Steelmakers Suffer Worst Slump in a Decade

April 19 2020 - 8:29AM

Dow Jones News

By Bob Tita

U.S. steel companies are slashing production to match a sharp

collapse in demand caused by manufacturers idling plants to slow

the coronavirus pandemic.

The U.S. steel industry has fallen into its most severe downturn

since the 2008 financial crisis. United States Steel Corp.,

ArcelorMittal and other steelmakers are ratcheting back output and

shedding workers, anticipating that orders and prices will fall

further.

U.S. mills are operating at 56% of capacity, down from 80% in

2019, according to the American Iron and Steel Institute, and steel

output across the country has fallen by a third in three weeks. The

spot-market price for hot-rolled coiled sheet steel is $485 a ton,

off 18% from a month ago and down nearly half from a recent high in

July 2018.

"We're in for a rough ride," said Bill Douglass, a regional

president for Lex Group, a steel distributor in Illinois. "There's

nobody who's unaffected."

Industry executives and analysts expect production to drop

further, even as manufacturers reopen plants. High stockpiles at

distributors will likely be drawn down before companies place new

orders, said Credit Suisse, which expects sheet-steel demand to

plummet 50% in the second quarter from a year ago.

When orders do pick up, executives expect that businesses will

spend less and that high unemployment will weigh on demand for

autos, construction materials and energy equipment. Those

industries account for 82% of domestic sheet-steel consumption,

according to market consultant Metal Strategies Inc.

"The big three markets have fallen flat on their face," said

David Stickler, chief executive of Big River Steel LLC in Arkansas.

U.S. Steel bought a 50% share of Big River last year with a

deadline of 2023 to purchase the remaining share for $700 million.

U.S. Steel CEO David Burritt has described the acquisition as the

company's top strategic priority. A spokeswoman said there has been

no change in the acquisition plan.

ArcelorMittal, U.S. Steel and Cleveland-Cliffs Inc., formerly

known as AK Steel, are heavily dependent on auto-industry

customers. A month of idled car production across the U.S. will

cost the steel industry at least $1 billion in revenue, Metal

Strategies estimated. Crashing oil prices are discouraging

frack-drilling companies from starting new wells. The number of new

wells started in the U.S. is down 48% from a year ago and 27% since

the end of March.

U.S. Steel idled about two-thirds of its pipe business in March,

closing plants in Texas and Ohio. During two weeks in March,

customers of South Korea's SeAH Steel Corp. canceled orders for

25,000 tons of pipe, said Kirk Murray, the company's U.S. general

manager.

"Our pipe inventory is now massive," he said. Demand had been

weakening for a year before the market collapsed, he said. SeAH

last week laid off about 30 of the 250 workers at its Houston pipe

plant.

"There's more struggles to come," Mr. Murray said. "This is not

going away."

U.S. Steel, which was recording losses before the sudden

downturn in the steel market, has been one of the more aggressive

steelmakers in cutting costs. Last month, the company trimmed its

capital-spending budget for this year to $750 million from $875

million to preserve cash. It indefinitely delayed $1.2 billion in

upgrades to the rolling line for steel at its mill near Pittsburgh,

which includes $200,000 for a coal-coking plant that has been the

site of two fires in recent years and has been fined by

environmental regulators for emissions violations.

Improvements at a mill in Gary, Ind., also were suspended, and

U.S. Steel has idled blast furnaces in Illinois, Indiana and

Michigan that account for half the company's capacity to make raw

steel. With fewer blast furnaces now melting iron ore, the company

also idled one of its iron ore mines in northern Minnesota.

U.S. Steel, ArcelorMittal and other companies that rely on

labor-intensive blast furnaces tend to suffer more during market

downturns because their mills are costly to maintain even when the

coal-fueled furnaces are idled and steel production is lowered,

analysts say. The electric furnaces at newer mills operated by

competitors including Nucor Corp. and Steel Dynamics Inc. can be

quickly throttled up or down, and operate with fewer workers.

Before the downturn, Nucor, Steel Dynamics, Big River Steel and

other companies had planned to add about 8 million tons of new

steelmaking capacity from electric furnaces by 2021. That would

have increased domestic sheet-steel supply by about 10% before the

downturn.

Nucor and Big River say they haven't changed their plans. Steel

Dynamics didn't respond to requests for comment. Australia's

BlueScope Steel Ltd. earlier this month said it has delayed an

expansion at its Ohio mill to preserve cash. Adding more steel to a

weak market would hold down already depressed prices, analysts

say.

"We're small enough and nimble enough to maneuver through

difficult times," Big River Steel's Mr. Stickler said.

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

April 19, 2020 08:14 ET (12:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

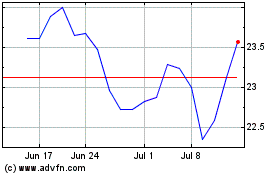

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Mar 2024 to Apr 2024

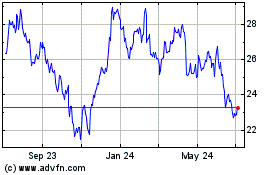

Arcelor Mittal (NYSE:MT)

Historical Stock Chart

From Apr 2023 to Apr 2024