Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

_________________________________

Filed by Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to Section 240.14a-12 |

Walgreens Boots Alliance, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required |

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

|

1) |

Title of each class of securities to which transaction applies: |

|

2) |

Aggregate number of securities to which transaction applies: |

|

3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

4) |

Proposed maximum aggregate value of transaction: |

|

5) |

Total fee paid: |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

1) |

Amount previously paid: |

|

2) |

Form, Schedule or Registration Statement No.: |

|

3) |

Filing party: |

|

4) |

Date Filed: |

| |

|

|

Table of Contents

Table of Contents

|

Our |

|

vision |

|

|

Be the first choice for pharmacy, well-being and beauty – caring for people and communities around the world. |

|

purpose |

|

|

We help people across the world lead healthier and happier lives. |

|

values |

|

|

Walgreens Boots Alliance takes seriously its aim of inspiring a healthier and happier world, as reflected in our core values. |

|

|

|

Trust Respect, integrity and candor guide

our actions to do the right thing |

|

|

|

Care Our people and customers inspire

us to act with commitment and passion |

|

|

|

Innovation We cultivate an open and

entrepreneurial mind-set in all that we do |

|

|

|

Partnership We work collaboratively

with each other and our partners to win

together |

|

|

|

Dedication We work with rigor, simplicity

and agility to deliver exceptional results |

|

|

|

Inclusion We are empowered to bring our authentic selves in

an open, welcoming and equitable workplace |

Table of Contents

Message from our

Lead Independent Director

|

“Our commitment to open communication and collaboration with stockholders stands firm, even as we continue to fulfill the immense, essential role we play in supporting health and wellness in our communities in response to the ongoing health crisis.”

– William C. Foote, Lead Independent Director |

| |

|

Dear Fellow Stockholders:

As your lead independent director, I am pleased to present the Walgreens Boots Alliance Proxy Statement and cordially invite you to our 2021 Annual Meeting of Stockholders to be held on Thursday, January 28, 2021 at 8:00 a.m. Central Time. This year, in light of the public health impact of the COVID-19 pandemic and our commitment to support health and wellness, the Annual Meeting of Stockholders will be held entirely online. The virtual meeting will also allow for greater participation by all of our stockholders, regardless of their geographic location. Please see the Notice of Annual Meeting on the next page for more information about how to virtually attend and participate in the Annual Meeting of Stockholders. Your vote is very important. Whether or not you plan to attend the Annual Meeting of Stockholders, please vote at your earliest convenience.

On behalf of the Board, I would like to take this opportunity to thank you, our fellow stockholders, for your ongoing engagement with us during a year in which our Company has operated vigorously on the front lines helping lead the response to an unprecedented global pandemic. Our commitment to open communication and collaboration with stockholders stands firm, even as we continue to fulfill the immense, essential role we play in supporting health and wellness in our communities in response to the ongoing health crisis.

We thank those of you who met with us over the past months and provided invaluable input on our corporate governance practices. At a time when our industries are re-evaluating risk and adapting to change more quickly than ever, we reaffirm our steadfast and ongoing commitment to strong corporate governance and to rigorous, independent Board leadership. Throughout a year marked by urgent issues, the full Board and its Committees have continued to provide direction and oversight to management, including on the elements and dimensions of the major risks we face. Effective governance remains a critical driver of our long-term strategy and I encourage you to read more about our governance structure and practices in this proxy statement.

In July, we announced a search for a new Chief Executive Officer as we continue our work to drive further progress on our key strategic priorities and to transform the business for the future to address the rapidly-evolving healthcare sector. The strength of our governance practices will remain critical during this leadership transition.

We could not be more proud of Walgreens Boots Alliance employees and how they have responded to the COVID-19 pandemic. They have worked tirelessly to adapt our business to evolving societal needs while prioritizing the health, safety and well-being of our customers, all while providing critical access to healthcare, trustworthy information and innovative solutions. I am proud of the leadership our management team has shown during this time of crisis as well. Our leaders have met the challenge of COVID-19 head on with incredible stamina and resolute focus on fulfilling the Company’s purpose of promoting health and wellness. They have also done this while leading the organization by example with commendable actions, such as bonuses for our front-line workers and our CEO’s request for no direct compensation for fiscal 2021 in light of the impact of the pandemic.

The pandemic has underlined the importance of sustainability for all enterprises and reinforced our Company’s Corporate Social Responsibility (CSR) strategy, which is centered on the health and well-being of our communities. The Company’s purpose is to help people across the world lead healthier and happier lives and it leverages its international scale to drive health initiatives in collaboration with community partners, to protect the planet, to do business fairly and with integrity and to foster a safe and inclusive workplace. WBA is a component of the Dow Jones Sustainability North America Index, a recognition of the Company's outstanding performance in corporate sustainability.

The Board cares deeply about racial equity and recognizes that while WBA can be proud of its long history of work on diversity and inclusion, we can do more to advance in this area. The Board is committed to drawing from diverse pools of candidates when considering new members as it upholds WBA’s core values, which have been updated to reflect inclusion, as well as trust, care, innovation, partnership and dedication.

On behalf of my fellow independent directors and the entire Board, thank you for your partnership and investment in WBA. We appreciate your trust and confidence in our leadership.

Sincerely,

William C. Foote

Lead Independent Director

2021 Proxy Statement 1

Table of Contents

Notice of 2021 Annual Meeting of Stockholders

Background

|

|

|

|

|

Date and Time

Thursday,

January 28, 2021

at 8:00 a.m.

Central Time |

|

Location

The Annual Meeting will be held

exclusively online at

www.virtualshareholdermeeting.

com/WBA2021

|

|

Who Can Vote

The Board of Directors has fixed the close of business on November 30, 2020 as the record date. You are entitled to vote at the Annual Meeting and at any adjournment thereof if you were a holder of the Company’s common stock as of the close of business on November 30, 2020. |

Proposals that Require Your Vote

|

|

|

Board

Recommendation |

|

Learn

More |

| 1 |

Vote on the election of 11 director nominees named in this proxy statement |

|

|

FOR each nominee |

|

► Page 13 |

| 2 |

Ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending August 31, 2021 |

|

|

FOR |

|

► Page 49 |

| 3 |

Approve, on an advisory basis, our named executive officer compensation |

|

|

FOR |

|

► Page 53 |

| 4 |

Approve the Walgreens Boots Alliance, Inc. 2021 Omnibus Incentive Plan |

|

|

FOR |

|

► Page 86 |

| 5-6 |

Consider two stockholder proposals, if properly presented at the meeting |

|

|

AGAINST |

|

► Page 93 |

Stockholders will also transact such other business as may properly be brought before the meeting or any adjournment thereof by or at the direction of the Board of Directors.

These proxy materials are first being sent (or, as applicable, made available) to stockholders commencing on December 8, 2020.

Your vote is important. Please vote by Internet, telephone or mail as soon as possible to ensure your vote is recorded properly.

The Annual Meeting will be held entirely online via live audio webcast due to the public health impact of the COVID-19 pandemic and to support the health and wellness of our stockholders, directors, team members, and guests. The virtual Annual Meeting will also allow for greater participation by all of our stockholders, regardless of their geographic location. To attend the Annual Meeting, examine our list of stockholders, vote and submit your questions during the Annual Meeting, go to www.virtualshareholdermeeting.com/WBA2021. Prior to the Annual Meeting, you will be able to vote at www.proxyvote.com and by the other methods described in this proxy statement. We are excited to embrace the latest technology to provide expanded access, improved communication and cost savings for our stockholders.

