Selective Predicts 3Q Cat Loss - Analyst Blog

October 14 2011 - 12:13PM

Zacks

Yesterday, property and casualty insurer Selective

Insurance Group, Inc. (SIGI) declared a preliminary

pre-tax catastrophe loss (cat loss) estimate of $70 million, to be

reflected in its third quarter 2011 results. The losses which

have been calculated net of reinsurance recoveries mainly emanated

from Hurricane Irene and six other catastrophes.

In the previous quarter Selective incurred $38 million in

weather related losses almost half of what is expected in this

quarter.

Other property and casualty insurers who suffered from bad

weather during the third quarter include Assurant

Inc. (AIZ), The Chubb

Corp. (CB), W. R. Berkley

Corp. (WRB) and Tower Group

Inc. (TWGP). While Assurant forecasts a

pre-tax cat loss of $80 million to $85 million, Chubb sees a

significantly high catastrophe loss of $400 million to $475 million

pre-tax. Besides, both Berkley and Tower expect an earnings hit of

$50 – $60 million.

According to the Insurance Information Institute, the property

and casualty industry was hit hard during the first half of the

year, as profitability suffered greatly amid high cat losses. In

the third quarter, hurricane Irene along with other catastrophes is

estimated to have caused insured losses of $3 billion-$4 billion to

the industry.

Year-to-date, weather related losses for the industry are

expected to trend above $25 billion, up $14.1 billion compared with

the cat losses incurred in first-half 2010 and about thrice the

average of $7.7 billion for first-half catastrophe losses

during the past ten years.

However, the only silver lining under the circumstances is that

the record high losses are gradually hardening commercial lines

pricing. Also, the recent market surveys by the CIAB (Council of

Insurance Agents and Brokers) and Market Scout have indicated that

the moderation of declining commercial lines pricing is

accelerating, while select commercial lines pricing is witnessing

rate increases in certain lines.

Despite cat losses we expect Selective to report good results as

the company is benefiting from favorable pricing in both its

business lines, Commercial as well as Personal. Along with

improvement in pricing, the company is also witnessing positive

audit and endorsement, which indicate an improving economy.

ASSURANT INC (AIZ): Free Stock Analysis Report

CHUBB CORP (CB): Free Stock Analysis Report

SELECT INS GRP (SIGI): Free Stock Analysis Report

TOWER GROUP INC (TWGP): Free Stock Analysis Report

BERKLEY (WR) CP (WRB): Free Stock Analysis Report

Zacks Investment Research

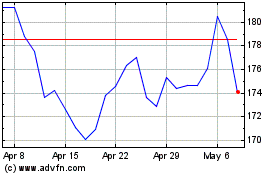

Assurant (NYSE:AIZ)

Historical Stock Chart

From Aug 2024 to Sep 2024

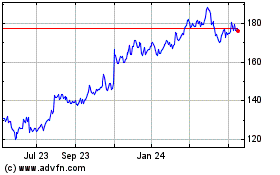

Assurant (NYSE:AIZ)

Historical Stock Chart

From Sep 2023 to Sep 2024