|

Item 1.01

|

Entry Into Material Definitive Agreements.

|

Recently Walgreens Boots Alliance, Inc. (“the Company”) has taken actions intended to increase its cash position and preserve financial flexibility in light of current uncertainty in the global markets, including the execution of new credit agreements and amendments to existing credit agreements described below. As of April 3, 2020, the Company had entered into $3.1 billion of new revolving credit facilities. No borrowings are outstanding under these facilities. In addition, the Company has, subject to the satisfaction of certain conditions, extended a $1.0 billion facility scheduled to mature in 2020 to May 2021.

Revolving Credit Agreement with JPMorgan Chase Bank, N.A.

On April 1, 2020 (the “Effective Date”), the Company entered into a revolving credit agreement (the “Revolving Bilateral Credit Agreement”) with the lenders from time to time party thereto and JPMorgan Chase Bank, N.A. (“JPMorgan”), as administrative agent.

The Revolving Bilateral Credit Agreement includes a $750 million senior unsecured revolving credit facility (the “Revolving Facility”). The Revolving Facility’s termination date is the earlier of (a) 364-days from the Effective Date (which date shall be shortened pursuant to the terms of the Revolving Bilateral Credit Agreement if the Company does not extend the maturity date of certain of its existing credit agreements or enter into new bank or bond financings with a certain maturity date and above an aggregate principal amount as described in the Revolving Bilateral Credit Agreement) and (b) the date of termination in whole of the aggregate amount of the commitments pursuant to the Revolving Bilateral Credit Agreement.

The Company will be the borrower under the Revolving Bilateral Credit Agreement. Subject to the terms of the Revolving Bilateral Credit Agreement, the Company may borrow, repay and reborrow amounts borrowed under the Revolving Facility while the commitments thereunder are in effect. The ability of the Company to request each loan under the Revolving Facility from time to time after the Effective Date is subject to the satisfaction (or waiver) of certain customary conditions set forth therein. Loans under the Revolving Bilateral Credit Agreement will be available in U.S. dollars, British Pound Sterling and Euro.

Borrowings under the Revolving Bilateral Credit Agreement will bear interest at a fluctuating rate per annum equal to, at the Company’s option, the Eurocurrency Rate or the Alternate Base Rate (each as defined in the Revolving Bilateral Credit Agreement), in each case, plus an applicable margin of 1.25% in the case of Eurocurrency Rate loans and 0.00% in the case of Alternate Base Rate loans. In addition, the Company has agreed to pay to the lenders under the Revolving Bilateral Credit Agreement certain customary fees, including an upfront fee and an unused commitment fee.

Voluntary prepayments of the loans and voluntary reductions of the unutilized portion of the commitments under the Revolving Bilateral Credit Agreement are permissible, in each case, without penalty, subject to certain conditions pertaining to minimum notice and minimum reduction amounts as described in the Revolving Bilateral Credit Agreement. Outstanding loans under the Revolving Facility will be prepaid by the net cash proceeds received by the Company in connection with the incurrence of indebtedness in the form of debt securities, other than certain debt issuances specified in the Revolving Bilateral Credit Agreement.

The Revolving Bilateral Credit Agreement contains representations and warranties and affirmative and negative covenants customary for unsecured financings of this type and substantially consistent with those of the Company’s (i) existing revolving credit agreement, dated as of August 30, 2019, among the Company, the lenders from time to time party thereto and Citibank, N.A., as administrative agent, (ii) existing revolving credit agreement, dated as of August 30, 2019, among the Company, the lenders from time to time party thereto and HSBC Bank USA, N.A., as administrative agent and (iii) existing revolving credit agreement, dated as of August 30, 2019, among the Company, the lenders from time to time party thereto and UniCredit Bank AG, New York Branch, as administrative agent. The Revolving Bilateral Credit Agreement includes a financial covenant requiring that, as of the last day of each fiscal quarter, commencing with the first full quarter ending after the Effective Date, the ratio of Consolidated Debt to Total Capitalization (as those terms are defined in the Revolving Bilateral Credit Agreement) shall not be greater than 0.60:1.00; provided that such ratio is subject to increase in certain circumstances set forth in the Revolving Bilateral Credit Agreement.

The Revolving Bilateral Credit Agreement also contains various events of default (subject to certain grace periods, to the extent applicable), including, events of default for the nonpayment of principal, interest or fees, breach of covenants; payment defaults on, or acceleration under, certain other material indebtedness; inaccuracy of the representations or warranties in any material respect; bankruptcy or insolvency; certain unfunded liabilities under employee benefit plans; certain unsatisfied judgments; certain ERISA violations; and the invalidity or unenforceability of the Revolving Bilateral Credit Agreement or any note issued in accordance therewith.

