By AnnaMaria Andriotis

For more than 20 years, Laura Chapman routinely charged

thousands of dollars a month on her American Express Co. Platinum

card.

The 57-year-old travel agent's income and spending took a dive

after coronavirus made the kind of business trips and vacations she

booked all but impossible. She canceled the card when AmEx charged

her the $550 annual fee.

"I thought 'that's it I'm done,'" said Ms. Chapman, who is still

paying off her balance on the card. "The card won't be worth

it."

Ultra-premium rewards credit cards aren't as rewarding these

days. Banks have spent years fine-tuning the cards to appeal to

big-spending jet-setters, offering generous sign-up bonuses and

extra points on airfare, hotel stays and restaurant meals. Travel

bans and social distancing have made those perks less appealing,

leading some customers to question if the cards are worth their

hefty annual fees.

Banks are scrambling to keep those hard-won customers. JPMorgan

Chase & Co. delayed a planned $100 increase on Sapphire

Reserve's $450 annual fee. It is also doling out extra points on

grocery purchases through the end of June. Citigroup Inc. rolled

out extra points on online grocery, drugstore and other purchases

made with its premium Prestige card through August. AmEx is

offering consumers who have the Platinum card up to $320 in

statement credits when they use their card to buy certain streaming

and wireless-phone services.

A pandemic that has grounded flights and closed borders is the

biggest test to date for this slice of the credit-card business,

which has helped banks deepen their relationships with wealthier

consumers. And, as millions of Americans are skipping their debt

payments and banks are setting aside billions of dollars to cover

potential losses on soured loans, it is a revenue source they can

ill afford to lose.

Doling out extra points for groceries and other everyday

expenses could become costly for banks.

"These aren't minor changes," said John Grund, a managing

director of payments at Accenture PLC. "Most issuers are trying to

stay top of wallet until they get line of sight as to whether they

have to do something more dramatic."

The coronavirus shutdown drastically altered consumer spending.

Credit-card spending was down 21% in the U.S. in May from the same

time a year ago, according to Visa Inc. Travel spending on credit

and debit cards fell more than 70% in May, Visa said, while food

and drugstore spending increased more than 20%.

"The Amazons, Netflix, Walmarts, Targets are up, groceries are

up. And then obviously restaurants, travel, airports are down 95%

or something like that," James Dimon, JPMorgan's chief executive,

said at a conference in late May.

So far, card issuers say they aren't seeing an increase in

cancellations, though some customers have switched to other cards

with low or no annual fees and less generous rewards. The new

reward offerings, they said, are meant to better align the cards'

benefits with their customers' new spending habits.

"Given the fact that things like our...lounge collection are not

particularly useful right now for most of our card members, we've

added different benefits that are more appropriate to today's

environment on a temporary basis," Jeffrey Campbell, AmEx's finance

chief, said at a June conference.

Claire Lee downgraded her Chase Sapphire Reserve card to the

bank's Freedom card in April to avoid the annual fee. The

24-year-old technology product manager said she charged about $100

on the card in April, a 10th of her pre-pandemic spending.

In the year she had it, Ms. Lee said she booked around a dozen

trips on the Sapphire Reserve. She used it a few times a week at

restaurants and to pay for parking near her office. Now, she is

working from home in Los Altos, Calif., and cooking most of her

meals.

"I buy groceries more than I ever bought in my life," said Ms.

Lee. She said she plans to go back to the Sapphire Reserve when it

is safe to travel again.

Travel rewards cards have bounced back from other shocks,

including the Sept. 11 terrorist attacks and the 2008 financial

crisis. This time is different. Coronavirus is still spreading

rapidly in many parts of the world and, absent a vaccine, it is

hard to predict when travel will return to pre-pandemic levels.

Banks are developing cards with lower annual fees that emphasize

food delivery, streaming services and home renovation, according to

people familiar with the matter. They are weighing adding rewards

benefits for national parks, campgrounds and museums in an effort

to branch out beyond airlines and hotel chains, the people

said.

Meanwhile, card issuers are paying up to keep their best

customers.

Zakeel Gordon said he called AmEx in March to downgrade his

Platinum card to a Green card. He said AmEx offered him a statement

credit of $500 to cover most of his annual fee, and he

accepted.

The 25-year-old Seattle resident said his monthly spending on

the card has fallen to about $500 from around $3,000 and that he

has shifted most of his spending to cash-back cards.

When Andrew Loo called AmEx in June to cancel his Platinum card,

he said a customer-service representative offered him 50,000 points

to keep it -- enough, in normal times, for one or two round-trip

domestic flights.

Mr. Loo, a 32-year-old IT project manager, decided to keep the

card and redeem the extra points for travel later. But he isn't

sure it is worth it.

He said he had upgraded to Platinum from the AmEx Gold in

November, in preparation for a busy travel schedule after his

wedding.

Mr. Loo's wife has been furloughed since March, and their trips

have been canceled. Restaurant meals have been replaced with trips

to the local Target. He has little use for the Platinum card's Saks

Fifth Avenue and Uber Eats perks.

"There's really nothing the card is offering me," he said.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

June 28, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

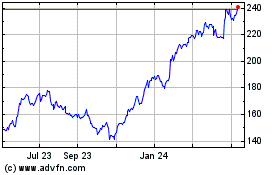

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

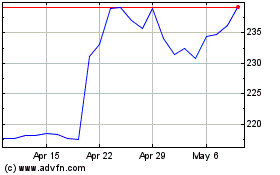

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024