3 Canadian Dividend Stocks to Buy for 2022 and Beyond!

September 13 2021 - 5:44AM

Finscreener.org

There are several benefits when

it comes to

investing in dividend

stocks. Investors can

generate a predictable income stream via dividend payouts as well

as benefit from long-term capital gains. While there are a ton of

dividend-paying stocks in the U.S., you can also consider Canadian

companies with equally strong fundamentals that fly under the

radar.

The Canadian stock market is not

as well-known compared to equity markets south of the border. But

this does not mean you need to miss out on the

best dividend stock

selection especially

given the market is expected to remain volatile in the near

term.

Keeping these factors in mind, we

take a look at three Canadian dividend-paying giants that should be

on your radar today.

Enbridge is a popular Canadian stock

One of Canada’s largest

companies, Enbridge (NYSE: ENB)

also pays investors a tasty forward yield of 6.7%. Valued at a

market cap of $80 billion, Enbridge has increased dividends for 25

consecutive years. In the last five years, dividends have increased

at an annual rate of 11.74% compared to revenue growth of less than

3%.

In the second quarter of 2021,

Enbridge reported adjusted earnings of $1.4 billion, up from $1.1

billion in the year-ago period. The energy heavyweight reaffirmed

its EBITDA guidance range for 2021 that is forecast between $13.9

billion and $14.3 billion. At the midpoint estimate, this

represents a growth of 6% year over year.

The company’s gas operations are

regulated allowing it to generate stable earnings across business

cycles. Further, its liquids pipelines connect Canada’s oil sands

to several refineries that are located on the Gulf Coast. The

demand for pipelines remains robust enabling Enbridge to reserve

these requirements at appealing rates.

We can see how Enbridge’s

earnings stability has allowed the company to increase dividends

across business cycles.

Brookfield Renewable Partners is among the best

Canadian dividend stocks

One Canadian stock that has

crushed the broader markets in the last two decades, is Brookfield

Renewable Partners (NYSE:

BEP). It is one of the largest renewable energy

companies in the world and has managed to expand its revenue and

earnings by acquiring and developing quality clean energy

cash-generating assets.

In the last 10 years, Brookfield

has increased its funds from operations at an annual rate of 10%

while its dividends have grown by 6% annually in this period.

Brookfield Renewable stock currently provides investors with a

yield of 3% and has returned over 15% to investors annually since

2000.

The shift towards clean energy

solutions is all set to accelerate in the upcoming decades which

suggests Brookfield can easily leverage its leadership position in

this sector making it a top bet for 2021 and beyond.

Brookfield explains its existing

assets can support annual FFO increases between 3% and 6% through

2025. The company ended Q2 with 31 gigawatts in development which

is higher than its current operating portfolio that stands at 21

gigawatts.

Algonquin Power & Utilities

The final Canadian

dividend-paying stock on my list is Algonquin Power & Utilities

(NYSE:

AQN), a company that has increased its dividends at

an annual rate of 36.5% in the last five years. Comparatively, its

revenue and earnings grew by 11% and 19% respectively in this

period.

AQN has increased its customer

base from 120,000 in 2013 to 800,000 in 2021. It generates

two-thirds of its cash flows from utilities and the rest from

renewable energy. Algonquin expects to spend $9.2 billion in

capital expenditure over the next three years which will help it

support dividend increases moving forward. Since its IPO in October

2009, AQN stock has returned 450% to investors.

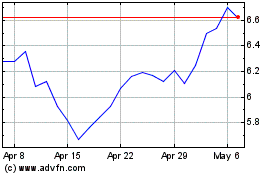

Algonquin Power (NYSE:AQN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Algonquin Power (NYSE:AQN)

Historical Stock Chart

From Apr 2023 to Apr 2024