Current Report Filing (8-k)

December 15 2020 - 7:09AM

Edgar (US Regulatory)

falsefalseAIMCO PROPERTIES, L.P.00009228640000926660MDDECOCO--12-31--12-31 0000922864 2020-12-15 2020-12-15 0000922864 aiv:AIMCOPropertiesLPMember 2020-12-15 2020-12-15

SECURITIES AND EXCHANGE COMMISSION

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 15, 2020

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

MARYLAND (Apartment Investment and Management Company)

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

|

|

|

SUITE 1450, DENVER, CO 80237

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (303)

224-7900

(Former name or Former Address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

Apartment Investment and Management Company

Class A Common Stock

|

|

AIV

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the exchange act. ☐

|

|

Entry into a Material Definitive Agreement.

|

On December 15, 2020, Apartment Investment and Management Company (“Aimco”) completed the previously announced separation, which was effected by way of a pro rata distribution (the “REIT Distribution”), in which stockholders of Aimco received one share of Class A common stock of Apartment Income REIT Corp. (“AIR”) for every one share of Class A common stock of Aimco held as of the close of business on December 5, 2020, the record date for the REIT Distribution, and received cash in lieu of fractional shares of Class A common stock of AIR. AIMCO Properties, L.P. (“AIR OP”) also completed the previously announced separation, which was effected through a pro rata distribution (the “OP Distribution”) of all of the outstanding common limited partnership units of Aimco OP L.P. (“Aimco OP,” and such units, “Aimco OP Units”) to holders of AIR OP common limited partnership units and AIR OP Class I High Performance partnership units as of the close of business on December 5, 2020, the record date for the OP Distribution. The transactions described in this paragraph are collectively referred to as the “Separation.”

In connection with the Separation, Aimco, Aimco OP, AIR and AIR OP entered into a Separation and Distribution Agreement, effective as of December 15, 2020 (the “Separation Agreement”), which, among other things, contains the agreements among the parties regarding the principal transactions necessary to effect the Separation. It also sets forth other agreements that govern certain aspects of the parties’ ongoing relationship after the completion of the Separation.

In connection with the Separation, Aimco and Aimco OP GP, LLC, which is Aimco OP’s general partner, entered into an Amended and Restated Agreement of Limited Partnership of Aimco OP, effective as of December 14, 2020 (the “Aimco OP A&R LPA”), which amended and restated the Limited Partnership Agreement of Aimco OP to provide for, among other things, the following rights and obligations of the partners of Aimco OP following the Separation.

Under the Aimco OP A&R LPA, limited partners have voting rights only with respect to certain limited matters such as certain amendments of the partnership agreement and certain transactions such as the institution of bankruptcy proceedings, an assignment for the benefit of creditors, and certain transfers by the general partner of its interest in Aimco OP or the admission of a successor general partner.

The Aimco OP A&R LPA requires the general partner to cause Aimco OP to distribute quarterly all, or such portion as the general partner may in its sole and absolute discretion determine, of Available Cash (as defined in the Aimco OP A&R LPA) generated by Aimco OP during such quarter to the general partner, the special limited partner, and the other holders of Aimco OP Units on the record date established by the general partner with respect to such quarter, as follows: to (i) the

Non-Aimco

Holders Sharing Percentage (as defined in the Aimco OP A&R LPA) to the

non-Aimco

holders, and (ii) the Aimco Partners Sharing Percentage (as defined in the Aimco OP A&R LPA) to Aimco and its subsidiaries (excluding Aimco OP and its subsidiaries), in each case, allocated among them based on their ownership of Aimco OP Units.

Liquidity, Transferability/Redemption and Exchanges

Under the Aimco OP A&R LPA, until the expiration of one year from the date on which a holder acquired Aimco OP Units (or for the holders of Aimco OP Units who received them in connection with the OP Distribution and certain

one year from the date such holder acquired AIR OP units prior to the OP Distribution in respect of which such Aimco OP Units were distributed in the OP Distribution), subject to certain exceptions, such holder of Aimco OP Units may not transfer all or any portion of its Aimco OP Units to any transferee without the consent of the

general partner, which consent may be withheld in its sole and absolute discretion. After the expiration of one year, such holder of Aimco OP Units has the right to transfer all or any portion of its Aimco OP Units to any person, subject to the satisfaction of certain conditions specified in the Aimco OP A&R LPA, including the general partner’s right of first refusal.

