Elliott Discloses AT&T Stake, Calls for Shake-Up -- 3rd Update

September 09 2019 - 10:25AM

Dow Jones News

By Drew FitzGerald

Activist investor Elliott Management Corp. disclosed a $3.2

billion stake in AT&T Inc., criticized the company's strategy

and called on the telecommunications giant to shed unnecessary

assets.

The New York hedge fund wrote in a letter to the company

released Monday that it would seek seats on the company's board and

challenged AT&T to sharpen its focus on its core assets,

including its relatively healthy wireless business.

The fund didn't ask AT&T to sell specific divisions but said

the company should review any assets that lack a strategic

rationale, including the DirecTV satellite service and Mexican

wireless operations.

With a market value of more than $260 billion, the Dallas

company is among the hedge fund's biggest corporate targets to

date. AT&T shares rose 4% to $37.80 in Monday morning

trading.

Elliott assailed AT&T management for alleged missteps

including the purchase of DirecTV and said it remains cautious

about last year's purchase of Time Warner Inc., a collection of TV

and film businesses including HBO and CNN that was renamed

WarnerMedia.

"AT&T has been an outlier in terms of its M&A strategy,"

Elliott wrote. "Most companies today no longer seek to assemble

conglomerates."

AT&T said it looked forward to engaging with the hedge

fund.

"Indeed, many of the actions outlined are ones we are already

executing today," the company said in a statement. "AT&T's

Board and management team firmly believe that the focused and

successful execution of our strategy is the best path forward to

create long-term value for shareholders. This strategy is driven by

the unique portfolio of valuable businesses we've assembled across

communications networks and media and entertainment."

AT&T Chief Executive Randall Stephenson has reshaped the

company in recent years by buying DirecTV and Time Warner, making

it one of the biggest U.S. media players. The deals left the

company with more than $170 billion in net debt at the end of

2018.

President Trump, a frequent critic of CNN, weighed in on the

news, tweeting: "Great news that an activist investor is now

involved with AT&T." As a presidential candidate in 2016, Mr.

Trump vowed to block AT&T's takeover of Time Warner. The

Justice Department filed an antitrust suit to stop the merger, but

AT&T prevailed in court.

Elliott, founded by billionaire Paul Singer, is one of the

biggest activist investors. Last year, the hedge fund launched the

equivalent of nearly one new public activism campaign every two

weeks, pushing for change at companies around the world including

Sempra Energy, Nielsen Holdings PLC and Pernod Ricard SA.

In its AT&T letter, Elliott said the company has

underperformed the market for the past decade and put much of the

blame on Mr. Stephenson's acquisition strategy.

"AT&T has transformed itself into a sprawling collection of

businesses battling well-funded competitors, in new markets, with

different regulations, and saddled with the financial repercussions

of its choices, " the fund said.

In addition to asset sales, Elliott called on AT&T to boost

its profit margins by cutting at least $5 billion in costs,

including outsourcing some functions, consolidating offices and

rethinking its retail footprint.

"While unsurprising for a former regulated monopoly which many

still liken to the federal government, AT&T suffers from a

bureaucratic organization," Elliot said, arguing that AT&T's

wireless profits have fallen further behind rival Verizon

Communications Inc.'s.

The challenge to the company's strategy comes less than a week

after AT&T named longtime executive John Stankey to its newly

created chief operating officer position, a move widely seen as

preparing him to eventually succeed Mr. Stephenson. Mr. Stankey

remains in charge of WarnerMedia and previously served as

AT&T's strategy chief.

Elliott questioned the executive change and asked whether

AT&T conducted an external review for the new No. 2

position.

The fund predicted that if AT&T pursues the strategic and

operational improvements Elliott suggests, the shares could be

worth more than $60 by the end of 2021.

AT&T shares closed Friday at $36.25 and have rallied in

recent months after starting the year around $30.

Entering the week, AT&T has posted a total shareholder

return -- or stock-price changes plus dividends -- of more than 20%

over the past year, compared with 5.8% for the S&P 500 and 14%

for Verizon.

Over the past five years, AT&T has posted a total

shareholder return of 6.6%, compared with 10.7% for the S&P 500

and 8.8% for Verizon.

Shares hit a multiyear low of $27.36 in December as investors

questioned whether its heavy debt load was sustainable. The company

has spent the past year shoring up its balance sheet, partly

through sales of assets such as its stake in streaming service Hulu

and its ownership of WarnerMedia's new Manhattan headquarters.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

September 09, 2019 10:10 ET (14:10 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

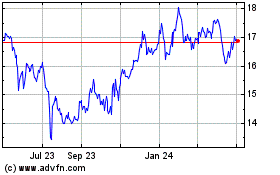

AT&T (NYSE:T)

Historical Stock Chart

From Mar 2024 to Apr 2024

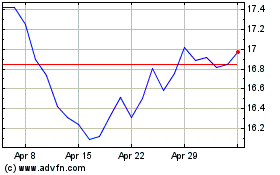

AT&T (NYSE:T)

Historical Stock Chart

From Apr 2023 to Apr 2024