By Melanie Evans and Drew Hinshaw

Hospitals and public-health officials in the U.S. and Europe are

rationing medical masks and scrounging for more, as they prepare

for a potential widening of the coronavirus epidemic.

Global hoarding has left European wholesalers with empty

shelves. Manufacturers outside China say they won't be able to fill

an exploding stack of orders for months. U.S. hospitals and

medical-supply companies have reported dwindling mask inventory and

partial or delayed shipments as the surge in global demand for

protective equipment enters a second month.

While many people in China have taken to wearing masks in

public, the U.S. Centers for Disease Control and Prevention and its

European counterparts are trying to reserve masks for health-care

workers and patients. The CDC has urged the public not to use masks

unless told to do so by a doctor.

Masks known as N95 respirators guard against the virus, but only

if used properly. Other masks don't filter out small particles

harboring the bug.

The U.S. has a stockpile of 12 million N95 masks, Health and

Human Services Secretary Alex Azar told the Senate Appropriations

Committee on Wednesday. The U.S. would need 300 million N95 masks

to respond to an emergency, he said.

A Food and Drug Administration spokeswoman said today the agency

has received reports of spot shortages and urged hospitals to

report concerns to the agency.

In New York, officials have begun drawing from government

stockpiles to fill requests from hospitals and nursing homes for

thousands of respirator masks, more than one million surgical masks

and 18,000 face shields in the past month, said Stephanie Buhle, a

spokeswoman for the New York City Department of Health and Mental

Hygiene.

NYU Langone Health, which includes about 360 outpatient centers

and four hospitals around New York, has removed all but an

emergency supply of respirator masks from many locations to create

a stockpile in case of a U.S. outbreak.

"We would love if there would be cavalry on the other side of

the hill. We have to expect they are not going to come," said Dr.

Michael Phillips, NYU Langone Health's chief epidemiologist

The stockouts are a reckoning for the West, which for decades

has outsourced the manufacture of goods including medical supplies

to China.

Manufacturers say much of the world's protective-medical gear is

made in Hubei, the quarantined province where the virus first

emerged late last year. Hubei is a global hub for producing masks,

bandages, surgical drapes and gowns, said a spokesman for Medline

Industries Inc., a Northfield, Ill., medical-supply manufacturer

and distributor.

In Europe, where more than 500 cases emerged this week, chiefly

in Italy, officials have told health-care workers to be prepared to

reuse disposable face masks because the supply from China has been

cut off.

"It is expected that there will be no deliveries to Europe as

long as the crisis persists," the Robert Koch Institute, Germany's

equivalent to the CDC, said last week.

As coronavirus spread through China weeks ago, the Vatican sent

hundreds of thousands of masks to alleviate a shortage there. Now

officials at Rome's Gemelli Hospital, where popes normally go for

medical treatment, say they are worried about where to find masks

after their current stock runs out in two months.

"There has been panic and a run on supplies," said Giovanni

Paolo D'Incecco Bayard de Volo, Gemelli Hospital's head of

procurement.

Masks are part of a wider shortage of basic goods that

health-care workers need to combat a virus that has sickened 82,585

and killed 2,814. The European Medicines Agency said it is worried

about a global medicine shortage, because many active

pharmaceutical ingredients, the basic inputs for drugs, are

produced in China. Italy's main pharmaceutical lobby this week said

it was giving drugstores a recipe to produce their own hand

sanitizer.

"Masks are just the beginning of the crisis," said Darius

Sawicki, owner of Poland-based wholesaler Medyk eRKa. His suppliers

have run out of several health-care products, including hand

sanitizer. "There is nothing we can order, because their warehouses

are empty," he said.

Officials in China have told companies making masks there to

divert their output to the fight against the domestic outbreak, The

Wall Street Journal reported earlier this month. India, Taiwan and

South Korea -- which is now grappling with its own outbreak of the

virus -- have banned the export of masks made in those places.

Some mask makers that have ramped up production outside China

say they remain reliant on raw materials produced there.

"In the next month or so, we're going to run out of components,"

said Ronald Reuben, chief executive of Medicom Group, in Montreal,

which has raised production at factories in France and Augusta, Ga.

"Europe will not be able to supply its own market."

Premier Inc., which contracts for supplies on behalf of about

2,400 U.S. hospitals, said one of its distributors recently halted

shipments of private-label masks manufactured in China. All

distributors surveyed recently by Premier said they had delivered

less than half of the medical respirators that hospitals had

ordered in the past 45 days.

U.S-based mask-makers 3M Co. and Prestige Ameritech have roughly

doubled their U.S. production since the outbreak began, to one

million masks a week, according to Premier.

3M said it had ramped up production in the U.S., Asia, Europe

and Latin America but declined to say how many masks it was

producing.

Prestige Ameritech Chief Executive Mike Bowen said he has shared

production data with Premier. He said he wants federal officials in

the future to urge U.S. hospitals to buy critical medical supplies

domestically to avoid shortage risks from a global supply

chain.

Manufacturers in the U.S. must report the location of plants to

the FDA, but other information about medical-supply production is

confidential. Hospitals often don't know where their masks were

made, which some executives said makes it difficult to predict how

they might be hit by production disruptions.

"This health crisis is highlighting the fact that the industry

lacks visibility into manufacturing-site details across the board,"

said David Gillan, an executive with Vizient Inc., another

medical-supply contractor.

--Francis X. Rocca and Natalia Ojewska contributed to this

article.

Write to Melanie Evans at Melanie.Evans@wsj.com and Drew Hinshaw

at drew.hinshaw@wsj.com

(END) Dow Jones Newswires

February 27, 2020 14:03 ET (19:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

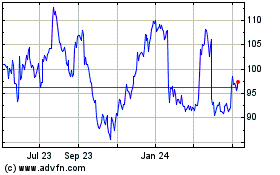

3M (NYSE:MMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

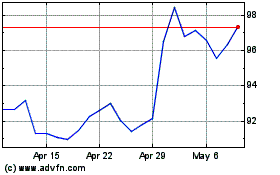

3M (NYSE:MMM)

Historical Stock Chart

From Apr 2023 to Apr 2024