To be admitted to the Annual Meeting, please visit www.virtualshareholdermeeting.com/WBA2021. You will log into the Annual Meeting by entering your unique 16-digit control number found on your proxy card or voting instruction form. For more information about how to attend the Annual Meeting online, please see “Attending the Annual Meeting” on page 103 of this proxy statement.

By order of the Board of Directors,

Joseph B. Amsbary, Jr.

Vice President, Corporate Secretary

December 8, 2020

Walgreens Boots Alliance, Inc.

108 Wilmot Road

Deerfield, Illinois 60015

(principal executive office)

Stockholders of record may vote without attending the Annual Meeting by one of the following methods:

|

Complete, sign and date the enclosed proxy card and return it in the prepaid envelope provided. |

|

|

Call the toll-free telephone number 1-800-690-6903 and follow the recorded instructions. |

|

|

Go to https://www.proxyvote.com and follow the instructions on the website. |

2 Walgreens Boots Alliance

Table of Contents

Contents

Our Board of Directors (the “Board”) is soliciting your proxy on behalf of the Company for our 2021 annual meeting of stockholders (the “Annual Meeting”), which will be held on January 28, 2021 at 8:00 a.m., Central Time, or any adjournment or postponement thereof. This proxy statement (this “Proxy Statement”), and the accompanying Notice of Annual Meeting of Stockholders and proxy card, are being distributed, along with the 2020 Annual Report, beginning on December 8, 2020 to holders of our common stock, par value $0.01 per share, as of the close of business on November 30, 2020 (the “Record Date”). The Proxy Statement Summary highlights selected information that is provided in more detail throughout this Proxy Statement. The Proxy Statement Summary does not contain all of the information you should consider before voting. You should read the full Proxy Statement before casting your vote.

Walgreens Boots Alliance, Inc., a Delaware corporation, is the successor to Walgreen Co., an Illinois corporation (“Walgreens”), following the completion of the holding company reorganization approved by Walgreens shareholders on December 29, 2014. Unless otherwise stated, references herein to the “Company,” "WBA," “we,” “us,” and “our” refer to Walgreens Boots Alliance, Inc. from and after the effective time of the holding company reorganization on December 31, 2014 and, prior to that time, to its predecessor Walgreens. Unless otherwise stated, all information presented in this proxy statement is based on our fiscal calendar, which ends on August 31 (e.g., references to “2020” refer to the fiscal year ended August 31, 2020).

2021 Proxy Statement 3

Table of Contents

Proxy Statement Summary

Company Overview

We are a global leader in retail and wholesale pharmacy, touching millions of lives every day through dispensing and distributing medicines, and through our convenient retail locations, digital platforms and health and beauty products, with sales of $139.5 billion in fiscal 2020. We have more than 100 years of trusted healthcare heritage and innovation in community pharmacy and pharmaceutical wholesaling.

We are the largest retail pharmacy, health and daily living destination across the United States and Europe. Walgreens Boots Alliance and the companies in which it has equity method investments together have a presence in more than 25* countries and employ more than 450,000* people. Including equity method investments, the Company has more than 21,000* stores in 11* countries, and one of the largest global pharmaceutical wholesale and distribution networks, with over 425* distribution centers delivering to more than 250,000** pharmacies, doctors, health centers and hospitals each year in more than 20* countries. In addition, we are one of the world’s largest purchasers of prescription drugs and many other health and well-being products. Our size, scale and expertise will help us to expand the supply of, and address the rising cost of, prescription drugs in the United States and worldwide.

We are proud to be a force for good through our contributions to healthy communities, a healthy planet, an inclusive workplace and a sustainable marketplace.

Our retail and business brands

Our portfolio of retail and business brands includes Walgreens, Duane Reade, Boots and Alliance Healthcare, as well as increasingly global health and beauty product brands, such as No7, Soap & Glory, Liz Earle, Botanics, Sleek MakeUP and YourGoodSkin. Our community pharmacy and pharmaceutical wholesaling operations have a trusted healthcare heritage and a history of innovation. Our partnerships with some of the world’s leading companies enable us to extend our healthcare solutions and convenience offering to the communities we serve.

Key strategic priorities

| ● |

Creating neighborhood health destinations around a more modern pharmacy; |

| ● |

Transforming and restructuring our retail offering; |

| ● |

Accelerating the digitalization of our Company; and |

| ● |

Accelerating and increasing our Transformational Cost Management Program. |

| * | As of August 31, 2020. |

| ** | For 12 months ending August 31, 2020. |

4 Walgreens Boots Alliance

Table of Contents

Proxy Statement Summary

COVID-19 Impact on the Company

Our Company’s essential role in healthcare has been put to the test during the unprecedented global COVID-19 pandemic. We rose to the challenge, living our purpose to help people lead healthier and happier lives. Our people have worked tirelessly on the front lines to help vulnerable people adhere to their medications and stay healthy, to ramp up new testing services, to implement delivery options including free prescription delivery, to expand our digital and telehealth capabilities and ability to fill orders, to facilitate supply chain continuity and access to essential items and to help keep our patients, customers and team members safe.

At the heart of our pharmacy-led business, our pharmacists activated their unique strengths to serve their communities and help to fight the spread of the virus. As we continue to partner with government health agencies to help combat the coronavirus, our pharmacists have become trusted resources to help accurately address patient questions and concerns and to provide testing and train others to test and to conduct community health consultations.

Across the globe, our crisis response teams have actively worked to find ways for the Company and its wide network of healthcare and strategic partners to play a greater role in the global emergency – including working with the U.S. federal government to expand access to COVID-19 testing and preparing our retail pharmacies to help millions of people access a vaccine when one becomes available. We are also working closely with the U.S. federal government’s Operation Warp Speed, a public-private partnership to accelerate development, manufacturing and distribution of COVID-19 vaccines, as well as the Centers for Disease Control and Prevention (CDC), the Department of Health and Human Services, and state and local governments to support access to COVID-19 vaccines, once approved.

Throughout the pandemic, safety has been our watchword. In our stores we implemented extra cleaning, social distancing and face covering protocols, implemented contactless payment, expanded drive-thru and delivery options and initiated other measures. We have listened to our employees, implementing feedback mechanisms and conducting wellness checks. And we have responded to their needs and concerns in real time, providing personal protective equipment, expanding paid sick leave in cases of COVID-19, adopting workplace flexibility measures, reviewing travel guidelines for employees and helping colleagues across our global business take appropriate steps in the best interest of their families.

Our business has been significantly impacted by the pandemic, as foot traffic fell in stores during lockdowns, demand for medication fell temporarily as doctor visits and elective medical procedures were halted and we incurred increased costs to protect the health and safety of our patients, customers and team members. However, we remain committed to and focused on our strategic priorities. The pandemic has reinforced our pharmacy-centered business as being at the heart of community healthcare and we are expanding on that role for the future.

Leadership Transition

On July 27, 2020, the Company announced a search for a new Chief Executive Officer and its plans for a transition of leadership to drive further progress on its key strategic priorities and to transform the business for the future to address the rapidly-evolving healthcare sector.

The Company also announced that when the new Chief Executive Officer takes office, its current Chief Executive Officer, Stefano Pessina, will resign as Chief Executive Officer and Executive Vice Chairman of the Board and be appointed as the Executive Chairman of the Board on an annual basis (provided that Mr. Pessina is a member of the Board at the time and subject to applicable law, including fiduciary duties) in accordance with the Company's letter agreement with Mr. Pessina, and James Skinner, the Company’s current Executive Chairman of the Board, will resign as Executive Chairman, while remaining on the Board to provide continuity to the Board during the management transition.

