First-Quarter Financial Highlights

- Strong first-quarter net sales of

$1,066 million; year-over-year growth of 9.1%

- Net income of $115 million and net

income per diluted share of $2.12

- Non-GAAP diluted EPS increased 14%

year-over-year to $2.92

- Adjusted EBITDA increased 10.3%

year-over-year to $225 million; and adjusted EBITDA margin expanded

20 bps year-over-year to 21.1%

Zebra Technologies Corporation (NASDAQ: ZBRA), an innovator at

the edge of the enterprise with solutions and partners that enable

businesses to gain a performance edge, today announced results for

the first quarter ended March 30, 2019.

“Our first quarter results were driven by solid execution and

strong demand for our leading portfolio of solutions. We

outperformed in data capture and mobile computing and managed costs

well,” said Anders Gustafsson, chief executive officer of Zebra

Technologies. “We are increasing our 2019 sales and profit outlook

based on our solid start to the year and recent acquisition of

Temptime Corporation. We remain focused on our enterprise asset

intelligence vision to drive innovative solutions for our

customers.”

$ in millions, except per share amounts

1Q19

1Q18 Change Select

reported measures: Net

sales $ 1,066 $ 977 9.1 % Gross profit 501 465 7.7 % Net income 115

109 5.5 % Net income per diluted share $ 2.12 $ 2.01 5.5 %

Select Non-GAAP measures: Organic net sales growth 7.9 % Adjusted

gross profit 503 466 7.9 % Adjusted gross margin 47.2 % 47.7 % (50)

bps Adjusted EBITDA 225 204 10.3 % Adjusted EBITDA margin 21.1 %

20.9 % 20 bps Non-GAAP net income $ 160 $ 138 15.9 % Non-GAAP

earnings per diluted share $ 2.92

$ 2.56 14.1 %

Reported (GAAP) results

Net sales were $1,066 million in the first quarter of 2019

compared to $977 million in the first quarter of 2018. Net sales in

the Enterprise Visibility & Mobility ("EVM") segment were $709

million in the first quarter of 2019 compared with $625 million in

the first quarter of 2018. Asset Intelligence & Tracking

("AIT") segment net sales were $357 million in the first quarter of

2019 compared to $352 million in the prior year period.

First-quarter 2019 gross profit was $501 million compared to $465

million in the comparable prior year period. Net income for the

first quarter of 2019 was $115 million, or $2.12 per diluted share,

compared to net income of $109 million, or $2.01 per diluted share,

for the first quarter of 2018.

Adjusted (Non-GAAP) results

Consolidated net sales were $1,066 million in the first quarter

of 2019 compared to $977 million in the prior year period, an

increase of 9.1%. Consolidated organic net sales growth for the

first quarter was 7.9% reflecting solid growth in APAC, EMEA and

North America. First-quarter year-over-year organic net sales

growth was 11.6% in the EVM segment and 1.2% in the AIT

segment.

Consolidated adjusted gross margin was 47.2% in the first

quarter of 2019, compared to 47.7% in the prior year period. This

decrease was primarily due to unfavorable business mix. Adjusted

operating expenses increased in the first quarter of 2019 to $297

million from $282 million in the prior year period primarily due to

investments to accelerate organic growth as well as inclusion of

expenses from recently acquired Xplore Technologies and Temptime

Corporation.

Adjusted EBITDA for the first quarter of 2019 increased to $225

million, or 21.1% of adjusted net sales, compared to $204 million,

or 20.9% of adjusted net sales, for the first quarter of 2018

primarily due to lower operating expenses as a percentage of net

sales.

Non-GAAP net income for the first quarter of 2019 was $160

million, or $2.92 per diluted share, compared with $138 million, or

$2.56 per diluted share, for the first quarter of 2018.

Balance Sheet and Cash Flow

As of March 30, 2019, the company had cash and cash

equivalents of $61 million and total debt of $1,744 million.

Free cash flow in the first quarter was $27 million. The company

generated $42 million of operating cash flow and incurred capital

expenditures of $15 million. The company had net borrowings of $146

million, primarily to fund the acquisition of Temptime

Corporation.

Outlook

Second Quarter 2019

The company expects second-quarter 2019 net sales to increase

approximately 7% to 9% from the second quarter of 2018. This

expectation includes an approximately 250-300 basis point additive

impact from recently acquired businesses, and an approximately 50

basis point negative impact from foreign currency translation.

