Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

December 31 2020 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2020

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

Publicly-Held Company

Corporate Taxpayer’s ID No.

60.746.948/0001-12

COMMUNICATION ON RELATED-PARTY TRANSACTIONS

Medical Services

Banco Bradesco S.A. (“Bradesco”

or “Company”) informs its shareholders and the market in general, in accordance with Article 30 and Exhibit

30-XXXVI of Securities and Exchange Commission (“CVM”) Instruction No. 480/09 and Related-Party Transactions

Policy of the Company (“Internal Policy”) that, on this date, the Operational Agreement initiated in April of

this year between Fleury S.A. (“Fleury”) and Bradesco Saúde S.A. (“Bradesco Saúde”),

Bradesco´s wholly-owned subsidiary, with the purpose of carry out COVID-19 tests in Bradesco Organization´s employees

and their dependents who are beneficiaries of Bradesco Saúde (“Transaction”), was finalized.

The information referring to the

Transaction, provided in the aforementioned CVM Instruction, are listed in the chart below:

|

Transaction

|

|

Related-Party´s Name

|

Fleury

|

|

Relation between the Related-Party and the Company

|

Bradesco holds, direct and indirectly, 100% of the capital

of Bradseg Participações S.A. (“Bradseg”) and Bradesco Saúde.

Bradseg holds around 22% of the shares issued by Fleury.

|

|

Transaction´s Subject

|

Medical Services provided by Fleury, in the area of diagnostics tests and clinical analyses relating to the performance of COVID-19 tests, to Bradesco Organization´s employees and their dependents, who are beneficiaries of Bradesco Saúde.

|

|

Main Terms and Conditions

|

Signature Date: 12.30.2020.

Duration: In effect until 04.16.2021 and may be

extended by prior agreement between the parties. The Operational Agreement will start on this date, with its legal effects retroactively

to 04.17.2020.

Total Amount: R$ 63,000,000.00 (sixty three million

reais).

Method of payment: monthly instalment, according

to the quantity and type of tests actually performed.

|

|

If, when, how and to what extend the counterparty in the transaction, its partners or managers participated in the process

|

Not applicable.

|

|

Detailed justification of the reasons why the issuer's Management considers that the Transaction observed commutative conditions or provides for adequate compensatory payment

|

The Company´s Management understands that the Transaction observed commutative conditions and provides for adequate compensatory payment, since was carried out in the best interest of the Company, observing Market Conditions (according to the Company's Internal Policy), good governance practices, conduct, ethics and transparency and no Conflicts of Interest (according to the Company's Internal Policy).

|

The documents referring to the Transaction

are filed at the Company´s headquarters.

Cidade de Deus, Osasco, SP, December 30, 2020.

Banco Bradesco S.A.

Leandro de Miranda Araujo

Deputy Executive Officer and

Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: December 30, 2020

|

BANCO BRADESCO S.A.

|

|

|

|

By:

|

|

/S/Leandro de Miranda Araujo

|

|

|

|

Leandro de Miranda Araujo

Executive Deputy Officer and

Investor Relations Officer.

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

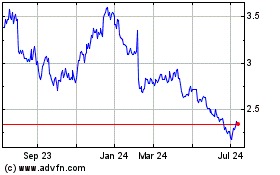

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Apr 2023 to Apr 2024