Current Report Filing (8-k)

August 18 2021 - 5:15PM

Edgar (US Regulatory)

false000167486200016748622021-08-182021-08-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 18, 2021

ASHLAND GLOBAL HOLDINGS INC

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

8145 Blazer Drive

Wilmington, DE 19808

(Address of Principal executive offices)

(Zip Code)

(302) 995-3000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

Item 1.01. Entry into a Material Definitive Agreement.

On August 18, 2021, Ashland Global Holdings Inc. (“Ashland”) announced the closing of the offering (the “Notes Offering”) by Ashland LLC (the “Issuer”), a wholly owned

subsidiary of Ashland, of $450 million aggregate principal amount of its 3.375% senior notes due 2031 (the “Notes”). The Notes are senior unsecured obligations of the Issuer. The Notes are initially guaranteed on an unsecured basis by Ashland (the

“Guarantee”).

The Notes were offered in the United States to (i) qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”),

and (ii) to non-U.S. persons outside the United States pursuant to Regulation S under the Securities Act. The Notes and the Guarantee have not been, and will not be, registered under the Securities Act or the securities laws of any other

jurisdiction, and may not be offered or sold in the United States or to U.S. persons without registration under the Securities Act, the securities laws of any other jurisdiction or an applicable exemption from the registration requirements.

On August 18, 2021, Ashland entered into an indenture (the “Indenture”) among the Issuer, Ashland, as Guarantor, and U.S. Bank National Association, as Trustee, in

connection with the Notes Offering.

The Indenture contains customary events of default for similar debt securities, which if triggered may accelerate payment of principal, premium, if any, and accrued but

unpaid interest on all the Notes issued thereunder. Such events of default include non-payment of principal and interest, non-performance of covenants and obligations, default on other material debt, and bankruptcy or insolvency. If a change of

control repurchase event as described in the Indenture occurs, the Issuer may be required to offer to purchase the Notes from the holders thereof. The Notes are not otherwise required to be repaid prior to maturity, although they may be redeemed at

the option of the Issuer at any time prior to their maturity in the manner specified in the Indenture.

The Indenture is filed as Exhibit 4.1 to this Form 8-K and is incorporated herein by reference. The description of the material terms of the Indenture and the Notes is

qualified in its entirety by reference to such exhibit.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01 of this Form 8-K is incorporated herein by reference.

Item 8.01. Other Events.

On August 18, 2021, Ashland issued a news release (the “News Release”) relating to the completion of the Notes Offering.

A copy of the News Release is hereby incorporated by reference and attached hereto as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

Forward Looking Statements

This Form 8-K contains forward-looking statements. Ashland has identified some of these forward-looking statements with words such as “anticipates,” “believes,”

“expects,” “estimates,” “is likely,” “predicts,” “projects,” “forecasts,” “objectives,” “may,” “will,” “should,” “plans” and “intends” and the negative of these words or other comparable terminology. In addition, Ashland may from time to time make

forward-looking statements in its annual report to shareholders, quarterly reports and other filings with the SEC, news releases and other written and oral communications. These forward-looking statements are based on Ashland’s expectations and

assumptions, as of the date such statements are made, regarding Ashland’s future operating performance, financial condition and expected effects of the COVID-19 pandemic on Ashland’s business, operating cash flow and liquidity, as well as the economy

and other future events or circumstances. These statements include, but may not be limited to, statements about the Notes Offering and the use of proceeds therefrom, including in connection with the refinancing. Various risks and uncertainties may

cause actual results to differ materially from those stated, projected or implied by any forward-looking statements. The extent and duration of the COVID-19 pandemic on Ashland’s business and operations is uncertain. Factors that will influence the

impact on Ashland’s business and operations include, without limitation, risks and uncertainties affecting Ashland that are described in its most recent Form 10-K (including Item 1A Risk Factors) filed with the SEC, which is available on Ashland’s

website at http://investor.ashland.com or on the SEC’s website at http://www.sec.gov. Ashland believes its expectations and assumptions are reasonable, but there can be no assurance that the expectations reflected herein will be achieved. Unless

legally required, Ashland undertakes no obligation to update any forward-looking statements made in this Form 8-K whether as a result of new information, future events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

ASHLAND GLOBAL HOLDINGS INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

August 18, 2021

|

By:

|

/s/ J. Kevin Willis

|

|

|

|

Name:

|

J. Kevin Willis

|

|

|

|

Title:

|

Senior Vice President and

Chief Financial Officer

|

|

|

|

|

|

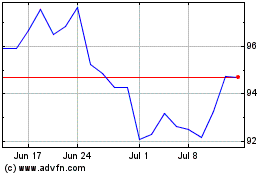

Ashland (NYSE:ASH)

Historical Stock Chart

From Mar 2024 to Apr 2024

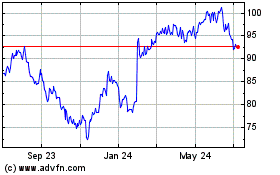

Ashland (NYSE:ASH)

Historical Stock Chart

From Apr 2023 to Apr 2024