Item 1.01. Entry into a Material Definitive Agreement.

On June 25, 2019, AbbVie Inc., a Delaware corporation (“AbbVie”), issued an announcement (the “Rule 2.5 Announcement”) pursuant to Rule 2.5 of the Irish Takeover Rules disclosing that the boards of directors of AbbVie and Allergan plc, an Irish public limited company (“Allergan”),

had reached agreement on the terms of a recommended acquisition of Allergan by AbbVie (the “Acquisition”). In connection with the Acquisition, (i) AbbVie, Allergan and Venice Subsidiary LLC, a Delaware limited liability company and a direct wholly-owned subsidiary of AbbVie (“Acquirer Sub”), entered into a Transaction Agreement, dated as of June 25, 2019 (the “Transaction Agreement”), (ii) AbbVie and Allergan entered into an Expenses Reimbursement Agreement, dated as of June 25, 2019 (the “Expenses Reimbursement Agreement”), and (iii) AbbVie, Morgan Stanley Senior Funding, Inc. (“Morgan Stanley”), as administrative agent, and certain other parties entered into a 364-Day Bridge Credit Agreement, dated as of June 25, 2019 (the “Bridge Credit Agreement”).

Rule 2.5 Announcement

On June 25, 2019, AbbVie issued the Rule 2.5 Announcement disclosing that the boards of directors of AbbVie and Allergan had reached agreement on the terms of the Acquisition. The Acquisition will be effected by means of a court-sanctioned scheme of arrangement (the “Scheme”) under Irish law pursuant to which Acquirer Sub will acquire all of the outstanding ordinary shares of Allergan (“Allergan Shares”) in exchange for 0.8660 of a share of AbbVie common stock (“AbbVie Shares”) and $120.30 in cash (and any cash in lieu of fractions of AbbVie Shares due to a holder of Allergan Shares) per Allergan Share, subject to adjustment in accordance with the Exchange Ratio Modification Number (as defined in the Transaction Agreement).

The Acquisition will be conditioned upon, among other things, the approval of the Scheme by the

Allergan shareholders

, the sanction of the Scheme

by the Irish High Court (the “Court”), the registration of the Court Order (as defined in the Transaction Agreement) with the Registrar of Companies in Dublin, Ireland and the receipt of certain

regulatory approvals. The conditions to the Acquisition are set out in full in Appendix III to the Rule 2.5 Announcement (the “Conditions Appendix”). It is expected that, subject to the satisfaction or waiver of all relevant conditions, the Acquisition will be completed in early 2020.

AbbVie reserves the right, subject to the terms of the Transaction Agreement, to elect to implement the Acquisition by way of a takeover offer (as such term is defined in the Irish Takeover Panel Act 1997 and Takeover Rules, 2013).

Transaction Agreement

On June 25, 2019, AbbVie, Allergan and Acquirer Sub entered into the Transaction Agreement in connection with the proposed Acquisition.

The Transaction Agreement contains customary representations, warranties and covenants by AbbVie and Allergan. AbbVie and Allergan have agreed, among other things and subject to certain exceptions, that Allergan may not, directly or indirectly, (a) solicit, initiate or take any action or knowingly facilitate or knowingly encourage any offer or alternative proposal for specified alternative transactions or any indication, proposal or inquiry that would reasonably be expected to lead to such an offer or proposal, (b) enter into or participate in any discussions or negotiations regarding such an offer or proposal with, or furnish any information relating to Allergan or any of its subsidiaries to, or otherwise cooperate in any way with, or knowingly assist, participate in, knowingly facilitate or knowingly encourage any effort by, any person that would reasonably be expected to seek to make, or has made, such an offer or proposal or (c) enter into any agreement in principle, letter of intent, term sheet, merger agreement, acquisition agreement, option agreement or other agreement providing for or relating to such an offer or proposal.

In addition, certain covenants require each of the parties to use, subject to the terms and conditions of the Transaction Agreement, their reasonable best efforts to cause the Acquisition to be consummated.