Adjusted EBITDA margin is expected to be in the range of 20% to

21% for the second quarter of 2019. Non-GAAP earnings per diluted

share are expected to be in the range of $2.80 to $2.95. This

assumes an adjusted effective tax rate of approximately 16% to

17%.

Full Year 2019

The company expects full-year 2019 net sales to increase

approximately 5% to 8% from 2018. This expectation includes an

approximately 2 percentage point positive impact from recently

acquired businesses, and an approximately 50 basis point negative

impact from foreign currency translation.

Adjusted EBITDA margin is expected to be in the range of 21% and

22% for the full-year 2019, favorable to 2018.

For the full-year 2019, the company expects to generate free

cash flow of at least $625 million.

Conference Call Notification

Investors are invited to listen to a live webcast of Zebra’s

conference call regarding the company’s financial results for the

first quarter of 2019. The conference call will be held today,

Tuesday, Apr. 30, at 7:30 a.m. Central Time (8:30 a.m. Eastern

Time). To view the webcast, visit the investor relations section of

the company’s website at investors.zebra.com.

About Zebra

Zebra (NASDAQ: ZBRA) empowers the front line of business in

retail/ecommerce, manufacturing, transportation and logistics,

healthcare and other industries to achieve a performance edge. With

more than 10,000 partners across 100 countries, we deliver

industry-tailored, end-to-end solutions that intelligently

connect people, assets and data to help our

customers make business-critical decisions. Our

market-leading solutions elevate the shopping experience, track and

manage inventory as well as improve supply chain efficiency and

patient care. Ranked on Forbes’ list of America’s Best Employers

for the last three years, Zebra helps our customers capture their

edge. For more information, visit www.zebra.com/ or sign up

for our news alerts. Follow us on LinkedIn, Twitter and

Facebook.

Forward-Looking Statements

This press release contains forward-looking statements, as

defined by the Private Securities Litigation Reform Act of 1995,

including, without limitation, the statements regarding the

company’s outlook. Actual results may differ from those expressed

or implied in the company’s forward-looking statements. These

statements represent estimates only as of the date they were made.

Zebra undertakes no obligation, other than as may be required by

law, to publicly update or revise any forward-looking statements,

whether as a result of new information, future events, changed

circumstances or any other reason after the date of this

release.

These forward-looking statements are based on current

expectations, forecasts and assumptions and are subject to the

risks and uncertainties inherent in Zebra’s industry, market

conditions, general domestic and international economic conditions,

and other factors. These factors include customer acceptance of

Zebra’s hardware and software products and competitors’ product

offerings, and the potential effects of technological changes. The

continued uncertainty over future global economic conditions, the

availability of credit and capital markets volatility may have

adverse effects on Zebra, its suppliers and its customers. In

addition, a disruption in our ability to obtain products from

vendors as a result of supply chain constraints, natural disasters

or other circumstances could restrict sales and negatively affect

customer relationships. Profits and profitability will be affected

by Zebra’s ability to control manufacturing and operating costs.

Because of its debt, interest rates and financial market conditions

will also have an impact on results. Foreign exchange rates will

have an effect on financial results because of the large percentage

of our international sales. The outcome of litigation in which

Zebra may be involved is another factor. The success of integrating

acquisitions could also affect profitability, reported results and

the company’s competitive position in its industry. These and other

factors could have an adverse effect on Zebra’s sales, gross profit

margins and results of operations and increase the volatility of

our financial results. When used in this release and documents

referenced, the words “anticipate,” “believe,” “outlook,” and

“expect” and similar expressions, as they relate to the company or

its management, are intended to identify such forward-looking

statements, but are not the exclusive means of identifying these

statements. Descriptions of the risks, uncertainties and other

factors that could affect the company’s future operations and

results can be found in Zebra’s filings with the Securities and

Exchange Commission, including the company’s most recent Form 10-K

and Form 10-Q.

Use of Non-GAAP Financial Information

This press release contains certain Non-GAAP financial measures,

consisting of “adjusted net sales,” “adjusted gross profit,”

“EBITDA,” “Adjusted EBITDA,” “Non-GAAP net income,” “Non-GAAP

earnings per share,” “free cash flow,” “organic net sales growth,”

and “adjusted operating expenses.” Management presents these

measures to focus on the on-going operations and believes it is

useful to investors because they enable them to perform meaningful

comparisons of past and present operating results. The company

believes it is useful to present Non-GAAP financial measures, which

exclude certain significant items, as a means to understand the

performance of its ongoing operations and how management views the

business. Please see the “Reconciliation of GAAP to Non-GAAP

Financial Measures” tables and accompanying disclosures at the end

of this press release for more detailed information regarding

non-GAAP financial measures herein, including the items reflected

in adjusted net earnings calculations. These measures, however,

should not be construed as an alternative to any other measure of

performance determined in accordance with GAAP.