The foregoing description of the Revolving Bilateral Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Revolving Bilateral Credit Agreement, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

The lenders under the Revolving Bilateral Credit Agreement and/or their affiliates may have in the past performed, and may in the future from time to time perform, investment banking, financial advisory, lending and/or commercial banking services, or other services for the Company and its subsidiaries, for which they have received, and may in the future receive, customary compensation and expense reimbursement.

Revolving Credit Agreement with JPMorgan Chase Bank, N.A.

On April 2, 2020, the Company entered into a revolving credit agreement (the “Revolving Club Credit Agreement”) with the lenders from time to time party thereto and JPMorgan, as administrative agent.

The Revolving Club Credit Agreement includes a $1.325 billion senior unsecured revolving credit facility. Other than as described herein, the terms and conditions of the Revolving Club Credit Agreement, including the applicable margin and maturity date, are substantially similar to the Revolving Bilateral Credit Agreement.

The foregoing description of the Revolving Club Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Revolving Club Credit Agreement, which is attached hereto as Exhibit 10.2 and is incorporated herein by reference.

The lenders under the Revolving Club Credit Agreement and/or their affiliates may have in the past performed, and may in the future from time to time perform, investment banking, financial advisory, lending and/or commercial banking services, or other services for the Company and its subsidiaries, for which they have received, and may in the future receive, customary compensation and expense reimbursement.

Amendment No. 2 to Credit Agreement with Sumitomo Mitsui Banking Corporation

On April 2, 2020 , the Company entered into Amendment No. 2 to Credit Agreement (the “Amendment”) which amends that certain Credit Agreement, dated November 30, 2018 (the “Initial Closing Date”) (as amended by that certain Amendment No. 1 to Credit Agreement dated as of March 25, 2019, the “Existing SMBC Credit Agreement”; the Existing SMBC Credit Agreement as amended by the Amendment, the “Amended Credit Agreement”), currently governing a $500 million senior unsecured term loan facility (the “Existing Term Facility”) which was funded in full on the Initial Closing Date and a $500 million revolving credit facility (the “Existing Revolving Facility”), with Sumitomo Mitsui Banking Corporation, as administrative agent and sole lender. The Amended Credit Agreement will become effective on May 29, 2020 (the “Amendment Effective Date”), subject to delivery by the Company of a customary officer’s certificate. The Existing SMBC Credit Agreement, which was filed as Exhibit 10.5 of the Company’s Form 10-Q on April 2, 2019, will retain its current terms until the Amendment Effective Date.

As of the Amendment Effective Date, the Existing Revolving Facility will be automatically converted into a term loan facility (the resulting facility together with the Existing Term Facility, the “Amended Facility”). The Amended Facility’s termination date (the “Termination Date”) is the earlier of (a) 364-days from the Amendment Effective Date and (b) the date of acceleration of all loans under the Amended Credit Agreement pursuant to the terms of the Amended Credit Agreement.

Borrowings under the Amended Credit Agreement will bear interest at a fluctuating rate per annum equal to, at the Company’s option, the Eurocurrency Rate (including, at the Company’s election, a LIBOR Daily Floating Rate) or the Alternate Base Rate (each as defined in the Amended Credit Agreement), in each case, plus an applicable margin of 1.25% in the case of Eurocurrency Rate loans and 0.125% in the case of Alternate Base Rate loans. In addition, the Company has agreed to pay to the lenders under the Amended Credit Agreement a customary upfront fee.

The term loans under the Amended Credit Agreement will amortize in quarterly installments of $25 million, with the first payment to be made on August 31, 2020.

Other than as described herein, the terms and conditions of the Amended Credit Agreement remain substantially similar to the Existing SMBC Credit Agreement.

The foregoing description of the Amendment and the Amended Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment (to which the Amended Credit Agreement is attached), which is attached hereto as Exhibit 10.3 and is incorporated herein by reference.

The lenders under the Amended Credit Agreement and/or their affiliates may have in the past performed, and may in the future from time to time perform, investment banking, financial advisory, lending and/or commercial banking services, or other services for the Company and its subsidiaries, for which they have received, and may in the future receive, customary compensation and expense reimbursement.

Amended and Restated Credit Agreement with Wells Fargo Bank, National Association

On April 2, 2020 (the “Amendment and Restatement Effective Date”), the Company entered into an Amended and Restated Revolving Credit Agreement (the “Amended and Restated Credit Agreement”) which amends and restates that certain Term Loan Credit Agreement dated as of December 5, 2018 (as amended by that certain Amendment No. 1 to Term Loan Credit Agreement dated as of August 9, 2019, the “Existing Wells Credit Agreement”), with Wells Fargo Bank, National Association, as administrative agent and sole lender.