2021 Proxy Statement 5

Table of Contents

Proxy Statement Summary

Voting Matters

The following table summarizes the proposals to be considered at the Annual Meeting and the Board’s voting recommendations with respect to each proposal.

|

|

|

Board

Recommendation |

|

Page

Reference |

| 1 |

Election of 11 Directors Named in this Proxy Statement |

|

|

FOR each nominee |

|

13 |

| 2 |

Ratification of the Appointment of Deloitte & Touche LLP as the Independent Registered Public Accounting Firm for Fiscal Year 2021 |

|

|

FOR |

|

49 |

| 3 |

Advisory Vote to Approve Named Executive Officer Compensation (“say-on-pay”) |

|

|

FOR |

|

53 |

| 4 |

Approval of the Walgreens Boots Alliance, Inc. 2021 Omnibus Incentive Plan |

|

|

FOR |

|

86 |

| 5 |

Stockholder Proposal Requesting an Independent Board Chairman |

|

|

AGAINST |

|

93 |

| 6 |

Stockholder Proposal Requesting Report on how Health Risks from COVID-19 Impact the Company's Tobacco Sales Decision-Making |

|

|

AGAINST |

|

95 |

Other than the matters listed above, the Company knows of no other matters to be presented at the Annual Meeting. If any other matters are properly presented at the Annual Meeting or any adjournment

thereof, the proxies intend to vote your shares in accordance with their best judgment.

Board Composition and Evaluation

The Board is committed to ensuring that its composition is aligned with the Company's needs and that as the business evolves over time, fresh viewpoints and perspectives are regularly considered. Each

year, the Nominating and Governance Committee of the Board (the “Nominating and Governance Committee”) oversees a robust, multi-step Board evaluation process, including a confidential director peer review process led by our Lead Independent

Director, which we believe is an essential component of Board effectiveness. We also regularly discuss director succession and Board refreshment, both in executive sessions and as a full Board.

The Nominating and Governance Committee oversees and facilitates our nomination process and seeks to cultivate a Board with the appropriate skill sets, balance of tenure, and diversity of experiences to

discharge its responsibilities effectively. Each director possesses a unique background and, in the aggregate, we believe the Board encompasses the skills and experiences deemed important to effectively oversee our business. In 2020, the Board reaffirmed

its commitment to diversity, when it amended the Company’s Corporate Governance Guidelines (the “Corporate Governance Guidelines”) and the charter of the Nominating and Governance Committee to provide that when searching for new

directors, the Nominating and Governance Committee will actively seek out women and individuals from minority groups to include in the pool from which Board nominees are chosen. In October 2020, the Board appointed Valerie B. Jarrett, who is the

Company’s first female African American director and the fourth woman on the current Board.

6 Walgreens Boots Alliance

Table of Contents

Proxy Statement Summary

The following graphic summarizes our process of composing and evaluating our Board and the key skills, qualifications and experiences that the Nominating and Governance Committee currently believes

should be represented on the Board, as well as the number of directors who possess each skill. Also included are statistics (as of the Record Date) that underscore our commitment to refreshment and diversity, which we believe are critical elements of a

strong Board.

| Composing and Evaluating our Board |

|

1

Review output of the Board evaluation

2

Assess how each director impacts the skills and experience represented on the Board in the context of the current and future

needs of the Company |

|

3

If deemed necessary, in conjunction with a third-party search firm, identify new director nominee(s)

4

Recommend to the Board a slate of candidates for election |

| |

A Snapshot of our 2021 Nominees |

|

Tenure

9.9 Years

Average Tenure |

Skills, Qualifications and Experience

|

|

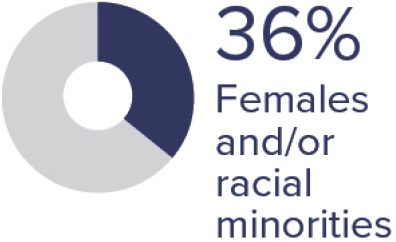

Diversity

|

| |

|

|

2021 Proxy Statement 7

Table of Contents

Proxy Statement Summary

Board of Directors

The Board consists of highly experienced and accomplished directors who are uniquely qualified to oversee our business. The following table provides summary information about each director nominee as of

the Record Date. Each director stands for election annually. Detailed information about each director’s background, skill set and areas of experience can be found beginning on page 18 of the Proxy Statement.

On July 27, 2020, the Company announced a search for a new Chief Executive Officer. The Company also announced that when the new Chief Executive Officer takes office, Mr. Pessina will resign as Chief

Executive Officer and Executive Vice Chairman of the Board and be appointed as the Executive Chairman of the Board (subject to applicable law, including fiduciary duties) and Mr. Skinner will resign as Executive Chairman of the Board, while

remaining on the Board to provide continuity to the Board during the management transition.

Board Member Details

|

Name and Principal

Occupation |

Independent |

Age |

Director

Since

(Calendar

Year) |

Currently Serving on

Other Public Boards |

Committee

Memberships |

| A |

C |

F |

N |

|

José E. Almeida

Chairman & CEO, Baxter International Inc. |

|

58 |

2017 |

●Baxter International Inc. |

|

|

|

|

|

Janice M. Babiak

Former Managing Partner, Ernst & Young LLP |

|

62 |

2012 |

●Bank of Montreal

●Euromoney Institutional Investor PLC |

|

|

|

|

|

David J. Brailer

Chairman, Health Evolution

Partners |

|

61 |

2010 |

|

|

|

|

|

|

William C. Foote

Lead Independent Director, Walgreens Boots Alliance, Inc. Former Chairman

and CEO, USG Corporation |

|

69 |

1997 |

|

|

|

|

|

|

Ginger L. Graham

Former President and CEO, Amylin Pharmaceuticals |

|

65 |

2010 |

●Clovis Oncology, Inc. |

|

|

|

|

|

Valerie B. Jarrett

Former Senior Advisor to President Barack Obama |

|

64 |

2020 |

●Lyft, Inc.

●2U, Inc.

●Ralph Lauren Corporation |

|

|

|

|

|

John A. Lederer

Senior Advisor, Sycamore Partners |

|

65 |

2015 |

●Maple Leaf Foods

●US Foods |

|

|

|

|

|

Dominic P. Murphy

Managing Partner and Co-Head of UK Investments, CVC Capital

Partners |

|

53 |

2012 |

●THG Holdings plc |

|

|

|

|

|

Stefano Pessina

Executive Vice Chairman and CEO, Walgreens Boots Alliance,

Inc. |

|

79 |

2012 |

|

|

|

|

|

|

Nancy M. Schlichting

Former CEO, Henry Ford Health System |

|

66 |

2006 |

●Hill-Rom Holdings, Inc.