After the first anniversary of becoming a holder of Aimco OP Units, a holder has the right once per quarter on an exchange date set by Aimco OP, subject to the terms and conditions of the Aimco OP A&R LPA, to require Aimco OP to redeem all or a portion of such holder’s Aimco OP Units in exchange for shares of common stock of Aimco or a cash amount equal to the value of such shares, as Aimco OP may elect. Upon receipt of a notice of redemption, which must be provided at least 45 days prior to the quarterly exchange date, Aimco OP may, in its sole and absolute discretion but subject to the restrictions on the ownership of common stock of Aimco imposed under the Aimco charter and the transfer restrictions and other limitations thereof, elect to cause Aimco to acquire some or all of the tendered Aimco OP Units in exchange for shares of common stock of Aimco, based on an exchange ratio of one share of common stock of Aimco for each Aimco OP unit, subject to adjustment as provided in the Aimco OP A&R LPA.

Master Services Agreement

In connection with the Separation, Aimco, Aimco OP, AIR and AIR OP entered into a Master Services Agreement, effective as of December 15, 2020 (the “Master Services Agreement”), pursuant to which, among other things, AIR and its subsidiaries will provide Aimco and its subsidiaries with certain administrative and support services that AIR and its subsidiaries are in a position to continue to provide following the Separation. The Master Services Agreement generally provides that (x) the fees to be charged to Aimco and its subsidiaries will approximate the fully-burdened costs of AIR and its subsidiaries and any and all third-party costs and expenses incurred in connection with the services provided, and (y) Aimco and Aimco OP may terminate services upon customary advance notice and, after December 31, 2023, AIR and AIR OP may terminate services upon customary advance notice.

Employee Matters Agreement

In connection with the Separation, Aimco, Aimco OP, AIR and AIR OP entered into an Employee Matters Agreement, effective as of December 15, 2020 (the “Employee Matters Agreement”), to allocate liabilities and responsibilities relating to employment matters, employee compensation and benefits plans and programs, and other related matters.

In connection with the Separation, Aimco Development Company, LLC, a subsidiary of Aimco, and AIR OP entered into a Master Leasing Agreement, effective as of December 15, 2020 (the “Master Leasing Agreement”), which governs certain leasing arrangements between the parties, the initial term of which is 18 months, with automatic annual extensions (subject to each party’s right to terminate upon notice prior to the end of any such extension term). The Master Leasing Agreement provides that each time the parties thereto wish to enter into a lease for a particular property, such parties will cause their applicable affiliates to execute a stand-alone lease, generally in the lease form attached as an exhibit to the Master Leasing Agreement.

During the term of the Master Leasing Agreement, and in accordance with the terms thereof, AIR OP or its applicable subsidiaries will have, subject to certain exceptions set forth in the Master Leasing Agreement, (a) a purchase option (an “Option”) with respect to any real property owned or, subject to the consent of the landlord, leased by Aimco or its subsidiaries, with respect to real property for which redevelopment has been substantially completed by Aimco (if applicable) and that has reached a specified occupancy for a minimum time period, and (b) a right of first offer (a “ROFO”) on stabilized properties that Aimco is under contract to purchase from third parties. In the event AIR OP exercises either its Option or its ROFO with respect to a property and the parties proceed to a sale of such property, then, (a) in the event of an Option property, AIR OP or its applicable subsidiary will acquire such property from Aimco OP or its applicable subsidiary for an amount equal to the then-current fair market value and (b) in the case of a ROFO for a stabilized property that Aimco is under contract to purchase, AIR OP will acquire such property for an amount equal to 101% of the sum of the agreed-upon purchase price plus out of pocket costs. If AIR OP declines to exercise its ROFO or its Option, as applicable, Aimco may

offer the property to a third party on the same terms as those offered to AIR OP (or in the case of a stabilized property that Aimco is under contract to purchase, Aimco may proceed with the acquisition of such property at the agreed-upon purchase price). Any purchase of an Aimco asset by AIR OP pursuant to a ROFO or an Option will be accompanied by a

pre-closing

tax liability indemnity by Aimco in favor of AIR OP.

In connection with the Separation, four AIR properties currently under construction or in

lease-up,

including North Tower at Flamingo Point in Miami Beach, Florida, The Fremont on the Anschutz Medical Campus in Aurora, Colorado, Prism in Cambridge, Massachusetts, and 707 Leahy Apartments in Redwood City, California, are being leased to Aimco from AIR (collectively, the “Initial Master Leases”, and each, an “Initial Master Lease”). Under each such Initial Master Lease, the terms thereof are on an

arm’s-length

basis, including the initial term and extensions and the initial annual rent, which are, and will be, based on the current, and then-current, fair market value of the leased property and market NOI cap rates, subject to certain adjustments and periodic escalation as set forth in such lease. Further, under the terms of the Initial Master Leases, Aimco has the option to complete the

on-going

redevelopment and development of such properties and their

lease-ups.

