Heavy Metal Earnings Surge - Analyst Blog

June 16 2011 - 9:05AM

Zacks

No less than five steel stocks currently carry the esteemed Zacks

#1 Rank (strong buy) this week. And four of the five have been

there for over a month.

In the list below, the first three are classified as standard

producers and occupy a Zacks Industry Rank of 163, near the bottom

of the Neutral category. The last two names are considered

"specialty" steel companies and their industry grouping holds the

26th spot, making it very worthy of attention.

AK Steel (AKS): Zacks #1 Rank

since April 1, largely because consensus earnings estimates have

risen in the last 90 days from $0.84 to $1.26 for this year, and

from $1.46 to $1.87 for 2012.

Olympic Steel (ZEUS): Zacks #1

Rank since May 10, due to analyst estimate revisions in the last 60

days going from consensus $1.69 to $2.54 this year, and from $2.19

to $2.63 for 2012.

Universal Stainless & Alloy

(USAP): Zacks #1 Rank since April 29, on the heels of estimate

boosts in the last 60 days from $2.50 to $2.83 for this year, and

from $2.90 to $3.54 for 2012.

Allegheny Technologies (ATI):

Zacks #1 Rank since April 29, based on analysts upping their EPS

projections in the last 60 days from $3.00 to $3.17 for this year,

and from $4.24 to $4.85 for 2012.

Citic Pacific (CTPCY): Zacks #1

Rank since May 26, after upward estimate revisions in the last 30

days took this year from $1.20 to $1.44 EPS and next year from

$1.44 to $1.73.

Two Caveats for #1 Steel

Stocks

Before you rush into buying any of these names, let

me highlight two areas for further research. First, the Zacks Rank

is designed to be a short-term timing indicator, alerting you to

high-probability upside in stocks with upward earnings estimate

revisions in the last 60 days.

A few of these picks are getting "long in the tooth" and could get

knocked out of the #1 Rank if better stocks with new upward

revisions come along since we only focus on analyst estimates for

the last 60 days.

Second, milder economic data in the past two months

has definitely tilted the stock market downward as the "path of

least resistance," especially in a seasonally weak time of year. I

wrote about this on May 31 when the S&P 500 was at 1,345.

And if we needed confirmation that this slowdown could get more

serious, yesterday's surprisingly weak Empire State Manufacturing

Survey provided a wincing blow. As Steve Reitmeister wrote in his

daily market comment for Zacks Premium Subscribers this

morning:

"The -7.8 reading is only the second negative

reading in 2 years. The last time was a little blip in November

before jumping back into positive territory. Is it the same this

time around or does it portend ill for the future? Add into the mix

Greek riots and, voila, we are back under Dow 12,000 once

again."

The bottom line is that steel stocks are

experiencing a strong earnings recovery as the global economy

continues the cyclical expansion on the back of emerging markets

growth. Keep your eye on these names and their Zacks Rank as you

may want to buy them at a nice discount from where many were

trading a month ago.

Kevin Cook is a Senior Stock Strategist

for Zacks.com

AK STEEL HLDG (AKS): Free Stock Analysis Report

ALLEGHENY TECH (ATI): Free Stock Analysis Report

UNVL STAINLESS (USAP): Free Stock Analysis Report

OLYMPIC STEEL (ZEUS): Free Stock Analysis Report

Zacks Investment Research

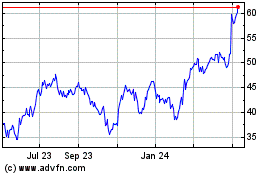

ATI (NYSE:ATI)

Historical Stock Chart

From Aug 2024 to Sep 2024

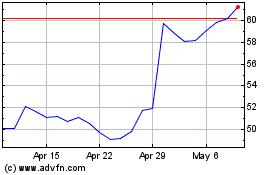

ATI (NYSE:ATI)

Historical Stock Chart

From Sep 2023 to Sep 2024