SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2021

Commission File Number 1565025

AMBEV S.A.

(Exact name of registrant as specified in its

charter)

AMBEV S.A.

(Translation of Registrant's name into English)

Rua Dr. Renato Paes de Barros, 1017 - 3rd

Floor

04530-000 São Paulo, SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check mark whether the

registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

AMBEV S.A.

CNPJ [National Register of Legal Entities]

No. 07.526.557/0001-00

NIRE [Corporate Registration Identification

Number] 35.300.368.941

(the “Company”)

Extract of the Minutes of the Meeting

of the Board of Directors of Ambev S.A. held on March 18, 2021 drawn up in summary form

|

|

1.

|

Date, Time and Venue. On March 18, 2021, at 10:00 a.m.,

by videoconference, as authorized by article 19, paragraph 1st, of the Company’s bylaws.

|

|

|

2.

|

Call and Attendance. Call notice duly given pursuant

to the Company’s bylaws. Meeting with attendance of Messrs. Victorio Carlos De Marchi and Carlos Alves de Brito, copresidents,

and Messrs. Milton Seligman, Roberto Moses Thompson Motta, Antonio Carlos Augusto Ribeiro Bonchristiano, Nelson José Jamel

and Marcos de Barros Lisboa.

|

|

|

3.

|

Board. Chairman: Victorio Carlos De Marchi; Secretary:

Letícia Rudge Barbosa Kina.

|

|

|

4.

|

Resolutions: The Directors unanimously and unrestrictedly

resolved:

|

4.1. Resignation

of an effective member of the Board of Directors. The Board of Directors acknowledged receipt of the resignation request presented

by Mr. José Heitor Attilio Gracioso, effective as of March 8, 2021, informing his decision to resign from the Company’s

Board of Directors and, consequently, from the Related Parties and Antitrust Conducts Committee.

The Board of Directors praised

and thanked Mr. José Heitor Attilio Gracioso for his invaluable contribution to the Company's history of success, in more

than 20 years as a board member.

4.2. Election

of an effective member of the Board of Directors. In view of Mr. José Heitor Attilio Gracioso's resignation, to elect

Mr. Fabio Colletti Barbosa, Brazilian, married, business administrator, with business address in the city and State of São

Paulo, at Praça General San Martin, No. 23, zip code 01439-030, bearer of identity card RG No. 5.654.446-7 (SSP/SP)

and enrolled with the Individual Taxpayers’ Registry under No. 771.733.258-20, for the position of effective member of the

Board of Directors and member of the Related Parties and Antitrust Conducts Committee, effective as of the date hereof, with a

term of office until the 2023 Annual Shareholders’ Meeting, according to article 20 of the Company's bylaws.

Minutes of the Meeting of the Board of Directors

of Ambev S.A. held on March 18, 2021

4.3. Resignation

of an effective member of the Board of Directors. The Board of Directors acknowledged receipt of the resignation request presented

by Mr. Vicente Falconi Campos, effective from March 12, 2021, expressing his decision to resign from the Company’s Board

of Directors.

The Board of Directors praised

and thanked Mr. Vicente Falconi Campos for his invaluable contribution to the Company's history of success, in more than 20 years

as a board member.

4.4. Election

of an effective member of the Board of Directors. In view of Mr. Vicente Falconi Campos’s resignation, to elect Mrs.

Claudia Quintella Woods, Brazilian, economist, with business address in the city and State of São Paulo, at Av.

Presidente Juscelino Kubitschek, No. 1909, Torre Sul, 15th floor, zip code 04543-907,

bearer of identity card RG No. 020.462.491-0 (DETRAN/RJ) and enrolled with the Individual

Taxpayers’ Registry under No. 098.823.117-41, for the position of effective

member of the Board of Directors, in the capacity of Independent Member, effective as of the date hereof, with a term of office

until the 2023 Annual Shareholders’ Meeting, according to article 20 of the Company's bylaws.

4.5. Resignation

of an effective member of the Board of Directors. The Board of Directors acknowledged receipt of the resignation request presented

by Mrs. Cecília Sicupira, effective as of March 15, 2021, expressing her decision to resign from the Company’s Board

of Directors.

The Board of Directors praised

and thanked Mrs. Cecília Sicupira for her important contribution to the Board of Directors in the last years.

4.6. Election

of an effective member of the Board of Directors. In view of Mrs. Cecília Sicupira’s resignation, to elect Mrs.