●Encompass Health Corporation |

|

|

|

|

|

James A. Skinner

Executive Chairman, Walgreens Boots Alliance, Inc. |

|

76 |

2005 |

|

|

|

|

|

|

Chair |

|

Member |

A |

Audit |

C |

Compensation and Leadership Performance |

F |

Finance |

N |

Nominating and Governance |

8 Walgreens Boots Alliance

Table of Contents

Proxy Statement Summary

Corporate Governance Highlights

We are committed to corporate governance policies and practices that serve the interests of our stockholders. The following table summarizes certain highlights of our governance policies and

practices:

|

●Annual Election of All Directors;

●Majority Voting for All Directors in Uncontested

Elections;

●Cumulative Voting for Election of Directors;

●No Supermajority Voting Provisions;

●No Stockholder Rights Plan (“Poison

Pill”);

●3%, 3-Year Proxy Access By-law;

●Stockholder Right to Request Special Meetings at

20%;

●Stockholder Right to Act by Written Consent;

●Enhanced Commitment to Diversity, including Women and

Minorities, in Corporate Governance Documents; |

|

●Independent Lead Director Responsibilities;

●Regular Executive Sessions of Independent

Directors;

●Annual Board and Committee Evaluation

Process;

●Strategic and Risk Oversight by Board and

Committees;

●Commitment to Sustainability at the Senior Executive and

Board Levels;

●Stock Ownership Guidelines for Executives and

Directors;

●Policies Prohibiting Hedging and Short Sales of Stock by

Directors, Executives and Senior Employees;

●Active Stockholder Engagement; and

●Board Composition Requirement of Two-Thirds

Independent. |

More information about our corporate governance efforts can be found in “Governance—Our Commitment to Strong Corporate Governance” beginning on page 25 of this Proxy

Statement.

Stockholder Engagement and Board Responsiveness

We value an open dialogue with our stockholders, and we believe that regular communication with our stockholders and other stakeholders is a critical part of enabling our long-term success.

During fiscal 2020, members of our management team met with many of our stockholders. In addition, in advance of the Annual Meeting, we conducted formal outreach relating to governance matters as

described below:

|

Reached out to approximately

40

of our largest stockholders representing

over

40%

of our outstanding stock*

*As of August 31, 2020, excluding shares held by affiliates of Stefano Pessina, our Executive Vice Chairman and Chief Executive Officer.

Discussed wide-ranging topics, including:

●Board oversight of response to COVID-19

pandemic

●Board oversight of strategy and risk

management

●Corporate governance and Board succession

planning

●Executive compensation, diversity, equity and inclusion and

human capital

●Sustainability and corporate social responsibility

initiatives |

|

We have made improvements in recent years in response to stockholder feedback and our continuous focus on best

practices |

|

●We amended our Corporate Governance Guidelines and the

charter of the Nominating and Governance Committee to provide that when searching for new directors, the Nominating and Governance Committee will actively seek out women and individuals from minority groups to include in the pool from which Board

nominees are chosen. |

|

●We approved new performance metrics for the fiscal 2021

short and long-term incentive programs, including a diversity metric in the short-term program, to further align our incentive programs with key Company initiatives, such as cost savings and digital innovation investments.

●We published our Board Report on Oversight of Risks Related

to Opioids.

●We revised our clawback policy to provide that we will

publicly disclose enforcement against any of our executive officers, unless the Board or the Compensation and Leadership Performance Committee concludes that legal or privacy concerns would prevent such disclosure.

●We amended the charter and renamed our Compensation and

Leadership Performance Committee to reflect the Committee’s dedication to broader oversight of leadership performance, including areas of diversity and inclusion, management development and talent recruitment, retention and

engagement.

●We enhanced our disclosure regarding our Board leadership

structure and our Board’s role in the oversight of risk management and strategy in this Proxy Statement. |

More information about our stockholder engagement efforts can be found in “Governance—Board Responsibilities—Stockholder Engagement” beginning on page 38 of this Proxy

Statement.

2021 Proxy Statement 9

Table of Contents

Proxy Statement Summary

Corporate Social Responsibility

Spotlight: Corporate Social Responsibility and our Response to COVID-19

As a leading global pharmacy retailer and distributor that provides an essential public service, it is our Company’s responsibility and a business imperative to operate sustainably for people and the planet at all times. This is especially true in times of crisis. The global COVID-19 pandemic, an unprecedented and ongoing emergency, has given us an opportunity to reinforce ourselves as a caring corporate citizen and we are emerging even more resilient for the future.

The Company stepped up to make a difference during the pandemic, engaging with employees and external stakeholders to understand their needs. Our sustainability work has always been embedded in our business operations and this has been more true than ever during the global pandemic, as we have responded with agility to the needs of millions of customers and our own employees.

Highlights of our response include collaborating with government and industry partners to implement testing sites, rapidly putting in place safety measures for customers and employees, activating our expert pharmacists to provide trustworthy health information for the public, working to guarantee supplies of essential items including personal protective equipment, pivoting our charity work to help people most vulnerable to the pandemic, and conducting targeted outreach to the most at-risk patients to help them access medication and essential items.

Transparency and accountability are central to our approach to sustainability. We report our progress on our Corporate Social Responsibility ("CSR") commitments annually, in our CSR Report. At the Board level, several Committees have oversight of CSR-related policies, programs and risks, with the Nominating and Governance Committee having broad oversight of policies and activities regarding sustainability and CSR.

Please read more about the Company’s response to the pandemic and our other CSR efforts in “Governance—Board Responsibilities —Sustainability and Corporate Citizenship” beginning on page 40 of this Proxy Statement.

Executive Compensation Program

Our executive compensation program incorporates policies and practices designed to be aligned with the Company’s long-term goals and strategies and promote responsible pay and governance practices. We believe we have a strong pay-for-performance philosophy, which seeks to link the interests of our executives with those of our stockholders. Accordingly, we emphasize variable and performance-based compensation over fixed or guaranteed pay.

| In fiscal 2020, to maintain alignment of our executive compensation program with the objectives of our other stockholders and with then-current market practices for the compensation of executives, we made the following two changes to the design of the executive compensation programs: |

| ● | We added time-vested Restricted Stock Units ("RSUs") to the mix of equity vehicles, resulting in a mix of 50% Performance Shares, 25% Stock Options and 25% RSUs. |

| ● | We widened our performance curve applicable to both Performance Shares and Short-Term Incentives from 95% of the target goal paying at 50% of target and 110% of the target goal paying at 150% (Performance Shares) /200% of target (for Short-Term Incentives) to be 90% of the target goal paying at 50% of target and 110% of target goal paying at 150% (Performance Shares) /200% of target (for Short-Term Incentives). |

Impact of COVID-19: In light of the impact of the COVID-19 pandemic on the Company’s business and the economy in general, the Compensation and Leadership Performance Committee has used the principles and executive compensation philosophy described in this Proxy Statement to guide its decisions related to executive compensation, with a focus on supporting the business decisions and leadership required during this unprecedented time. A majority of the compensation decisions, including base salary adjustments, incentive plan target setting, and the granting of fiscal 2020 long-term incentive awards, were made in October 2019, prior to and long before we could anticipate the impact of COVID-19. Consequently, the Compensation and Leadership Performance Committee, with the input of its independent compensation consultant, evaluated appropriate adjustments to recognize both actual Company performance and the extraordinary efforts of our executives and broader team members during this unprecedented and unanticipated pandemic and this period of social unrest. In particular, the Compensation and Leadership Performance Committee’s review of our incentive plans in light of the impact of COVID-19 considered internal business objectives, including the Company’s key strategic priorities discussed above, external market data and stockholder feedback.

For fiscal 2021, the Compensation and Leadership Performance Committee did not increase the salary of any of the Company’s named executive officers in light of the impact of COVID-19 on our business and the uncertainty of its future impact. In addition, Mr. Pessina requested that the Compensation and Leadership Performance Committee not grant him any long-term equity incentive awards (or any other direct compensation) in fiscal 2021. Accordingly, Mr. Pessina did not participate in the November 2021 long-term equity incentive grants.

10 Walgreens Boots Alliance

Table of Contents

Proxy Statement Summary

We have addressed these decisions and the adjustments due to COVID-19 in detail in the “Executive Compensation—Compensation Discussion and Analysis” section of this Proxy Statement.

