Aerie posted exceptional growth, with revenue up 32% and record

margins

AEO’s digital demand accelerated and increased 48%; Aerie grew

113% and AE rose 21%

Improved demand and operating discipline drove $173 million in

positive operating cash flow and a strengthened financial position,

ending with $899 million in cash

Ending inventory declined 21%; AEO is well positioned for the

second half

American Eagle Outfitters, Inc. (NYSE: AEO) today reported EPS

of ($0.08) for the 13 weeks ended August 1, 2020. This compared to

$0.38 for the 13 weeks ended August 3, 2019. Adjusted EPS of

($0.03) this year excluded $0.05 of COVID-19 related expenses and

restructuring charges and compared to adjusted EPS of $0.39 last

year, which excluded $0.01 of restructuring costs.

Jay Schottenstein, AEO’s Chairman and Chief Executive Officer

commented, “In the midst of an unprecedented crisis, we delivered a

significant improvement from the first quarter throughout our

business – a true testament to the agility, talent and commitment

of our team. Aerie was simply outstanding, fueled by strong demand,

with revenue rising 32% and record margins, demonstrating the power

of the brand and signaling the vast opportunity ahead. Across

brands, digital sales accelerated and we successfully reopened

stores during the quarter.”

“Throughout this event, we operated with strong disciplines,

reduced expenses, cut inventories and carefully managed liquidity.

We controlled what we could, and generated positive free cash flow,

strengthening our balance sheet. Inventories are in good shape and

I believe we are very well-positioned for the second half of the

year. We will remain focused on managing through the near term and

preparing for a new future as we accelerate strategies to transform

our business and emerge with strength.”

Adjusted amounts represent Non-GAAP results, as described in the

accompanying GAAP to Non-GAAP reconciliations.

Second Quarter 2020 Results

- Total net revenue for the 13 weeks ended August 1, 2020

decreased $157 million, or 15% to $884 million, compared to $1.04

billion for the 13 weeks ended August 3, 2019. The decline to last

year largely reflected store closures during the second quarter.

Revenue in the year-ago period also included $40 million from

Japanese license royalties.

- By brand, American Eagle revenue decreased 26%, following a 1%

decline last year. Aerie’s revenue increased 32%, following a 22%

increase last year.

- The company’s second quarter digital demand, as measured by

ordered sales, increased 48%. Aerie digital demand rose 113% and AE

increased 21%. AEO’s digital reported revenue increased 74%,

reflecting the strong demand and a timing benefit related to the

reversal of temporary fulfillment delays from the first quarter.

Aerie digital revenue rose 142% and AE increased 47%.

- Gross profit of $265 million compared to $383 million last

year. The year-ago gross profit included an approximately $38

million benefit from Japanese license royalties. The decline to

last year also reflected a reduction in store revenue and higher

delivery and distribution center costs, primarily due to a strong

digital business and higher cost per shipment. This was partly

offset by lower rent expense and an increase in mark-up. As a rate

to revenue, gross margin of 30.0% compared to 36.7% last year.

- Selling, general and administrative expense of $224 million

decreased $29 million from $253 million last year, primarily

reflecting lower operating expenses due to store closures and

disciplined cost controls.

- Depreciation and amortization expense of $39 million decreased

$6 million from $45 million last year, due to asset impairments

taken in recent quarters, as well as lower capital spending.

- Operating loss of $12 million compared to income of $82 million

last year. Adjusted operating income of $2 million this year

excluded $15 million of COVID-19 related expenses and restructuring

charges and compared to adjusted operating income of $85 million

last year, which excluded $3 million of restructuring charges. GAAP

and adjusted operating income in the year-ago period included a $34

million benefit from Japanese license royalties.

- Net interest expense of $9 million compared to net interest

income of $2 million last year, reflecting interest expense

associated with convertible notes and borrowings under the

revolving credit facility this year.

- EPS of ($0.08) compared to EPS of $0.38 last year. Adjusted EPS

of ($0.03) excluded $0.05 of COVID-19 related expenses and

restructuring costs and compared to adjusted EPS of $0.39 last

year, which excluded $0.01 of restructuring costs.