The company does not provide a reconciliation for non-GAAP

estimates on a forward-looking basis (including the information

under “Outlook” above) where it is unable to provide a meaningful

or accurate calculation or estimation of reconciling items and the

information is not available without unreasonable effort. This is

due to the inherent difficulty of forecasting the timing or amount

of various items that have not yet occurred, are out of the

company’s control and/or cannot be reasonably predicted, and that

would impact diluted net earnings per share, the most directly

comparable forward-looking GAAP financial measure. For the same

reasons, the company is unable to address the probable significance

of the unavailable information. Forward-looking non-GAAP financial

measures provided without the most directly comparable GAAP

financial measures may vary materially from the corresponding GAAP

financial measures.

As a global company, Zebra's operating results reported in U.S.

dollars are affected by foreign currency exchange rate fluctuations

because the underlying foreign currencies in which the company

transacts change in value over time compared to the U.S. dollar;

accordingly, the company presents certain organic growth financial

information, which includes impacts of foreign currency

translation, to provide a framework to assess how the company’s

businesses performed excluding the impact of foreign currency

exchange rate fluctuations. Foreign currency impact represents the

difference in results that are attributable to fluctuations in the

currency exchange rates used to convert the results for businesses

where the functional currency is not the U.S. dollar. This impact

is calculated by translating, for certain currencies, current

period results at the currency exchange rates used in the

comparable period in the prior year, rather than the exchange rates

in effect during the current period. In addition, the company

excludes the impact of its foreign currency hedging program in both

the current year and prior year periods. The company believes these

measures should be considered a supplement to and not in lieu of

the company’s performance measures calculated in accordance with

GAAP.

ZEBRA TECHNOLOGIES CORPORATION AND

SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

March 30, 2019

December 31, 2018

(Unaudited) Assets Current assets: Cash and cash equivalents

$ 61 $ 44 Accounts receivable, net of allowances for doubtful

accounts of $2 million and $3 million as of March 30, 2019 and

December 31, 2018, respectively 488 520 Inventories, net 510 520

Income tax receivable 21 24 Prepaid expenses and other current

assets 62 54 Total Current assets 1,142 1,162

Property, plant and equipment, net 257 249 Right-of-use lease asset

110 — Goodwill 2,567 2,495 Other intangibles, net 311 232 Long-term

deferred income taxes 97 114 Other long-term assets 92 87

Total Assets $ 4,576 $ 4,339 Liabilities and

Stockholders’ Equity Current liabilities: Current portion of

long-term debt $ 131 $ 157 Accounts payable 457 552 Accrued

liabilities 275 322 Deferred revenue 222 210 Income taxes payable

61 60 Total Current liabilities 1,146 1,301 Long-term

debt 1,605 1,434 Long-term lease liabilities 102 — Long-term

deferred income taxes 1 8 Long-term deferred revenue 178 172 Other

long-term liabilities 77 89 Total Liabilities 3,109

3,004 Stockholders’ Equity: Preferred stock, $.01 par

value; authorized 10,000,000 shares; none issued — — Class A common

stock, $.01 par value; authorized 150,000,000 shares; issued

72,151,857 shares 1 1 Additional paid-in capital 305 294 Treasury

stock at cost, 18,176,120 and 18,280,673 shares as of March 30,

2019 and December 31, 2018, respectively (611 ) (613 ) Retained

earnings 1,803 1,688 Accumulated other comprehensive loss (31 ) (35

) Total Stockholders’ Equity 1,467 1,335 Total

Liabilities and Stockholders’ Equity $ 4,576 $ 4,339

ZEBRA TECHNOLOGIES CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In millions, except share data)

(Unaudited)

