By AnnaMaria Andriotis | Photographs by Andrew Spear for The Wall Street Journal

The American Express Co. saleswoman had finally convinced Bryan

Daughtry to apply for a card. There was just one thing: She had to

run a credit check.

Mr. Daughtry, who owns a disaster-cleanup company in Ohio,

balked. He was trying to get a mortgage and didn't want the inquiry

to dent his credit score. She refused to stop the process, he said,

checked his credit, and his application was approved.

"That left a bad taste in my mouth," said Mr. Daughtry.

Some AmEx salespeople strong-armed business owners like Mr.

Daughtry to increase card sign-ups, according to more than a dozen

current and former AmEx sales, customer-service and compliance

employees. The salespeople have misrepresented card rewards and

fees, checked credit reports without consent and, in some cases,

issued cards that weren't sought, the current and former employees

said.

An AmEx spokesman said the company found a very small number of

cases "inconsistent with our sales policies." "All of those

instances were promptly and appropriately addressed with our

customers, as necessary, and with our employees, including through

disciplinary action," he said.

"We have rigorous, multilayered monitoring and independent

risk-management processes in place, which we continuously review

and enhance to ensure that all sales activities conform with our

values, internal policies and regulatory requirements," he said.

"We carefully examine any issues raised through our various

internal and external feedback channels and audits, and we do not

tolerate any misconduct."

Current and former employees said the dodgy sales tactics date

to at least 2015, when AmEx was scrambling to retain Costco

Wholesale Corp. small-business customers after the warehouse club

ended their long-running partnership.

The deal's demise was a huge blow to AmEx. For 16 years, the

warehouse club didn't accept credit cards in its stores from any

company but AmEx. AmEx also issued credit cards branded with the

Costco logo that offered special perks.

Small businesses were a particularly valuable slice of the

Costco cohort. The warehouse club sells a lot of things they need

-- two-liter jugs of olive oil, bulk cleaning supplies, big-screen

TVs, tires for their delivery vans. AmEx was about to lose the

stream of fees on all of those card purchases.

Customers were also free to use their Costco-branded cards

elsewhere, and they did. Kenneth Chenault, then AmEx's chief

executive, said that about 70% of spending on the Costco cards were

non-Costco purchases. Those fees would go away, too.

The potential revenue hit from the loss of the Costco customers

was enormous, so AmEx launched an aggressive campaign to keep them.

The push ushered in an era of escalating sales goals and hefty

commissions that persists today.

Mr. Daughtry said he didn't seek out the AmEx card. The

saleswoman called his office numerous times over several weeks last

spring before she finally got him on the line. Although he said he

never consented to the card, he got a $250 bill for its annual fee

in the mail.

He called to complain. "I told them I wouldn't stand for it, and

I would take some type of action," Mr. Daughtry said. AmEx agreed

to drop the charge.

Known for courting well-heeled consumers, AmEx also relies

heavily on its business customers. It derives about 30% of its

revenue from the services it sells to a range of companies -- from

mom-and-pop shops to multinational corporations.

AmEx is the largest business-card issuer in the U.S., according

to the Nilson Report. Small businesses are an especially important

constituency; AmEx has said its small-business card portfolio is

larger than that of its nearest five competitors combined.

The task of retaining Costco customers initially fell to about a

hundred AmEx salespeople in Phoenix. The "top client acquisitions"

group employees were told that the Costco retention program --

Project Lincoln -- was a once-in-a-lifetime opportunity to make big

money. Their task: dial up Costco business-card holders and

convince as many as possible to sign up for AmEx business

cards.

The dial-for-dollars strategy worked. AmEx managed to hang onto

a big chunk of the Costco customers. Within six months of the push,

some salespeople had earned commissions of $50,000 to $100,000,

according to current and former employees. BMWs and other high-end

cars began appearing in the office parking lot.

Some salespeople took shortcuts to get there, current and former

employees said.

Salespeople are required to call customers on their recorded

desk lines, but some placed calls from personal cellphones, often

while standing in a breezeway between two buildings on AmEx's

Phoenix campus, according to current and former employees. Senior

managers sometimes closed sales on their unrecorded desk lines.

There were red flags. Some 40% to 45% of cards that were being

mailed out as part of Project Lincoln were being activated,

according to a 2015 presentation by a senior employee in the

division -- well below the typical rate of at least 60%. Phoenix

salespeople were earning the highest commissions, but the accounts

they had opened had the lowest usage rates of any other group, said

people familiar with the presentation.

An executive at the company's headquarters in New York flagged

the low activation rates to senior sales employees in Phoenix,

according to people familiar with the matter. Commissions were

scaled back, and some salespeople suspected of dicey behavior were

fired, the people said.

The Costco retention campaign ended in 2016, but the problematic

sales practices didn't, current and former employees said.