Restructuring and COVID-19 Related Charges

In the second quarter of 2020, the company incurred incremental

COVID-19 expenses and restructuring charges of approximately $15

million pre-tax, or $0.05 per share after-tax. In the second

quarter of 2019, the company incurred restructuring charges of $3

million pre-tax, or $0.01 per share after-tax.

Inventory

Total ending inventory at cost decreased $114 million or 21% to

$421 million. AE brand inventory was significantly lower, as

inventories were cut due to COVID-19-related store closures and

inventory optimization strategies. Aerie inventory increased to

support strong demand. In the fall, the company plans to continue

inventory optimization initiatives to streamline assortments,

provide greater alignment of inventory to sales plans and better

utilize supply chain strengths to chase product demand.

Capital Expenditures

In the second quarter of 2020, capital expenditures totaled $27

million. On a year-to-date basis, capital expenditures were $61

million. For fiscal 2020, the company continues to expect capital

expenditures to be in the range of $100 to $125 million,

prioritizing strategic customer-facing and supply chain

investments. This compares to $210 million for the full-year fiscal

2019.

Cash Flow and Balance Sheet

The company generated $173 million in operating cash flow during

the second quarter and ended the period with total cash and

short-term investments of $899 million, an increase from $317

million last year. The quarter-end cash balance included $406

million in proceeds from the April 2020 convertible notes offering

and $200 million in outstanding borrowings from the company’s

revolving credit facility. Due to the strong cash flow, the company

repaid $130 million in outstanding borrowings from its revolving

credit facility during the second quarter. Subsequent to

quarter-end, the company repaid the facility’s remaining $200

million outstanding balance.

Shareholder Returns

As previously announced, the company suspended its dividend in

June 2020 and at this point does not anticipate declaring a

dividend for the rest of this year. The company’s first quarter

cash dividend was deferred until 2021 and will be payable on April

23, 2021 to stockholders of record at the close of business on

April 9, 2021.

Conference Call and Supplemental Financial

Information

Today, management will host a conference call and real time

webcast at 9:00 a.m. Eastern Time. To listen to the call, dial

1-877-407-0789 or internationally dial 1-201-689-8562 or go to

www.aeo-inc.com to access the webcast and audio replay.

Additionally, a financial results presentation is posted on the

company’s website.

Non-GAAP Measures

This press release includes information on non-GAAP financial

measures (“non-GAAP” or “adjusted”), including earnings per share

information and the consolidated results of operations excluding

non-GAAP items. These financial measures are not based on any

standardized methodology prescribed by U.S. generally accepted

accounting principles (“GAAP”) and are not necessarily comparable

to similar measures presented by other companies. Management

believes that this non-GAAP information is useful for an alternate

presentation of the company’s performance, when reviewed in

conjunction with the company’s GAAP financial statements. These

amounts are not determined in accordance with GAAP and therefore,

should not be used exclusively in evaluating the company’s business

and operations.

About American Eagle Outfitters, Inc.

American Eagle Outfitters, Inc. (NYSE: AEO) is a leading global

specialty retailer offering high-quality, on-trend clothing,

accessories and personal care products at affordable prices under

its American Eagle® and Aerie® brands. Our purpose is to show the

world that there’s REAL power in the optimism of youth. The company

operates stores in the United States, Canada, Mexico, and Hong

Kong, and ships to 81 countries worldwide through its websites.

American Eagle and Aerie merchandise also is available at more than

200 international locations operated by licensees in 25 countries.

