Current Report Filing (8-k)

December 01 2020 - 4:32PM

Edgar (US Regulatory)

0001278027

false

0001278027

2020-12-01

2020-12-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

As filed with the Securities and Exchange Commission on December 1, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 1, 2020

|

|

B&G Foods, Inc.

|

|

|

(Exact name of Registrant as specified in its charter)

|

|

Delaware

|

|

001-32316

|

|

13-3918742

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

|

Four Gatehall Drive, Parsippany,New Jersey

|

|

07054

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (973) 401-6500

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

BGS

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.01. Completion of Acquisition or Disposition of Assets.

On December 1, 2020, B&G Foods, Inc.,

through two of its wholly owned subsidiaries, B&G Foods North America, Inc. and B&G Foods Canada, ULC, closed on the

acquisition of the Crisco brand oils and shortening business from The J. M. Smucker Company for a purchase price of $550

million in cash, subject to a customary adjustment based upon inventory at closing, pursuant to an asset purchase agreement. The

purchased assets include a manufacturing facility and warehouse in Cincinnati, Ohio; inventory; supply, sales and other agreements;

intellectual property, including trademarks, patents, trade secrets, know-how and licensing agreements; and marketing materials,

customer lists and sales information. As described in B&G Foods’ Current Report on Form 8-K filed on October 27,

2020, the asset purchase agreement contains customary representations, warranties, covenants and indemnification provisions, except

that Smucker’s obligation to indemnify B&G Foods for breaches of the representations and warranties contained in the

asset purchase agreement is limited to breaches of certain fundamental representations, as defined in the asset purchase agreement.

In connection with its entry into the asset purchase agreement, B&G Foods bound a customary representations and warranties

insurance policy as recourse for certain losses arising out of a breach of the representations and warranties of Smucker contained

in the asset purchase agreement. The representations and warranties policy is subject to certain policy limits, exclusions, deductibles

and other terms and conditions. The asset purchase agreement includes an agreement for Smucker to provide certain transition services

associated with the acquired business for up to nine to twelve months following closing.

Prior to the closing of the acquisition,

neither B&G Foods nor any of its affiliates, or any director or officer of B&G Foods or any of its affiliates, or any associate

of any such director or officer, had any material relationship with Smucker. The terms of the asset purchase agreement, including

the purchase price, were determined by arm’s length negotiations between B&G Foods and Smucker.

B&G Foods funded the acquisition and

related fees and expenses with cash on hand and revolving loans under its existing credit facility.

The asset purchase agreement was filed as

Exhibit 2.1 under Item 1.01 to the Current Report on Form 8-K filed by B&G Foods on October 27, 2020.

Item 7.01. Regulation FD Disclosure.

On December 1, 2020, B&G Foods

issued a press release to announce the closing of the acquisition described above. The information contained in the press release,

which is attached to this report as Exhibit 99.1, is incorporated by reference herein and is furnished pursuant to Item 7.01,

“Regulation FD Disclosure.”

Item 9.01. Financial Statements and Exhibits.

(a) Financial

Statements of Businesses Acquired.

B&G Foods intends to file financial

statements of the business acquired for the periods specified in Rule 3-05(b) of Regulation S-X within the time period

permitted by Item 9.01 of Form 8-K.

(b) Pro

Forma Financial Information.

B&G Foods intends to file the pro forma

financial information required pursuant to Article 11 of Regulation S-X within the time period permitted by Item 9.01 of Form 8-K.

(d) Exhibits.

|

|

2.1

|

Asset Purchase Agreement, dated as of October 26, 2020, among The J. M. Smucker Company, B&G Foods North America, Inc., and B&G Foods Canada, ULC. (Filed as Exhibit 2.1 to B&G Foods’ Current Report on Form 8-K filed on October 27, 2020, and incorporated herein by reference)

|

|

|

|

|

|

|

99.1

|

Press Release dated December 1, 2020, furnished pursuant to Item 7.01

|

|

|

|

|

|

|

104

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

B&G FOODS, INC.

|

|

|

|

|

|

|

|

Dated: December 1, 2020

|

By:

|

/s/ Scott E. Lerner

|

|

|

|

Scott E. Lerner

|

|

|

|

Executive Vice President,

|

|

|

|

|

General Counsel and Secretary

|

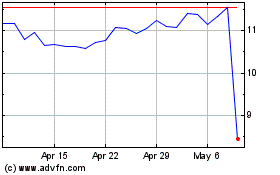

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

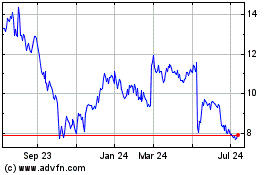

B and G Foods (NYSE:BGS)

Historical Stock Chart

From Apr 2023 to Apr 2024