Columbia Management Streamlines Mutual Fund Offerings

August 19 2010 - 11:16AM

Business Wire

Columbia Management announced that it has proposed 62 fund

mergers as part of the integration of Columbia Management and

RiverSource Investments. These proposals are subject to final

approval by the funds’ boards of directors/trustees and are

ultimately subject to shareholder approval.

Ameriprise Financial, Inc. completed its acquisition of Columbia

Management Group, LLC’s long-term asset management business in May.

Columbia Management Investment Advisers is the eighth largest

long-term asset manager in the U.S. with $327 billion in assets

under management as of June 30, 2010.

“These proposed mergers are an important milestone in the

integration of Columbia Management with RiverSource Investments,”

said Kevin Connaughton, head of mutual funds. “We believe the

mergers would strengthen and streamline our product line up while

providing fund shareholders and their financial advisors with

excellent products and greater cost-efficiency.”

“Our goal is to provide a compelling and diversified lineup of

strong-performing retail and institutional products that provide

investment solutions for our clients,” said Chris Thompson, head of

product management and marketing. “We expect these moves will help

us to achieve that goal.”

The company made personnel changes prior to the close of the

acquisition on April 30, 2010 and does not expect to eliminate

additional investment positions due to the proposed mergers. The

integration process remains on schedule and on budget. Fund

mergers, if approved, are expected to close in the first half of

2011. Additional aspects of the integration are expected to be

announced this fall.

On April 30, 2010, Ameriprise Financial, Inc., the parent

company of RiverSource Investments, LLC, acquired the long-term

asset management business of Columbia Management Group, LLC,

including certain of its affiliates, which were, prior to this

acquisition, part of Bank of America. In connection with the

acquisition of the long-term assets, certain clients of Columbia

Management Advisors, LLC (including the Columbia Funds) have a new

investment adviser, RiverSource Investments, LLC, which is now

known as Columbia Management Investment Advisers, LLC.

On the same date, Ameriprise Financial also acquired Columbia

Wanger Asset Management, LLC (CWAM). CWAM will continue as the

investment adviser for Columbia Acorn and Wanger Funds and no

changes are anticipated in the existing investment management

team.

For those clients that use the services of a subadviser, those

arrangements are continuing unless notified otherwise. RiverSource

Fund Distributors, Inc., now known as Columbia Management

Investment Distributors, Inc., member FINRA, will act as the

principal distributor of the Columbia, Wanger, Columbia Acorn,

RiverSource, Seligman and Threadneedle branded funds. RiverSource

Service Corporation, now known as Columbia Management Investment

Services Corp., is the transfer agent for the Funds.

Investment products are not federally or FDIC-insured, are not

deposits or obligations of, or guaranteed by any financial

institution, and involve investment risks including possible loss

of principal and fluctuation in value.

Investors should consider the investment objectives, risks,

charges and expenses of a mutual fund carefully before investing.

For a free prospectus, which contains this and other important

information about the funds, visit

columbiamanagement.com. Read the prospectus carefully

before investing.

© 2010 Columbia Management Investment Advisers, LLC. All rights

reserved.

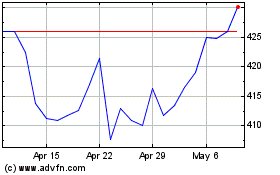

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Sep 2023 to Sep 2024