UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2021

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

Notice to the Market

Banco Bradesco S.A. (“Bradesco” or “Bank”)

hereby presents to its shareholders and the market in general the clarifications requested by the Superintendence of Relations with Companies

of the Securities and Exchange Commission (“CVM”), by means of Official Letter no. 68/2021/CVM/SEP/GEA-1, issued on

April 05, 2021 (“Circular").

The Circular makes reference to the news published on April 02, 2021,

in the newspaper “O Estado de São Paulo”, in the News section, under the headline: “Elo will buy its own brand

for R$ 400 million for the IPO”, which contains the following statements:

“The Elo card brand will acquire its own brand for around R$

400 million, as preparation for a possible listing on the Stock Exchange. Today, the brand belongs to Elopar, a holding that controls

the company, whose shareholding structure will also be reviewed. These actions untie part of the knots among the partners and pave the

way for the opening of capital (IPO). The initial offering will be possibly made on the American Nasdaq Stock Exchange. The objective

is to seek a more robust value for the brand, which is part of the technology developed at Onovolab (picture), in São Carlos (SP).

After months of discussions, the shareholders of Elo (Bradesco, Banco do Brasil and Caixa Econômica Federal, in addition to the

holding company) met on Wednesday, to define sensitive issues.

» Certain. The main points that inhibit the opening of capital

of Elo had already been resolved. One thing remains, to define, is the name of the new executive chairman.

» Untying the knots. In addition to the brand, the partners

also discussed other issues, such as the stakes of the shareholding banks, one of the matters that the partners were against until then.

Today, Elopar is formed by Bradesco (50.01% of the share capital), and BB (49.99%), which will receive the resources from the sale of

the brand. In turn, the holding will detain 56.96% of Elo, while Bradesco has the other 6.14% and Caixa, 36.88%.

» Balance. In the new ownership structure, the shares of each

partner will be recalculated considering the volume of cards issued by the banks in the last four years. As a consequence, Caixa gains

shareholding and its share ranges from 37% to 41.5%, in part thanks to the emergency aid. Now Bradesco will have a total of 30.5%, and

BB, slightly more than 28%."

Bradesco informs that it is still holding talks with the other shareholders

about an eventual operation involving Elo Serviços S.A. (Elo Serviços), there being, until now, no concrete decision or

deliberation on any corporate entity.

The matter as a whole, including the possible transfer of ownership

of the brand “Bandeira Elo” to Elo Serviços, depends on discussions and studies that are still being developed. In

any case, a possible receipt of funds from the sale of the “Elo” brand is Elopar’s decision, as owner of that brand.

Even though Bradesco receives a proportion of these resources, the corresponding value would not be relevant to the Bank.

Page 1 of 2

With respect to the recalculation of the stakes of the shareholders

in Elo Serviços, based on the volume of cards issued by them, Bradesco clarifies that the Shareholders’ Agreement of Elo

Serviços foresees the possibility of periodic adjustments of the shareholdings, according to the contribution of each shareholder

to the results of Elo Serviços. In any case, any adjustments are made considering the equity value of shares issued by Elo Serviços,

not representing the materiality of value to Bradesco.

Any decision involving the matter shall be communicated to the stock exchanges

and to the CVM, if applicable, according to the terms of the applicable legislation.

Cidade de Deus, Osasco, SP, April 6, 2021

Leandro de Miranda Araujo

Deputy Executive Officer and

Investor Relations Officer

Page 2 of 2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: April 6, 2021

|

BANCO BRADESCO S.A.

|

|

|

|

By:

|

|

/S/Leandro de Miranda Araujo

|

|

|

|

Leandro de Miranda Araujo

Executive Deputy Officer and

Investor Relations Officer.

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

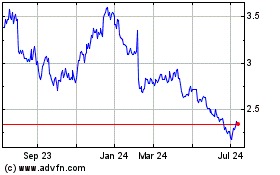

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Apr 2023 to Apr 2024