Three Months Ended March 30,

2019 March 31, 2018 Net sales: Tangible

products $ 924 $ 839 Services and software 142 138

Total Net sales 1,066 977 Cost of sales: Tangible products 471 423

Services and software 94 89 Total Cost of sales 565

512 Gross profit 501 465 Operating expenses: Selling

and marketing 122 120 Research and development 111 101 General and

administrative 76 71 Amortization of intangible assets 28 23

Acquisition and integration costs 4 2 Exit and restructuring costs

1 4 Total Operating expenses 342 321

Operating income 159 144 Other expenses: Foreign

exchange loss (3 ) — Interest expense, net (24 ) (11 ) Other, net

(1 ) — Total Other expenses, net (28 ) (11 ) Income before

income tax 131 133 Income tax expense 16 24 Net

income $ 115 $ 109 Basic earnings per share $ 2.14 $

2.04 Diluted earnings per share $ 2.12 $ 2.01

ZEBRA TECHNOLOGIES CORPORATION AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH

FLOWS

(In millions)

(Unaudited)

Three Months Ended March 30,2019

March 31,2018 Cash flows from operating

activities: Net income $ 115 $ 109 Adjustments to reconcile net

income to net cash provided by operating activities: Depreciation

and amortization 47 43 Amortization of debt issuance costs and

discounts 1 2 Share-based compensation 10 10 Deferred income taxes

(10 ) (2 ) Unrealized loss/(gain) on forward interest rate swaps 8

(12 ) Other, net 1 (1 ) Changes in operating assets and

liabilities: Accounts receivable, net 28 9 Inventories, net 23 6

Other assets (10 ) (7 ) Accounts payable (97 ) (12 ) Accrued

liabilities (94 ) (74 ) Deferred revenue 18 19 Income taxes 2 22

Other operating activities — 4 Net cash provided by

operating activities 42 116 Cash flows from investing

activities: Purchases of property, plant and equipment (15 ) (18 )

Acquisition of businesses, net of cash acquired (179 ) — Proceeds

from sale of long-term investments 10 — Purchases of long-term

investments — (2 ) Net cash used in investing activities

(184 ) (20 ) Cash flows from financing activities: Payments of

long-term debt (37 ) (95 ) Proceeds from issuance of long-term debt

183 — Other financing activities 15 3 Net cash

provided by/(used in) financing activities 161 (92 ) Effect

of exchange rate changes on cash (2 ) (2 ) Net increase in cash and

cash equivalents 17 2 Cash and cash equivalents at beginning of

period 44 62 Cash and cash equivalents at end of

period $ 61 $ 64 Supplemental disclosures of cash

flow information: Income taxes paid $ 22 $ 2 Interest paid $ 16 $

26

ZEBRA TECHNOLOGIES CORPORATION AND

SUBSIDIARIES

RECONCILIATION OF ORGANIC NET SALES

GROWTH

(Unaudited)

Three Months Ended March 30, 2019

AIT EVM Consolidated Reported GAAP

Consolidated Net sales growth 1.4 % 13.4 % 9.1 % Adjustments:

Impact of foreign currency translation(1) 1.0 % 0.8 % 0.9 % Impact

of acquisition(2) (1.2 )% (2.6 )% (2.1 )% Organic Net sales growth

1.2 % 11.6 % 7.9 % (1) Operating results reported in U.S.

dollars are affected by foreign currency exchange rate

fluctuations. Foreign currency translation impact represents the

difference in results that are attributable to fluctuations in the

currency exchange rates used to convert the results for businesses

where the functional currency is not the U.S. dollar. This impact

is calculated by translating, for certain currencies, the current

period results at the currency exchange rates used in the

comparable prior year period, rather than the exchange rates in

effect during the current period. In addition, we exclude the

impact of the company’s foreign currency hedging program in both

the current and prior year periods. (2) For purposes of computing

Organic Net sales, amounts directly attributable to the Xplore

acquisition (included in our consolidated results beginning August

14, 2018) and the Temptime acquisition (included in our

consolidated results beginning February 21, 2019) will be excluded

for 12-months following the acquisition date.

ZEBRA TECHNOLOGIES CORPORATION AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP

GROSS MARGIN

(In millions)

(Unaudited)

Three Months Ended March 30, 2019

March 31, 2018 AIT EVM

Consolidated AIT EVM

Consolidated

GAAP

Reported Net sales $ 357 $ 709 $ 1,066 $ 352 $ 625 $ 977 Reported

Gross profit (1) 184 318 501 183 282 465 Gross Margin 51.5 % 44.9 %

47.0 % 52.0 % 45.1 % 47.6 %

Non-GAAP

Adjusted Net sales $ 357 $ 709 $ 1,066 $ 352 $ 625 $ 977 Adjusted

Gross profit (2) 184 319 503 183 283 466 Adjusted Gross Margin 51.5

% 45.0 % 47.2 % 52.0 % 45.3 % 47.7 % (1) Fiscal 2019

consolidated results include corporate eliminations related to

business acquisitions that are not reported in segment results. (2)

Adjusted Gross profit excludes purchase accounting adjustments and

share-based compensation expense.