The Amended and Restated Credit Agreement governs a $2 billion senior unsecured revolving credit facility, consisting of the initial $1 billion senior unsecured revolving facility previously governed by the Existing Wells Credit Agreement (the “Initial Facility”) and a new $1 billion senior unsecured revolving credit facility (the “New Facility”; and together with the Initial Facility, the “Wells Facility”). The Wells Facility’s termination date is the earlier of (a) January 29, 2021 (the “Initial Maturity Date”) (which date shall be extended to February 26, 2021 or July 31, 2021 pursuant to the terms of the Amended and Restated Credit Agreement if the Company extends the maturity date of certain of its existing credit agreements or enters into new bank or bond financings with a certain maturity date and above an aggregate principal amount as described in the Amended and Restated Credit Agreement) and (b) the date of termination in whole of the aggregate amount of the commitments pursuant to the Amended and Restated Credit Agreement.

Subject to the terms of the Amended and Restated Credit Agreement, the Company may borrow, repay and reborrow (i) under the Initial Facility from time to time commencing on the Amendment and Restatement Effective Date and (ii) under the New Facility from time to time commencing on the later of (a) the Amendment and Restatement Effective Date and (b) the date on which the Company extends the maturity date of certain of its existing credit agreements or enters into new bank or bond financings with a certain maturity date and above an aggregate principal amount as described in the Amended and Restated Credit Agreement.

Borrowings under the Amended and Restated Credit Agreement will bear interest at a fluctuating rate per annum equal to, at the Company’s option, the Alternate Base Rate or the Eurocurrency Rate (including, at the Company’s election, a LIBOR Daily Floating Rate) (each as defined in the Amended Credit Agreement), in each case, plus an applicable margin of (i) in the case of the Initial Facility from the Amendment and Restatement Effective Date through and including the Initial Maturity Date, 0.75% in the case of Eurocurrency Rate loans and 0.00% in the case of Alternate Base Rate loans and (ii) in the case of the New Facility and the Initial Facility after the Initial Maturity Date, 1.50% in the case of Eurocurrency Rate loans and 0.50% in the case of Alternate Base Rate loans.

In addition, the Company has agreed to pay to the lenders under the Amended and Restated Credit Agreement certain customary fees, including: an upfront fee, an unused commitment fee and, with respect to the Initial Facility only, a minimum average percentage utilization fee based on average utilization of the commitments under the Initial Facility, which fee shall accrue through and including the Initial Maturity Date.

Other than as described herein, the terms and conditions of the Amended and Restated Credit Agreement remain substantially similar to the Existing Wells Credit Agreement. The Existing Wells Credit Agreement is described in further detail in Item 1.01 of the Company’s Current Report on Form 8-K filed on August 12, 2019 and was filed as Exhibit 10.1 thereto.

The foregoing description of the Amended and Restated Credit Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Amended and Restated Credit Agreement, which is attached hereto as Exhibit 10.4 and is incorporated herein by reference.

The lenders under the Amended and Restated Credit Agreement and/or their affiliates may have in the past performed, and may in the future from time to time perform, investment banking, financial advisory, lending and/or commercial banking services, or other services for the Company and its subsidiaries, for which they have received, and may in the future receive, customary compensation and expense reimbursement.

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off–Balance Sheet Arrangement of a Registrant.

|

The information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

|

|

Exhibit

|

|

|

Description

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Revolving Credit Agreement, dated as of April 1, 2020, by and among Walgreens Boots Alliance, Inc., the lenders from time to time party thereto and JPMorgan Chase Bank, N.A., as administrative agent.

|

|

|

|

|

|

|

|

|

10.2

|

|

|

Revolving Credit Agreement, dated as of April 2, 2020, by and among Walgreens Boots Alliance, Inc., the lenders from time to time party thereto and JPMorgan Chase Bank, N.A., as administrative agent.

|

|

|

|

|

|

|

|

|

10.3

|

|

|

Amendment No. 2 to Credit Agreement, dated as of April 2, 2020, by and among Walgreens Boots Alliance, Inc. and Sumitomo Mitsui Banking Corporation, as administrative agent and sole lender.

|

|

|

|

|

|

|

|

|

10.4

|

|

|

Amended and Restated Revolving Credit Agreement, dated as of April 2, 2020, by and among Walgreens Boots Alliance, Inc. and Wells Fargo Bank, National Association, as administrative agent and sole lender.

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

WALGREENS BOOTS ALLIANCE, INC.

|

|

|

|

|

|

|

|

|

|

Date: April 6, 2020

|

|

|

|

By:

|

|

/s/ Heather Dixon

|

|

|

|

|

|

Title:

|

|

Global Controller and Chief Accounting Officer

|

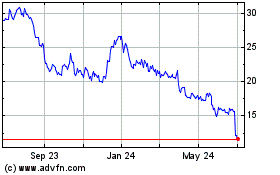

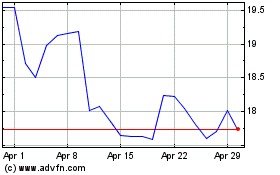

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Apr 2023 to Apr 2024