Increased sales offset by unexpected

operational headwinds; on track to deliver improved results for

remainder of 2019

First Quarter 2019 Highlights

- Sales were $1.0 billion, 3% higher

than Q1 2018

- High Performance Materials &

Components (HPMC) sales of $601 million, increased 7% versus Q1

2018

- Flat Rolled Products (FRP) sales of

$404 million, down 4% versus Q1 2018

- Business segment operating profit

was $61.7 million, or 6.1% of sales

- HPMC segment operating profit was

$72.6 million, or 12.1% of sales

- FRP segment operating loss was $10.9

million, or (2.7)% of sales

- Both segments impacted by unexpected

short-term operational headwinds

- Net income attributable to ATI was

$15.0 million, or $0.12 per share

Allegheny Technologies Incorporated (NYSE: ATI) reported first

quarter 2019 results, with sales of $1.0 billion and net income

attributable to ATI of $15.0 million, or $0.12 per share. This

compares to ATI’s first quarter 2018 sales of $979 million and net

income attributable to ATI of $58.0 million, or $0.42 per share,

and first quarter 2018 adjusted results of $43.3 million, or $0.32

per share, excluding a $15.9 million pre-tax, or $0.10 per share,

gain on the sale of a 50% interest and subsequent deconsolidation

of the A & T Stainless joint venture (JV).

“While our first quarter sales increased to $1 billion, our

financial results were below our expectations as we faced

unexpected operational headwinds in both of our business segments,”

said Robert S. Wetherbee, ATI President and Chief Executive

Officer. “We are working proactively to address challenges we faced

in the form of short-term powder billet shortages and higher

operating costs by ramping up our own production to offset future

uncertainty. The company holds strong positions in high-value,

growing markets, and the overall fundamentals of our businesses are

solid. We are on track to deliver improved results in the second

quarter and throughout the balance of 2019, and progress toward our

longer-term objectives remains on pace.”

HPMC sales increased 7.2% in the first quarter 2019 compared to

prior year primarily due to higher aerospace & defense market

sales, led by growth in airframes and government and defense.

Next-generation jet engine products sales increased by 8.9% and

represented 52% of total first quarter 2019 HPMC jet engine product

sales. Despite the increase in these sales, HPMC operating profit

declined versus prior year to $72.6 million, or 12.1% of sales, due

to the greater than anticipated operational and cost headwinds.

“HPMC segment results were negatively impacted by the ongoing

disruption in third party nickel powder billet supply, as well as

the related operating costs to qualify materials and quickly ramp

nickel powder production to help alleviate the shortage of incoming

third-party powder billet. Segment results were also adversely

impacted by the temporary margin compression caused by a recent

steep and rapid drop in cobalt prices,” said Mr. Wetherbee.

FRP sales were down 4% in the first quarter 2019 compared to

prior year, largely due to weaker demand for commodity stainless

products, resulting in an operating loss of $10.9 million for the

first quarter of 2019. “Our STAL JV extended its production

downtime for the Lunar New Year holiday period as a result of lower

domestic demand in China, which is in part related to the current

trade tensions between the U.S. and China. This lower demand,

coupled with increased operating costs for the newly expanded STAL

JV production facilities, resulted in lower than expected first

quarter profitability,” said Mr. Wetherbee. Additionally, due to

customer inventory destocking actions, the U.S. Flat Rolled

business faced weaker than expected demand for commodity stainless

products which resulted in operational inefficiencies in downstream

finishing operations. FRP segment results in the first quarter 2019

also include a $3 million loss for ATI’s share of the A&T

Stainless JV as a direct result of the ongoing Section 232 import

tariffs. The Company continues to work toward securing an exclusion

on behalf of the JV.

As of March 31, 2019, cash on hand was $217 million and

available additional liquidity under the asset-based lending (ABL)

credit facility was approximately $360 million, with no borrowings

under the revolving credit portion of the ABL. Cash used in

operations for the first quarter of 2019 was $130.0 million,

largely due to higher managed working capital from increased

business activity, a $25 million contribution to the U.S. defined

benefit pension plan and payment of 2018 annual incentive

compensation. Capital expenditures for the first quarter 2019 were

$24 million.

