Assurant Closes Reinsurance Deal - Analyst Blog

June 23 2011 - 11:24AM

Zacks

Yesterday, Assurant Specialty, a unit of Assurant

Inc. (AIZ) has announced its comprehensive catastrophe

(CAT) reinsurance program so as to shield itself from losses in

2011 that looms ahead as an above-average hurricane season. A

reinsurance agreement is a kind of reimbursement program for an

insurance company.

The CAT reinsurance program has been designed in layers

with purchases being made in three different parts:

The first one being the participation in the Florida Hurricane

Catastrophe Fund (FHCF) program is mandatory for insurers writing

property insurance in the state of Florida. The FHCF provides

reinsurance to about 186 residential property insurers doing

business in the state. It reimburses insurers after their

hurricane-related residential property insurance losses reach their

retention limit.

Assurant has chosen a coverage of 90% of losses up to $435

million in excess of a $170 million retention, as the FHCF is the

most cost-effective reinsurance available.

The second part is on a per-occurrence basis, which will provide

protection of up to $1.31 billion in excess of $190 million

retention. This coverage will be available in 5 parts or layers,

with a co-participation of 5% in the fifth layer by Assurant.

Any amount received from the FHCF will be deducted from the

amount recoverable from the reinsurer. The ‘per occurrence’ clause

frees the agreement from being claims-based; that is, the company

will be able to recover the amount if the catastrophe occurs,

irrespective of when it places the claim.

Ibis Re Ltd.provided $300 million of the total per-occurrence

reinsurance. In order to fund its obligations to Assurant, Ibis Re

had issued catastrophe bonds in May 2009 and April 2010.

Taking into account the fact that Florida has become a

hurricane-prone state, Assurant is also providing for subsequent

storm coverage, to safeguard itself from further losses. By this,

the company would be able to recover up to $90 million for the

second and third occurrences, even with retentions as low as $100

million.

In 2011, the reinsurance program will reduce the net premiums

earned by nearly $219 million. Assurant’s CAT reinsurance

agreements are part of Assurant’s catastrophe management strategy,

which is intended to provide the shareholders an acceptable return

on the risks assumed in its property business, and to reduce

variability of earnings while providing protection to its

customers.

Based in New York’s financial district, Assurant competes with

Principal Financial Group Inc. (PFG),

Loews Corp. (L), Conesco Inc.

(CNO) among others.

ASSURANT INC (AIZ): Free Stock Analysis Report

CNO FINL GRP (CNO): Free Stock Analysis Report

LOEWS CORP (L): Free Stock Analysis Report

PRINCIPAL FINL (PFG): Free Stock Analysis Report

Zacks Investment Research

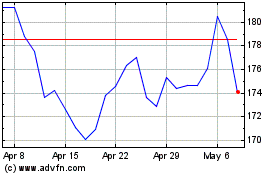

Assurant (NYSE:AIZ)

Historical Stock Chart

From Aug 2024 to Sep 2024

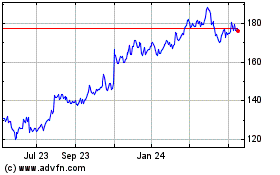

Assurant (NYSE:AIZ)

Historical Stock Chart

From Sep 2023 to Sep 2024