UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant

☒

Filed by a Party other than the Registrant

☐

Check the appropriate box:

☐

Preliminary Proxy Statement

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐

Definitive Proxy Statement

☒

Definitive Additional Materials

☐

Soliciting Material Pursuant to § 240.14a-12

Arlington Asset Investment Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

1.

|

Title of each class of securities to which transaction applies:

|

|

|

2.

|

Aggregate number of securities to which transaction applies:

|

|

|

3.

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4.

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1.

|

Amount Previously Paid:

|

|

|

2.

|

Form, Schedule or Registration Statement No.:

|

EXPLANATORY NOTE

This supplement to the Proxy Statement (the “Proxy Statement”) of Arlington Asset Investment Corp. (the “Company”) filed with the Securities and Exchange Commission on April 25, 2019 is being filed to supplement the Proxy Statement to attach Exhibit A in connection with Proposal No. 4, “APPROVAL OF THE ADOPTION OF ARTICLES OF AMENDMENT TO OUR ARTICLES OF INCORPORATION”, to include the proposed amendment to the Company’s Articles of Incorporation. This supplement does not otherwise modify or update in any way the Proxy Statement as previously filed.

Exhibit A

ARTICLES OF AMENDMENT

OF THE ARTICLES OF INCORPORATION

OF

ARLINGTON ASSET INVESTMENT CORP.

FIRST

: The name of the Corporation is Arlington Asset Investment Corp. (the “Corporation”).

SECOND

: Capitalized terms used in these Articles of Amendment (the “Amendment”) and not otherwise defined shall have the meaning given to such term in the Articles of Incorporation.

THIRD

: This amendment is adopted as follows:

|

|

1.

|

Article IV, Section 4.1 is hereby amended by deleting the following text:

|

Issuance in Series

. The Board of Directors is authorized to issue Preferred Stock from time to time in one or more series and to provide for the designation, preferences, limitations and relative rights of the shares of each series by the adoption of Articles of Amendment to the Articles of Incorporation of the Corporation setting forth:

and replacing it in its entirety with the following text

:

Issuance in Series

. The Board of Directors, without shareholder action, is authorized to issue Preferred Stock from time to time in one or more series and to provide for the designation, preferences, limitations and relative rights of the shares of each series by the adoption of Articles of Amendment to the Articles of Incorporation of the Corporation setting forth:

|

|

2.

|

Article IX, Section 9.1(o) is hereby amended by deleting the following text:

|

“Restriction Termination Date” shall mean the first day after the date of the Mergers on which either (i) the Corporation’s election to be taxed as a REIT is revoked pursuant to Section 9.2 of this Article IX or (ii) the restrictions contained in Section 9.3 of this Article IX are removed pursuant to Section 9.9 of this Article IX.”

and replacing it in its entirety with the following text

:

“Restriction Termination Date” shall mean the first day after January 1, 2019 on which either (i) the Corporation’s election to be taxed as a REIT is revoked pursuant to Section 9.2 of this Article IX or (ii) the restrictions contained in Section 9.3 of this Article IX are removed pursuant to Section 9.9 of this Article IX.”

|

|

3.

|

Article IX, Section 9.1(k) is hereby amended by deleting the following text

|

“Ownership Limit” shall mean (a) 9.9% of the number of outstanding shares of Common Stock and (b) 9.9% of the number of outstanding shares of any class or series of Preferred Stock.

and replacing it in its entirety with the following text:

“Ownership Limit” shall mean (a) 9.9% of the number of outstanding shares of Common Stock, (b) 9.9% of the number of outstanding shares of any class or series of Preferred Stock, and (c) 9.9% of the aggregate value of the outstanding Equity Stock.

3

|

|

4.

|

In Article IX, Sections 9.3 and Article IX, Section 9.7, the phrase “from the date of the Mergers and prior to the Restriction

Termination Date” is replaced with “from January 1, 2019 and prior to the Restriction Termination Date” each time that it occurs.

|

|

|

5.

|

In Article IX, Section 9.4, the phrase “at any time after the Mergers and prior to the Restriction Termination Date” is replaced with “from January 1, 2019 and prior to the Restriction Termination Date” each time that it occurs.

|

|

|

6.

|

For the avoidance of doubt, Article V, Section 5.3 (second sentence) and Article IX shall apply to the Corporation as of the date of this Amendment.

|

FOURTH

: The foregoing Amendment was proposed by the Corporation’s Board of Directors, which found adoption of the Amendment to be in the Corporation’s best interest and directed that the Amendment be submitted to a vote at a meeting of the Corporation’s shareholders on June 10, 2019.

FIFTH

: On April 25, 2019, notice of the meeting of the Corporation’s shareholders, accompanied by a copy of this Amendment, was given in the manner provided in the Virginia Stock Corporation Act to each of the Corporation’s shareholders of record.

SIXTH

: The designation, number of outstanding shares, and number of votes entitled to be cast by each voting group entitled to vote separately on the Amendment was:

|

|

|

|

|

|

Designation

|

|

Number of Outstanding Shares

|

Number of Votes Entitled to be Cast

|

|

Class A Common Stock, $0.01 par value per share

|

|

|

|

The total number of votes cast for and against the Amendment by each voting group entitled to vote separately on the Amendment was:

|

|

|

|

|

|

Voting Group

|

|

Votes “FOR”

|

Votes “AGAINST”

|

|

Class A Common Stock, $0.01 par value per share

|

|

|

|

The total number of votes cast for the Amendment by each voting group was sufficient for approval of the Amendment by the voting group.

SEVENTH

: Pursuant to Section 13.1-606 of the Virginia Stock Corporation Act, this Amendment shall become effective at 5:00 p.m., Eastern Time, on [DAY OF WEEK], [•], 2019.

[SIGNATURE PAGE FOLLOWS]

4

IN WITNESS WHEREOF, the Corporation has caused these Articles of Amendment to be executed in its name and o

n its behalf by its President and Chief Executive Officer on this [•]th day of [•], 2019.

|

|

|

ARLINGTON ASSET INVESTMENT CORP.

By:

Name:J. Rock Tonkel, Jr.

Title:President and Chief Executive Officer

|

5

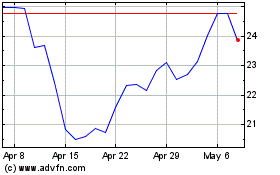

C3 AI (NYSE:AI)

Historical Stock Chart

From Mar 2024 to Apr 2024

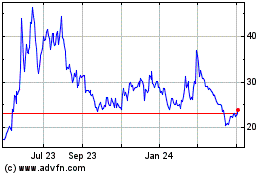

C3 AI (NYSE:AI)

Historical Stock Chart

From Apr 2023 to Apr 2024