Strategy and Outlook

“We continue to work proactively with our customers to jointly

address current supply constraints related to the ongoing aerospace

production ramp, and as previously announced, we expect to maintain

our current production and delivery schedules related to the 737

MAX aircraft,” said Mr. Wetherbee. “We have full confidence in

Boeing’s ability to address current narrow-body model issues.”

In the HPMC segment, the Company is aligned and focused on

overcoming first quarter headwinds and anticipates sequential

improvement in segment financial results. However, operating

margins will likely be below initial expectations for the second

quarter while the Company works aggressively to offset operational

challenges and prepare the Bakers Powder facility for additional

profitable growth. Segment operating margins in the second half of

2019 are expected to be much improved over the first half of the

year. The Company believes that the supply chain issues are

temporary and the benefits from increased share of high value

commercial jet engine materials and components will provide a

financial tailwind. “We are dedicated to strong operational

execution and to meeting our aerospace production ramp

requirements,” said Mr. Wetherbee.

In the FRP segment, the Company expects higher sequential

revenue and a solid return to profitability in the second quarter

of 2019 due to improved customer demand for high-value products,

both in the U.S. and for the STAL JV, and favorable raw material

surcharge values. Continued improvements in the second half of 2019

are expected due to further increases in high-value nickel and

titanium product sales. “Our focus for the FRP segment remains on

improving product mix and increasing volumes related to our HRPF

conversion agreements while ensuring a strong cost discipline as

the business changes over time.

“Cash generation from operations remains a key focus, and we

intend to carefully balance our working capital and other cash

needs with the pace of our capital expenditure requirements and

financing obligations. We expect to generate significant positive

free cash flow over the balance of 2019, excluding pension plan

contributions,” Wetherbee concluded.

First Quarter 2019 Financial Results

- Sales for the first quarter 2019

were $1.0 billion, a 3% increase compared to the first quarter

2018. HPMC sales reflect stronger demand for titanium products and

nickel-based and specialty alloy products, partially offset by

declines in forged components. FRP sales declined 4% principally in

oil and gas and commodity stainless sheet products. Aerospace &

defense market sales in the FRP segment were up 70% year-over-year.

This was supported by significantly higher production of titanium

armor plate for the Abrams tank in the U.S. and Stryker vehicle in

the U.K.; additional titanium volumes for jet airframes; and

increased nickel and cobalt bearing alloy sheet products for jet

engines.

- Gross profit in the first

quarter 2019 was $131.1 million, or 13.0% of sales, compared to

$148.6 million, or 15.2% of sales, in the first quarter of

2018.

- Net income attributable to ATI

for the first quarter 2019 was $15.0 million, or $0.12 per share,

compared to net income attributable to ATI of $58.0 million, or

$0.42 per share for the first quarter 2018, and adjusted net income

for the first quarter 2018 of $43.3 million, or $0.32 per share,

excluding the A&T Stainless gain. First quarter 2019 results

reflect a $9 million increase in retirement benefit expense.

Results in all periods include impacts from income taxes, which

differ from applicable standard tax rates, primarily related to the

impact of income tax valuation allowances.

- Cash on hand at March 31, 2019

was $217.0 million. In the first quarter 2019, cash used in

operating activities was $130.0 million, including $121.0 million

invested in managed working capital for increased business activity

and a $25.1 million contribution to the U.S. defined benefit

pension plan. Capital expenditures in the first quarter 2019 were

$23.5 million, in line with expectations. Cash used in financing

activities was $11.4 million, primarily related to income tax

withholding on share-based compensation.

High Performance Materials & Components Segment

Market Conditions

- Aerospace and defense sales in the

first quarter 2019 were $465.1 million, 1% higher than the fourth

quarter 2018, and represented 77% of total segment sales. Compared

to the fourth quarter 2018, commercial airframe sales were up 16%

and government aero/defense sales were 21% higher, while commercial

jet engine sales were 9% lower. Total HPMC first quarter 2019 sales

increased 1% over the fourth quarter 2018, with sales to the

medical market up 16%, offset by a 30% decline in the oil & gas

market. Direct international sales represented 44% of total segment

sales for the first quarter 2019.