Property Management Agreements

In connection with the Separation, subsidiaries of Aimco and subsidiaries of AIR entered into several Property Management Agreements, each effective as of December 15, 2020 (the “Property Management Agreements”). Pursuant to the Property Management Agreements, AIR will, through its subsidiaries, provide Aimco and its subsidiaries with certain property management and related services at a majority of the properties owned by Aimco and its subsidiaries, and Aimco will be obligated to pay to AIR a property management fee based on an agreed percentage of revenue collected and such other fees as may be mutually agreed for various other services. The initial term of each Property Management Agreement is one year, with automatic one year renewal periods, unless either party elects to terminate (for any reason or no reason whatsoever) at any time upon delivery of 60 days’ prior written notice to the other party. Neither party is obligated to pay to the other party a termination fee or other penalty upon such termination.

Mezzanine Note Agreement and Notes

In connection with the Separation, AIR OP and AIMCO/Bethesda Holdings, Inc. (“AIMCO/Bethesda”), a subsidiary of AIR, as purchasers, and Aimco JO Intermediate Holdings, LLC (“Aimco JO”), a subsidiary of Aimco, as borrower, entered into a Mezzanine Note Agreement, effective as of December 14, 2020 (the “Mezzanine Note Agreement”). Pursuant to the Mezzanine Note Agreement, Aimco JO became the obligor on two notes payable of its 5.2% Secured Mezzanine Notes due January 31, 2024, payable quarterly on January 1, April 1, July 1, and October 1, commencing on April 1, 2021 to: AIR OP with a principal amount equal to $477,987,511.45 and AIMCO/Bethesda with an aggregate principal amount equal to $56,139,563.55 (the “Mezzanine Notes”). AIMCO/Bethesda’s portion of the Mezzanine Notes has been transferred to AIR OP such that AIR OP holds the entire $534,127,075 of the Mezzanine Notes. The Mezzanine Notes are senior secured obligations of Aimco JO and will rank senior to all other senior obligations of Aimco JO to the extent of the value of the collateral under the Mezzanine Notes and will rank pari passu with all other senior unsubordinated obligations of Aimco JO to the extent the amount of such obligations exceed the value of the collateral under the Mezzanine Notes. The Mezzanine Notes will be secured by Aimco JO’s equity interests in James-Oxford Limited Partnership, an indirectly owned subsidiary of Aimco that directly or indirectly holds a separate portfolio of 16 assets. The Mezzanine Notes are not guaranteed and as a result, recourse is limited to Aimco JO and its assets (including the collateral).

The foregoing descriptions of the Separation Agreement, Aimco OP A&R LPA, Master Services Agreement, Employee Matters Agreement, Master Leasing Agreement, Initial Master Leases, Property Management Agreements, Mezzanine Note Agreement and Mezzanine Notes are only summaries and are qualified in their entirety by reference to the complete terms and conditions of the Separation Agreement attached hereto as Exhibit 2.1, Aimco OP A&R LPA attached hereto as Exhibit 10.1, Master Services Agreement attached hereto as Exhibit 10.2, Employee Matters Agreement attached hereto as Exhibit 10.3, Master Leasing Agreement attached hereto as Exhibit 10.4, Initial Master Leases attached hereto as Exhibits 10.5-10.8, Property Management Agreements attached hereto as Exhibits 10.9-10.12, Mezzanine Note Agreement attached hereto as Exhibit 10.13 and form of Mezzanine Notes attached hereto as Exhibit 10.14, which are incorporated herein by reference.

|

|

Completion of Acquisition or Disposition of Assets.

|

The description of the Separation included under Item 1.01 of this Current Report on Form

8-K

is incorporated into this Item 2.01 by reference.

|

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The description of the Mezzanine Note Agreement and Mezzanine Notes included under Item 1.01 of this Current Report on Form

8-K,

and the complete terms and conditions thereof attached hereto as Exhibit 10.12 and Exhibit 10.13, respectively, are incorporated into this Item 2.03 by reference.

|

|

Material Modification to Rights of Security Holders.

|

The description of the Articles Supplementary and Amended and Restated Bylaws (each as defined below) included under Item 5.03 of this Current Report on Form

8-K

is incorporated into this Item 3.03 by reference.