Substantially all CEO compensation is comprised of long-term equity incentives.

| * |

Subject to individual performance modifier adjustments |

The graphic above does not include special RSU awards (the "Transformational Cost Management Program awards"), which were approved by the Compensation and Leadership Performance Committee on December 9, 2019, and granted to individuals that were viewed as key to the success of the Company’s Transformational Cost Management Program, including certain of our executives. These awards are described in more detail in the “Executive Compensation—Compensation Discussion and Analysis” section of this Proxy Statement.

As noted above, Mr. Pessina did not participate in the November 2021 long-term equity incentive grants at his request.

Target Pay Mix

Stefano Pessina (CEO) and James Skinner (Executive Chairman)

Average of All Other NEOs

| • |

Information in graphics is based on total direct compensation (i.e., annual base salary, target annual cash incentive and target long-term incentive compensation) and excludes other elements of compensation, including the Transformational Cost Management Program awards described above and perquisites. |

2021 Proxy Statement 11

Table of Contents

Proxy Statement Summary

We support our pay-for-performance philosophy by implementing commonly viewed best practices that the Compensation and Leadership Performance Committee believes further align our executives’ interests with those of our stockholders.

|

We DO Have This Practice |

|

|

We DO NOT Have This Practice |

|

●Incentive award goals that are objective and tied to key Company performance metrics

●A majority of compensation delivered as at-risk compensation in the form of equity-based awards that are tied to stockholder return

●Stock ownership guidelines

●Policies prohibiting hedging/short sales of stock by directors, executives and senior employees

●Compensation recoupment “Clawback” policy

●Double-trigger change in control severance for participating Named Executive Officers (“NEOs”)

●Performance Share awards generally have a three-year performance period to drive sustainable value creation and promote retention

●Market comparison of executive compensation against a relevant peer group |

|

●Multi-year guarantees for salary increases, non- performance based bonuses, or equity compensation

●Change in control excise tax gross-ups for NEOs

●Repricing of options without stockholder approval

●Excessive perquisites

●Excessive severance and/or change in control provisions

●Payout of dividends or dividend equivalents on unearned or unvested equity

●Excessive pension or defined benefit supplemental executive retirement plan (SERP)

●A high percentage of fixed compensation |

More information about our pay-for-performance philosophy can be found in “Executive Compensation” beginning on page 54 of this Proxy Statement.

12 Walgreens Boots Alliance

Table of Contents

Proposal 1:

Election of Directors

| |

What am I voting on?

Stockholders are being asked to elect 11 director nominees named in this Proxy Statement for a one-year term. |

|

|

What is the Board’s voting recommendation? |

|

|

|

Vote FOR |

|

|

The Board recommends a vote “FOR” each of the director nominees named in this Proxy Statement. Valid proxies solicited by the Board will be so voted unless stockholders specify a contrary choice in their voting instructions. |

|

|

What is the required vote?

With respect to the election of directors, the number of votes “FOR” a director’s election must be a majority of the votes cast by the holders of the shares of our common stock voting in person or by proxy at the Annual Meeting with respect to that director’s election. Abstentions with respect to a director will have the same effect as a vote “AGAINST” him or her. |

|

Upon the recommendation of the Nominating and Governance Committee, the Board has nominated 11 directors for election at the Annual Meeting, each to hold office until our next annual meeting of stockholders and until his or her successor is duly elected and qualified or upon his or her earlier death, resignation, or removal.

All of the nominees are currently directors. Each nominee was elected to the Board by our stockholders at our 2020 annual meeting of stockholders (the “2020 Annual Meeting”) with the support of more than 92% of votes cast, other than Valerie B. Jarrett, who was appointed to the Board in October 2020. All of the nominees are expected to virtually attend the Annual Meeting.

Each nominee has agreed to be named in this Proxy Statement and to serve if elected. Consequently, we know of no reason why any of the nominees would be unable or unwilling to serve if elected. However, if any nominee is for any reason unable or unwilling to serve, the proxyholders intend to vote all proxies received by them for any substitute nominee proposed by the Board (consistent with any applicable terms of the Shareholders’ Agreement, as defined and described further in “—Director Nomination Process—Shareholders’ Agreement and Other Arrangements with Mr. Pessina” below), unless the Board instead chooses to reduce its size.

We are committed to the principle that a firm foundation of board effectiveness is essential to best serve the interests of stockholders, guide the Company and oversee management. As is detailed below in “Governance—Board Effectiveness is the Foundation of Our Corporate Governance,” we believe that effectiveness is a key feature of our Board and results from having the right combination of diverse and expert individuals on the Board as well as having the right processes and structures in place to promote the efficient, engaged and dynamic execution of the Board’s duties and responsibilities.

2021 Proxy Statement 13

Table of Contents

Proposal 1

Director Nomination Process

We believe decisions regarding the structure and composition of the Board are critical to ensuring a strong Board that is best suited to guide the Company. As specified in its charter, the Nominating and Governance Committee oversees our director candidate nomination process.

|

|

Consideration of Necessary Skills, Experience and Attributes

The Nominating and Governance Committee considers a wide range of factors when assessing potential director nominees. This assessment includes a review of the potential nominee’s judgment, experience, independence, understanding of our business or other related industries, and such other factors as the Nominating and Governance Committee concludes are pertinent in light of the needs of the Board. The Nominating and Governance Committee’s goal is to put forth a diverse slate of candidates with a combination of skills, experience, viewpoints, perspectives and personal qualities that will best serve the Board, the Company, and our stockholders. In 2020, the Board reaffirmed its commitment to diversity, when it amended the Corporate Governance Guidelines and the charter of the Nominating and Governance Committee to provide that when searching for new directors, the Nominating and Governance Committee will actively seek out women and individuals from minority groups to include in the pool from which Board nominees are chosen. |

| ▼ |

|

|

|

|

Nominating and Governance Committee Assessment

With respect to the potential re-nomination of current directors, the Nominating and Governance Committee assesses their current contributions to the Board. Among other matters, the Nominating and Governance Committee considers the results of the annual evaluation of the Board and its Committees, which the Nominating and Governance Committee also oversees, when assessing potential director nominees. More detail regarding this annual evaluation process can be found in “Governance—Board Operation and Processes—Board Evaluation and Director Peer Review Process” below. |

| ▼ |

|

|

|

|

Stockholder Vote

The Nominating and Governance Committee recommends to the Board a slate of candidates for election at each annual meeting of stockholders. The Nominating and Governance Committee assesses how each potential nominee would impact the skills and experience represented on the Board as a whole in the context of the Board’s overall composition and the current and future needs of the Company and the Board. The Nominating and Governance Committee also evaluates whether a potential director nominee meets the qualifications required of all directors and any of the key qualifications and experience to be represented on the Board, as described further in “—Board Membership Criteria” below. |

Board Refreshment and Committee Rotation

The Board believes that a degree of Board refreshment is important to ensure that Board composition is aligned with the changing needs of the Company and the Board, and that fresh viewpoints and perspectives are regularly considered. The Board also believes that directors develop an understanding of the Company and an ability to work effectively as a group over time that provides significant value, and therefore a significant degree of continuity year-over-year should be expected.