- The Company extended its Long-Term

Purchase Agreement (LTPA) with Rolls-Royce to supply rotating disc

quality specialty materials for the Trent engine family; the LTPA

reliably secures Rolls-Royce’s supply of critical materials for

their innovative engine portfolio through 2029.

First quarter 2019 compared to first quarter 2018

- Sales were $601.2 million, a $40.5

million, or 7%, increase compared to the first quarter 2018,

primarily due to higher sales of titanium products and nickel-based

and specialty alloy products, both up over 15%. Sales to the

aerospace and defense markets were 9% higher than the prior year,

including a 25% increase in airframe sales and a 30% increase in

aero/engine defense sales. Commercial jet engine sales declined 2%

compared to prior year, despite a 9% increase in next-generation

jet engine products.

- Segment operating profit declined to

$72.6 million, or 12.1% of sales, compared to $85.5 million, or

15.2% of sales for the first quarter 2018. This decline reflects

various operational headwinds, including third party nickel-powder

billet supply constraints, higher operating costs in preparation

for increased nickel-powder production and negative impacts from

the recent rapid drop in raw material prices, largely driven by

cobalt. These headwinds more than offset any operating profit

improvement from higher productivity related to increasing

aerospace and defense sales, and an improved product mix of

next-generation jet engine products.

Flat Rolled Products Segment

Market Conditions

- In the first quarter 2019, sales to the

oil & gas market declined 12% compared to the fourth quarter

2018. Recovery is anticipated in this market for the remainder of

the year; as previously announced, ATI has been selected to supply

the nickel-based flat rolled products for a large oil pipeline

project in South America. Expected revenue value is $45 million in

2019, with shipments beginning in the second quarter.

- In addition, sales to the electronics

market declined 25% sequentially along with a 16% sequential

decline in food equipment & appliances. Sales decreased 5% for

high-value products and 2% for standard products, compared to the

fourth quarter 2018. Direct international sales were 29% of first

quarter 2019 segment sales.

First quarter 2019 compared to first quarter 2018

- Sales were $403.6 million, a $14.7

million, or 4%, decrease compared to the prior year period, due to

8% lower sales of standard products, primarily commodity stainless

steel sheet. Shipment volume for high-value products was 2% lower,

compared to the first quarter 2018.

- Segment operating loss was $10.9

million, or (2.7%) of sales, compared to profit of $10.9 million,

or 2.6% of sales for the first quarter 2018. Results in 2019

reflect negative impacts from our STAL JV, due to demand softness

and higher operating costs related to the recent production

expansion, and commodity stainless products in the U.S. business,

resulting from cost inefficiencies in our finishing operations as a

result of customer inventory destocking actions. In addition, FRP

segment results for the first quarter 2019 reflect higher

retirement benefit expense and a $3 million loss for ATI’s share of

the A&T Stainless JV, primarily due to Section 232

tariffs.

Corporate Expenses/Closed Operations and Other

Expenses

- Corporate expenses in the first quarter

2019 were $16.6 million, which was $3.4 million higher than the

first quarter 2018, which includes higher expense for company-owned

life insurance policies and higher incentive compensation

costs.

- Closed operations and other expenses in

the first quarter 2019 were $3.1 million, which was $5.0 million

lower than the first quarter 2018 primarily from lower carry costs

and environmental costs for closed facilities in 2019, along with

foreign currency remeasurement gains in 2019 compared to losses in

2018.

Income Taxes

- ATI continues to maintain income tax

valuation allowances on its U.S. federal and state deferred tax

assets, and the Company does not expect to pay any significant U.S.

federal or state income taxes for the next few years due to net

operating loss carryforwards. The first quarter 2019 4.7% tax rate

primarily relates to the combination of the low tax rate caused by

the valuation allowances mentioned above and the inclusion of

income taxes on non-U.S. operations, resulting in a rate

substantially lower than the U.S. statutory rate of 21%.

