NEW YORK, July 23 /PRNewswire-FirstCall/ -- AllianceBernstein

Holding L.P. ("AllianceBernstein Holding") (NYSE:AB) and

AllianceBernstein L.P. ("AllianceBernstein") today reported

financial and operating results for the quarter ended June 30,

2008. AllianceBernstein Holding (The Publicly Traded Partnership):

-- Diluted net income per Unit for the quarter ended June 30, 2008

was $0.96, a decrease of 17% from $1.16 for the same period in

2007. -- Distribution per Unit for the second quarter of 2008 will

be $0.96, a decrease of 17% from $1.16 for the same period in 2007.

The distribution is payable on August 14, 2008 to holders of record

of AllianceBernstein Holding Units at the close of business on

August 4, 2008. AllianceBernstein (The Operating Partnership): --

Assets Under Management (AUM) at June 30, 2008 were $717 billion, a

10% decrease from a year ago, due to market depreciation partially

offset by net inflows. -- Net outflows for the three months ended

June 30, 2008 were $4.6 billion, consisting of Retail net outflows

of $2.5 billion, Institutional Investments net outflows of $1.4

billion and Private Client net outflows of $0.7 billion. -- Net

inflows for the twelve months ended June 30, 2008 were $3.1

billion, consisting of Institutional Investments net inflows of

$8.2 billion, Private Client net inflows of $3.2 billion and Retail

net outflows of $8.3 billion. "Following a strong start to the

second quarter, capital market conditions deteriorated sharply

starting in mid-May. As a result, investment returns for clients

fell into negative territory for the quarter in the majority of our

equity and fixed income services. Absolute returns were weakest in

our value equities product suite, as this style of investing was

most exposed to market dislocations, while growth services produced

positive absolute results for the quarter. This dynamic highlights

the benefits of our style balanced product array to both clients

and the firm. Alternative investment returns were mixed, with some

services, most notably our stand-alone currency services, positive

and others negative by relatively small amounts. Importantly, many

of our private clients benefited from effective asset allocation

advice which reduced overall portfolio volatility during these

uncertain times" said Lewis Sanders, Chairman and Chief Executive

Officer. "The firm's organic growth was slightly negative for the

second consecutive quarter, primarily due to outflows in the retail

channel, with modest net outflows in our institutional and private

client channels as well. The backlog of new but not yet funded

institutional mandates also fell slightly, ending the quarter at

$15 billion. "Our institutional research services unit remained a

bright spot in an otherwise difficult environment. Although down

somewhat from a very robust first quarter of 2008, revenues grew 7%

compared to last year's second quarter. Excellent showings in

recent independent client surveys measuring research quality and

trading acumen suggest that this business remains well positioned

for the future. "Overall financial results in the second quarter

made clear once again the firm's inherent sensitivity to capital

market conditions. Falling assets under management, primarily a

function of declining global stock markets, produced an 8%

reduction in net revenue versus last year's comparable quarter.

More than one-half of this decline was attributable to a $54

million negative variance on net gains and losses from investments

related to employee deferred compensation. Aggressive expense

management moderated the impact of the revenue decline on earnings;

however, our year-over-year operating margin fell by 210 basis

points to 28.9%. Net income was also impacted by a rise in income

taxes, as the mix of earnings continued to shift to non-US

domiciles having higher tax rates. Overall, net income fell by 16%

compared to last year's second quarter. "As we've noted in past

communications, turbulent market conditions, while unsettling,

establish the basis for strong relative and absolute investment

performance in future periods. Exploiting these opportunities to

generate superior investment returns for clients and providing them

with world class service remains our singular goal. Achieving this

goal will benefit all of AllianceBernstein's stakeholders,"

concluded Mr. Sanders. CONFERENCE CALL INFORMATION RELATING TO

SECOND QUARTER 2008 RESULTS July 23, 2008 at 5:00 P.M. (Eastern

Daylight Time) AllianceBernstein's management will review second

quarter 2008 financial and operating results on Wednesday, July 23,

2008, during a conference call beginning at 5:00 p.m. (EDT),

following the release of its financial results after the close of

the New York Stock Exchange. The conference call will be hosted by

Lewis A. Sanders, Chairman and Chief Executive Officer, and Gerald

M. Lieberman, President and Chief Operating Officer. Parties may

access the conference call by either webcast or telephone: 1. To

listen by webcast, please visit AllianceBernstein's Investor

Relations website at

http://ir.alliancebernstein.com/investorrelations at least 15

minutes prior to the call to download and install any necessary

audio software. 2. To listen by telephone, please dial (866)