As part of planning for director succession, the Nominating and Governance Committee periodically engages in the consideration of potential director candidates, occasionally with the assistance of a third-party advisor or recruitment firm.

| Director Nominee Tenure Diversity |

| |

|

14 Walgreens Boots Alliance

Table of Contents

Proposal 1

As set forth in the Corporate Governance Guidelines, the Board does not have absolute limits on the length of time that a director may serve, but considers the tenure of directors as one of several factors in re-nomination decisions. The Board has established a retirement age of 75. Subject to our contractual obligations and applicable law, no individual is eligible for election to the Board after his or her 75th birthday unless the Nominating and Governance Committee makes a finding that the nomination of the individual is in the best interests of the Company notwithstanding the individual’s age, and the nomination is also approved by the Board.

While the Board believes that refreshment is an important consideration in assessing Board composition, it also believes the best interests of the Company are served by being able to take advantage of all available talent. Therefore, the Board does not make determinations with regard to its membership based solely on age or tenure.

James A. Skinner, our Executive Chairman, will be older than this retirement age as of the date of the Annual Meeting. In accordance with the Corporate Governance Guidelines, the Nominating and Governance Committee considered whether Mr. Skinner should continue to serve on the Board and in the role of Executive Chairman and determined that his re-nomination is in the best interests of the Company due to the value of maintaining continuity and stability on the Board, and the importance of preserving the existing Board leadership structure at a time when the Company is undergoing significant transformation, including its search for a new CEO, during the COVID-19 crisis. Based on this determination, the Nominating and Governance Committee recommended to the Board, and the Board approved (taking into account the recommendation of the Nominating and Governance Committee, among other factors), Mr. Skinner’s re-nomination for election to the Board at the Annual Meeting. The Nominating and Governance Committee intends to review this determination on an annual basis. As discussed below, upon the effective date of the appointment of the new CEO, Mr. Skinner will resign as Executive Chairman and Mr. Pessina will assume the role of Executive Chairman (subject to applicable law, including fiduciary duties).

Stefano Pessina, our Executive Vice Chairman and Chief Executive Officer, will be older than the retirement age as of the date of the Annual Meeting. However, as described further in “—Shareholders’ Agreement and Other Arrangements with Mr. Pessina” below, Mr. Pessina is the contractual designee of the SP Investors (as defined below) for nomination to the Board, and the Shareholders’ Agreement (as defined below) includes a contractual waiver of any mandatory retirement age policy applicable to his service on the Board.

The Board also reviews Committee assignments yearly to ensure that the needs of the Company are met and that fresh viewpoints and perspectives are regularly considered.

Director Resignation Policy

Our amended and restated by-laws (our "by-laws") state that if a nominee for director who was in office prior to the Annual Meeting is not elected and no successor is elected at such Annual Meeting, the director must promptly tender his or her resignation from the Board. Thereafter, the Nominating and Governance Committee, excluding the director in question, will make a recommendation to the Board about whether to accept or reject the resignation or whether to take other action. The Board, excluding the director in question, will act on the recommendation of the Nominating and Governance Committee and publicly disclose its decision and its rationale within 90 days from the date the election results are certified.

Stockholder-Recommended Director Candidates

Nominees may be suggested by directors, members of management, stockholders or other third parties. Stockholders who would like the Nominating and Governance Committee to consider their recommendations for director nominees should submit their recommendations in writing by mail to Walgreens Boots Alliance, Inc., 108 Wilmot Road, MS #1858, Deerfield, Illinois 60015, Attention: Corporate Secretary. The Nominating and Governance Committee considers stockholder-recommended candidates on the same basis as other suggested nominees.

Stockholder-Nominated Director Candidates (“Proxy Access”)

We have adopted a proxy access by-law, which permits a stockholder, or a group of up to 20 stockholders, owning 3% or more of our outstanding common stock continuously for at least three years to nominate and include in our proxy materials director nominees constituting up to 20% of the Board, provided that the stockholder(s) and the nominee(s) satisfy the requirements specified in Article II, Section 2.20 of our by-laws. See “Additional Information—Director Nominations for Inclusion in the Proxy Statement for the 2022 Annual Meeting” below for more information.

2021 Proxy Statement 15

Table of Contents

Proposal 1

Stockholders, including those stockholders who are not eligible to nominate director candidates under our proxy access by-law, may also nominate director candidates in accordance with the advance notice provisions described in our by-laws. See “Additional Information—Other Proposals or Director Nominations for Presentation at the 2022 Annual Meeting” below for more information.

Shareholders’ Agreement and Other Arrangements with Mr. Pessina

On August 2, 2012, in connection with Walgreen Co.’s acquisition of 45% of Alliance Boots GmbH (“Alliance Boots”), Walgreen Co., Kohlberg Kravis Roberts & Co. L.P. (“KKR”) and, inter alios, Stefano Pessina, our current Executive Vice Chairman and Chief Executive Officer (and together with certain of his affiliates, the “SP Investors”) entered into a Shareholders’ Agreement (the “Shareholders’ Agreement”). Pursuant to the Shareholders’ Agreement, for so long as the SP Investors continue to meet certain common stock beneficial ownership thresholds and subject to certain other conditions, the SP Investors are entitled to designate a nominee for election to the Board. The SP Investors continue to meet these beneficial ownership thresholds, and Mr. Pessina is the current designee of the SP Investors. In addition, on July 23, 2020, Mr. Pessina and the Company entered into a letter agreement which provides, among other things, that upon the effective date of the appointment of the new Chief Executive Officer, the Board will appoint Mr. Pessina on an annual basis (subject to applicable law, including fiduciary duties) as Executive Chairman, provided that Mr. Pessina is a member of the Board of the Company at the time. For more information about the Shareholders’ Agreement, see “Governance—Board Structure—Related Party Transactions” below.

Board Membership Criteria

Pursuant to its charter, the Nominating and Governance Committee is charged with establishing, and reviewing as necessary, criteria to be used by the Board for selecting directors. The Nominating and Governance Committee believes there are general qualifications that all directors must exhibit and other key qualifications and experience that should be represented on the Board as a whole, but not necessarily by each director.

Qualifications Required of All Directors

The Nominating and Governance Committee seeks to construct a Board consisting of directors with the following qualities:

| Experience |

|

Personal attributes |

|

●High-level leadership experience in business or managerial activities and significant accomplishments;

●Expertise in key facets of corporate management;

●Breadth of knowledge about issues affecting the Company; and

●Proven ability and willingness to contribute special competencies to the Board’s activities. |

|

●Personal integrity;

●Loyalty to the Company and concern for its success and welfare;

●Willingness to apply sound and independent business judgment;

●Awareness of a director’s vital role in good corporate governance and citizenship;

●Willingness and energy to devote the time necessary for meetings and for consultation on relevant matters; and

●Willingness to assume the fiduciary responsibility of a director and enthusiasm about the prospect of serving. |

With respect to directors who are not employees of the Company (“Non-Employee Directors”), the Nominating and Governance Committee also focuses on continued independence under the listing standards of The Nasdaq Global Select Market (“Nasdaq”), transactions that may present conflicts of interest, changes in principal business activities, and overall prior contributions to the Board.

16 Walgreens Boots Alliance

Table of Contents

Proposal 1

Key Skills, Qualifications and Experience to be Represented on the Board

The Board has identified key skills, qualifications and experience that are important to be represented on the Board as a whole in light of our current business strategy and expected needs. The table below summarizes the key skills, qualifications and experience of each nominee. This summary is not intended to be an exhaustive list of each nominee’s skills or contributions to the Board.