For more information, please visit www.aeo-inc.com.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995

This release and related statements by management contain

forward-looking statements (as such term is defined in the Private

Securities Litigation Reform Act of 1995), which represent our

expectations or beliefs concerning future events, including third

quarter 2020 results. All forward-looking statements made by the

company involve material risks and uncertainties and are subject to

change based on many important factors, some of which may be beyond

the company’s control. Words such as "estimate," "project," "plan,"

"believe," "expect," "anticipate," "intend," “potential,” and

similar expressions may identify forward-looking statements. Except

as may be required by applicable law, we undertake no obligation to

publicly update or revise any forward-looking statements whether as

a result of new information, future events or otherwise and even if

experience or future changes make it clear that any projected

results expressed or implied therein will not be realized. The

following factors, in addition to the risks disclosed in Item 1A.,

Risk Factors, of the company’s Annual Report on Form 10-K for the

fiscal year ended February 1, 2020 and in any subsequently-filed

Quarterly Reports on Form 10-Q filed with the Securities and

Exchange Commission in some cases have affected, and in the future

could affect, the company's financial performance and could cause

actual results for the third quarter 2020 and beyond to differ

materially from those expressed or implied in any of the

forward-looking statements included in this release or otherwise

made by management: the impact that the COVID-19 pandemic, the 2020

U.S. Presidential election and disruption related to social unrest

will have on our operations and financial results, which is

difficult to accurately predict; the risk that the company’s

operating, financial and capital plans may not be achieved; our

inability to anticipate customer demand and changing fashion trends

and to manage our inventory commensurately; seasonality of our

business; our inability to achieve planned store financial

performance; our inability to react to raw material cost, labor and

energy cost increases; our inability to gain market share in the

face of declining shopping center traffic; our inability to respond

to changes in e-commerce and leverage omni-channel demands; our

inability to expand internationally; difficulty with our

international merchandise sourcing strategies; challenges with

information technology systems, including safeguarding against

security breaches; and changes in global economic and financial

conditions, and the resulting impact on consumer confidence and

consumer spending, as well as other changes in consumer

discretionary spending habits, which could have a material adverse

effect on our business, results of operations and liquidity.

AMERICAN EAGLE OUTFITTERS,

INC.

CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands)

(unaudited)

August 1,

February 1,

August 3,

2020

2020

2019

ASSETS Cash and cash equivalents $

898,787

$

361,930

$

267,166

Short-term investments

-

55,000

50,000

Merchandise inventory

421,196

446,278

534,762

Accounts receivable

107,243

119,064

98,604

Prepaid expenses and other

155,141

65,658

69,541

Total current assets

1,582,367

1,047,930

1,020,073

Property and equipment, net

659,351

735,120

754,031

Operating lease right-of-use assets

1,271,491

1,418,916

1,462,544

Intangible assets, including goodwill

51,432

53,004

56,326

Non-current deferred income taxes

30,224

22,724

16,759

Other assets

33,111

50,985

49,426

Total Assets $

3,627,976

$

3,328,679

$

3,359,159

LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable

$

295,296

$

285,746

$

316,995

Current portion of operating lease liabilities

348,921

299,161

279,207

Accrued income and other taxes

12,783

9,514

17,754

Accrued compensation and payroll taxes

66,131

43,537

54,683

Dividends payable

22,837

-

-

Unredeemed gift cards and gift certificates

43,165

56,974

34,742

Other current liabilities and accrued expenses

51,281

56,824

60,265

Total current liabilities

840,414

751,756

763,646

Long-term debt, net

516,953

-

-

Non-current operating lease liabilities

1,253,105

1,301,735

1,338,634

Other non-current liabilities

19,604

27,335

28,302

Total non-current liabilities

1,789,662

1,329,070

1,366,936

Commitments and contingencies

-

-

-

Preferred stock

-

-

-

Common stock

2,496

2,496

2,496

Contributed capital

647,284

577,856

568,413

Accumulated other comprehensive income

(47,991

)

(33,168

)

(36,630

)

Retained earnings

1,807,687

2,108,292

2,070,077

Treasury stock

(1,411,576

)

(1,407,623

)

(1,375,779

)

Total stockholders' equity

997,900

1,247,853

1,228,577

Total Liabilities and Stockholders' Equity $

3,627,976

$

3,328,679

$

3,359,159

Current Ratio

1.88

1.39

1.33

AMERICAN EAGLE OUTFITTERS,

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Dollars and shares in thousands,

except per share amounts)