Subject to certain exceptions, the Transaction Agreement also requires Allergan to hold an extraordinary general meeting of shareholders and requires the board of directors of Allergan to recommend approval of the Acquisition.

Pursuant to the Transaction Agreement, upon completion of the Acquisition, two members of Allergan’s board of directors will join AbbVie’s board of directors.

2

The Transaction Agreement may be terminated by mutual written consent of the parties. The Transaction Agreement also contains certain customary termination rights, including, among others and subject to certain conditions, the right of either party to terminate if (a) the Scheme has not become effective by 5:00 p.m., New York City time, on June 25, 2020, which period will be extended to September 25, 2020 in certain circumstances, (b) the requisite Allergan shareholder approvals are not obtained, (c) the other party breaches or fails to perform in any material respect any of its covenants or other agreements or any of the other party’s representations or warranties are inaccurate and such breach, failure to perform or inaccuracy would result in certain of the closing conditions not being satisfied, subject to a cure period, (d)

there is any final and non-appealable order, writ, decree, judgement or injunction by any court or other tribunal or any law (other than any antitrust law in a jurisdiction in which no antitrust clearance is required) that permanently restrains, enjoins, makes illegal or otherwise prohibits the consummation of the Acquisition

or (e) the Court declines or refuses to sanction the Scheme, unless both parties agree in writing to appeal the decision. Allergan also has the right, prior to the receipt of the requisite Allergan shareholder approvals, to terminate the Transaction Agreement to accept an Allergan Superior Proposal (as defined in the Transaction Agreement) in certain circumstances and AbbVie also has the right, prior to receipt of the requisite Allergan shareholder approvals, to terminate the Transaction Agreement if an Allergan Change of Recommendation (as defined in the Transaction Agreement) occurs. The Transaction Agreement also provides that, upon termination of the Transaction Agreement under certain circumstances

relating to the failure to obtain antitrust approvals, AbbVie will pay Allergan a reverse termination fee of $1.25 billion

.

The Transaction Agreement contains representations and warranties made by and to the parties thereto as of specific dates. The statements embodied in those representations and warranties were made for purposes of the contract between the parties and may be subject to qualifications and limitations agreed by the parties in connection with negotiating the terms of that contract. In addition, certain representations and warranties were made as of a specified date, may be subject to a contractual standard of materiality different from those generally applicable to investors, or may have been used for the purpose of allocating risk between the parties rather than establishing matters as facts.

Expenses Reimbursement Agreement

On June 25, 2019, AbbVie and Allergan entered into an Expenses Reimbursement Agreement (the “ERA”), the terms of which have been approved by the Irish Takeover Panel. Under the ERA, Allergan has agreed to pay to AbbVie, in certain circumstances, an amount equal to all documented, specific and quantifiable third-party costs and expenses incurred, directly or indirectly, by AbbVie and/or its subsidiaries or on their behalf, for the purposes of, in preparation for, or in connection with the Acquisition. The maximum amount payable by Allergan to AbbVie pursuant to the ERA is an amount equal to 1% of the aggregate value of the total Scheme Consideration (as defined in the ERA).

Bridge Credit Facility

On June 25, 2019 (the “Effective Date”), AbbVie entered into the Bridge Credit Agreement among AbbVie, certain lenders and Morgan Stanley Senior Funding, Inc. as administrative agent.

The Bridge Credit Agreement provides for a $38,000,000,000 bridge credit facility (the “Bridge Credit Facility”). The proceeds of the Bridge Credit Facility may be used to finance the payment of the cash consideration in connection with the Acquisition, fees and expenses related thereto and to repay certain existing indebtedness of Allergan. Advances under the Bridge Credit Facility will be available on a date after the Effective Date, subject to the satisfaction of certain conditions set forth in the Bridge Credit Agreement (the “Closing Date”) and will mature on the date that is 364 days after the Closing Date.