Lia Machado de Matos, Brazilian, in a stable union, physicist, with business address in the city and State of São

Paulo, at Rua Fidêncio Ramos, No. 308, 10th floor, Vila Olimpia, zip code 04551-010, bearer of identity

card RG No. 66707627-X (SSP/SP) and enrolled with the Individual Taxpayers’ Registry under No. 071.991.147-88, for the position

of effective member of the Board of Directors, effective as of the date hereof, with a term of office until the 2023 Annual Shareholders’

Meeting, according to article 20 of the Company's bylaws.

|

Minutes of the Meeting of the Board of Directors of Ambev S.A. held on March 18, 2021

|

4.7. Resignation

of an effective member of the Board of Directors. The Board of Directors acknowledged receipt of the resignation request presented

by Mr. Luis Felipe Pedreira Dutra Leite, effective as of March 15, 2021, expressing his decision to resign from the Company’s

Board of Directors and the Operations, Finance and Compensation Committee.

The Board of Directors praised

and thanked Mr. Luis Felipe Pedreira Dutra Leite for his fundamental participation in the Company's history of success.

4.8. Election

of an effective member of the Board of Directors. In view of Mr. Luis Felipe Pedreira Dutra Leite’s resignation, to elect

Mr. Fernando Mommensohn Tennenbaum, Brazilian, married, production engineer, with business address in the city and State

of New York, at 250 Park Avenue, zip code 10177, United States of America, bearer of identity card RG No. 18.433.610-7 (SSP/SP)

and enrolled with the Individual Taxpayers’ Registry under No. 245.809.418-02, for the position of effective member of the

Board of Directors, effective as of the date hereof, with a term of office until the 2023 Annual Shareholders’ Meeting, according

to article 20 of the Company's bylaws.

The newly elected members of

the Board of Directors will start serving at their relevant positions upon the execution of the instruments of investiture to be

registered in the appropriate corporate book, at which time they will execute statements confirming that there is no impediment

to their election as required by Brazilian law.

4.9. Share

buyback program. To approve, pursuant to article 30, Paragraph 1st, “b”, of Law 6,404/76 and CVM Instruction

567/15, a share buyback program for the repurchase of shares issued by the Company up to the limit of 5,700,000 common shares,

with the primary purpose of covering any share delivery requirements contemplated in the Company's share-based compensation plans

or to be held in treasury, canceled and/or subsequently transferred, which will be in effect until September 18, 2022, as detailed

in the Notice Regarding the Negotiation of Shares Issued by the Company, in the form of Exhibit 30-XXXVI of CVM Instruction No.

480/09 attached to these minutes, which is hereby approved by the Board for public disclosure. The Company has 4,357,308,131 outstanding

shares as defined in CVM Instruction 567/15. The acquisition will occur as per a deduction of the capital reserve account recorded

in the balance sheet dated as of December 31, 2020. The transaction will be carried out through one or more of the following financial

institutions: UBS Brasil Corretora de Câmbio, Títulos e Valores Mobiliários S.A. (CNPJ No. 02.819.125/0001-73)

and Itaú Corretora de Valores S.A. (CNPJ No. 61.194.353/0001-64).

|

Minutes of the Meeting of the Board of Directors of Ambev S.A. held on March 18, 2021

|

The

Board of Directors authorizes the Company's Executive Board of Officers to take any and all actions that may be required to implement

the aforementioned resolutions (including those required pursuant to the Manual on Disclosure and Use of Information and Securities

Trading Policy for Securities Issued by Company, particularly with respect to the trading of shares by related parties during the

period in which the repurchase program is in effect), as well as determine the timing and number of shares issued by the Company

to be acquired within the limits authorized above.

|

|

6.

|

Close. With no further matters to be discussed, the

present Minutes were drawn up and duly executed.

|

São Paulo, March 18, 2021

|

/s/ Victorio Carlos De Marchi

|

/s/ Carlos Alves de Brito

|

|

/s/ Roberto Moses Thompson Motta

/s/ Antonio Carlos Augusto Ribeiro Bonchristiano

/s/ Nelson José Jamel

|

/s/ Marcos de Barros Lisboa

/s/ Milton Seligman

/s/ Letícia Rudge Barbosa Kina

Secretary

|

|

|

|

|

|

|

|

|

|

|

|

Minutes of the Meeting of the Board of Directors of Ambev S.A. held on March 18, 2021

|

AMBEV S.A.

CNPJ [National Register of Legal Entities]

No. 07.526.557/0001-00

NIRE [Corporate Registration Identification

Number] 35.300.368.941

(the “Company”)

NOTICE REGARDING THE NEGOTIATION

OF SHARES ISSUED BY AMBEV S.A.

Ambev S.A. (“Company"),

pursuant to the terms of CVM Instruction No. 480/09, disclose the following information set forth in Exhibit 30-XXXVI regarding

the negotiation of shares issued by the Company.

1. Justify in detail the objective

and the expected economic effects of the operation.