(unaudited)

GAAP Basis

13 Weeks Ended

August 1,

% of

August 3,

% of

2020

Revenue

2019

Revenue

Total net revenue $

883,510

100.0

%

$

1,040,879

100.0

%

Cost of sales, including certain buying, occupancy and warehousing

expenses

618,311

70.0

%

658,308

63.3

%

Gross profit

265,199

30.0

%

382,571

36.7

%

Selling, general and administrative expenses

223,711

25.3

%

253,051

24.3

%

Impairment, restructuring, and COVID-19 related charges

14,611

1.7

%

2,728

0.3

%

Depreciation and amortization expense

39,114

4.4

%

44,870

4.3

%

Operating (loss) income

(12,237

)

-1.4

%

81,922

7.8

%

Other (expense) income, net

(6,993

)

-0.8

%

3,990

0.4

%

(Loss) income before income taxes

(19,230

)

-2.2

%

85,912

8.2

%

(Benefit) provision for income taxes

(5,478

)

-0.6

%

20,931

2.0

%

Net (loss) income $

(13,752

)

-1.6

%

$

64,981

6.2

%

Net (loss) income per basic share $

(0.08

)

$

0.38

Net (loss) income per diluted share $

(0.08

)

$

0.38

Weighted average common shares outstanding - basic

166,315

170,756

Weighted average common shares outstanding - diluted

166,315

171,781

GAAP Basis

26 Weeks Ended

August 1,

% of

August 3,

% of

2020

Revenue

2019

Revenue

Total net revenue $

1,435,202

100.0

%

$

1,927,169

100.0

%

Cost of sales, including certain buying, occupancy and warehousing

expenses

1,141,697

79.5

%

1,219,677

63.3

%

Gross profit

293,505

20.5

%

707,492

36.7

%

Selling, general and administrative expenses

411,908

28.7

%

483,791

25.1

%

Impairment, restructuring, and COVID-19 related charges

170,231

11.9

%

4,272

0.2

%

Depreciation and amortization

81,844

5.7

%

89,661

4.7

%

Operating (loss) income

(370,478

)

-25.8

%

129,768

6.7

%

Other (expense) income, net

(10,122

)

-0.7

%

8,172

0.4

%

(Loss) income before income taxes

(380,600

)

-26.5

%

137,940

7.1

%

(Benefit) provision for income taxes

(109,685

)

-7.6

%

32,206

1.7

%

Net (loss) income $

(270,915

)

-18.9

%

$

105,734

5.4

%

Net (loss) income per basic share $

(1.63

)

$

0.61

Net (loss) income per diluted share $

(1.63

)

$

0.61

Weighted average common shares outstanding - basic

166,461

172,291

Weighted average common shares outstanding - diluted

166,461

173,701

AMERICAN EAGLE OUTFITTERS,

INC.

GAAP TO NON-GAAP

RECONCILIATION

(Dollars in thousands, except per

share amounts)

(unaudited)

13 Weeks Ended

August 1, 2020

Operating (Loss)

Income

Diluted (Loss) per Common

Share

GAAP Basis

$

(12,237

)

$

(0.08

)

% of Revenue

-1.4

%

Add: Incremental COVID-19 related

expenses and restructuring(1):

14,611

0.05

Non-GAAP Basis

$

2,374

$

(0.03

)

% of Revenue

0.3

%

(1) $14.6 million Incremental COVID-19 related expenses and

restructuring charges: - $13.9 million of incremental COVID-19

related expenses consisting of personal protective equipment and

supplies for our associates and customers

- $0.7 million of corporate severance charges

AMERICAN EAGLE OUTFITTERS, INC.

GAAP TO NON-GAAP

RECONCILIATION

(Dollars in thousands, except per

share amounts)

(unaudited)

13 Weeks Ended

August 3, 2019

Operating Income

Diluted Earnings per Common

Share

GAAP Basis

$

81,922

$

0.38

% of Revenue

7.8

%

Add: Restructuring

charges(1):

2,728

0.01

Non-GAAP Basis

$

84,650

$

0.39

% of Revenue

8.1

%

(1) - $2.7 million for pre-tax corporate restructuring charges,

primarily severance

AMERICAN EAGLE OUTFITTERS, INC.