Borrowings under the Bridge Credit Facility may, at AbbVie’s election, bear interest at either (a) the base rate plus an applicable margin (“Base Rate Loans”) or (b) the Eurocurrency rate plus an applicable margin (“Eurocurrency Rate Loans”). The applicable margin ranges from 0.0% to 1.250% per annum for Base Rate Loans and 0.750% to 2.250% per annum for Eurocurrency Rate Loans, in each case depending on the public debt rating of AbbVie then in effect.

The commitments under the Bridge Credit Facility will be reduced by the net cash proceeds received by AbbVie in connection with debt and equity issuances and non-ordinary course of business asset dispositions, other than certain debt issuances and non-ordinary course asset dispositions specified in the Bridge Credit Agreement.

3

The commitments under the Bridge Credit Facility, unless previously terminated, will terminate on the earlier of (i) the date on which all of the certain funds purposes have been achieved without the making of any advances under the facility and (ii) the time after a mandatory cancellation event occurs.

The Bridge Credit Agreement contains customary affirmative covenants, negative covenants, including a financial covenant that will apply after the Closing Date, and events of default.

The Bridge Credit Facility is guaranteed by certain subsidiaries of AbbVie depending on the amount of indebtedness that such subsidiaries incur or guarantee, as further set forth in the Bridge Credit Agreement.

The foregoing summaries of the Acquisition, the Rule 2.5 Announcement, the Transaction Agreement, the ERA and the Bridge Credit Agreement do not purport to be complete and are subject to, and qualified in their entirety by, the full text of the Rule 2.5 Announcement, the Transaction Agreement, the Conditions Appendix, the ERA and the Bridge Credit Agreement, copies of which are attached as Exhibits 99.1, 2.1, 2.2, 2.3 and 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

The information in Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On June 25, 2019, AbbVie entered into the Bridge Credit Agreement as described under Item 1.01 above. The description of the Bridge Credit Agreement set forth in Item 1.01 above is hereby incorporated by reference.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit

No.

|

|

Exhibit

|

|

|

|

|

|

2.1

|

|

Transaction Agreement, dated as of June 25, 2019, between AbbVie, Allergan and Acquirer Sub.

|

|

|

|

|

|

2.2

|

|

Appendix III to the Rule 2.5 Announcement, dated as of June 25, 2019 (Conditions Appendix).

|

|

|

|

|

|

2.3

|

|

Expenses Reimbursement Agreement, dated as of June 25, 2019, between AbbVie and Allergan.

|

|

|

|

|

|

10.1

|

|

364-Day Bridge Credit Agreement, dated as of June 25, 2019, among AbbVie, Morgan Stanley Senior Funding, Inc. and the lenders party thereto.

|

|

|

|

|

|

99.1

|

|

Rule 2.5 Announcement, dated as of June 25, 2019.

|

NO OFFER OR SOLICITATION

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction pursuant to the acquisition or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. In particular, this communication is not an offer of securities for sale into the United States. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended, or pursuant to an exemption from, or in a transaction not subject to, such registration requirements. Any securities issued in the acquisition are anticipated to be issued in reliance upon available

4

exemptions from such registration requirements pursuant to Section 3(a)(10) of the U.S. Securities Act of 1933, as amended.

