose shares are deposited at B3 S.A. - Brasil,

Bolsa, Balcão, by means of Institutions and/or brokerage houses which keep their shareholding position in custody.

The shareholders who do not have their data updated must

go to a Bradesco Branch of their preference, with their Individual Taxpayer’s ID, Identification Document and proof of residence

to update their information and receive the respective amounts to which they are entitled.

The interest hereby approved represents approximately 28

times the value of interest paid monthly, net from withholding tax, and shall be computed in the calculation of mandatory yearly dividends

set forth in the company’s articles of association.

Cidade de Deus, Osasco, SP, June 22, 2021

Leandro de Miranda Araujo

Executive and

Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: June 22, 2021

|

BANCO BRADESCO S.A.

|

|

|

|

By:

|

|

/S/Leandro de Miranda Araujo

|

|

|

|

Leandro de Miranda Araujo

Executive Deputy Officer and

Investor Relations Officer.

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

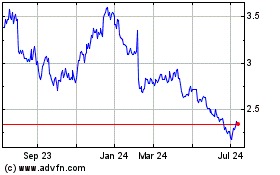

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Apr 2023 to Apr 2024