Salespeople who had grown accustomed to the big commissions from

the retention program were back to mostly relying on cold calls to

meet their now-higher monthly sales targets.

Salespeople sometimes told hesitant business owners they would

send informational "welcome kits" in the mail. Instead, they used

Social Security numbers and addresses gleaned from customer

databases to submit applications on the business owners' behalf.

The "welcome kits" were simply the cards and their associated

paperwork.

It didn't take long for senior sales employees to begin spotting

the same practice at another AmEx office in Florida focusing on

business-card sales, they said.

Some employees tried to warn higher-ups about the questionable

tactics. In early 2017, a saleswoman contacted Susan Sobbott, at

the time president of global commercial services. She connected the

saleswoman with employees in human resources and risk management so

they could investigate the allegations.

When human-resources staff reached out to the employee's

manager, he denied the saleswoman's allegations and said she was

underperforming. The employee later left the company. The manager

was later promoted. Ms. Sobbott has since left AmEx.

"The senior leader appropriately referred the matter to

independent groups outside the business, who then investigated the

allegations and found them to be unsubstantiated," the AmEx

spokesman said.

Around this time, AmEx was conducting a broad review of its

sales tactics. After Wells Fargo & Co. disclosed in September

2016 that branch employees had opened fake accounts without

customer consent, the Office of the Comptroller of the Currency

asked AmEx and other banks it oversees to make sure their employees

weren't doing the same thing.

AmEx reviewed calls from desk phone lines of sales staff between

2014 and 2017 and found evidence of misleading behavior, according

to people familiar with the matter. Some customers were told their

cards were being upgraded when they were being given new cards;

others received more cards than they sought. Salespeople skipped

over required disclosures and, in some cases, falsely told

customers their credit wouldn't be checked, the people said. Cards

also had been issued without customer consent, they said.

AmEx told the OCC it found few cases of inappropriate sales

tactics, the people said. The company reprimanded or fired a small

number of employees and asked credit-reporting firms to remove

inquiries from the credit reports of customers who didn't consent

to the checks, they said. AmEx asked customers who received cards

they didn't authorize if they wanted to keep them, the people

said.

The review didn't capture calls made from employees' cellphones,

nor did it catch those made by senior sales staff on unrecorded

lines, according to people familiar with the matter.

An AmEx spokesman said the company "found no evidence of a

pattern of misleading sales practices."

Last year, the OCC listened to some AmEx sales calls and found

evidence of misconduct, according to people familiar with the

matter.

AmEx said the business-card sales teams were responsible for

around 0.25% of 65 million new cards issued by the company

world-wide between 2014 and 2019, or about 162,500 cards. "Less

than 0.25% of the group's sales activities have been identified by

us as inconsistent with our sales policies," a spokesman said.

As recently as last year, AmEx's customer-service department

fielded complaints from business owners who said they had received

cards they didn't sign up for, according to people familiar with

the matter. Some of those calls made their way to the company's

executive escalations department, some of the people said. Angry

customers were often offered extra rewards points to drop their

complaints, they said.

Customers also complained that salespeople misled them about

card fees and rewards, current and former employees said.

Abdelnasser Abdeen said a salesperson told him he wouldn't be

charged an annual fee if he didn't activate his AmEx card. Soon

after the card came in the mail last year, he got a bill for $295.

When he called to complain, Mr. Abdeen said he was told the card

rewards would more than cover the fee.

"They were pushing to sell me that card," said Mr. Abdeen, who

owns a used-car dealership in northern Virginia. "I didn't like

that." He canceled the card and signed up for a different type of

AmEx card. He said he isn't getting the rewards points he was told

he would get.

In the fall, an AmEx salesman convinced Glen Vitale to take out

six business cards with an unusually generous offer of four rewards

points per dollar on certain spending categories for the first

$150,000 spent. He said he was led to believe he would pay a single

annual fee of $295 for all the cards.

Mr. Vitale, an executive at an auto-parts manufacturer in

Pompano Beach, Fla., began using one of the cards right away. The

salesperson emailed to ask whether he would make a small purchase

with the others to test their security chips.

Soon after, Mr. Vitale said he got six separate bills for $295

each. The salesperson told him the rewards would more than cover

the cost.

"I said, 'I hope you're right,' and I went on with my business,"

he said. AmEx recently fired the salesman.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

March 01, 2020 10:14 ET (15:14 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

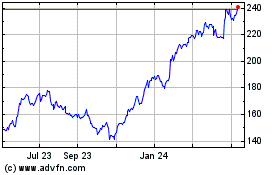

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

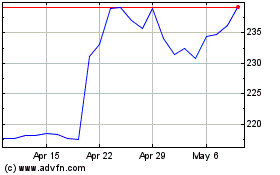

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024