Allegheny Technologies will conduct a conference call with

investors and analysts on Tuesday, April 23, 2019, at 8:30 a.m. ET

to discuss the financial results. The conference call will be

broadcast, and accompanying presentation slides will be available,

at ATImetals.com. To access the broadcast, click on “Conference

Call”. Replay of the conference call will be available on the

Allegheny Technologies website.

This news release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. Certain statements in this news release relate to future

events and expectations and, as such, constitute forward-looking

statements. Forward-looking statements, which may contain such

words as “anticipates,” “believes,” “estimates,” “expects,”

“would,” “should,” “will,” “will likely result,” “forecast,”

“outlook,” “projects,” and similar expressions, are based on

management’s current expectations and include known and unknown

risks, uncertainties and other factors, many of which we are unable

to predict or control. Our performance or achievements may differ

materially from those expressed or implied in any forward-looking

statements due to the following factors, among others: (a) material

adverse changes in economic or industry conditions generally,

including global supply and demand conditions and prices for our

specialty metals; (b) material adverse changes in the markets we

serve; (c) our inability to achieve the level of cost savings,

productivity improvements, synergies, growth or other benefits

anticipated by management from strategic investments and the

integration of acquired businesses; (d) volatility in the price and

availability of the raw materials that are critical to the

manufacture of our products; (e) declines in the value of our

defined benefit pension plan assets or unfavorable changes in laws

or regulations that govern pension plan funding; (f) labor

disputes or work stoppages; (g) equipment outages and (h) other

risk factors summarized in our Annual Report on Form 10-K for the

year ended December 31, 2018, and in other reports filed with the

Securities and Exchange Commission. We assume no duty to update our

forward-looking statements.

Creating Value Thru Relentless Innovation™

ATI is a global manufacturer of technically advanced specialty

materials and complex components. ATI revenue was $4.1 billion for

the twelve month period ended March 31, 2019. Our largest markets

are aerospace & defense, particularly jet engines. We also have

a strong presence in the oil & gas, electrical energy, medical,

automotive, and other industrial markets. ATI is a market leader in

manufacturing differentiated specialty alloys and forgings that

require our unique manufacturing and precision machining

capabilities and our innovative new product development competence.

We are a leader in producing powders for use in next-generation jet

engine forgings and 3D-printed aerospace products. See more at our

website ATIMetals.com.

Allegheny Technologies Incorporated and

Subsidiaries

Consolidated Statements of Income

(Unaudited, dollars in millions, except

per share amounts)

Three Months Ended March 31

December 31 March 31 2019 2018

2018 Sales $ 1,004.8 $

1,037.9 $ 979.0 Cost of sales

873.7 890.3 830.4 Gross profit

131.1 147.6 148.6 Selling and administrative expenses

68.0 72.9 67.1 Operating income

63.1 74.7 81.5 Nonoperating retirement benefit expense (18.3 ) (8.4

) (8.3 ) Interest expense, net (24.8 ) (25.2 ) (25.5 ) Other

(expense) income, net (2.9 ) (1.9 ) 17.8

Income before income taxes 17.1 39.2 65.5 Income tax

provision (benefit) 0.8 (5.8 ) 5.0

Net income $ 16.3 $ 45.0

$ 60.5 Less: Net income attributable to

noncontrolling interests 1.3 3.9

2.5

Net income attributable to ATI $

15.0 $ 41.1 $ 58.0

Basic net income attributable to ATI

per common share

$ 0.12 $ 0.33 $

0.46 Diluted net income attributable to ATI

per common share $ 0.12 $

0.30 $ 0.42

Allegheny Technologies Incorporated and Subsidiaries

Sales and Operating Profit (Loss) by Business Segment

(Unaudited, dollars in millions)