The description of the Aimco OP A&R LPA included under Item 1.01 of this Current Report on Form

8-K

is incorporated into this Item 3.03 by reference.

|

|

Changes in Control of Registrant.

|

Immediately prior to the Separation, Aimco OP was a wholly-owned subsidiary of AIR OP. Following completion of the Separation, AIR OP retains no ownership interest in Aimco OP. The description of the Separation included under Item 1.01 of this Current Report on Form

8-K

is incorporated into this Item 5.01 by reference.

|

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Effective immediately prior to the completion of the Separation, Thomas L. Keltner, Devin I. Murphy, Kathleen M. Nelson, John D. Rayis, Ann Sperling, and Nina A. Tran resigned from their positions as members of the Board of Directors of Aimco (the “Board”) and the size of the Board was increased to 10, and the following individuals were appointed by the Board (each, a “New Director”) to fill the resulting vacancies and to serve in the class and on the committee(s) of the Board set forth opposite each New Director’s name:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class I Director

|

|

Compensation and Human Resources Committee

Nominating and Corporate Governance Committee

|

|

|

|

|

|

|

|

Class II Director

|

|

Compensation and Human Resources Committee

Nominating and Corporate Governance Committee

|

|

|

|

|

|

|

|

Class III Director

|

|

N/A

|

|

|

|

|

|

|

|

Class II Director

|

|

Compensation and Human Resources Committee

Nominating and Corporate Governance Committee

|

|

|

|

|

|

|

|

Class I Director

|

|

Compensation and Human Resources Committee

Nominating and Corporate Governance Committee

|

Terry Considine, Robert A. Miller and Michael A. Stein continue to serve as directors of Aimco. Mr. Considine is a Class III director. Mr. Miller is a Class III director and was appointed as Chairman of the Board. Mr. Stein is a Class II director and was appointed as Chairman of the Audit Committee of the Board. Mr. Miller and Mr. Stein continue to serve as members of the Audit Committee, the Compensation and Human Resources Committee, the Nominating and Corporate Governance Committee, and the Investment Committee of the Board.

There are no arrangements or understandings between any New Director and any other person pursuant to which such New Director was elected as a director of Aimco. Except for the independent director compensation to be awarded to each of the New Directors other than Mr. Powell, there have not been any transactions, nor are there any currently proposed transactions, to which Aimco or Aimco OP or any of Aimco’s subsidiaries was or is to be a party in which any New Director had, or will have, a direct or indirect material interest. Aimco’s Board determines the compensation to be paid to individuals who serve as Aimco’s independent directors. Compensation information for Mr. Powell can be found in the Information Statement of Aimco OP, dated as of November 30, 2020, filed as Exhibit 99.1 to the Current Report on Form

8-K

filed jointly by Aimco and Aimco OP with the Securities and Exchange Commission on November 30, 2020, under the sections entitled “Going Forward Aimco Compensation Arrangements.”

Effective immediately prior to the completion of the Separation, Terry Considine resigned as Chief Executive Officer and President, Paul Beldin resigned as Executive Vice President and Chief Financial Officer, Lisa Cohn resigned as Executive Vice President, General Counsel and Secretary, and Keith Kimmel resigned as Executive Vice President, Property Operations, in each case, of Aimco, and the following individuals were appointed by the Board to the corporate offices of Aimco set forth opposite their respective names:

|

|

|

|

|

|

|

|

|

|

|

President and Chief Executive Officer

|

|

|

|

|

|

|

Executive Vice President and Chief Financial Officer

|

|

|

|

|

|

|

Executive Vice President, Chief Administrative Officer, General Counsel and Secretary

|

|

|

|

|

|

|

Vice President and Chief Accounting Officer

|

. Mr. Powell is the President and Chief Executive Officer of Aimco following the Separation. Mr. Powell was appointed as Aimco’s Executive Vice President, Redevelopment in January 2018, in which capacity he had responsibility for redevelopment activities nationally and Aimco’s acquisition activities in the eastern region. From August 2013 to January 2018, Mr. Powell served as Aimco’s Senior Vice President, Redevelopment with responsibility for the eastern region. Since joining Aimco in January 2004, Mr. Powell has held various positions, including Asset Manager, Director and Vice President of Redevelopment. Prior to joining Aimco, Mr. Powell was a Staff Architect with Ai Architecture (now Perkins & Will) in Washington, D.C.