Walgreens Boots Alliance, Inc. Board of Directors Expertise Analysis Matrix

| Key Competencies/Experience |

|

|

|

|

|

|

|

|

|

|

|

|

| Business Development and M&A |

|

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

| Corporate Governance |

|

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

| Current or Former Public Company CEO |

|

● |

|

● |

● |

● |

|

● |

|

● |

|

● |

| Finance and Accounting |

|

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

| Global Operations |

|

● |

● |

● |

● |

● |

● |

● |

● |

● |

|

● |

| Healthcare or Regulated Industries |

|

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

| Human Capital |

|

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

● |

| Retail or Consumer-Facing Industries |

|

|

● |

|

|

|

● |

● |

|

● |

● |

● |

| Risk Management |

|

● |

● |

● |

● |

|

● |

|

|

|

● |

● |

| Technology or E-commerce |

|

|

● |

● |

|

|

● |

|

|

|

|

|

Consideration of Diversity

The Nominating and Governance Committee also assesses whether the group of nominees is comprised of individuals with a diversity of perspectives, viewpoints, backgrounds and professional experiences that would best serve the Board, the Company, and our stockholders. The Board, in accordance with our Corporate Governance Guidelines, considers diversity in broad terms, including, but not limited to, competencies, experience, geography, gender, ethnicity, race and age, with the goal of obtaining diverse perspectives, viewpoints, backgrounds and professional experiences. In 2020, the Board reaffirmed its commitment to diversity, when it amended the Corporate Governance Guidelines and the charter of the Nominating and Governance Committee to provide that when searching for new directors, the Nominating and Governance Committee will actively seek out women and individuals from minority groups to include in the pool from which Board nominees are chosen. In October 2020, the Board appointed Valerie B. Jarrett, who is the Company’s first female African American director and the fourth woman on the current Board.

2021 Proxy Statement 17

Table of Contents

Proposal 1

2021 Director Nominees

Our by-laws provide that the number of directors shall be determined by the Board, which has currently set the number at 11. The Board reserves the right to increase or decrease its size at any time. Upon the recommendation of the Nominating and Governance Committee, the Board has nominated each of the following 11 nominees for election at the Annual Meeting. All of the nominees, other than Messrs. Pessina and Skinner, are independent under Nasdaq listing standards. See “Governance—Board Structure—Director Independence” below for more information.

The Board believes that each nominee has the skills, experience and personal qualities the Board seeks in its directors, and that the combination of these nominees creates an effective and well-functioning Board, with a diversity of perspectives, viewpoints, backgrounds and professional experiences that best serves the Board, the Company and our stockholders.

Included in each director nominee’s biography is a description of select key qualifications and experience that led the Board to conclude that each nominee is qualified to serve as a member of the Board. All biographical information below is as of the Record Date.

José E. Almeida

Director since: April 2017

Age: 58

Independent

Committee Memberships:

●Compensation and Leadership Performance

●Nominating and Governance

Other Current Public Company Boards:

●Baxter International Inc. |

|

Professional Experience |

|

Baxter International Inc., a global medical device company

●Chairman of the Board and Chief Executive Officer (January 2016 – Present)

●Executive Officer (October 2015 – January 2016)

The Carlyle Group, a global alternative asset manager

●Senior Advisor (May 2015 – October 2015) |

|

Covidien plc (formerly Tyco Healthcare), a global healthcare products company

●Chairman (March 2012 – January 2015)

●President and Chief Executive Officer (July 2011 – January 2015)

●Executive roles (April 2004 – June 2011) |

|

|

Key Qualifications and Experience

Mr. Almeida has substantial knowledge of the healthcare industry and considerable expertise in leading complex, highly-regulated global organizations, primarily as a result of his roles at Baxter and Covidien. As a native of Brazil, Mr. Almeida brings a diverse perspective alongside his significant international business experience. With his experience as a director of several large, publicly-traded companies, he has an extensive background in public company governance and has dealt with a wide range of issues, including risk management, talent development, executive compensation, and succession planning.

Other Directorships

Mr. Almeida has served on the board of directors of Baxter International Inc. since January 2016 and served on the board of directors of State Street Corporation from October 2013 to November 2015; Analog Devices, Inc. from December 2014 to November 2015; and EMC Corporation from January 2015 to November 2015. |

18 Walgreens Boots Alliance

Table of Contents

Proposal 1

Janice M. Babiak

Director since: April 2012

Age: 62

Independent

Committee Memberships:

●Audit (Chair)

●Finance

Other Current Public Company Boards:

●Bank of Montreal

●Euromoney Institutional Investor PLC |

|

Professional Experience |

|

Ernst & Young LLP

●Former Managing Partner

●Variety of roles in the United States and the United Kingdom (1982 – 2009)

●Founder and Global Leader of EY’s Climate Change and Sustainability Services practice (July 2008 – December 2009) |

|

●Board Member and Managing Partner of Regulatory & Public Policy for the Northern Europe, Middle East and India and Africa (NEMIA) region (July 2006 – July 2008)

●A Founder of EY’s technology security and risk services practice in 1996, building and leading cyber and IT security, data analytics, and technology risk practices in the NEMIA region |

|

|

Key Qualifications and Experience

Ms. Babiak is a U.S.-qualified Certified Public Accountant (CPA), Certified Information Systems Auditor (CISA), and Certified Information Security Manager (CISM). She is a Chartered Accountant (FCA), and a member of the Institute of Chartered Accountants in England and Wales (ICAEW), of which she served as a Council Member from 2011 until she reached the term limit in 2019.

Ms. Babiak brings to the Board her general management expertise and depth of experience in the areas of audit, accounting, and finance, through her prior experience as a Council Member of the ICAEW and as a managing partner at EY, including service as partner for a number of retail and healthcare-related industry clients. With her extensive accounting knowledge and experience, she is highly qualified to serve as the chair of the Audit Committee of the Board (the “Audit Committee”) and as a member of the Finance Committee of the Board (the “Finance Committee”). Through her career experience and current CISM and CISA qualifications, she provides the Board with meaningful insight and knowledge related to information technology, cybersecurity best practices, and the relationship between information security programs and broader business goals and objectives. Her international experience, leadership in the areas of climate change and sustainability, and experience working with and serving on the audit committees of other publicly-traded companies further contribute to the perspective and judgment that she brings to service on the Board.

Other Directorships

Ms. Babiak has served on the board of directors of Bank of Montreal since October 2012 and on the board of directors of Euromoney Institutional Investor PLC, an international business-information group listed on the London Stock Exchange, since December 2017. Previously, she served as a non-executive director of Royal Mail Holdings plc from March 2013 to April 2014 as it transitioned from government ownership to a FTSE 100-listed company; Experian plc from April 2014 to January 2016; and Logica plc from January 2010 until its sale in August 2012. |

David J. Brailer, MD, PhD

Director since: October 2010

Age: 61

Independent

Committee Memberships:

●Audit

●Finance (Chair) |

|

Professional Experience |

|

Health Evolution Partners, a private equity firm focused on the healthcare industry

●Chairman (2006 – Present)

Department of Health and Human Services of the U.S. federal government

●National Coordinator for Health Information Technology (May 2004 – April 2006)

Health Technology Center

●Senior Fellow (2002 – 2004) |

|

CareScience, Inc., a provider of care management services and Internet-based healthcare solutions

●Chairman and Chief Executive Officer (1992 – 2002)

The Wharton School of Business at the University of Pennsylvania

●Former Adjunct Assistant Professor of Health Care Systems |

|

|

Key Qualifications and Experience

With his experience as Chairman and Chief Executive Officer of CareScience, Inc. for more than ten years and his subsequent experience with the U.S. federal government, where he was commonly referred to as the “health information technology czar,” Dr. Brailer provides the Board with strong technology experience coupled with business leadership and expertise. In addition, he brings to the Board insight and knowledge of investment and market conditions in the healthcare industry.