Three Months

Ended March 31 December 31 March

31 2019 2018 2018 Sales: High Performance

Materials & Components $ 601.2 $ 596.1 $ 560.7 Flat Rolled

Products 403.6 441.8 418.3

Total external sales $ 1,004.8

$ 1,037.9 $ 979.0

Operating profit (loss): High Performance Materials

& Components $ 72.6 $ 76.0 $ 85.5 % of Sales 12.1 % 12.7 % 15.2

% Flat Rolled Products (10.9 ) 11.3 10.9 % of Sales

-2.7 % 2.6 % 2.6 %

Total operating

profit 61.7 87.3 96.4 % of Sales 6.1 % 8.4

% 9.8 % LIFO and net realizable value reserves (0.1 )

(0.7 ) - Corporate expenses (16.6 ) (17.2 ) (13.2 )

Closed operations and other expense (3.1 ) (5.0 ) (8.1 )

Gain on joint venture deconsolidation - - 15.9 Interest

expense, net (24.8 ) (25.2 ) (25.5 )

Income before income taxes $ 17.1

$ 39.2 $ 65.5

Allegheny Technologies Incorporated and

Subsidiaries Condensed Consolidated Balance Sheets

(Current period unaudited, dollars in millions)

March 31, December 31, 2019 2018

ASSETS Current Assets: Cash and cash

equivalents $ 217.0 $ 382.0

Accounts receivable, net of allowances for

doubtful accounts

565.1 527.8 Short-term contract assets 48.7 51.2 Inventories, net

1,254.4 1,211.1 Prepaid expenses and other current assets

92.7 74.6

Total Current Assets 2,177.9

2,246.7 Property, plant and equipment, net 2,470.7

2,475.0 Goodwill 536.8 534.7 Other assets 305.6 245.4

Total Assets $ 5,491.0 $

5,501.8 LIABILITIES AND EQUITY

Current Liabilities: Accounts payable $ 455.3 $ 498.8

Accrued liabilities 220.4 260.1 Short-term contract liabilities

77.9 71.4

Short-term debt and current portion of

long-term debt

6.4 6.6

Total Current Liabilities 760.0

836.9 Long-term debt 1,536.2 1,535.5 Accrued

postretirement benefits 309.5 318.4 Pension liabilities 701.1 730.0

Deferred income taxes 14.5 12.9 Other long-term liabilities

123.1 76.5

Total Liabilities 3,444.4

3,510.2 Total ATI stockholders' equity 1,934.2

1,885.7 Noncontrolling interests 112.4 105.9

Total

Equity 2,046.6 1,991.6

Total Liabilities and Equity $ 5,491.0

$ 5,501.8 Allegheny Technologies

Incorporated and Subsidiaries Condensed Consolidated

Statements of Cash Flows (Unaudited, dollars in millions)

Three Months Ended March 31 2019

2018 Operating Activities: Net

income $ 16.3 $ 60.5 Depreciation and amortization 38.7 39.8

Deferred taxes 1.6 (0.2 ) Change in managed working capital (121.0

) (63.1 ) Change in retirement benefits (18.4 ) 0.5 Accrued

liabilities and other (47.2 ) (84.6 )

Cash used in

operating activities (130.0 )

(47.1 ) Investing Activities: Purchases of property,

plant and equipment (23.5 ) (41.6 ) Asset disposals and other

(0.1 ) 0.1

Cash used in investing

activities (23.6 ) (41.5

) Financing Activities: Borrowings on long-term debt - 6.4

Payments on long-term debt and finance leases (1.5 ) (1.3 ) Net

(payments) borrowings under credit facilities - 50.9 Sale to

noncontrolling interests - 7.4 Taxes on share-based compensation

and other (9.9 ) (6.5 )

Cash (used in) provided by

financing activities (11.4 )

56.9 Decrease in cash and cash equivalents

(165.0 ) (31.7 ) Cash and cash

equivalents at beginning of period 382.0 141.6

Cash and cash equivalents at end of period $

217.0 $ 109.9

Allegheny Technologies Incorporated and

Subsidiaries

Revenue by Market (Unaudited, dollars in millions)