556-2265 in the U.S. or (404) 665-9935 outside the U.S., 10 minutes

before the 5:00 p.m. (EDT) scheduled start time. The conference ID#

is 55239099. The presentation that will be reviewed during the

conference call will be available on AllianceBernstein's Investor

Relations website shortly after the release of second quarter 2008

financial results. An audio replay of the conference call will be

made available beginning at approximately 7:00 p.m. (EDT) on July

23, 2008 and will be available for one week. To access the audio

replay, please call (800) 642-1687 from the U.S., or outside the

U.S. call (706) 645-9291, and provide conference ID# 55239099. The

replay will also be available via webcast on AllianceBernstein's

website for one week. About AllianceBernstein AllianceBernstein is

a leading global investment management firm that offers

high-quality research and diversified investment services to

institutional clients, individuals and private clients in major

markets around the world. AllianceBernstein employs more than 500

investment professionals with expertise in growth equities, value

equities, fixed income securities, blend strategies and alternative

investments and, through its subsidiaries and joint ventures,

operates in more than 20 countries. AllianceBernstein's research

disciplines include fundamental research, quantitative research,

economic research and currency forecasting capabilities. Through

its integrated global platform, AllianceBernstein is

well-positioned to tailor investment solutions for its clients.

AllianceBernstein also offers independent research, portfolio

strategy and brokerage-related services to institutional investors.

At June 30, 2008, AllianceBernstein Holding L.P. ("Holding") owned

approximately 33.6% of the issued and outstanding AllianceBernstein

Units. AXA Financial was the beneficial owner of approximately

62.7% of the AllianceBernstein Units at June 30, 2008 (including

those held indirectly through its ownership of approximately 1.6%

of the issued and outstanding Holding Units) which, including the

general partnership interests in AllianceBernstein and Holding,

represent an approximate 63.0% economic interest in

AllianceBernstein. AXA Financial is a wholly-owned subsidiary of

AXA, one of the largest global financial services organizations.

Cautions regarding Forward-Looking Statements Certain statements

provided by management in this news release are "forward-looking

statements" within the meaning of the Private Securities Litigation

Reform Act of 1995. Such forward-looking statements are subject to

risks, uncertainties, and other factors that could cause actual

results to differ materially from future results expressed or

implied by such forward- looking statements. The most significant

of these factors include, but are not limited to, the following:

the performance of financial markets, the investment performance of

sponsored investment products and separately managed accounts,

general economic conditions, future acquisitions, competitive

conditions, and government regulations, including changes in tax

regulations and rates and the manner in which the earnings of

publicly traded partnerships are taxed. We caution readers to

carefully consider such factors. Further, such forward-looking

statements speak only as of the date on which such statements are

made; we undertake no obligation to update any forward-looking

statements to reflect events or circumstances after the date of

such statements. For further information regarding these

forward-looking statements and the factors that could cause actual

results to differ, see "Risk Factors" in Part I, Item 1A of our

2007 Form 10-K and Part II, Item 1A of our 1Q08 Form 10-Q. Any or

all of the forward-looking statements that we make in this news

release, Form 10-K, Form 10-Q, other documents we file with or

furnish to the SEC, or any other public statements we issue, may

turn out to be wrong. It is important to remember that other

factors besides those listed in "Risk Factors" and those listed

above and below could also adversely affect our revenues, financial

condition, results of operations, and business prospects. The

forward-looking statements referred to in the preceding paragraph

include statements regarding: -- Our backlog of new institutional

mandates not yet funded: Before they are funded, institutional

mandates do not represent legally binding commitments to fund and,

accordingly, the possibility exists that not all mandates will be

funded in the amounts and at the times we currently anticipate. --

Turbulent market conditions establishing the basis for strong

relative and absolute investment performance in future periods: The

actual performance of the capital markets and other factors beyond

our control will affect our investment success for clients and

asset flows. ALLIANCEBERNSTEIN L.P. (THE OPERATING PARTNERSHIP)

