Walgreens Sales Drop Off After Early Coronavirus Surge -- WSJ

April 03 2020 - 3:02AM

Dow Jones News

By Sharon Terlep and Micah Maidenberg

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 3, 2020).

Pharmacy chain Walgreens Boots Alliance Inc. said U.S. store

sales fell sharply in the final week of March, offsetting gains

from an initial surge in demand as Americans rushed to stock up

amid the spread of coronavirus.

The drop-off could have broader implications for U.S. retailers

given that drugstores are among the few businesses permitted to

operate even in places with the tightest restrictions, and the

chain sells staples and medications in great demand amid the

pandemic.

Walgreens provided an update on the pandemic's impact on

business as it disclosed financial results for the quarter ended

Feb. 29, a period that preceded the start of widespread consumer

stockpiling of food and other goods.

"The full impact of Covid-19 won't be known for months,"

Walgreens finance chief James Kehoe said in a call with analysts,

referring to the disease caused by the virus. "The situation is

quite fluid and we expect volatility."

Walgreens' shares were down more than 5%, to $40.79, in late

morning trading. At that level, shares would have their lowest

close since March 8, 2013.

The Deerfield, Ill.-based chain generated stronger-than-expected

sales during its latest quarter. It reported $35.82 billion in

sales for the quarter ended Feb. 29, up from $34.53 billion a year

earlier. Operating income fell 19% to $1.2 billion, in part because

of reimbursement pressure on prescription drugs.

Earnings dropped to $946 million, or $1.07 a share, from $1.16

billion, or $1.24 a share, a year earlier. The company said it

earned an adjusted profit of $1.52 a share for the latest period, 6

cents more than analysts forecast.

In March, executives said, the end-of-month drop off was most

pronounced in communities where residents have been directed to

stay home. Sales of beauty products and so-called seasonal items

such as holiday decorations fell sharply, while sales rose for

health-related products and staples.

Walgreens, in the midst of a restructuring program, is diverting

funds intended to enable cost-cutting to instead manage the

coronavirus crisis. The company is paying bonuses to workers,

increasing home delivery and shortening store hours. In the U.K.,

where Walgreens operates the drugstore chain Boots, the company has

shut down most of its 600 optician centers.

Executives said the company is well-positioned to ride out the

pandemic, though uncertainty grows if mass lockdowns continue

beyond May. A planned share buyback program will proceed as

planned.

"We are confident this is a temporary situation," Mr. Kehoe

said.

Write to Sharon Terlep at sharon.terlep@wsj.com and Micah

Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

April 03, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

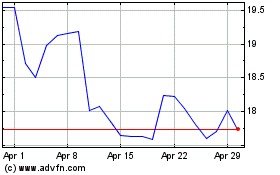

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

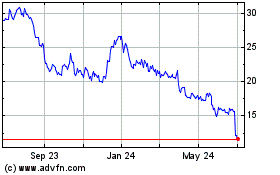

Walgreens Boots Alliance (NASDAQ:WBA)

Historical Stock Chart

From Apr 2023 to Apr 2024