Former Louisiana Broker Sentenced To Five Years In Jail

January 22 2010 - 6:09PM

Dow Jones News

David McFadden, a former broker, was sentenced in New Orleans to

five years in jail Thursday, the maximum amount of time he could

serve, for conspiracy to commit securities fraud against elderly

investors.

McFadden, 62, was also fined $250,000, by U.S. District Court

Judge Carl Barbier.

The case is highly unusual because brokers accused of misleading

clients, as McFadden was, rarely end up in jail. Such brokers

usually end up paying a fine and losing their securities licenses.

It usually takes outright theft of clients' money or running Ponzi

schemes to land a broker (or a money manager like Bernie Madoff) in

jail.

"The fact that this is a criminal case is unprecedented and

sends a message to brokers that they could end up in jail if they

give clients reckless advice," said lawyer Joseph Fogel of Fogel

& Associates, who isn't involved in the case.

McFadden pleaded guilty in May, and entered a plea to serve 18

to 24 months in jail.

According to a May 2009 court filing from the U.S. Attorney for

the Eastern District of Louisiana, McFadden, a former Securities

America Inc. broker, put himself in the position to sell

high-commission variable annuities and mutual funds to clients,

made material misrepresentations and omissions related to his

qualifications, the diversification of stocks, and the investment

returns he would achieve." As a result, prosecutors said, the

clients didn't have enough money to retire. The conspiracy began

sometime before January 1999 and continued to September 2006,

according to the court filing.

In September 2006, Securities America, a unit of Ameriprise

Financial Inc. (AMP), settled with the National Association of

Securities Dealers, the predecessor of the Financial Industry

Regulatory Authority, without admitting or denying the allegations.

It agreed to pay a $2.5 million fine for failing to adequately

supervise McFadden, and $13.8 million in restitution to Exxon

retirees who were McFadden's clients. McFadden agreed to give up

his securities license late in 2006.

"I hope this sends a clear message to all who sponsor or

transact business with employee benefit plans that the federal

government will aggressively pursue those who commit crimes against

employees and retirees of private-sector pension and health plans,"

said Roger Hilburn, Dallas Regional Director of the Department of

Labor, Employee Benefits Security Administration, in a U.S.

attorney's press release.

-By Jessica Papini, Dow Jones Newswires; 212-416-2172;

jessica.papini@dowjones.com

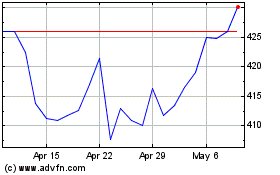

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Aug 2024 to Sep 2024

Ameriprise Financial (NYSE:AMP)

Historical Stock Chart

From Sep 2023 to Sep 2024