SUMMARY CONSOLIDATED STATEMENTS OF INCOME JUNE 30, 2008 (unaudited,

$ thousands) Three Months Ended ------------------------------

6/30/08 6/30/07 ------------ ------------ Revenues: Investment

Advisory & Services Fees $794,638 $845,192 Distribution

Revenues 107,935 118,939 Institutional Research Services 110,454

102,847 Dividend and Interest Income 21,322 70,068 Investment Gains

(Losses) 9,056 46,140 Other Revenues 30,687 30,550 ------------

------------ Total Revenues 1,074,092 1,213,736 Less: Interest

Expense 10,468 54,963 ------------ ------------ Net Revenues

1,063,624 1,158,773 ------------ ------------ Expenses: Employee

Compensation & Benefits 428,198 475,887 Promotion &

Servicing: Distribution Plan Payments 78,667 84,814 Amortization of

Deferred Sales Commissions 20,518 24,799 Other 57,417 62,891

General & Administrative 138,050 136,368 Interest on Borrowings

3,251 7,037 Amortization of Intangible Assets 5,179 5,179

------------ ------------ 731,280 796,975 ------------ ------------

Operating Income 332,344 361,798 Non-Operating Income 3,591 4,014

------------ ------------ Income before Income Taxes and

Non-Controlling Interest in Earnings 335,935 365,812 Income Taxes

30,991 28,794 Non-Controlling Interest in Earnings 24,655 2,089

------------ ------------ NET INCOME $280,289 $334,929 ============

============ Operating Margin(1) 28.9% 31.0% (1) Operating Margin =

(Operating Income - Non-Controlling Interest in Earnings)/Net

Revenues. ALLIANCEBERNSTEIN L.P. (THE PUBLICLY TRADED PARTNERSHIP)

SUMMARY STATEMENTS OF INCOME (unaudited, $ thousands except per

unit amounts) Three Months Ended ------------------------------

6/30/08 6/30/07 ------------ ------------ Equity in Earnings of

Operating Partnership $93,042 $110,267 Income Taxes 9,131 9,620

------------ ------------ NET INCOME 83,911 100,647 Additional

Equity in Earnings of Operating Partnership(1) 139 1,392

------------ ------------ NET INCOME - Diluted(2) $84,050 $102,039

============ ============ DILUTED NET INCOME PER UNIT $0.96 $1.16

============ ============ DISTRIBUTION PER UNIT $0.96 $1.16

============ ============ (1) To reflect higher ownership in the

Operating Partnership resulting from application of the treasury

stock method to outstanding options. (2) For calculation of Diluted

Net Income per Unit. ALLIANCEBERNSTEIN L.P. AND ALLIANCEBERNSTEIN

HOLDING L.P. UNITS OUTSTANDING AND WEIGHTED AVERAGE UNITS

OUTSTANDING JUNE 30, 2008 Weighted Average Units Three Months Ended

---------------------------- Period End Units Basic Diluted

------------- ------------- ------------- AllianceBernstein L.P.

260,971,273 260,874,044 261,080,356 AllianceBernstein Holding

87,577,430 87,480,201 87,686,513 ALLIANCEBERNSTEIN L.P. ASSETS

UNDER MANAGEMENT THREE MONTHS ENDED JUNE 30, 2008 ($ billions)

Institutional Private Investments Retail Client Total -------------

--------- ------- --------- Beginning of Period $471.3 $162.7

$101.3 $735.3 Sales/New accounts 15.7 7.0 3.2 25.9

Redemptions/Terminations (9.4) (8.0) (1.6) (19.0) Cash flow (7.7)

(1.2) (2.2) (11.1) Unreinvested dividends - (0.3) (0.1) (0.4)

------------- --------- ------- --------- Net outflows (1.4) (2.5)

(0.7) (4.6) Transfers(1) (0.2) 0.2 - - Market depreciation (8.7)

(3.7) (1.7) (14.1) ------------- --------- ------- --------- End of

Period $461.0 $156.7 $98.9 $716.6 ============= ========= =======

========= (1) Transfers of certain client accounts were made among

distribution channels resulting from changes in how these accounts

are serviced by the firm. ALLIANCEBERNSTEIN L.P. ASSETS UNDER

MANAGEMENT TWELVE MONTHS ENDED JUNE 30, 2008 ($ billions)