The purpose of the operation is the acquisition

of shares in order to maximize the generation of value for shareholders, through the efficient management of its capital structure.

The shares may be used to meet the requirements under the Company's share-based compensation plans and may also be held in treasury,

canceled and/or subsequently transferred in public or private transactions (subject to the relevant approvals).

2. Inform the number of (i) outstanding

shares and (ii) shares held in treasury.

The Company currently has 4,357,308,131

outstanding shares and 210,166 shares held in treasury.

3. Inform the number of shares that

may be acquired or sold.

The Company may acquire up to 5,700,000

common shares.

4. Describe the main characteristics

of the derivative instruments that the company may use, if any.

Not applicable, considering that the Company

will not use derivative instruments in this transaction.

5. Describe, if applicable, any voting

agreements or guidelines existing between the company and the counterparty of the operations.

Not applicable, considering that the Company

will carry out operations on the Brazilian stock exchange with no knowledge of the identity of counterparties.

|

Minutes of the Meeting of the Board of Directors of Ambev S.A. held on March 18, 2021

|

6. In case the transactions are to

be carried out outside organized securities markets, inform: a. the maximum (minimum) price for which the shares will be acquired

(sold); and b. if applicable, the reasons that justify carrying out the transaction at prices more than 10% (ten percent) higher,

in the case of acquisition, or more than 10% (ten percent) lower, in the case of sale, than the average of the price, weighted

by the volume, in the 10 (ten) previous trading sessions.

Not applicable, considering that the operations

will be carried out on the Brazilian stock exchange.

7. Inform, if any, the impacts that

the negotiation will have on the composition of the shareholding control or the management structure of the company.

Not applicable, as the Company has a defined

controlling shareholder and therefore does not anticipate any impacts that the negotiation will have on the composition of our

shareholder structure or the management structure of the company.

8. Identify the counterparties, if

known, and, in the case of a related party to the company, as defined by the accounting rules that deal with this matter, also

provide the information required by art. 8 of CVM Instruction No. 481, of December 17, 2009.

Not applicable, considering that the Company

will carry out operations on the Brazilian stock exchange with no knowledge of the identity of counterparties.

9. Indicate the destination of the

funds received, if applicable.

Not applicable, considering that the Company

will not receive funds; the acquired shares will be held in treasury and may be used to meet the provisions of the Company's share-based

compensation plans, for subsequent sale in public or private transactions (subject to the relevant approvals) or even canceled.

10. Indicate the maximum period for

the settlement of authorized transactions.

Purchases may be made within up to 18

months counted as of the date of their approval, therefore, until September 18, 2022.

|

Minutes of the Meeting of the Board of Directors of Ambev S.A. held on March 18, 2021

|

11. Identify institutions that will

act as intermediaries, if any.

The following financial institutions will

act as intermediaries: UBS Brasil Corretora de Câmbio, Títulos e Valores Mobiliários S.A. (CNPJ No. 02.819.125/0001-73)

and Itaú Corretora de Valores S.A. (CNPJ No. 61.194.353/0001-64).

12. Specify the available resources

to be used, in the form of art. 7, § 1, of CVM Instruction 567, of September 17, 2015.

The acquisition will occur as per a deduction

of the capital reserve account recorded in the balance sheet dated as of December 31, 2020.

13. Specify the reasons why the members

of the board of directors feel comfortable that the repurchase of shares will not affect the compliance of obligations with creditors

or the payment of fixed or minimum mandatory dividends.

The total amount to be paid by the Company

if it repurchases a total of 5,700,000 shares would be approximately R$ 85,000,000.00, based on the weighted average of the

quotations for the last 30 days. This amount represents approximately 0.5% of the Company's cash, as determined in the most recent

financial statements disclosed to the market.

In view of the low percentage of the Company’s

cash that would be used for the repurchase, as well as the general assessment of the management in relation to the Company's financial

position, the members of the board of directors are comfortable that the repurchase of shares will not affect the compliance of

obligations with creditors nor the payment of mandatory dividends.

***

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: March 18, 2021

|

|

|

|

|

|

AMBEV S.A.

|

|

|

|

|

|

|

By:

|

/s/ Lucas Machado Lira

|

|

|

Lucas Machado Lira

Chief Financial and Investor Relations Officer

|

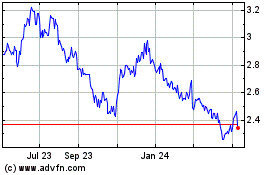

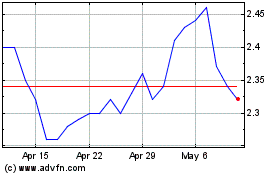

Ambev (NYSE:ABEV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ambev (NYSE:ABEV)

Historical Stock Chart

From Apr 2023 to Apr 2024