Amended Statement of Beneficial Ownership (sc 13d/a)

January 24 2022 - 5:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 3)1

Yatra Online, Inc.

(Name

of Issuer)

Ordinary Shares, par value $0.0001 per share

(Title of Class of Securities)

G98338109

(CUSIP Number)

TIMOTHY J. MAGUIRE

5625 East Nauni Valley Drive

Paradise Valley, Arizona 85253

(610) 517-6058

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

January 17, 2022

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

THE 2020 TIMOTHY J. MAGUIRE INVESTMENT TRUST

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

WC

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

4,525,357

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

-0-

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,525,357

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0-

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

4,525,357

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.8%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

OO

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

CHRISTOPHER J. MAGUIRE

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

AF

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

-0-

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

4,525,357

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0-

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0-

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

4,525,357

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.8%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

MEGAN MAGUIRE NICOLETTI

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

AF

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

-0-

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

4,525,357

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0-

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0-

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

4,525,357

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.8%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

IN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

TIMOTHY J. MAGUIRE

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

|

|

|

|

|

|

(b) ☐

|

|

|

|

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS

|

|

|

|

|

|

|

|

|

|

|

|

|

AF

|

|

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITED STATES

|

|

|

NUMBER OF

|

|

7

|

|

SOLE VOTING POWER

|

|

|

SHARES

|

|

|

|

|

|

|

BENEFICIALLY

|

|

|

|

|

-0-

|

|

|

OWNED BY

|

|

8

|

|

SHARED VOTING POWER

|

|

|

EACH

|

|

|

|

|

|

|

REPORTING

|

|

|

|

|

-0-

|

|

|

PERSON WITH

|

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,525,357

|

|

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-0-

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

4,525,357

|

|

|

|

12

|

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

|

|

7.8%

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

|

|

IN

|

|

The following constitutes

Amendment No. 3 to the Schedule 13D filed by the undersigned (“Amendment No. 3”). This Amendment No. 3 amends the Schedule

13D as specifically set forth herein.

|

|

Item 4.

|

Purpose of the Transaction.

|

Item 4 is hereby amended

to add the following:

On January 17, 2022, the

Reporting Persons entered into a Cooperation Agreement (the “Cooperation Agreement”) with the Issuer regarding, among other

matters, the composition of the Board of Directors of the Issuer (the “Board”).

Pursuant to the Cooperation

Agreement, the Issuer agreed to, effective immediately following the execution of the Cooperation Agreement, cause Roshan Mendis (the

“New Director”) to be appointed to the Board, for a term of office that expires at the 2023 Annual General Meeting of Shareholders

(the “2023 Annual Meeting”). Effective one year from the date of the Cooperation Agreement, if the New Director is unable

to serve or continue serving as a director for any reason, then the Reporting Persons shall have the ability to recommend a substitute

person for appointment to the Board, provided that at such time the Reporting Persons beneficially own at least the lesser of 5.0% of

the Issuer’s then outstanding Shares and 2,882,918 Shares.

In addition, the Reporting

Persons agreed to certain customary standstill provisions for a period commencing on the date of the Cooperation Agreement and ending

at 11:59 p.m., Eastern Time, on the date that is eighteen (18) months following the date of the Cooperation Agreement (the “Standstill

Period”).

Pursuant to the Cooperation

Agreement, the Reporting Persons have agreed that at each annual and extraordinary general meeting of shareholders held prior to the expiration

of the Standstill Period, the Reporting Persons will: (i) appear at such shareholders’ meeting or otherwise cause all Shares beneficially

owned by such Reporting Persons and any of their Related Persons (as defined in the Cooperation Agreement) to be counted as present thereat

for purposes of establishing a quorum; (ii) vote, or cause to be voted on the Issuer’s proxy card or voting instruction form, all

Shares beneficially owned by such Reporting Persons in accordance with the recommendation of the Board with respect to (a) the election,

removal and/or replacement of directors (or the requisition of an extraordinary general meeting or action by written consent of the Issuer’s

shareholders in respect of any of the foregoing) (a “Director Proposal”) and (b) any other proposal submitted to the Issuer’s

shareholders at a shareholder meeting; provided, however, that in the event that Institutional Stockholder Services Inc.

(“ISS”) or Glass Lewis & Co., LLC (“Glass Lewis”) issues a recommendation with respect to any matter (other

than Director Proposals) that is different from the recommendation of the Board, the Reporting Persons shall have the right to vote in

accordance with the ISS or Glass Lewis recommendation; provided, further, the Reporting Persons and any of their Related

Persons shall be entitled to vote the Shares beneficially owned by them in their sole discretion with respect to any publicly announced

proposal relating to a merger, acquisition, disposition of all or substantially all of the assets of the Issuer and its subsidiaries or

other business combination involving the Issuer, in each case, that requires a vote of the Issuer’s shareholders.

The foregoing description

of the Cooperation Agreement is qualified in its entirety by reference to the full text of the Cooperation Agreement, a copy of which

is filed as Exhibit 10.1 in the Issuer’s Form 6-K filed with the Securities and Exchange Commission (the “SEC”) on January

21, 2022, and is incorporated herein by reference.

|

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

|

Item 6 is hereby amended

to add the following:

On January 17, 2022, the

Reporting Persons entered into the Cooperation Agreement with the Issuer as defined and described in Item 4, a copy of which is attached

as Exhibit 10.1 to the Issuer’s Form 6-K filed with the SEC on January 21, 2022 and is incorporated herein by reference.

|

|

Item 7.

|

Material to be Filed as Exhibits.

|

Item 7 is hereby amended

to add the following exhibit:

|

|

99.1

|

Cooperation Agreement by and among The 2020 Timothy J. Maguire Investment Trust, Timothy J. Maguire and

Yatra Online, Inc., dated January 17, 2022 (incorporated by reference to Exhibit 10.1 of the Issuer’s Form 6-K filed with the SEC

on January 21, 2022).

|

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: January 24, 2022

|

|

/s/ Timothy J. Maguire

|

|

|

TIMOTHY J. MAGUIRE

Individually and as attorney-in-fact for Christopher J. Maguire and Megan

Maguire Nicoletti

|

|

|

|

|

|

|

|

|

THE 2020 TIMOTHY J. MAGUIRE INVESTMENT TRUST

|

|

|

|

|

|

By:

|

/s/ Timothy J. Maguire

|

|

|

|

Name:

|

Timothy J. Maguire

|

|

|

|

Title:

|

Investment Manager

|

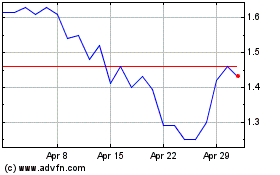

Yatra Online (NASDAQ:YTRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

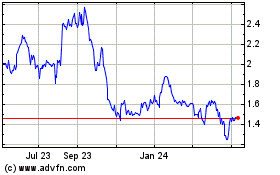

Yatra Online (NASDAQ:YTRA)

Historical Stock Chart

From Apr 2023 to Apr 2024