Current Report Filing (8-k)

March 11 2022 - 5:10PM

Edgar (US Regulatory)

false

0001823587

0001823587

2022-03-07

2022-03-07

0001823587

skyh:ClassACommonStockParValue00001PerShareCustomMember

2022-03-07

2022-03-07

0001823587

skyh:WarrantsEachWholeWarrantExercisableForOneShareOfClassACommonStockAtAnExercisePriceOf1150PerShareCustomMember

2022-03-07

2022-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) March 7, 2022

Sky Harbour Group Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-39648

|

|

85-2732947

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

136 Tower Road, Suite 205

Westchester County Airport

White Plains, NY

|

|

10604

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(212) 554-5990

Registrant’s telephone number, including area code

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A common stock, par value $0.0001 per share

|

|

SKYH

|

|

NYSE American LLC

|

|

Warrants, each whole warrant exercisable for one share of Class A common stock at an exercise price of $11.50 per share

|

|

SKYH WS

|

|

NYSE American LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On March 7, 2022, Sky Harbour Group Corporation (the “Company”) and ACM ARRT VII E LLC (“Seller”) entered into a Payment Agreement (the “Payment Agreement”) effective as of such date. The Payment Agreement amended certain provisions of that certain Forward Purchase Agreement, dated January 17, 2022, between the Company and Seller (the “Forward Purchase Agreement”) for an OTC Equity Prepaid Forward Transaction (the “Forward Purchase Transaction”), as previously disclosed in the report on Form 8-K filed by the Company on January 18, 2022. Pursuant to the terms of the Forward Purchase Agreement, Seller intended, but was not obligated, to purchase shares of Class A common stock, par value $0.0001 per share, of the Company (the “Shares”) after the date of the Forward Purchase Agreement from holders of Shares (other than the Company, Boston Omaha Corporation or their affiliates) who redeemed Shares or indicated an interest in redeeming Shares pursuant to the redemption rights set forth in the Company’s Amended and Restated Certificate of Incorporation in connection with the closing of the previously announced business combination pursuant to that certain Equity Purchase Agreement, dated August 1, 2021, between the Company and Sky Harbour LLC. Pursuant to the terms of the Forward Purchase Agreement, Seller agreed to purchase a minimum of 2,500,000 Shares (the “Minimum Purchase Amount”) and a maximum of the lesser of (i) 7,000,000 Shares and (ii) the maximum number of Shares such that Seller did not beneficially own greater than 9.9% of the Shares on a post-combination pro forma basis. Seller purchased a total of 664,909 Shares in the Forward Purchase Transaction.

The Payment Agreement amended the Forward Purchase Agreement to remove the requirement that the Seller purchase the Minimum Purchase Amount and remove the requirement that the Company pay the Seller a structuring fee. In addition, pursuant to the terms of the Payment Agreement, the Seller paid $6,734,602.01 to the Company in respect of the Seller’s obligations under the Forward Purchase Agreement. The Forward Purchase Agreement, as amended pursuant to the Payment Agreement, remains in full force and effect.

The foregoing description of the Payment Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Payment Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The Exhibit Index set forth below is incorporated herein by reference.

EXHIBIT INDEX

|

Exhibit Number

|

Exhibit Title

|

|

10.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: March 11, 2022

| |

SKY HARBOUR GROUP CORPORATION

|

| |

|

|

| |

By:

|

/s/ Tal Keinan

|

| |

Name:

|

Tal Keinan

|

| |

Title:

|

Chief Executive Officer

|

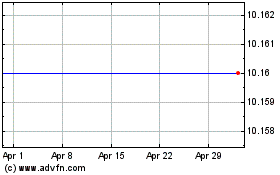

Yellowstone Acquisition (NASDAQ:YSAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Yellowstone Acquisition (NASDAQ:YSAC)

Historical Stock Chart

From Apr 2023 to Apr 2024