ZEBRA TECHNOLOGIES CORPORATION AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP NET

INCOME

(In millions, except share data)

(Unaudited)

Three Months Ended March 30,

2019 March 31, 2018 Net income $

115 $ 109 Adjustments to Cost of sales(1) Purchase

accounting adjustments 1 — Share-based compensation 1 1

Total adjustments to Cost of sales 2 1

Adjustments to Operating expenses(1) Amortization of intangible

assets 28 23 Acquisition and integration costs 4 2 Share-based

compensation 12 10 Exit and restructuring costs 1 4

Total adjustments to Operating expenses 45 39

Adjustments to Other expenses, net(1) Amortization of debt issuance

costs and discounts 1 2 Investment loss 1 — Foreign exchange loss 3

— Forward interest rate swaps loss/(gain) 8 (12 )

Total

adjustments to Other expenses, net 13 (10 ) Income tax

effect of adjustments(2) Reported income tax expense 16 24 Adjusted

income tax (31 ) (25 )

Total adjustments to income tax (15 )

(1 ) Total adjustments 45 29

Non-GAAP Net

income $ 160 $ 138 GAAP earnings per share

Basic $ 2.14 $ 2.04 Diluted $ 2.12 $ 2.01

Non-GAAP earnings per share Basic $ 2.96 $ 2.59

Diluted $ 2.92

$ 2.56 (1) Presented on a pre-tax basis. (2)

Represents adjustments to the GAAP income tax expense commensurate

with pre-tax non-GAAP adjustments and to exclude the impacts of

certain discrete income tax items.

ZEBRA TECHNOLOGIES CORPORATION AND

SUBSIDIARIES

GAAP to NON-GAAP RECONCILIATION TO

EBITDA

(In millions)

(Unaudited)

Three Months Ended March 30,

2019 March 31, 2018 Net income $ 115 $

109 Add back: Depreciation 19 20 Amortization of intangible assets

28 23 Total Other expenses, net 28 11 Income tax expense 16

24 EBITDA (Non-GAAP) 206 187

Adjustments to Cost of sales Purchase accounting adjustments 1 —

Share-based compensation 1 1 Total adjustments to

Cost of sales 2 1 Adjustments to Operating expenses

Acquisition and integration costs 4 2 Share-based compensation 12

10 Exit and restructuring costs 1 4 Total adjustments

to Operating expenses 17 16 Total adjustments to

EBITDA 19 17 Adjusted EBITDA (Non-GAAP) $ 225

$ 204 Adjusted EBITDA % of Adjusted Net Sales 21.1 %

20.9 %

FREE CASH

FLOW

Three Months Ended March 30, 2019

March 31, 2018 Net cash provided by operating

activities $ 42 $ 116 Less: Purchases of property, plant and

equipment (15 ) (18 ) Free cash flow (Non-GAAP)(1) $ 27 $ 98

(1) Free cash flow is defined as Net cash provided by

operating activities in a period minus purchases of property, plant

and equipment (capital expenditures) made in that period. This

measure does not represent residual cash flows available for

discretionary expenditures as the measure does not deduct the

payments required for debt service and other contractual

obligations or payments for future business acquisitions.

Therefore, we believe it is important to view free cash flow as a

measure that provides supplemental information to our entire

statements of cash flows.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190430005131/en/

InvestorsMichael Steele, CFA,

IRCVice President, Investor RelationsPhone: + 1 847 793

6707msteele@zebra.com

MediaTherese Van RyneDirector,

Global Public RelationsPhone: + 1 847 370 2317therese.vanryne@zebra.com

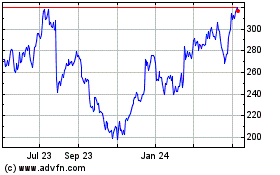

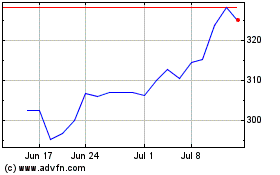

Zebra Technologies (NASDAQ:ZBRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Zebra Technologies (NASDAQ:ZBRA)

Historical Stock Chart

From Apr 2023 to Apr 2024