. Ms. Stanfield is the Executive Vice President and Chief Financial Officer of Aimco following the Separation. Ms. Stanfield was appointed as Aimco’s Executive Vice President, Financial Planning & Analysis and Capital Allocation in October 2018, in which capacity she also had responsibility for Strategy and Tax. Ms. Stanfield has previously led Aimco’s Investor Relations and Asset Management. Since joining Aimco in March 1999, Ms. Stanfield has held various positions, including Manager of the Tax Department, Vice President, Tax, and Senior Vice President, Tax and Financial Planning & Analysis. Prior to joining Aimco, Ms. Stanfield was engaged in public accounting at Ernst and Young with a focus on partnership and real estate clients and served as Assistant Professor of Accounting at Erskine College.

. Ms. Johnson is the Executive Vice President, Chief Administrative Officer, General Counsel and Secretary of Aimco following the Separation. Ms. Johnson was appointed as Senior Vice President, Human Resources in August 2009, in which capacity she also had responsibility for facilities and communications. From July 2006 to August 2009, Ms. Johnson served as Vice President and Assistant General Counsel. She joined the Company as Senior Counsel in August 2004. Prior to joining the Company, Ms. Johnson was in private practice with the law firm of Faegre & Benson LLP with a focus on labor and employment law and commercial litigation.

. Mr. Frenzel is the Vice President and Chief Accounting Officer of Aimco following the Separation. Mr. Frenzel joined Aimco in November 2020. Prior to joining Aimco, Mr. Frenzel was engaged in public accounting at PricewaterhouseCoopers for 14 years with a focus on public and private real estate clients.

In connection with the foregoing officer resignations and appointments, the Board appointed Mr. Powell as Aimco’s principal executive officer, Ms. Stanfield as Aimco’s principal financial officer, and Mr. Frenzel as Aimco’s principal accounting officer.

Compensation information for Mr. Powell and Ms. Stanfield can be found in the Information Statement of Aimco OP, dated as of November 30, 2020, filed as Exhibit 99.1 to the Current Report on Form

8-K

filed jointly by Aimco and Aimco OP with the Securities and Exchange Commission on November 30, 2020, under the sections entitled “Going Forward Aimco Compensation Arrangements.”

|

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On December 14, 2020, Aimco filed with the Maryland Department of Assessments & Taxation an Articles Supplementary with an effective time of 12:01 am on December 15, 2020 (the “Articles Supplementary”). Pursuant to the Articles Supplementary, Aimco elects to be subject to the provisions of the Maryland Unsolicited Takeover Act (“MUTA”).

Effective as of December 15, 2020, the Board amended and restated Aimco’s bylaws (such amended and restated bylaws, the “Amended and Restated Bylaws”) to provide that, among other things:

|

|

•

|

|

Aimco elects by resolution of the Board to be subject to the provisions of MUTA, and consistent with such election, the Board is initially classified into three classes, denominated as Class I, Class II, and Class III, with such classes serving until the 2021, 2022, and 2023 annual meetings of Aimco’s stockholder, respectively, at which annual meetings each Class will be elected to a term expiring at the 2024 annual meeting of Aimco’s stockholders;

|

|

|

•

|

|

Aimco elects by resolution of the Board, effective as of immediately prior to the 2024 annual meeting of Aimco’s stockholders, to not be subject to the provisions of MUTA, and consistent with such election, commencing with the 2024 annual meeting of Aimco’s stockholders, the Board will no longer be classified, and each director will be elected annually for a term of one year expiring at the next succeeding annual meeting; and

|

|

|

•

|

|

Aimco’s stockholders will have the right to call a special meeting only upon the written request of the stockholders entitled to cast not less than a majority of all the votes entitled to be cast on the business proposed to be transacted at such meeting.

|

The description set forth under this Item 5.03 is qualified in its entirety by reference to the full text of the Articles Supplementary and the Amended and Restated Bylaws, which are attached hereto as Exhibit 3.1 and Exhibit 3.2, respectively, and incorporated herein by reference.

The description of the Aimco OP A&R LPA included under Item 1.01 of this Current Report on Form

8-K

is incorporated into this Item 5.03 by reference, solely with respect to Aimco OP.

