Initial Statement of Beneficial Ownership (3)

October 02 2019 - 5:51PM

Edgar (US Regulatory)

FORM 3

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

INITIAL STATEMENT OF BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0104

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

GOLDMAN BARRY R |

2. Date of Event Requiring Statement (MM/DD/YYYY)

9/27/2019

|

3. Issuer Name and Ticker or Trading Symbol

ACUITY BRANDS INC [AYI]

|

|

(Last)

(First)

(Middle)

C/O ACUITY BRANDS, INC., 1170 PEACHTREE STREET, NE, SUITE 2300 |

4. Relationship of Reporting Person(s) to Issuer (Check all applicable)

_____ Director _____ 10% Owner

___X___ Officer (give title below) _____ Other (specify below)

SVP & General Counsel / |

|

(Street)

ATLANTA, GA 30309

(City)

(State)

(Zip)

| 5. If Amendment, Date Original Filed(MM/DD/YYYY)

| 6. Individual or Joint/Group Filing(Check Applicable Line)

_X_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Beneficially Owned

|

1.Title of Security

(Instr. 4) | 2. Amount of Securities Beneficially Owned

(Instr. 4) | 3. Ownership Form: Direct (D) or Indirect (I)

(Instr. 5) | 4. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Common Stock | 5274 (1) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 4) | 2. Date Exercisable and Expiration Date

(MM/DD/YYYY) | 3. Title and Amount of Securities Underlying Derivative Security

(Instr. 4) | 4. Conversion or Exercise Price of Derivative Security | 5. Ownership Form of Derivative Security: Direct (D) or Indirect (I)

(Instr. 5) | 6. Nature of Indirect Beneficial Ownership

(Instr. 5) |

| Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Non-Qualified Stock Option | (2) | 10/26/2025 | Common Stock | 2145.0 | $207.8 | D | |

| Non-Qualified Stock Option | (3) | 10/24/2026 | Common Stock | 2325.0 | $239.76 | D | |

| Non-Qualified Stock Option | (4) | 10/25/2027 | Common Stock | 1751.0 | $156.39 | D | |

| Non-Qualified Stock Option | (5) | 10/24/2028 | Common Stock | 2936.0 | $116.36 | D | |

| Explanation of Responses: |

| (1) | The total direct shares owned includes 5,274 time-vesting restricted shares. |

| (2) | This option was granted on October 26, 2015 and vested ratably over a three-year period. It became fully vested on October 26, 2018. |

| (3) | This option was granted on October 24, 2016 and vests ratably over a three-year period. It will become fully vested on October 24, 2019. |

| (4) | This option was granted on October 25, 2017 and vests ratably over a three-year period. It will become fully vested on October 25, 2020. |

| (5) | This option was granted on October 24, 2018 and vests ratably over a three-year period. It will become fully vested on October 24, 2021. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

GOLDMAN BARRY R

C/O ACUITY BRANDS, INC.

1170 PEACHTREE STREET, NE, SUITE 2300

ATLANTA, GA 30309 |

|

| SVP & General Counsel |

|

Signatures

|

| Jill A. Gilmer, under Power of Attorney for Barry R. Goldman | | 10/2/2019 |

| **Signature of Reporting Person | Date |

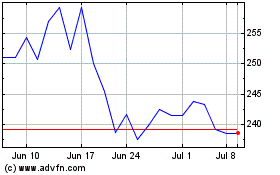

Acuity Brands (NYSE:AYI)

Historical Stock Chart

From Mar 2024 to Apr 2024

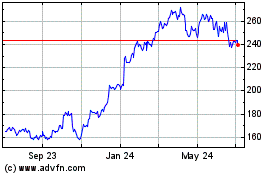

Acuity Brands (NYSE:AYI)

Historical Stock Chart

From Apr 2023 to Apr 2024