Other Directorships

Dr. Brailer has served on the boards of directors of a number of privately-held companies in the healthcare industry. |

2021 Proxy Statement 19

Table of Contents

Proposal 1

William C. Foote

Director since: January 1997

Age: 69

Lead Independent Director

Committee Memberships:

●Compensation and Leadership Performance

●Nominating and Governance (Chair) |

|

Professional Experience |

|

Independent Business Advisor

Walgreens Boots Alliance, Inc.

●Lead Independent Director (January 2015 – Present)

USG Corporation, a manufacturer and distributor of building materials

●Chairman of the Board (April 1996 – December 2011)

●Chief Executive Officer (January 1996 – December 2010)

●President (September 1999 – January 2006) |

|

Williams College

●Trustee

Northwestern Memorial HealthCare

●Life Trustee

The Federal Reserve Bank of Chicago

●Former Chairman of the Board |

|

|

Key Qualifications and Experience

With many roles as a corporate director over the years and his experience as Chairman and Chief Executive Officer of USG Corporation, Mr. Foote provides the Board with strong business leadership, expertise in strategy formulation, financial acumen, management development and succession planning and substantial experience with respect to corporate governance matters. These roles, in addition to his service as Chairman of The Federal Reserve Bank of Chicago, enable him to provide valuable insights and perspectives with regard to business and market conditions. In addition, he brings strength in the area of corporate governance to his role as chair of the Nominating and Governance Committee. |

|

Ginger L. Graham

Director since: April 2010

Age: 65

Independent

Committee Memberships:

●Audit

●Nominating and Governance

Other Current Public Company Boards:

●Clovis Oncology, Inc. |

|

Professional Experience |

|

Two Trees Consulting, Inc., a healthcare and executive leadership consulting firm

●President and Chief Executive Officer (November 2007 – December 2016)

Harvard Business School

●Senior Lecturer (October 2009 – June 2012)

Amylin Pharmaceuticals, a biopharmaceutical company

●Director (1995 – 2009)

●Chief Executive Officer (September 2003 – March 2007)

●President (September 2003 – June 2006) |

|

Guidant Corporation, a cardiovascular medical device manufacturer

●Various positions including Group Chairman, Office of the President, President of the Vascular Intervention Group, and Vice President (1994 – 2003) |

|

|

Key Qualifications and Experience

Ms. Graham brings to the Board her extensive experience in senior management and leadership roles in the healthcare industry, including experience leading companies in drug, device, and product development and commercialization. The Board values her insight and experience, including her service on the faculty of Harvard Business School where she taught classes in entrepreneurship. She also brings to her service on the Board valuable experience as a director of publicly- and privately-held life sciences companies and as a consultant to healthcare companies regarding strategy, leadership, team building, and capability building.

Other Directorships

Ms. Graham has served on the board of directors of Clovis Oncology, Inc. since 2013 (and has served as its chair since 2019). She served on the board of directors of Genomic Health, Inc. from 2008 until its merger with Exact Sciences Corporation in 2020. |

20 Walgreens Boots Alliance

Table of Contents

Proposal 1

Valerie B. Jarrett

Director since: October 2020

Age: 64

Independent

Committee Memberships:

●Audit

●Compensation and Leadership Performance

Other Current Public Company Boards:

●Lyft, Inc.

●2U, Inc.

●Ralph Lauren Corporation |

|

Professional Experience |

|

University of Chicago Law School

●Distinguished Senior Fellow (January 2018 – Present)

Obama Foundation, a non-profit organization

●Senior Advisor (April 2018 – Present)

United States White House

●Senior Advisor to the President (January 2009 – January 2017) |

|

The Habitat Company, a Chicago real estate development and management firm

●Various senior positions, including Chief Executive Officer (1995 — 2009)

City of Chicago

●Commissioner of the Chicago Department of Planning and Development (1992 — 1995)

●Former Deputy Chief of Staff for the Mayor |

|

|

Key Qualifications and Experience

Ms. Jarrett brings to the Board her unique experience and expertise in governmental and public policy matters, including as a result of her service to a former President of the United States and in various positions with the City of Chicago, along with significant private sector experience. The Board also values her diverse perspectives as a business executive and civic leader, as well as an African-American woman. Ms. Jarrett was identified as a director nominee by other members of the Board.

Other Directorships

Ms. Jarrett has served on the boards of directors of Lyft, Inc., a ride sharing service company, since July 2017, 2U, Inc., an education technology company, since December 2017, and Ralph Lauren Corporation, a premium lifestyle products company, since October 2020. She also serves on the board of Ariel Investments, LLC, a private investment company, and Sweetgreen, a private restaurant chain. |

John A. Lederer

Director since: April 2015

Age: 65

Independent

Committee Memberships:

●Compensation and Leadership Performance

●Finance

Other Current Public Company Boards:

●Maple Leaf Foods

●US Foods |

|

Professional Experience |

|

Sycamore Partners, a private equity firm

●Senior Advisor (September 2017 – Present)

●Executive Chairman of privately-held Staples, Inc. (and its newly formed and independent U.S. and Canadian retail businesses following acquisition by Sycamore Partners in 2017), a leading provider of office products and services to business customers (September 2017 – Present)

US Foods, a leading food service distributor in the United States

●President and Chief Executive Officer (2010 – 2015) |

|

Duane Reade, a New York-based pharmacy retailer (acquired by Walgreens in 2010)

●Chairman of the Board and Chief Executive Officer (2008 – 2010)

Loblaw Companies Limited, Canada’s largest grocery retailer and wholesale food distributor

●President (2000 – 2006)

●Spent 30 years in various positions including a number of leadership roles |

|

|

Key Qualifications and Experience

Mr. Lederer brings to the Board significant management and business experience in the retail and healthcare industries as a result of his experience as Chief Executive Officer of a retail pharmacy. The Board values his understanding of the business operations of and issues facing large retail companies, including in the areas of marketing, merchandising, and supply chain logistics. Mr. Lederer also has extensive experience with respect to mergers & acquisitions and other corporate development activities. His prior and current service as a director of several public companies also provides him with insight into public company operations, including with respect to talent development, executive compensation, and succession planning.

Other Directorships

Mr. Lederer has served on the board of directors of US Foods since 2010 and on the board of directors of Maple Leaf Foods, a company listed on the Toronto Stock Exchange, since 2016. He served on the board of directors of Restaurant Brands International from 2014 until 2016 and as a director of Tim Hortons Inc. from 2007 until 2014, when it was acquired by Restaurant Brands International. |

2021 Proxy Statement 21

Table of Contents

Proposal 1

Dominic P. Murphy

Director since: August 2012

Age: 53

Independent

Committee Memberships:

●Finance

●Nominating and Governance |

|

Professional Experience |

|

CVC Capital Partners, a private investment firm

●Managing Partner and Co-Head of UK Investments (2019 – Present)

8C Capital LLP, a private investment firm

●Founder and Chief Executive Officer (2017 – 2019)

KKR, a private equity firm

●Partner, responsible for the development of the firm’s activities in the United Kingdom and Ireland, served as the head of its healthcare industry team in Europe and served as a member of the firm’s European investment and portfolio management committees (2005 – 2017) |

|

Cinven, a European-based private equity firm

●Partner (1996 – 2004)

3i Group plc, an international investment management firm

●Investment Manager (1994 – 1996) |

|

|

Key Qualifications and Experience