On December 15, 2020, Aimco issued a press release announcing the completion of the Separation. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated herein by reference.

|

|

Financial Statements and Exhibits.

|

(b) Pro forma Financial Information

Aimco and Aimco OP have previously filed audited historical combined financial data and unaudited pro forma combined financial data, in each case, giving effect to the Separation and related transactions in the Information Statement of Aimco OP, dated as of November 30, 2020, filed as Exhibit 99.1 to the Current Report on Form

8-K

filed jointly by Aimco and Aimco OP with the Securities and Exchange Commission on November 30, 2020.

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

2.1

|

|

Separation and Distribution Agreement, effective as of December 15, 2020, by and among Apartment Investment Management Company, Aimco OP L.P., Apartment Income REIT Corp. and AIMCO Properties, L.P.

|

|

|

|

|

3.1

|

|

Articles Supplementary of Apartment Investment Management Company

|

|

|

|

|

3.2

|

|

Amended and Restated Bylaws of Apartment Investment Management Company

|

|

|

|

|

10.1

|

|

Amended and Restated Agreement of Limited Partnership of Aimco OP L.P., effective as of December 14, 2020

|

|

|

|

|

10.2

|

|

Master Services Agreement, effective as of December 15, 2020, by and among Apartment Investment Management Company, Aimco OP L.P., Apartment Income REIT Corp. and AIMCO Properties, L.P.

|

|

|

|

|

10.3

|

|

Employee Matters Agreement, effective as of December 15, 2020, by and among Apartment Investment Management Company, Aimco OP L.P., Apartment Income REIT Corp. and AIMCO Properties, L.P.

|

|

|

|

|

10.4

|

|

Master Leasing Agreement, effective as of December 15, 2020, by and between AIMCO Properties, L.P. and Aimco Development Company, LLC

|

|

|

|

|

10.5

|

|

Master Lease Agreement, dated as of December 15, 2020 (to be effective January 1, 2021), by and between AIMCO 50 Rogers Street, LLC and Prism Lessee, LLC

|

|

|

|

|

10.6

|

|

Master Lease Agreement, dated as of December 15, 2020 (to be effective January 1, 2021), by and between AIMCO Fitzsimons 3A Lessor, LLC and Fremont Lessee, LLC

|

|

|

|

|

10.7

|

|

Master Lease Agreement, dated as of December 15, 2020 (to be effective January 1, 2021), by and between MCZ/Centrum Flamingo II, L.L.C. and Flamingo North Lessee, LLC

|

|

|

|

|

10.8

|

|

Master Lease Agreement, dated as of December 15, 2020 (to be effective January 1, 2021), by and between AIMCO Leahy Square Apartments, LLC and 707 Leahy Lessee, LLC

|

|

|

|

|

|

10.9

|

|

Property Management Agreement, effective as of December 15, 2020, by and between James-Oxford Limited Partnership and AIR Property Management TRS, LLC

|

|

|

|

|

10.10

|

|

Property Management Agreement, effective as of December 15, 2020, by and between Aimco OP L.P. and AIR Property Management TRS, LLC

|

|

|

|

|

10.11

|

|

Property Management Agreement, effective as of December 15, 2020, by and between Aimco OP L.P. and AIR Property Management TRS, LLC

|

|

|

|

|

10.12

|

|

Property Management Agreement, effective as of December 15, 2020, by and between Aimco Development Company, LLC and AIR Property Management TRS, LLC

|

|

|

|

|

10.13

|

|

Mezzanine Note Agreement, effective as of December 14, 2020, by and among Aimco REIT Sub, LLC, AIMCO/Bethesda Holdings, Inc. and AIMCO Properties, L.P.

|

|

|

|

|

10.14

|

|

Form of 5.2% Secured Mezzanine Note, made by Aimco REIT Sub, LLC (included in Exhibit 10.13)

|

|

|

|

|

99.1

|

|

Press Release, dated December 15, 2020

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

|

|

|

|

|

|

|

|

|

|

|

Wes Powell

|

|

|

|

Chief Executive Officer

|

|

|

|

AIMCO OP L.P.

|

By Aimco OP GP, LLC, its general partner

By Apartment Investment and Management Company, its managing member

|

|

|

|

|

|

|

|

|

|

|

Wes Powell

|

|

|

|

Chief Executive Officer

|

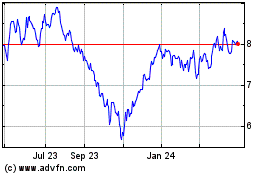

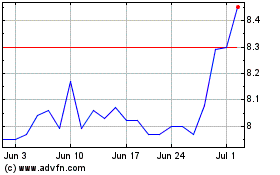

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Apr 2023 to Apr 2024