Annaly Capital Management, Inc. Provides Update on Employee Stock Ownership Guidelines & Recent Purchases by Officers & Direc...

July 08 2019 - 9:00AM

Business Wire

- 100% of employees subject to Annaly’s broad-based Employee

Stock Ownership Guidelines have purchased stock, including all

Executive Officers

- During the second quarter of 2019, Annaly’s Executive

Officers and Directors led all large-capitalization U.S. financial

companies in common stock purchases

- Annaly’s Chairman, Chief Executive Officer and President,

Chief Investment Officer, Chief Corporate Officer and Chief Legal

Officer, and two Independent Directors all made purchases of common

stock during the second quarter of 2019

Annaly Capital Management, Inc. (NYSE: NLY) (“Annaly” or the

“Company”) today announced an update on its Employee Stock

Ownership Guidelines and recent stock purchases by the Company’s

Executive Officers and Directors, further substantiating Annaly’s

alignment with shareholders and significant ownership culture

throughout the Company.

Beginning in 2016, Annaly implemented broad-based Employee Stock

Ownership Guidelines, further solidifying its commitment to

aligning the interests of its employees with those of its

stockholders to foster long-term value creation. Pursuant to these

voluntary guidelines, Annaly’s Director-level and above employees,

representing a total of 69 employees or 38% of the firm, have been

asked to purchase stock in the open market with after-tax dollars

over a period of five years. As of June 30, 2019, 100% of employees

subject to the guidelines for over one year have purchased shares

of Annaly common stock.

Since implementing the guidelines in March 2016, total ownership

of Annaly common stock by current Executive Officers has increased

by over $12 million to a total of over $21 million. In July 2017,

each of the Company’s Executive Officers, Annaly’s Chairman, Chief

Executive Officer and President, Chief Corporate Officer and Chief

Legal Officer, Chief Financial Officer, Chief Investment Officer

and Chief Credit Officer, voluntarily committed to increase their

stock ownership positions beyond their individual ownership

guidelines. Since May 6, 2019 alone, Annaly’s Directors and

Executive Officers have purchased shares of Annaly common stock

with an aggregate value of $5.2 million, with Executive Officers

representing $4.3 million, as reported on forms filed with

Securities and Exchange Commission.

“The recent stock purchases made by Annaly’s Board, executive

officers and employees further emphasize our belief in this Company

and its future,” commented Kevin Keyes, Chairman, Chief Executive

Officer and President. “Having an established ownership culture at

our Firm is extremely important and our very unique stock purchase

guidelines support alignment of the long-term interests of our

management and employees with our shareholders. Our continued

purchases, coupled with the fact that all current executives have

never sold any stock, exemplify our ongoing commitment to our

shareholders.”

About Annaly

Annaly is a leading diversified capital manager that invests in

and finances residential and commercial assets. Annaly’s principal

business objective is to generate net income for distribution to

its stockholders and to preserve capital through prudent selection

of investments and continuous management of its portfolio. Annaly

has elected to be taxed as a real estate investment trust, or REIT,

for federal income tax purposes. Annaly is externally managed by

Annaly Management Company LLC. Additional information on the

company can be found at www.annaly.com.

Forward-Looking Statements

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as "may,” “will,” “believe,” “expect,”

“anticipate,” “continue,” or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financing; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow our commercial real estate business;

our ability to grow our residential credit business; our ability to

grow our middle market lending business; credit risks related to

our investments in credit risk transfer securities, residential

mortgage-backed securities and related residential mortgage credit

assets, commercial real estate assets and corporate debt; risks

related to investments in mortgage servicing rights; our ability to

consummate any contemplated investment opportunities; changes in

government regulations and policy affecting our business; our

ability to maintain our qualification as a REIT for U.S federal

income tax purposes; and our ability to maintain our exemption from

registration under the Investment Company Act of 1940, as amended.

For a discussion of the risks and uncertainties which could cause

actual results to differ from those contained in the

forward-looking statements, see “Risk Factors” in our most recent

Annual Report on Form 10-K and any subsequent Quarterly Reports on

Form 10-Q. We do not undertake, and specifically disclaim any

obligation, to publicly release the result of any revisions which

may be made to any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances

after the date of such statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190708005090/en/

Annaly Capital Management, Inc. Investor Relations 1-888-8Annaly

www.annaly.com

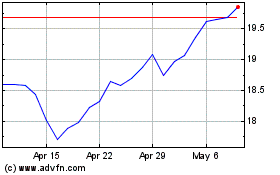

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

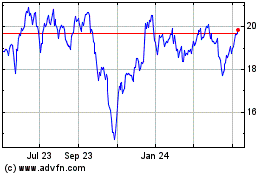

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024