Earnings Before Interest and

Taxes

GAAP TO NON-GAAP

RECONCILIATION

(Dollars in thousands)

(unaudited)

13 Weeks Ended

August 1,

August 3,

2020

2019

Net (Loss) Income

$

(13,752

)

$

64,981

Add: (Benefit) provision for

income taxes

(5,478

)

20,931

Add: Depreciation and

amortization

39,114

44,870

Add: Interest expense (income),

net

8,547

(1,605

)

EBITDA

$

28,431

$

129,177

Add: Incremental COVID-19 related

expenses and restructuring(1) (2)

14,611

2,728

Adjusted EBITDA

$

43,042

$

131,905

(1) $14.6 million Incremental

COVID-19 related expenses and restructuring charges:

- $13.9 million of incremental

COVID-19 related expenses consisting of personal protective

equipment and supplies for our associates and customers

- $0.7 million of corporate

severance charges

(2) - $2.7 million for pre-tax

corporate restructuring charges, primarily severance

AMERICAN EAGLE OUTFITTERS, INC.

STORE INFORMATION

(unaudited)

Second Quarter

YTD Second Quarter

2020

2020

Consolidated stores at beginning of period

1,093

1,095

Consolidated stores opened during the period

AE Brand

1

3

Aerie stand-alone

14

15

Todd Snyder

1

1

Consolidated stores closed during the period

AE Brand

(8)

(12)

Aerie stand-alone

(2)

(3)

Tailgate Clothing Co.

(1)

(1)

Total consolidated stores at end of period

1,098

1,098

AE Brand

931

Aerie stand-alone

160

Aerie side-by-side(2)

175

Tailgate Clothing Co.

4

Todd Snyder

3

Stores remodeled and refurbished during the period

3

4

Total gross square footage at end of period (in '000)

6,828

6,828

International license locations at end of period (1)

220

220

Aerie Openings

Aerie stand-alone

14

15

Total Aerie side-by-side stores (2)

2

3

Total Aerie Openings

16

18

(1) International license locations are not included in the

consolidated store data or the total gross square footage

calculation. (2) Aerie side-by-side stores are included in the AE

Brand store count as they are considered part of the AE Brand store

to which they are attached.

AMERICAN EAGLE OUTFITTERS,

INC.

GAAP TO NON-GAAP

RECONCILIATION

DEMAND SALES & TOTAL

REVENUE BY BRAND

Q2 2020 vs. Q2 2019

(unaudited)

Aerie Brand

AE Brand

Total(4)

%

Change

%

Change

%

Change

Digital: Digital Demand (Ordered sales)(1)

113%

21%

48%

Total Net Revenue(1)

142%

47%

74%

Total(2): Total Demand(3)

25%

-29%

-19%

Total Net Revenue

32%

-26%

-15%

(1) Digital Demand Sales represent sales orders placed

through our e-commerce channels during the period. Total Net

Revenue represents revenue recognized in accordance with the

Company’s revenue recognition policies, which reflect revenue upon

the customer receipt date of the merchandise. (2) Total

includes Direct, Stores, and International (3) Total Demand

represents Digital demand sales plus total store revenue (4)

Total includes Aerie Brand, AE Brand, and Todd Snyder

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200909005576/en/

Olivia Messina 412-432-3300 LineMedia@ae.com

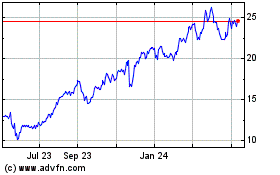

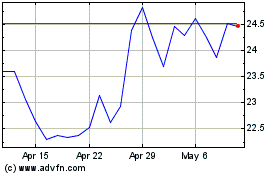

American Eagle Outfitters (NYSE:AEO)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Eagle Outfitters (NYSE:AEO)

Historical Stock Chart

From Apr 2023 to Apr 2024