AmerisourceBergen to Buy Alliance Healthcare From Walgreens Boots for $6.5 Billion

January 06 2021 - 7:51AM

Dow Jones News

By Colin Kellaher

AmerisourceBergen Corp. on Wednesday said it agreed to buy the

majority of Walgreens Boots Alliance Inc.'s Alliance Healthcare

businesses for about $6.5 billion.

Amerisource, a Valley Forge, Pa., provider of pharmaceutical

products, said it would pay $6.275 billion in cash and issue 2

million shares to Walgreens in exchange for European pharmaceutical

wholesaler Alliance.

Amerisource said the deal extends its distribution presence and

its global platform of higher-margin manufacturer services.

Walgreens, based in Deerfield, Ill., said it plans to increase its

focus on expanding its core retail pharmacy businesses.

Amerisource and Walgreens also agreed to extend and expand their

U.S. commercial agreements through 2029. Walgreens currently owns a

roughly 28% stake in Amerisource, according to FactSet.

Amerisource said it will fund the transaction, which it expects

to complete by the end of fiscal 2021, with cash on hand and new

debt financing.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

January 06, 2021 07:36 ET (12:36 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

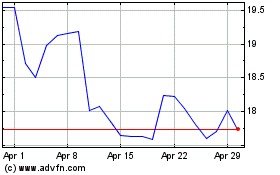

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

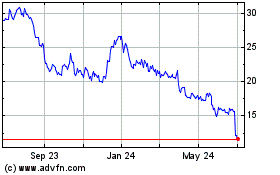

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Apr 2023 to Apr 2024