Three Months Ended March 31

March 31 2019 2018 Market Aerospace &

Defense: Jet Engines $ 280.0 28 % $ 276.7 28 % Airframes 152.3 15 %

120.3 12 % Government Aerospace & Defense 93.3 9 %

65.4 7 % Total Aerospace & Defense $ 525.6 52 % $ 462.4

47 % Oil & Gas 112.8 11 % 152.7 16 % Automotive 76.9 8 % 79.1 8

% Construction/Mining 57.9 6 % 55.6 6 % Electrical Energy 55.7 6 %

52.2 5 % Food Equipment & Appliances 53.2 5 % 58.9 6 % Medical

46.1 5 % 44.9 5 % Electronics/Computers/Communications 34.1 3 %

32.9 3 % Other 42.5 4 % 40.3 4 % Total $ 1,004.8 100

% $ 979.0 100 %

Allegheny Technologies

Incorporated and Subsidiaries Selected Financial Data

(Unaudited)

Three Months Ended March 31

December 31 March 31 2019 2018

2018 Percentage of Total ATI Sales High-Value

Products Nickel-based alloys and specialty alloys 30 % 30 % 30

% Precision forgings, castings and components 19 % 19 % 21 %

Titanium and titanium-based alloys 19 % 19 % 16 % Precision and

engineered strip 13 % 14 % 14 % Zirconium and related alloys

6 % 5 % 5 % Total High-Value Products 87 % 87 % 86 %

Standard Products Stainless steel sheet 7 % 8 % 8 %

Specialty stainless sheet 4 % 4 % 4 % Stainless steel plate and

other 2 % 1 % 2 % Total Standard Products

13 % 13 % 14 %

Grand Total 100 %

100 % 100 %

Three Months Ended

March 31 December 31 March 31 Shipment

Volume: 2019 2018 2018 Flat Rolled

Products (000's lbs.) High value 82,178 89,963 84,042 Standard

92,638 90,529 109,249

Flat Rolled Products total 174,816 180,492 193,291

Average Selling Prices: Flat Rolled Products (per

lb.) High value $ 3.27 $ 3.14 $ 3.30 Standard $ 1.37 $ 1.43 $ 1.26

Flat Rolled Products combined average $ 2.26 $ 2.28 $ 2.15

Allegheny Technologies Incorporated and

Subsidiaries Computation of Basic and Diluted Earnings Per

Share Attributable to ATI (Unaudited, in millions, except per

share amounts)

Three Months Ended

March 31 December 31 March 31 2019

2018 2018 Numerator for Basic net income per

common share - Net income attributable to ATI $ 15.0 $ 41.1 $ 58.0

Effect of dilutive securities: 4.75% Convertible Senior Notes due

2022 - 3.3 3.2 Numerator for Diluted net

income per common share -

Net income attributable to ATI after

assumed conversions

$ 15.0 $ 44.4 $ 61.2 Denominator for Basic net income per

common share - Weighted average shares outstanding 125.4 125.2

125.0 Effect of dilutive securities: Share-based compensation 0.7

1.4 0.6 4.75% Convertible Senior Notes due 2022 -

19.9 19.9 Denominator for Diluted net income per common

share - Adjusted weighted average shares assuming conversions

126.1 146.5 145.5 Basic net income

attributable to ATI per common share

$ 0.12 $

0.33 $ 0.46 Diluted net income

attributable to ATI per common share

$ 0.12 $

0.30 $ 0.42 Allegheny

Technologies Incorporated and Subsidiaries Other Financial

Information Managed Working Capital (Unaudited, dollars

in millions)

March 31 December 31 2019

2018 Accounts receivable $ 565.1 $ 527.8 Short-term

contract assets 48.7 51.2 Inventory 1,254.4 1,211.1 Accounts

payable (455.3 ) (498.8 ) Short-term contract liabilities

(77.9 ) (71.4 ) Subtotal 1,335.0 1,219.9 Allowance

for doubtful accounts 5.7 6.0 LIFO reserve (4.7 ) (2.9 ) Inventory

reserves 96.5 88.5 Managed working

capital $ 1,432.5 $ 1,311.5

Annualized prior 3 months sales

$ 4,019.0 $ 4,151.3

Managed working capital as a % of

annualized sales

35.6 % 31.6 %

March 31, 2019 change in managed working

capital

$ 121.0 As part of managing the liquidity in our business, we focus

on controlling managed working capital, which is defined as gross

accounts receivable, short-term contract assets and gross

inventories, less accounts payable and short-term contract

liabilities. In measuring performance in controlling this managed

working capital, we exclude the effects of LIFO and other inventory

valuation reserves and reserves for uncollectible accounts

receivable which, due to their nature, are managed separately.