Institutional Private Investments Retail Client Total -------------

--------- ------- --------- Beginning of Period(1) $500.8 $185.4

$106.9 $793.1 Sales/New accounts 64.5 34.5 14.6 113.6

Redemptions/Terminations (32.9) (36.7) (5.8) (75.4) Cash flow

(23.4) (4.8) (5.1) (33.3) Unreinvested dividends - (1.3) (0.5)

(1.8) ------------- --------- ------- --------- Net

inflows/(outflows) 8.2 (8.3) 3.2 3.1 Transfers(2) 0.3 (0.2) (0.1) -

Market depreciation (48.3) (20.2) (11.1) (79.6) -------------

--------- ------- --------- End of Period $461.0 $156.7 $98.9

$716.6 ============= ========= ======= ========= (1) Prior period

AUM has been adjusted to reflect client assets associated with

existing services previously not included. (2) Transfers of certain

client accounts were made among distribution channels resulting

from changes in how these accounts are serviced by the firm.

ALLIANCEBERNSTEIN L.P. ASSETS UNDER MANAGEMENT BY INVESTMENT

SERVICE AT JUNE 30, 2008 ($ billions) Institutional Private

Investments Retail Client Total ------------- --------- -------

--------- Equity: Value U.S. $39.5 $26.7 $20.6 $86.8 Global &

International 169.2 47.8 22.3 239.3 ------------- --------- -------

--------- 208.7 74.5 42.9 326.1 ------------- --------- -------

--------- Growth U.S. 26.1 19.4 14.0 59.5 Global &

International 78.4 20.0 10.9 109.3 ------------- --------- -------

--------- 104.5 39.4 24.9 168.8 ------------- --------- -------

--------- Total Equity 313.2 113.9 67.8 494.9 -------------

--------- ------- --------- Fixed Income: U.S. 71.1 9.6 30.3 111.0

Global & International 58.4 29.3 0.8 88.5 -------------

--------- ------- --------- 129.5 38.9 31.1 199.5 -------------

--------- ------- --------- Other(1) U.S. 9.9 3.9 - 13.8 Global

& International 8.4 - - 8.4 ------------- --------- -------

--------- 18.3 3.9 - 22.2 ------------- --------- ------- ---------

Total: U.S. 146.6 59.6 64.9 271.1 Global & International 314.4

97.1 34.0 445.5 ------------- --------- ------- --------- $461.0

$156.7 $98.9 $716.6 ============= ========= ======= ========= (1)

Includes Index, Structured and Asset Allocation services.

ALLIANCEBERNSTEIN L.P. ASSETS UNDER MANAGEMENT ($ billions) Three

Month Period Twelve Month Period ---------------------

--------------------- 06/30/08 6/30/07(1) 06/30/08 6/30/07(1)

---------- ---------- ---------- ---------- Ending Assets Under

Management $716.6 $793.1 $716.6 $793.1 Average Assets Under

Management $747.8 $774.8 $777.7 $708.6 (1) Prior period AUM has

been adjusted to reflect client assets associated with existing

services previously not included. ALLIANCEBERNSTEIN L.P. ASSETS

UNDER MANAGEMENT BY CLIENT DOMICILE AT JUNE 30, 2008 ($ billions)

Institutional Private Investments Retail Client Total -------------

--------- ------- --------- U. S. Clients $212.3 $120.0 $95.5

$427.8 Non-U.S. Clients 248.7 36.7 3.4 288.8 -------------

--------- ------- --------- $461.0 $156.7 $98.9 $716.6

============= ========= ======= ========= DATASOURCE:

AllianceBernstein L.P. CONTACT: Philip Talamo, Investor Relations,

+1-212-969-2383, , or John Meyers, Media, +1-212-969-2301, Web

site: http://ir.alliancebernstein.com/investorrelations

Copyright

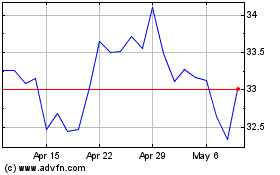

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From Aug 2024 to Sep 2024

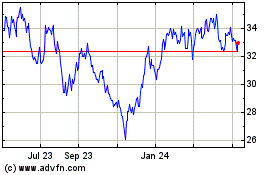

AllianceBernstein (NYSE:AB)

Historical Stock Chart

From Sep 2023 to Sep 2024