Allegheny Misses on Top, Beats on Bottom - Analyst Blog

October 26 2011 - 12:00PM

Zacks

Allegheny Technologies Inc. (ATI) reported an

increase in profit to $70.6 million or 63 cents per share

(excluding acquisition related expenses of $8.3 million, net of

tax) in the third quarter of 2011 from $1.0 million or 1 cent per

share in the same quarter of 2010.

Results exceeded the Zacks Consensus Estimate of 61 cents per

share.

Sales in the quarter increased 28% to $1.35 billion, driven by

higher shipments for most high-value products, higher raw material

surcharges and increases in average base selling prices for many

products. However, sales were lower than the Zacks Consensus

Estimate of $1.39 billion.

Segment operating profit surged 157% to $161.8 million, or 12.0% of

sales, from $63.0 million, or 6.0% of sales, in the third quarter

of 2010.

Segment Results

Sales in the High Performance Metals segment surged 55% to $534.7

million. Segment operating profit increased to $95.7 million, or

17.9% of sales, from $72.0 million, or 20.9% of sales, in the third

quarter of 2010. The increase in operating profit resulted from

higher shipment volumes, improved product pricing and the benefits

of gross cost reductions.

Sales in the Flat-Rolled Products segment increased 11.4% to $689.6

million, as a result of improved base-selling prices for most

high-value products. Operating profit improved to $58.8 million, or

8.5% of sales, compared with a loss $11.8 million, in the third

quarter of 2010 due to increased high-value product shipments and

higher base prices for most high-value products.

Sales in the Engineered Products segment soared 34.8% to $128.3

million, driven by higher demand and increased prices for

tungsten-based and carbon alloy steel forging products. Segment

operating profit was $7.3 million compared with $2.8 million in the

third quarter of 2010.

Financials

Allegheny’s cash on hand was $431.5 million as of September 30,

2011, a decrease of $0.8 million as of December 31, 2010.

Cash flow provided by operations for the first nine months of 2011

was $107.5 million. Increased profitability was partially offset by

an investment of $390.3 million in managed working capital due to a

higher level of business.

Net debt as a percentage of total capitalization was 30.3% at the

end of the third quarter 2011 compared with 23.6% at the end of

2010. Total debt to total capital was 37.2% as of September 30,

2011, compared with 34.3% at the end of 2010.

Outlook

Over the next 3 to 5 years, Allegheny expects to continue to

benefit from its new alloys and products, diversified global growth

markets and differentiated product mix. Demand is expected to be

strong for its mill products and highly engineered forged and cast

components from the aerospace market. Strong growth is also

expected from the oil and gas/chemical process industry for its

titanium-based alloys, nickel-based alloys and specialty alloys,

and tungsten products.

Allegheny Technologies, based in Pittsburgh, Pennsylvania, produces

and sells specialty metals worldwide. Its primary competitor

includes

Carpenter Technology Corp. (CRS). The

company currently retains a Zacks #4 Rank on its stock, which

translates to a short-term rating of Sell.

ALLEGHENY TECH (ATI): Free Stock Analysis Report

CARPENTER TECH (CRS): Free Stock Analysis Report

Zacks Investment Research

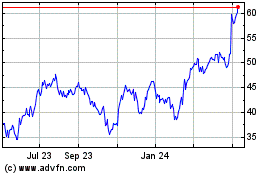

ATI (NYSE:ATI)

Historical Stock Chart

From Aug 2024 to Sep 2024

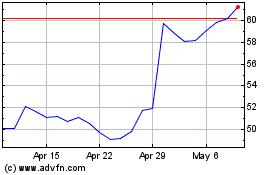

ATI (NYSE:ATI)

Historical Stock Chart

From Sep 2023 to Sep 2024