Allegheny Technologies Incorporated and

Subsidiaries Other Financial Information Debt to

Capital (Unaudited, dollars in millions)

March

31 December 31 2019 2018 Total debt

(a) $ 1,552.3 $ 1,552.5 Less: Cash (217.0 ) (382.0 )

Net debt $ 1,335.3 $ 1,170.5 Net debt $ 1,335.3 $ 1,170.5

Total ATI stockholders' equity 1,934.2 1,885.7

Net ATI capital $ 3,269.5 $ 3,056.2

Net debt to

ATI capital 40.8 % 38.3

% Total debt (a) $ 1,552.3 $ 1,552.5 Total ATI

stockholders' equity 1,934.2 1,885.7

Total ATI capital $ 3,486.5 $ 3,438.2

Total debt to total

ATI capital 44.5 % 45.2

%

(a)

Excludes debt issuance costs.

In managing the overall capital structure

of the Company, some of the measures that we focus on are net debt

to net capitalization, which is the percentage of debt, net of cash

that may be available to reduce borrowings, to the total invested

and borrowed capital of ATI (excluding noncontrolling interest),

and total debt to total ATI capitalization, which excludes cash

balances.

Allegheny Technologies Incorporated and

SubsidiariesNon-GAAP Financial Measures(Unaudited,

dollars in millions, except per share amounts)

The Company reports its financial results in accordance with

accounting principles generally accepted in the United States of

America ("GAAP"). However, management believes that certain

non-GAAP financial measures, used in managing the business, may

provide users of this financial information with additional

meaningful comparisons between current results and results in prior

periods. Non-GAAP financial measures should be viewed in addition

to, and not as an alternative for, the Company's reported results

prepared in accordance with GAAP. The following table provides the

calculation of the non-GAAP financial measures discussed in the

Company's press release dated April 23, 2019:

Three Months Ended March 31 2018

Net income attributable to ATI $ 58.0 Adjust for special items:

Gain on joint venture deconsolidation, net of tax (a) (14.7

) Net income attributable to ATI excluding special items $ 43.3

Per Diluted Share * Net income attributable to

ATI $ 0.42 Adjust for special items: Gain on joint venture

deconsolidation, net of tax (a) (0.10 ) Net income

attributable to ATI excluding special items $ 0.32 *

Presentation of adjusted results per diluted share includes the

effects of convertible debt, if dilutive. (a) First quarter

2018 results include a gain on deconsolidation of Allegheny &

Tsingshan Stainless following the sale of a 50% noncontrolling

interest and subsequent derecognition. The $15.9 pretax gain,

including ATI's retained 50% share, was recorded at fair value.

Free cash flow as defined by ATI includes the total of cash

provided by (used in) operating activities and investing activities

as presented on the consolidated statements of cash flows, adjusted

to exclude cash contributions to the Company's U.S. qualified

defined benefit pension plans.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190423005505/en/

Investor Contact:Scott A.

Minder412-395-2720scott.minder@atimetals.com

Media Contact:Natalie

Gillespie412-394-2850natalie.gillespie@atimetals.comwww.ATImetals.com

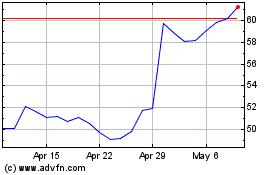

ATI (NYSE:ATI)

Historical Stock Chart

From Mar 2024 to Apr 2024

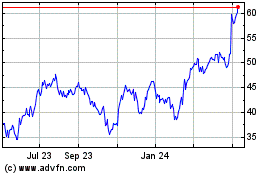

ATI (NYSE:ATI)

Historical Stock Chart

From Apr 2023 to Apr 2024