FORWARD-LOOKING STATEMENTS

This communication contains certain forward-looking statements with respect to a possible acquisition involving AbbVie and Allergan and AbbVie’s, Allergan’s and/or the combined group’s estimated or anticipated future business, performance and results of operations and financial condition, including estimates, forecasts, targets and plans for AbbVie and, following the acquisition, if completed, the combined group. The words “believe,” “expect,” “anticipate,” “project” and similar expressions, among others, generally identify forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those indicated in the forward-looking statements. Such risks and uncertainties include, but are not limited to, the possibility that a possible acquisition will not be pursued, failure to obtain necessary regulatory approvals or required financing or to satisfy any of the other conditions to the possible acquisition, adverse effects on the market price of AbbVie’s shares of common stock or Allergan’s ordinary shares and on AbbVie’s or Allergan’s operating results because of a failure to complete the possible acquisition, failure to realize the expected benefits of the possible acquisition, failure to promptly and effectively integrate Allergan’s businesses, negative effects relating to the announcement of the possible acquisition or any further announcements relating to the possible acquisition or the consummation of the possible acquisition on the market price of AbbVie’s shares of common stock or Allergan’s ordinary shares, significant transaction costs and/or unknown or inestimable liabilities, potential litigation associated with the possible acquisition, general economic and business conditions that affect the combined companies following the consummation of the possible acquisition, changes in global, political, economic, business, competitive, market and regulatory forces, future exchange and interest rates, changes in tax laws, regulations, rates and policies, future business acquisitions or disposals and competitive developments. These forward-looking statements are based on numerous assumptions and assessments made in light of AbbVie’s or, as the case may be, Allergan’s experience and perception of historical trends, current conditions, business strategies, operating environment, future developments and other factors it believes appropriate. By their nature, forward-looking statements involve known and unknown risks and uncertainties because they relate to events and depend on circumstances that will occur in the future. The factors described in the context of such forward-looking statements in this communication could cause Allergan’s plans with respect to AbbVie, Allergan’s or AbbVie’s actual results, performance or achievements, industry results and developments to differ materially from those expressed in or implied by such forward-looking statements. Although it is believed that the expectations reflected in such forward-looking statements are reasonable, no assurance can be given that such expectations will prove to have been correct and persons reading this communication are therefore cautioned not to place undue reliance on these forward-looking statements which speak only as at the date of this communication. Additional information about economic, competitive, governmental, technological and other factors that may affect AbbVie is set forth in Item 1A, “Risk Factors,” in AbbVie’s 2018 Annual Report on Form 10-K, which has been filed with the SEC, the contents of which are not incorporated by reference into, nor do they form part of, this communication.

Any forward-looking statements in this communication are based upon information available to AbbVie and/or its board of directors, as the case may be, as of the date of this communication and, while believed to be true when made, may ultimately prove to be incorrect. Subject to any obligations under applicable law, neither AbbVie nor any member of its board of directors undertakes any obligation to update any forward-looking statement whether as a result of new information, future developments or otherwise, or to conform any forward-looking statement to actual results, future events, or to changes in expectations. All subsequent written and oral forward-looking statements attributable to AbbVie or its board of directors or any person acting on behalf of any of them are expressly qualified in their entirety by this paragraph.

STATEMENT REQUIRED BY THE IRISH TAKEOVER RULES

The AbbVie Directors accept responsibility for the information contained in this communication other than that relating to Allergan and the Allergan group and the directors of Allergan and members of their immediate families, related trusts and persons connected with them. To the best of the knowledge and belief of the AbbVie Directors (who have taken all reasonable care to ensure that such is the case), the information contained in this communication for which they accept responsibility is in accordance with the facts and does not omit anything likely to affect the import of such information.

5

NO PROFIT FORECAST / ASSET VALUATIONS

No statement in this communication is intended to constitute a profit forecast for any period, nor should any statements be interpreted to mean that earnings or earnings per share will necessarily be greater or lesser than those for the relevant preceding financial periods for AbbVie or Allergan as appropriate. No statement in this communication constitutes an asset valuation.

6

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ABBVIE INC.

|

|

|

|

|

|

Date: June 25, 2019

|

By:

|

/s/ LAURA J. SCHUMACHER

|

|

|

|

Laura J. Schumacher

|

|

|

|

Vice Chairman, External Affairs, Chief Legal Officer, and Corporate Secretary

|

7

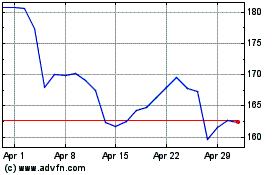

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Mar 2024 to Apr 2024

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Apr 2023 to Apr 2024