AIG Unit to Pay $20 Million to Settle SEC Probe of Teacher-Retirement Business--Update

July 28 2020 - 9:30AM

Dow Jones News

By Dave Michaels and Anne Tergesen

A unit of American International Group Inc. agreed to pay $20

million to settle claims that it failed to disclose payments

intended to draw more business to the firm, the first case to

emerge from a crackdown on practices in the market for teachers'

retirement plans.

Florida teachers saving for retirement through 403(b) plans --

similar to corporate 401(k) plans -- weren't told about an

arrangement by which Valic Financial Advisors Inc. paid hundreds of

thousands of dollars to an entity owned by a local affiliate of the

Florida Education Association, which in turn promoted Valic's

services, the Securities and Exchange Commission said Tuesday.

Valic benefited in two ways: Teachers bought its annuity

products and signed up as clients of its investment-advisory

business, paying Valic an annual fee to manage all of their

assets.

The case against Valic, which neither admitted nor denied the

SEC's civil claims, is the first to emerge from an enforcement

crackdown launched in 2019 and focused on sales practices in the

approximately $1 trillion 403(b) market.

"We are pleased to have resolved these matters involving VALIC

Financial Advisors, which is taking all necessary steps to ensure a

robust program of disclosure improvements and governance

enhancements," the company said.

The SEC didn't name the Florida Education Association or its

affiliates in its settlement order, but The Wall Street Journal

reported the SEC's investigation of Valic and the company's

arrangement with the affiliate of the Florida teachers' unions in

2019.

"When I learned that our nation's educators -- who provide such

an important service, often at great personal and financial

sacrifice -- often were not appropriately informed regarding

essential aspects of their investment options, I was disturbed,"

SEC Chairman Jay Clayton said Tuesday. "We launched our Teachers

Initiative with the objective of bringing our resources --

including enforcement, examinations and investor education -- to

benefit these investors, including through rooting out fraud and

misconduct."

The SEC continues to investigate the 403(b) market, people

familiar with the matter said.

The SEC's investigation found Valic paid the salaries of three

employees at the entity linked to the Florida union. At meetings

and seminars where teachers sought investment advice, the three

touted Valic products, presenting themselves as workers for the

union entity and not disclosing they were also paid by Valic, the

SEC said.

The Journal reported in December that the union entity was known

as Creative Benefits for Educators. As recently as October 2019,

teachers' unions in central Florida were advising members to take

retirement questions to Mary L. Thomas, a consultant at the

union-owned firm -- and a longtime Valic sales representative,

according to regulatory records.

After the Journal asked about her dual role, the Creative

Benefits website went dark last fall. At the time, a spokesman for

Creative Benefits said that it no longer employed Ms. Thomas and

two other consultants.

Teachers who bought Valic's Portfolio Director, an annuity

popular in teachers' retirement plans, paid fees of up to 2.3% of

assets annually. Valic earned $29 million from its annuity products

sold during the 13 years it dealt with Creative Benefits. As part

of the settlement with the SEC, Valic agreed to charge lower fees

to teachers who signed up to have their money managed by the

company, under a "wrap-fee" program.

Valic Financial Advisors manages over $21 billion and has more

than 318,000 individual-investor clients, according to its most

recent regulatory disclosure filed with the SEC.

In a separate settlement with the SEC also announced Tuesday,

Valic agreed to pay $19.9 million to resolve claims that it steered

clients into higher-fee mutual funds without clearly telling them

about cheaper alternatives.

The case involves 12b-1 fees, continuing charges levied against

investor assets that typically reward financial advisers who sell

mutual funds. Nearly 100 investment advisory firms last year agreed

to deals with the SEC that required them to refund the fees to

investors. The firms reported their own misconduct to the SEC under

a program that waived penalties because they cooperated with the

investigation.

Valic didn't participate in the self-reporting program, the SEC

said. In Valic's case, clients were placed in funds that charged

continuing fees even though they had deals with Valic that

suggested they were eligible for a cheaper version of the fund, the

SEC said.

Write to Dave Michaels at dave.michaels@wsj.com and Anne

Tergesen at anne.tergesen@wsj.com

(END) Dow Jones Newswires

July 28, 2020 09:15 ET (13:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

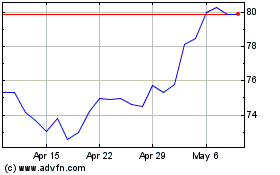

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

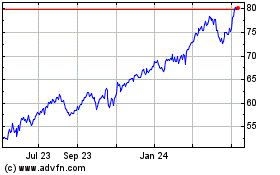

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024